Reviews

Reviews

California Solar Incentives, Rebates & Tax Credits (2024 Guide)

Here’s what we’ll cover in this guide to solar incentives in California:

- How can available solar incentives in California affect your total system cost? (We’ll cover nine main incentives)

- How do you correctly file for the federal tax credit in California to maximize your savings?

- Which solar rebates in California are the most valuable? (It’s not what you think!)

- Nem 2.0 vs NEM 3.0

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Is California a Good State for Solar Incentives?

California is one of the best places in the country to convert to solar, and one of the primary reasons for this is the array of valuable incentives for going solar. These energy rebate and benefit programs make solar conversion and energy efficiency upgrades more affordable, and they also help to boost your long-term savings.

The average cost to convert to solar — before any incentives — in the U.S. is around $29,970. After incentives, the total average cost of solar in California can even be under $14,000. System size, electricity use, per-watt cost and other factors have something to do with this lower amount as well, but incentives are a big part of why solar is so affordable in the Golden State.

California residents also have access to some of the most appealing and beneficial incentive programs in the country. Along with the abundant sunlight, the available perks are a big reason why the state is ranked #1 in the U.S. for solar conversion rates by the Solar Energy Industries Association (SEIA).

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

NRG Clean Power

Regional Service

Average cost

Pros

- Industry-leading warranty

- Outstanding customer service

- Representatives are experts on local policies

Cons

- No leases or PPAs

- Can be slightly expensive

Overview of California Solar Incentives

The chart below provides a quick look at the available incentives for going solar in CA. We’ll dive deeper into how they affect your total solar system cost and how to redeem them in the following sections.

| Solar Incentives in California Listed | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Credit to your income tax burden in the amount of 30% of your system total | One-time: Applied when you file taxes for the year your system is commissioned | $5,994, on average |

| Self-Generation Incentive Program (SGIP) | State | Rebates for installing batteries alongside your panels | One-time: Applied after registration | $200 per kWh of battery installed |

| Single-Family Affordable Solar Homes (SASH) Program | State | Affordable financing for qualifying individuals (based on eligibility by income). Note that this program is currently CLOSED. | One-time: Application is completed prior to installation | Up to $3 per watt, or an average of $18,000 in CA |

| Equity Resiliency Program | State | Additional rebates for installing batteries | One-time: Applied after registration | $1,000 per kWh of battery installed in qualifying areas |

| Active Solar Energy System Property Tax Exclusion | State | Prevents taxes from increasing as a result of solar conversion | One-time: Takes effect upon installation | Varies based on property value, system value and local tax rates |

| California FIRST (PACE Financing) | State | Affordable financing with reduced interest rates and down payment requirements | One-time: Application is completed prior to installation | Varies based on system value |

| CA Solar Rights and Easement Laws | State | Provides guaranteed access to solar panel installation and solar energy | Continuous: Always in effect | N/A |

| Net Metering | Local | Allows you to earn energy credits for all overproduction and use them to offset future utility bills, new policy as of 04/2024 | Continuous: Always in effect | Varies based on system size, energy needs and credit rate |

| Local incentives | Local | Special perks offered by utility companies and municipalities in CA | Varies | Varies based on incentive |

Federal Solar Tax Credit (ITC) for Californians

The federal solar tax credit is one of the most valuable incentives in California, and it’s available to all residents. It’s designed to help reduce the effective cost of converting to solar and incentivize residents to adopt renewable energy.

This federal tax credit for solar is a credit to your income tax liability for 30% of your system value. When you file your income taxes, 30% of your system cost will be credited to what you owe. Unused credit can be carried over for up to five years to allow more individuals to take the credit.

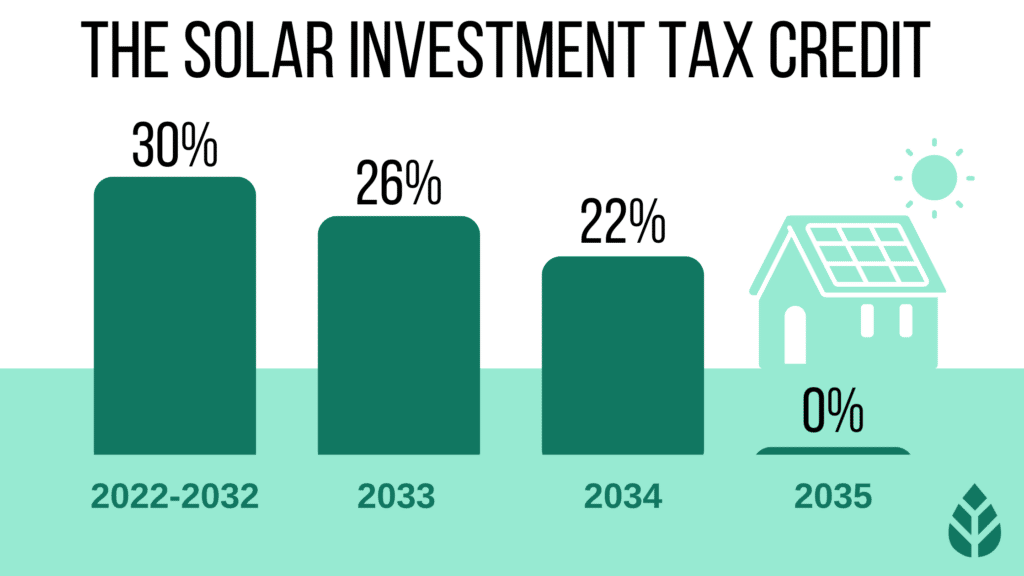

This credit was originally established in 2006. Since then, the credit dropped to 26% in 2022 and was previously scheduled to drop to 22% in 2023 and would no longer be available in 2024. However, the federal government updated the policy with the IRA, extended the dates for inclusion and re-upped the credit percentage. Current credit rates are as follows:

- 30% for systems installed between 2022 and 2032

- 26% for systems installed in 2033

- 22% for systems installed in 2034

- The program will be discontinued in 2035 and will no longer be available2

In California, where the average 6 kW system totals $19,980, the federal credit will average around $5,994, bringing down your effective system cost to $13,986.

How to Claim the Federal ITC in California (click to expand)

Claiming the federal tax credit in CA is relatively straightforward and requires just a little extra time when you file your taxes. We’ll include a quick breakdown of how to take advantage of the federal credit below.

- Step 1: When you or your accountant are ready to file your taxes, print IRS form 5695, which is the form for Residential Energy Credits.

- Step 2: Fill out the form using the information provided by your solar installation company. You’ll need the total system value, the address where the panels were installed, the size of the system in kW and some additional information that your installer should have provided.

- Step 3: Include the form when filing your taxes. Automated sites like TurboTax and HR Block usually ask if you’ve installed solar equipment, so those programs will also ask for the form or have you fill it out digitally.

Is the Federal ITC Worth the Time/Effort of Claiming in California? (click to expand)

In our opinion, the federal credit is the best financial incentive available for residential customers in California. This incentive requires just a single form to be filled out, which should take no longer than a few minutes.

However, keep in mind that the credit only rolls over for five years, and therefore only makes sense if you expect to owe at least $6,000 in federal taxes over the next five years—or $1,200 per year.

With a quick and simple claims process, the ITC can effectively save you a ton of money. Just a few minutes when you’re already filing your taxes can let you take an average of $5,000 in credit value. If you only have time to take one credit, this should be it.

California’s Self-Generation Incentive Program (SGIP)

Since power outages can be an issue for utility companies in California (the state leads the nation in power outages), the state initiated the Self-Generation Incentive Program, which provides rebates to customers who add a solar battery to their solar system.

