Solar Tax Exemptions Exist, Find out How to Save on Sales Tax and Property Tax (2024)

Here’s what we’ll cover in this guide:

- Can you claim solar on your taxes?

- How do you get the 30% credit?

- How much can you write off when buying solar?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

There are financial incentives available that make it easier for homeowners to invest in solar energy systems.Including a number of solar tax exemptions at the state and local levels. These solar tax exemptions can vary by location and may include relief from sales taxes, property taxes and more.

Tax Exemptions exist on a

- City/ County level (sales tax)

- State level (property tax)

- Federal level (incentives)

In this article, we’ll discuss which tax exemptions are available to homeowners who invest in renewable energy systems in each state, as well as the federal solar tax credit (ITC).

To see what exemptions are available in your area, get a free, no-obligation quote from one of our trusted EcoWatch solar installers below.

Trusted EcoWatch Solar Providers

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Solar Sales Tax Exemptions

Solar sales tax exemptions are a common financial incentive designated by state governments. According to the Solar Energy Industries Association, there are currently 25 states that offer a solar sales tax exemption. What does this mean, exactly? Most states levy a tax on consumer purchases, which can range from 2.9% to 9.5%.

With a solar sales tax exemption, these taxes are waived on purchases of solar panels, solar batteries and other forms of solar equipment. Naturally, this can reduce the total purchasing cost considerably, making a solar investment a bit more affordable.

For example, if your state has a sales tax of 6% and you purchase a solar panel system for $16,000, you’ll end up paying $16,960 in total. If your state has a solar sales tax exemption, however, you’ll only pay $16,000.

Solar Property Tax Exemptions

The Solar Energy Industries Association notes that 36 states currently offer a property tax exemption for homeowners who install residential solar systems.

Here’s what this means: A solar panel installation typically results in a significant increase in your property values. (On average, homeowners see a solar-related property value increase of about 4.1%.) In states that have renewable energy property tax exemptions, homeowners whose property values rise are protected from a comparable increase in property taxes.

In other words, the worth of the home goes up, but homeowners do not have to pay anything more come tax time.

To see what exemptions are available in your area, get a free, no-obligation quote from a solar installer near you.

Solar Tax Exemptions: State By State Breakdown

Different states have different laws when it comes to sales and property tax exemptions for solar installations. To learn about the tax incentives available in your area, check the table below:

| State | Solar Property Tax Exemption* | Solar Sales Tax Exemption* |

| Alabama | No exemption | No exemption |

| Alaska | Local exemptions | No sales tax |

| Arizona | 100% exempt | 100% exempt |

| Arkansas | No exemption | No exemption |

| California | 100% exempt until 1/2/2025 | No exemption |

| Colorado | 100% exempt | 100% exempt |

| Connecticut | 100% exempt | 100% exempt |

| Delaware | No exemption | No state sales tax |

| Florida | 100% exempt | 100% exempt |

| Georgia | No exemption | No exemption |

| Hawaii | 100% NHL only | No exemption |

| Idaho | No exemption | No exemption |

| Illinois | Special assessment | No exemption |

| Indiana | 100% exempt | No exemption |

| Iowa | 100% exempt for 5 years | 100% exempt |

| Kansas | 100% exempt | No exemption |

| Kentucky | No exemption | No exemption |

| Louisiana | 100% exempt | No exemption |

| Maine | No exemption | No exemption |

| Maryland | 100% exempt | 100% exempt |

| Massachusetts | 100% exempt for 20 years | 100% exempt |

| Michigan | 100% exempt | No exemption |

| Minnesota | 100% exempt | 100% exempt |

| Mississippi | No exemption | No exemption |

| Missouri | 100% exempt | No exemption |

| Montana | 100% exempt for 10 years | No state sales tax |

| Nebraska | Exemptions only for systems over 100 kW | No exemption |

| Nevada | Exemptions only for certain systems over 10 MW | No exemption |

| New Hampshire | Local exemptions | No state sales tax |

| New Jersey | 100% exempt | 100% exempt |

| New Mexico | 100% exempt | 100% exempt |

| New York | 100% exempt for 5 years | 100% exempt |

| North Carolina | 80% exempt | No exemption |

| North Dakota | 100% exempt for 5 years | No exemption |

| Ohio | Exemptions in Cincinnati and Cleveland | 100% exempt |

| Oklahoma | No exemption | No exemption |

| Oregon | 100% exempt | No state sales tax |

| Pennsylvania | No exemption | No exemption |

| Rhode Island | 100% exempt | 100% exempt |

| South Carolina | No exemption | No exemption |

| South Dakota | Exemption of either $50,000 or 70% of total property value | No exemption |

| Tennessee | Tax value no more than 12.5% of installed cost | 100% exempt |

| Texas | 100% exempt | No exemption |

| Utah | No exemption | Exemptions only for systems over 2 MW |

| Vermont | 100% exempt | 100% exempt |

| Virginia | Local exemptions | No exemption |

| Washington | No exemption | Exemptions only for systems up to 10 kW |

| Washington DC | 100% exempt | No exemption |

| West Virginia | No exemption | No exemption |

| Wisconsin | 100% exempt | 100% exempt |

| Wyoming | No exemption | No exemption |

*Accurate as of time of publication.

Federal Solar Tax Incentives

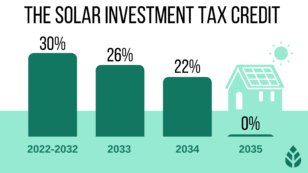

In addition to these state-specific incentives, there is also a federal tax incentive that is available to all Americans who invest in solar power. The solar investment tax credit (ITC) is currently valued at 30% of the total solar installation cost, meaning homeowners can essentially deduce 30% of that up-front cost. This tax credit covers:

- The cost of solar panels

- Labor costs for installation

- Additional solar equipment, like inverters, wiring, etc.

- Energy storage devices, including solar batteries

- Sales taxes paid for eligible solar installation expenses (in states that do not have sales tax exemptions)

Note that the federal tax credit is available for all homeowners who purchase a system, whether they buy it outright or finance it with a solar loan, but it is not available to those who lease solar panels.

To see what exemptions are available in your area, get a free, no-obligation quote from a solar installer near you.

Frequently Asked Questions: Solar Tax Exemptions

In states that have a solar sales tax exemption, yes, the purchase of solar panels is shielded from sales tax. Currently, at least 25 states offer a solar sales tax exemption.

No, Texas solar incentives do not currently include a sales tax exemption.

Currently, there are 36 states that offer solar property tax incentives. Take a look at the chart included above to find out whether your state offers a solar property tax exemption. Some municipalities may have local property tax abatements as well, so property owners considering going solar should check government websites for additional information about incentives and rebates.

Your solar roof shingles can be claimed via the federal solar investment tax credit, allowing you to deduct 30% of your total clean energy system costs.

Solar projects usually increase residential property values, which in some states may actually mean an increase in property taxes. However, in the 36 states that offer a solar property tax exemption, an increase in home values does not result in an increase in property taxes.

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe