There are several factors. Advanced energy markets are quasi-cartels, and incumbent fossil interests obstruct market transitions. American public utilities are waging war on their own customers who choose cheaper rooftop solar, seeking to tax them out of the market. Or try buying $3.00 E85 instead of $4.35 gasoline for your flex-fueled vehicle at an Exxon station.

In emerging markets raw energy is not enough—new infrastructure must be built to get that energy to consumers reliably when they need it—transmission lines, substations, pipelines, refineries. Hard infrastructure must be accompanied by complex administrative and economic mechanisms—rate regulation, credit arrangements, pollution standards, land use and leasing regimes.

The problems posed by renewables—generation intermittency, surface leasing rules for wind and solar farms, net metering—are not necessarily more difficult than those posed by base-load coal plants—fuel supply and storage, pollution damage or labor stoppages, grid failures, inability to meet peak afternoon loads. But the problems associated with fossil fuel energy are old problems, with established solutions and the security of being “proven.” Disruptive clean energy solutions pose new kinds of challenges. Ossified energy bureaucracies would rather deal with intractable old problems, rather than wrestle with potentially much easier but innovation-dependent new ones.

(It is remarkable how often the “intermittency” of solar power is cited as a barrier to its growth in India by people who routinely back up their local grid with diesel, in a country where the biggest brown-out risk is on hot summer afternoons when solar is at its most reliable, and where almost any local solar array is more reliable).

And, the economic chatter of market fundamentalists notwithstanding, market lag is normal. For example, most analysis suggests that solar or wind should only displace coal or gas as investment choices AFTER they become cheaper and “grid parity” is achieved. That’s logical if you were building a power plant that could be equally well fuelled by wind, sunlight, natural gas or coal—buy the cheapest fuel today. But if you build a fuel-specific power plant based on today’s costs, and it operates for 20 years, you can easily blunder, because you have to pay tomorrow’s much higher cost for fuel most of the time, as Japanese importers of Qatari LNG are doing today under their old contracts.

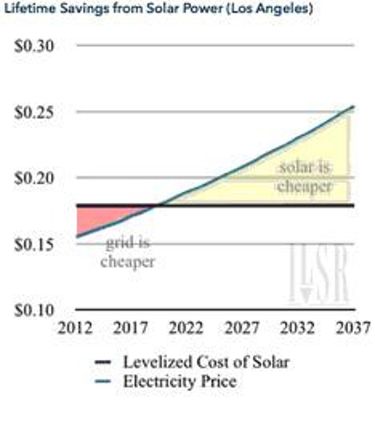

Here’s a chart that shows that risk:

This chart contrasts the costs of building a solar vs. natural gas plant in 2012, operating it for 25 years, assuming that grid parity occurs in 2017. A solar power plant costs the same $0.18 for the whole life of the project. A gas plant starts cheaper—at $0.155—but gradually climbs with the price of gas and inflation to $0.25 by the end of its life. The red area—savings from cheaper gas power for the first five years—are dwarfed by the light pink area—savings from cheaper solar power for most of the project life. In most markets parity between clean and fossil energy is projected to occur within 7-8 years. Infrastructure lasts for 25. So almost no new piece of fossil dependent energy infrastructure—vehicles, power plant, transmission line and building—will pay off on a lifetime cost basis.

Market true-believers may argue that this could not be true—if solar plants would generate cheaper electrons in India over a 25 year period Indian utilities would build them. But that version of market efficiency is preposterous. The world is cluttered with bankrupt projects built on the basis of outdated assumptions about the future. What is true is that companies—or countries—who see the clean energy revolution and act on it sooner will have much better balance sheets in 15 years than those who stick with a sinking fossil ship.

It’s time for climate advocates to start pointing out what the data makes obvious—with no price on carbon, clean energy should still be replacing fossil fuels as fast as we can get it built—and future investments in new coal plants, or finding new $120 oil—are going to be stranded assets, whatever the world does about climate change.

We aren’t asking for sacrifice—just common sense.

233k

233k  41k

41k  Subscribe

Subscribe