The program, initiated by the California Public Utilities Commission (CPUC), provides a rebate of up to $200 per kWh of battery installed as a part of residential solar panel systems.

A Tesla Powerwall solar battery, for example, which has a capacity of 13.5 kWh, could be eligible for a rebate of up to $2,600.

How to Claim the SGIP in California (click to expand)

Claiming the Self-Generation Incentive Program in CA is another relatively simple process. In fact, your installer should do most of the work for you. You can start by finding approved SGIP installers by using the “Find an Installer” tool on the CPUC website.

Once your installer provides you with the eligible energy storage system, a representative will file the paperwork needed to get you the rebate for which you qualify.

Is the SGIP Worth the Time/Effort of Claiming in California? (click to expand)

If you’re interested in installing a solar energy storage solution in your home, then the Self-Generation Incentive Program is a no-brainer. Your installation company will do most of the work, so it’s well worth the minimal time and effort it will take you to find an eligible solar photovoltaic (PV) equipment provider.

However, the SGIP is a tiered incentive program, meaning that the rebates diminish with every new battery that is installed across the state. As such, it’s best to apply to the program as soon as you can. The exact rebate amount will depend on your utility provider.

If you are a customer with a pre-existing solar array and want to add a battery, we recommend that you wait until 2024 when the standalone energy storage tax credit goes into effect (an extension of the solar tax credit passed in the Inflation Reduction Act). You’ll save more money that way than you would with the additional savings realized through acting early on this tiered rebate.

Watch Below: California Updated Their Net Metering Policy. What Does That Mean For You?

California’s Single-Family Affordable Solar Housing (SASH) Program

The SASH program — also known as the Disadvantaged Communities SASH (DAC-SASH) program — was initiated to make solar accessible to low-income households and areas. It provides one-time, upfront cash-back incentives to bring down the cost of solar in California for eligible individuals.

This solar program was started by the California Solar Initiative (CSI). It’s open to prospective solar customers who:

- Are customers of Pacific Gas & Electric (PG&E), Southern California Edison (SCE) or San Diego Gas & Electric (SDG&E)

- Own their home

- Live in the home full-time that qualifies

- Have a household income that is at or below 80% of the median household income in the area

- Take advantage of “affordable housing,” which is defined by Public Utilities Code 2852

If you qualify, you can get immediate rebates of up to $3 per watt — an average of $18,000 in CA — to make your solar array more affordable.

As of January 2024, the SASH program is CLOSED. It might open again in the future if funds are replenished, so make sure to check with your utility company or the DSIRE database for future opportunities.

How to Claim the SASH Program Incentives in California (click to expand)

Filing for the SASH Program can be a bit time-intensive. You need to confirm that you qualify, which can entail working with the program administrator and providing a slew of documents to verify income and residence in your home, as well as your affordable housing qualification.

You can start by seeing if you qualify on the Energy Program for All website. After you qualify, a representative from GRID Alternatives will discuss verification requirements and the next steps.

Is the SASH Program Worth the Time/Effort of Claiming in California? (click to expand)

The SASH Program can take quite a long time to qualify for, as you have to verify home ownership, your household’s income and that your home is part of an affordable housing program in CA.

While the process is time-consuming, it provides a massive reduction in solar installation costs if you qualify — usually up to $18,000. As such, this is well worth the time you’ll spend applying if you believe you’ll qualify.

In addition to the significant savings, the system is designed to make solar affordable and accessible to low-income individuals. If you think you’ll qualify, this program could be the difference between being able to convert to clean energy and having to stick with fossil fuels and less environmentally-friendly energy sources.

The bottom line: if you think you might qualify as a low-income homeowner, this is one of the most valuable incentives in California, and is absolutely worth your time if the program opens again.

California’s Equity Resiliency Program (ERP)

The Equity Resiliency Program (ERP) is offered as part of the SASH program. Rather than providing rebates for solar panels, this program provides rebates for energy storage solutions.

