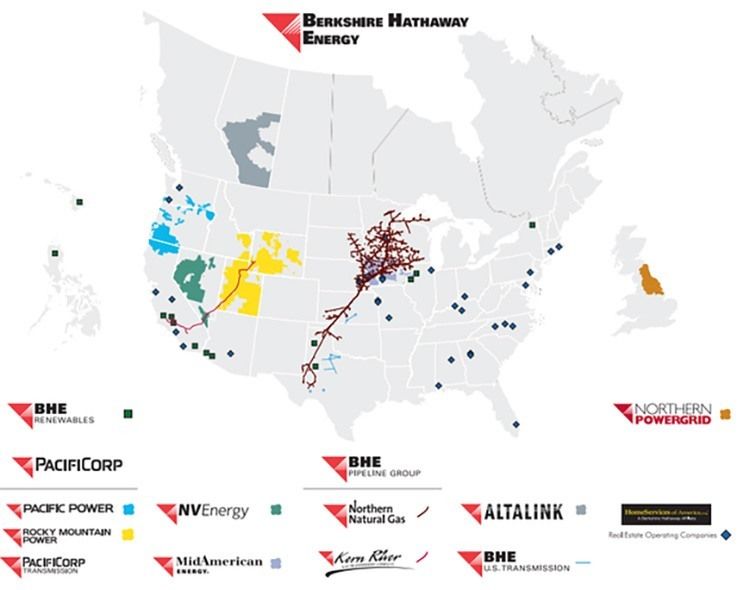

And that’s why Warren Buffett’s utilities want to crush it. Berkshire Hathaway Energy’s holdings are still intractably dependent on coal—relying on it for well over half of electricity generation in its four major regional utilities. And the fact that Buffett’s BNSF Railways hauls a whole lot of coal is a subject often covered on DeSmogBlog.

The various Berkshire Hathaway subsidiaries are executing a multipronged PURPA attack targetting the state level utility commissions, while also lobbying for federal reform on Capitol Hill. Here’s the current state of play.

Idaho

Last August, PacifiCorp, operating in Idaho as Rocky Mountain Power, started the state-level siege on PURPA. Joining forces with Idaho Power, the utilities argued to the Public Utility Commission that too many solar and wind projects were seeking grid connection through PURPA. To bolster its argument, PacifiCorp claimed that with existing and proposed PURPA contracts, enough power would be generated to supply 108 percent of the utility’s average load. (As if that were a bad thing).

The commission basically agreed with the companies, granting the request to reduce the length of contracts to just two years. “The utilities all have ample amounts of PURPA on their systems and additional renewable generation is in the queue,” the Public Utility Commission said.

The policy change will have an immediate impact on solar development in the state, as it forces big developers like SunEdison to pull out. “We’d like to invest further in Idaho, but we’re not going to be able to build a project on a two-year contract,” Ben Fairbanks, SunEdison’s development manager for the Northwest, said.

Oregon

Across the border in Oregon, Pacific Power, another subsidiary of PacifiCorp, asked the Public Utility Commission to shorten PURPA contract lengths from fifteen to three years.

“PacifiCorp, in particular, has a giant fossil fuel fleet and they’ve shown very little interest in developing a renewable energy portfolio,” Travis Ritchie, an attorney with the Sierra Club, said.

David Brown, owner of Obsidian Renewables in Lake Oswego, described the chilling effect that the shortened term has on developers, said: “Nobody is going to loan you money on a 15-year loan if you only have a three-year purchase agreement. I think it would be an end to PURPA projects.”

A final order from the Oregon Public Utility Commission is expected in March.

Wyoming

In August, Rocky Mountain Power requested that the Wyoming Public Service Commission reduce PURPA contracts from twenty to three years.

In its filings to the Commission, Rocky Mountain Power said it is facing 713 megawatts in proposed PURPA projects, in addition to 413 megawatts in existing PURPA development, which together would account for a full 96 percent of its average load. This in a state where traditionally 90 percent of electricity generation has been coal-fired.

The Wyoming PSC will hold a hearing in March and a decision is expected soon thereafter.

Utah

Rocky Mountain Power made the very same request last year in Utah: asking that the purchase agreements from PURPA qualified facilities be shortened from twenty years to just three years.

The Utah Public Service Commission, however, offered a solar-friendly compromise, shortening the term to 15 years, a move that was generally applauded by the solar industry.

In its decision, the Commission stated that “a term of 3-5 years would not sufficiently compensate a QF (qualifying facility) for generation.”

Federal Showdown

The patchwork of state rulings might well be leading to some federal intervention. No surprise, then, that Berkshire Hathaway has been actively engaged in lobbying for PURPA reform in Washington DC.

Back in April and May 2015, there was a flurry of legislation introduced, with at least five Senate bills proposed that dealt with PURPA in some shape or form.

As the Senate was debating Sen. Murkowski’s broad energy bill, Berkshire Hathaway Energy lobbyist Jonathan Weisgall testified before a hearing that many Western utilities should be exempt from their requirements to buy power from a PURPA-qualified facility.

Sen. Maria Cantwell of Washington, the top ranking Democrat in the Energy and Natural Resources Committee, noted the many coal holdings in the Berkshire Hathaway portfolio—from coal generation power plants to BNSF Railway, which makes a good deal of its business now from coal shipments—and essentially called the company out for lobbying to stifle competition.

She asked: “Isn’t it the case that obviously getting rid of this PURPA requirement would just greatly benefit the company financially on your profit margin by reducing competition for central station generation?”

Not long after, Weisgall was back at the Capitol, this time in the lower chamber, making similar testimony to the House.

The current version of Sen. Murkowski’s bill, however, doesn’t include any significant changes to PURPA.

Which isn’t to say that Berkshire Hathaway’s interests have been ignored by leaders in Congress. Sen. Murkowski and her counterparts in the House—Energy and Commerce Committee Chairman Fred Upton and House Energy and Power Subcommittee Chairman Ed Whitfield—have requested that the Federal Energy Regulatory Commission (FERC) conduct an official technical conference to review PURPA. This week, FERC agreed and the conference will be on June 29.

Berkshire Hathaway’s endorsement of President Obama’s Climate Commitment seems difficult to square with the company’s quest to kill “the most effective single measure in promoting renewable energy.”

YOU MIGHT ALSO LIKE

Robert F. Kennedy, Jr. to Keynote SXSW Eco

Koch Brothers Plotting Multimillion Dollar War on Electric Vehicles

Elon Musk Shows His Love for Dramatic Tesla Video With Powerful Message

233k

233k  41k

41k  Subscribe

Subscribe