If you qualify for the SASH program and you also want to install solar energy batteries in your home, then the ERP is an outstanding option. It will help reduce the cost of your batteries by up to $1,000 per kWh of battery capacity installed. For a Tesla Powerwall, which has a capacity of 13.5 kWh, the ERP could cover the entire cost.

Note that, since the SASH program is currently closed, this perk is also not currently available as of January 2024. Check the DSIRE website or the program’s website for more information on future openings.

How to Claim the ERP in California (click to expand)

If you’re already working with a representative to take advantage of the SASH program, you can claim the ERP by letting the rep know that you’d like to install solar energy batteries as well. The representative can help you fill out the additional paperwork to take advantage of this program.

You may, however, need to supply some additional information, including:

- The capacity of your battery system

- The price you paid for your batteries

- The installer’s name and address

- The installation address

Is the ERP Worth the Time/Effort of Claiming in California? (click to expand)

As mentioned above, the SASH program requires quite a lot of paperwork and verification, but it’s worth the time investment because of the payoff. The ERP is a phenomenal add-on to the SASH program since the perks come from the same company — GRID Alternatives.

If you already qualify for the SASH program, then the additional paperwork required to take advantage of the ERP is minimal.

The ERP is the closest incentive that you’ll get to installing batteries for free, so we strongly recommend taking this perk if you’ve already qualified for SASH. The payoff is high for minimal extra work if it opens up again and becomes available.

Active Solar Energy System Property Tax Exemption in California

This exemption is available to all residents of California. Normally, when you carry out home improvements, your home value increases, which drives up your taxes. As with any home improvement project, converting to solar is expected to boost your home value by around 4.1%.3

While going solar would normally cause your taxes to increase as a result, this exemption prevents that from happening. Ultimately, this perk can save you hundreds or thousands of dollars in taxes over the lifespan of your system.

How to Claim Property Tax Exemptions in California (click to expand)

Thankfully, this tax exemption for going solar is automatically applied to all solar power systems in California. The value added by home improvements is typically taxed based on closed permits. Your municipality will automatically neglect to consider the value your system adds when assessing your home value.

Are Property Tax Exemptions Worth the Time/Effort of Claiming in California? (click to expand)

Since this perk requires no work on your part, this is an outstanding incentive you will automatically enjoy after going solar. You won’t see a reduction on your taxes, but you won’t see the increase you’d normally see after such a substantial home improvement.

PACE Financing in California

PACE financing is a pro-solar financing program that provides low-APR, no-money-down financing options for aspiring solar customers. PACE loans let you pay for your solar installation via your taxes, and the cost of financing is often significantly lower than if you chose to finance through your installer or a third party.

How to Claim PACE Financing in California (click to expand)

Applying for a PACE loan begins by choosing a certified PACE vendor from the list provided by the Department of Financial Protection and Innovation (DFPI). Once you choose a vendor, a program administrator will help guide you through the process of filing the necessary paperwork.

Is the PACE Program Worth the Time/Effort of Claiming in California? (click to expand)

PACE loans can be an exceptional option for aspiring solar customers who cannot afford to take out a standard solar loan. It might be a suitable option for you if you’re looking for the lowest APR possible or for an affordable loan with minimal down payment requirements.

Applying for the PACE program takes quite a bit of time and requires filing paperwork and discussing your options with a program administrator. While it is time-consuming, it can be great for customers who cannot afford other payment options and don’t want to lease.

However, it’s important to note that PACE loans are attached to your home as a lien, which means they can be an issue if you plan to sell your home before the loan is paid off. It might not be worth the potential future headache if you think you might not be in your home for decades to come.

There are some other potential downsides to PACE loans, including:

- The risk of some improvements not being eligible for coverage

- An increase in property taxes

- Increased property taxes leading to tax sale or foreclosure if you cannot afford the bump

California’s Solar Rights and Easement Laws

California has initiated solar rights and easement laws, which basically make solar accessible to all residents. These laws prevent homeowners associations (HOAs) and municipalities from preventing residents from installing rooftop solar panels.

This is less of an incentive than it is a guarantee that you retain the right to enjoy the benefits of solar.

How to Claim the Solar Rights and Easements in California (click to expand)

Thankfully, the solar rights and easement laws don’t need to be claimed, and all residents can automatically enjoy them. No governing body can stop you from installing panels and accessing the solar energy that would normally hit your property.

Are the Solar Rights and Easement Laws Worth the Time/Effort of Claiming in California? (click to expand)

These laws are a great addition to the incentives in California, especially since they don’t require any action on your part. They’re not a financial perk but instead guarantee that you always have the right to convert to solar and produce clean energy.

Net Metering in California: NEM 2.0 vs NEM 3.0

Net metering — sometimes called net energy metering (NEM) — has historically been one of the most crucial incentives for solar customers in the U.S. This is a billing policy that lets you over-produce electricity with your system when the sunlight is abundant and intense. You earn credits for all excess energy you generate and then use those credits to reduce future electric bills.

Unfortunately, as of December 2022 the local governance in California have decided to get away with the majority of the incentive and have enacted NEM 3.0 to take place starting April 14th 2024. While NEM 2.0 mandated that all excess energy be credited at the full retail rate, which is the best-case scenario for solar customers and leads to the greatest long-term savings, with credits also rolling over to future months indefinitely, NEM 3.0 is much more conservative- and reduced the buy back rate for solar energy from retail rate to 75% less.

Net metering policies are changing across the country, and most are becoming less appealing rather than more beneficial as it is seen as na unequal pricing structurer and can be seen as a penalty to lower income households without solar.

It is important to note that while the policy does go into affects starting April 4th, 2024, if you install solar prior to that date you will be grandfathered into the NEM 2.0 guideline of full retail rate for 20 years- making now the BEST time to go solar in California for the foreseeable future. If you already have solar panels but need to replace them in the next 5 years and were grandfathered into NEM 1.0, we also recommend you re-install solar panels before this deadline to qualify for the more lucrative policy for the extended length of time.

How to Enroll in Net Metering in California (click to expand)

Any reputable solar company in California will take the lead on enrolling you in net metering. The appropriate application is called an interconnection application. If your utility company has installed a two-way meter on your home prior to you becoming a solar customer, chances are you may automatically be enrolled. Still, it’s worth reaching out to your electric company to confirm if you need to take action.

If you do need to apply, you can follow the simple steps below:

- Step 1: Fill out the interconnection application provided by your utility company

- Step 2: Wait for approval and inspection from your utility company

- Step 3: Receive permission to operate from your utility (PTO)

- Step 4: Monitor your first few bills after installation to ensure your credits are accruing (only if your production outpaces your energy usage)

Is Net MeteringWorth the Time/Effort of Claiming in California? (click to expand)

For most solar customers in California, enrolling in net metering won’t cost any money and won’t require any additional paperwork to be filled out. Even if you do need to submit an interconnection application, taking advantage of this perk will require minimal paperwork that is well worth the time you’ll spend filling it out.

We hope the net metering credits in California will stay at the retail rate it is currently. Unfortunately, this is unlikely, and the rate will probably drop in the future when utility companies have control over their own rates.

Even if the credit rate does drop, net metering is still wildly beneficial for all solar customers. It will still be a valuable perk that’s worth applying for — if you need to apply at all.

As we mentioned earlier, solar batteries will become extremely valuable in California should net metering drop to a lower rate (which we expect it will). For that reason, we recommend paying special attention to the Self-Generation Incentive Program.

Local Solar Incentives in California

Finally, California is home to quite a few local solar incentives, which are provided by individual utility companies, cities, counties or other municipalities. Below, we’ll provide a comprehensive list of all of the local perks available in California and how they can help make solar more affordable for you.

- San Diego County Green Building Program: If you live in San Diego County and you’re coupling a home build or renovation with solar or other energy efficiency upgrades, you can get a reduction in the permit fees. This offers a 7.5% reduction, plus expedited processing times.

- City of San Francisco GreenFinanceSF: Residents of San Francisco can opt to finance PV systems using this program. It allows your payments to be processed via your taxes for convenience, and it helps to reduce interest rates for greater savings over time.

- Rancho Mirage Energy Authority (RMEA) Solar Rebate: Customers of RMEA can claim up to $500 in rebates from the utility provider when installing or expanding upon an existing solar PV system.

- Sacramento Municipal Utility District (SMUD) Solar Rebates: SMUD provides additional rebates and incentives to customers who install batteries along with their panels. Rebates can add up to around $2,500.

Local incentives are always subject to change. As such, we recommend checking with your utility provider and your nearest municipality to see if there are any additional perks available to you for converting to solar.

You can use the links at the very bottom of this page to find all the local incentives available in your city.

So, What Are the Best Solar Rebates and Incentives In California?

We’ve included a comprehensive list of all of the incentives available for solar customers in California above. However, not all of the perks mentioned are of equal value, and some help to make going solar in California more worth it than others. Below, we’ll include a short list of the top incentives we think it’s most important for you to take advantage of.

Federal Tax Credit

If you only take one incentive in CA, make sure this is it. The federal tax credit provides an average of just under $6,000 in tax credits to solar customers. Not only does the federal tax credit provide the highest potential for savings, but it also takes minimal time to apply for. As such, the value you get for the time spent applying is outstanding.

Net Metering (For Now)

Net metering is another of the low-cost-high-reward incentives that we absolutely recommend taking advantage of. In many cases, your utility company won’t even require that you fill out any paperwork to access net metering. However, even if you do have to spend some time and effort applying, this policy is worth it, as it helps you maximize long-term savings.

Self-Generation Incentive Program (SGIP)

Finally, we strongly recommend taking advantage of the Self-Generation Incentive Program if you plan to install a battery with your other PV equipment. With the value of net metering set to drop in California, we especially recommend cashing in on this incentive. The SGIP requires minimal paperwork and can save you over $2,500, on average.

What’s The Near Term Outlook For More Incentives In California?

California has been ranked as one of the top states — if not the top state — for solar conversion for quite some time. This is partially because the state has maintained a variety of beneficial incentives to make converting more affordable and valuable.

Given how many incentives are available in California right now, the likelihood is that there won’t be too many more popping up in the near future. In fact, it’s more likely that incentives will become less readily available or less valuable in the coming years if any changes are made. That’s why we recommend acting now.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: California Solar Incentives

Below are a few questions EcoWatch readers regularly send in about solar incentives and tax credit programs in California. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

There is not an SREC market in California, so you cannot sell SRECs in the state. SRECs (solar renewable energy certificates) are certificates earned for generating a certain amount of clean electricity with a solar array. Customers in select states can then sell these certificates to utility companies looking to increase the amount of renewable energy added to the grid.

Some homeowners worry that the money they receive from rebate programs and other incentives in CA will be taxable. Thankfully, none of the cash-back programs or rebates in CA need to be reported on your taxes, as they are not income.

Yes. Unfortunately, there have been some changes proposed for the net metering policy in California. Rather than mandating that credits for excess energy be offered at the retail rate per kWh, California is proposing letting individual energy companies set the rate. The likelihood is that the credit rates will decline for many residents, based on which utility company they have.

As of right now, there are no other proposed changes to the solar industry incentives in California. Additionally, the changes could allow utility companies to implement a grid charge to solar customers, which could average around $50 per year.4

California residents have long had access to a wide variety of massively beneficial solar perks. Unfortunately, there are no proposed positive changes for the perks available or for new benefits to become available, especially after the passage of the historic Inflation Reduction Act.

Related articles

Top Solar Installers in California Cities

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe