Solar Power Purchase Agreements (Guide to a Solar PPA in 2024)

In this EcoWatch guides on solar PPAs, you’ll learn:

- What the basics of solar power purchase agreements are

- How solar PPAs differ from solar leases

- Whether the pros of PPAs outweigh the cons

- What other solar financing options you have

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

What Is a Solar Power Purchase Agreement (PPA)?

While loans and leases are pretty common with big purchases like cars, you may not know much about a third common solar financing option — power purchase agreements, or PPAs. A solar PPA is one way to lease solar panels.

Instead of leasing solar equipment in your name, you allow for either a third-party solar developer or in some cases solar companies to place their equipment on your roof at no cost to you. In exchange the solar developer (who owns the equipment) receives the tax breaks and a new energy client (that’s you). As the owner of the roof that the equipment gets placed on, you can expect to receive reduced energy costs, often time at a fixed-rate and lower than market price in your area. Making this a desirable deal for both the solar energy supplier and you.

A PPA is a popular financing option for solar energy because it allows the homeowner to use solar energy without paying the hefty up-front cost of going solar. But don’t be fooled by a “free solar panel” gimmick — solar PPAs aren’t free, and they have their disadvantages. In this article, we’ll dive into the pros and cons of solar PPAs. But first, let’s review some logistics.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

SunPower designs and installs industry-leading residential solar and storage solutions across all 50 states. With a storied history of innovation dating back to 1985, no other company on this list can match SunPower’s experience and expertise.

SunPower earns its position as the top national installer on our list for a handful of reasons: It installs the most efficient solar technology on the residential market, offers the most expansive service area and backs its installations with a warranty well above the industry standard. All the while, SunPower pioneers sustainability efforts within the industry.

If that weren’t enough, SunPower systems come packaged with products all manufactured in-house by its sister company, Maxeon. This means that your panels, solar cells, inverters, battery and EV chargers are designed to work together and are all covered under the same warranty.

SunPower’s biggest downside? Its high-efficiency panels are considerably more expensive than most of its competitors’ products. However, its powerful panels are workhorses that make up for the initial cost with more backend production (think about this like spending more money for a car that gets more miles per gallon).

Facts and Figures: Blue Raven Solar

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 4.5 |

| A+ |

| 2014 |

| $$ |

| Solar Panels, System Monitoring |

| Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower |

| 25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee |

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

We like Blue Raven Solar because it understands that, for most homeowners, the cost of solar presents the biggest barrier to entry.

For that reason, Blue Raven Solar developed an innovative solar financing plan that offers in-house, flexible, zero-money-down options. The results speak for themselves, as Blue Raven Solar is now one of the fastest-growing solar companies in the nation and was recently acquired by SunPower. Its BluePower Plus+ plan (exclusive to Blue Raven) mimics the flexible structure of a lease while still providing the greatest benefits of owning your system.

Eligible homeowners enjoy 18 months of solar power before having to pay their first bill. When coupled with the federal solar investment tax credit (ITC), the initial energy savings can offset more than a third of the overall cost of a system before requiring a dollar down.

In contrast, other installers can only offer similar financing through solar leases, PPAs or third-party providers (such as Mosaic or Sunlight). Third-party loan providers can complicate the process, while opting for a loan or PPA will disqualify you from some of solar’s biggest benefits (additional property value, federal solar tax credit and local solar incentives).

Facts and Figures: Blue Raven Solar

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 4.5 |

| A+ |

| 2014 |

| $$ |

| Solar Panels, System Monitoring |

| Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower |

| 25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee |

How Do Solar PPAs Work?

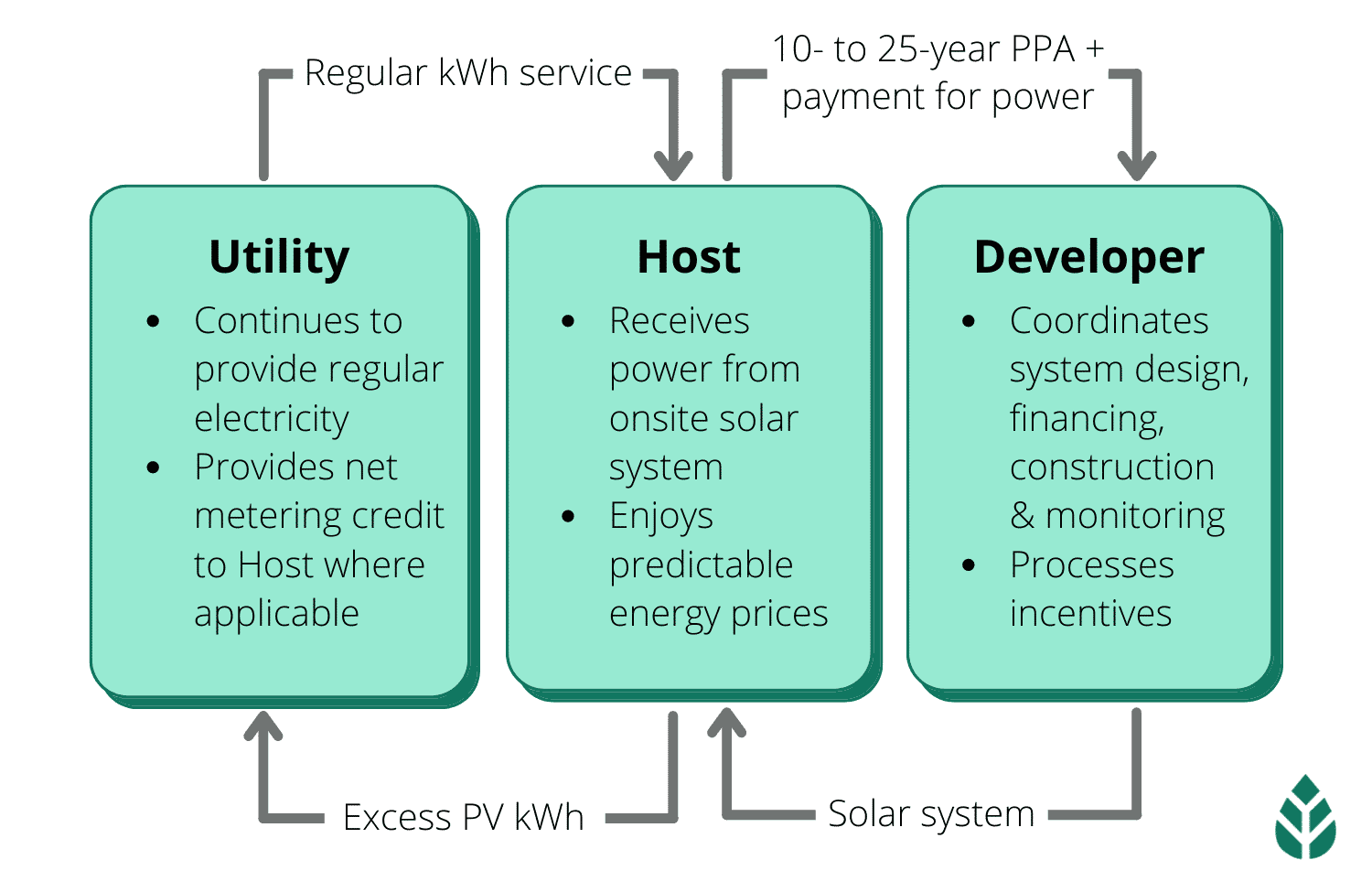

When a homeowner signs a solar power purchase agreement, they’re signing a contract with a solar company or a third-party owner who will take care of all the steps involved in putting the solar photovoltaic (PV) system on the home. That includes design, installation and necessary permitting.

In return, the homeowner — also called the host customer — pays the solar panel owner for the energy produced by the solar panel system installed on their house. The energy is typically sold at a fixed rate that’s lower than the local utility’s electricity rate.

Below is a diagram showing how it works between the utility, the homeowner/host, and the PV system owner/developer.

If your solar panels produce more energy than your home needs at any given time, the extra kilowatt-hours (kWhs) will be sent to the utility grid if net metering is available. You’ll receive energy credits for those kilowatt-hours that can offset (or potentially eliminate) any electricity charges you have (for example for electricity from the utility used at night when your solar panels aren’t producing energy).

Even if you eliminate your monthly utility bill by going solar, remember you’ll still have a separate monthly electricity bill from the owner of the solar energy system. You’ll send a monthly payment off to the solar panel owner for each kilowatt-hour of solar energy you used. If your home uses more energy than your solar panels produce, then you’ll have two bills — one from your utility company and the other from the owner of your PPA.

A solar PPA term typically ranges from five to 25 years. At the end of the term, you’ll have the option to renew the agreement, have the solar system removed or purchase your solar panel system from the owner at fair market value.1

How Much Can You Save With a Solar PPA?

The amount you can save with a solar PPA varies depending on a few factors:

- Electricity costs in your area

- Solar energy costs set out in your PPA

- Your average household energy usage

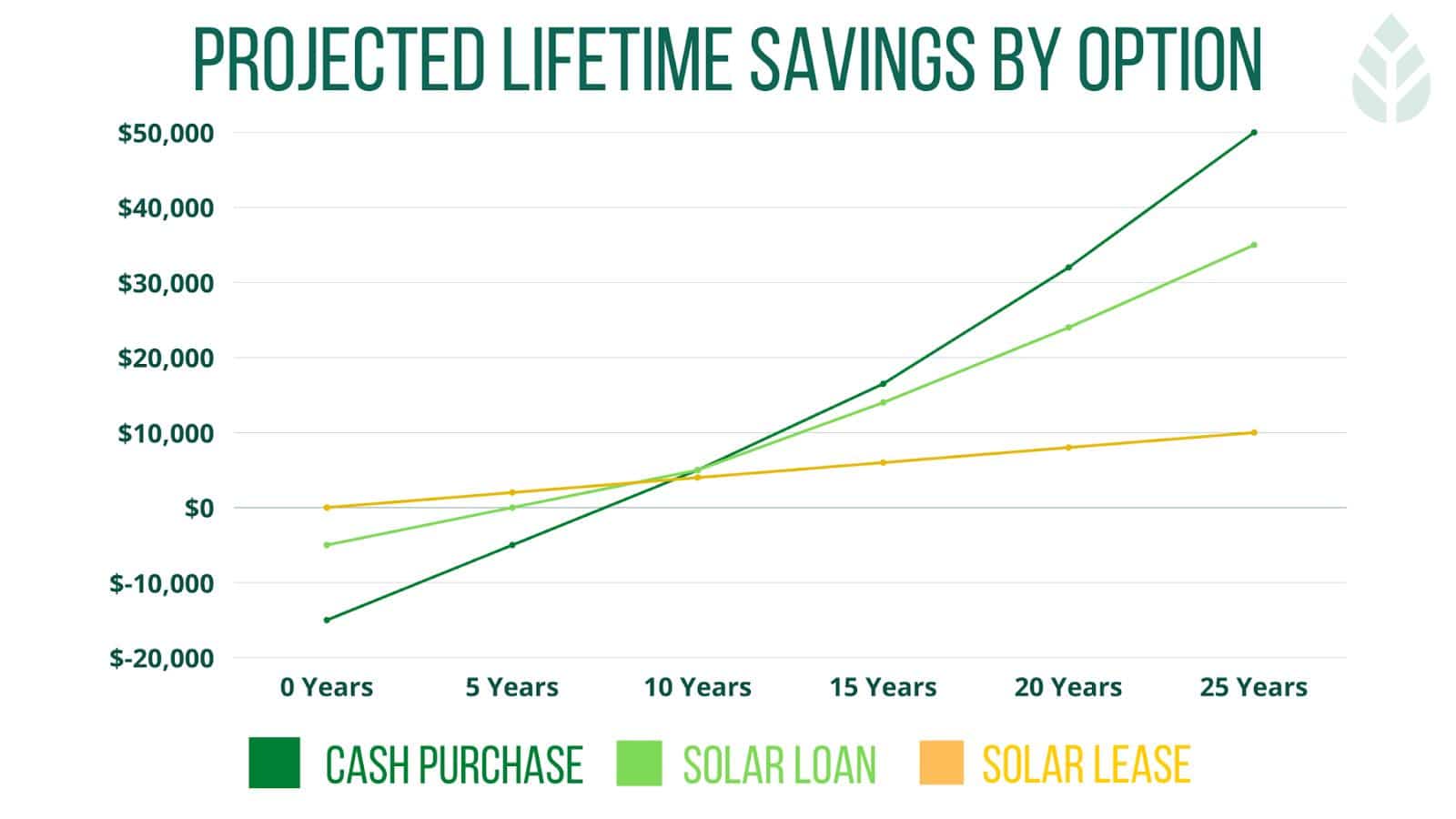

However, you’re going to see the lowest amount of lifetime savings with solar leasing compared to buying your solar panels with cash or with a solar loan.

Understanding How Much You Can Save Each Month with a Solar PPA:

Say you’re a homeowner in Vermont considering solar panel costs where electricity is roughly $0.20 cents per kWh. You enter into a PPA contract with a solar company that charges $0.15 per kWh of solar electricity used. To keep numbers simple, let’s say you used 1,000 kWh of electricity and your solar panel system produced 1,000 kWh of electricity in one month.

In this perfect scenario, the amount of electricity you created and consumed would cancel out, which means you’ve eliminated the $200 energy bill you would have owed your utility if you didn’t produce your own electricity. While that sounds nice, don’t forget you still owe the solar company $150 for the 1,000 kWh of solar energy you used from the solar panels.

In this example, you would end up saving $50 per month with a solar PPA, or $600 per year. That’s not bad, and it’s certainly a bigger savings than not going solar. But if you owned your solar panels you likely would have saved a lot more.

Solar PPA vs. Solar Lease: What’s the Difference?

While a solar PPA is a type of solar lease, there’s a difference between the two. With a standard solar lease, you make fixed monthly payments for access to the solar equipment — you can think of it as monthly rent for your solar panel system. Since you would be renting the equipment you would technically own the energy it produces. On the other hand, with a PPA, you’re not paying for the equipment but rather for the solar energy produced by the panels.

In many ways, solar leasing presents a competitive option compared with a PPA. The amount customers pay for a solar lease is determined based on the capacity of the panels, while solar PPAs are paid based on the actual generation and usage. The difference means that those with solar leases will have a more fixed price that won’t fluctuate with your energy usage.

That’s good news during high-energy months, like summer when your AC is cranked on high. But you could pay more with a standard solar lease during months of low energy usage.

Solar leases and PPAs are not offered by all solar companies but are common through national solar companies like Sunrun.

What are the Advantages and Disadvantages of Financing with a Solar PPA?

Although a great option for sustainability and energy savings, the decision to go solar comes with many pros and cons, as does each solar financing option. If you’re considering signing a solar PPA, here are a few advantages and disadvantages to keep in mind:

Pros of a Solar PPA |

Cons of a Solar PPA |

| No up-front costs | Won’t save as much on electricity costs |

| Still eligible to take advantage of net metering | Homeowner can’t take advantage of rebates, tax benefits, or other solar tax incentives of owning a clean energy system |

| Limited risk and performance headaches because the solar developer is in charge of installation and maintenance | Cost of leasing price typically increases each year of PPA contract |

| Reduced energy costs, as solar energy rates are lower than standard utility rates and will fluctuate less often | Over the system’s lifetime, you’ll likely end up paying an equivalent or higher amount than what you would have if you bought the solar panels outright |

| Smaller household carbon footprint | Leased solar panels don’t add value to your property like panels you own do, because they are not a part of the property you own. |

| Power production guarantees mean you won’t be paying if your system isn’t producing as advertised | Breaking your PPA can be a hassle |

Advantages of a Solar PPA

The majority of homeowners who sign a PPA do so because they’re interested in renewable energy production but don’t want to pay the high up-front cost. Installing a solar project with a PPA can seem like the best of both worlds.

- A solar PPA allows you to feel good about having a clean energy system without having to shell out tens of thousands of dollars and deal with the installation and permitting process, which can be quite the headache.

- Additionally, you get to enjoy lowered electricity bills and possibly even net-metering credits from your utility for the energy your panels produce. While you’ll still be paying a solar developer or third-party owner for the solar electricity your house uses, you’ll have a better idea of energy costs because they’re outlined and locked into a contract. Solar rates won’t increase without warning like electricity rates can.

Disadvantages of a Solar PPA

While there are several pros, the cons of solar PPA weigh a lot heavier in our opinion. Although you’re saving up front, the cost benefits of going solar are significantly reduced when you don’t own your solar panel system.

- You can lower your electricity bills with a solar PPA, but when you own your system you have the opportunity to significantly reduce or even eliminate those costs. When you have a solar PPA, you’re always going to be owing a company money for your energy consumption — whether it’s your utility, your solar developer or both.

- Sure, solar energy rates are often less than that of standard electricity, but most solar PPAs include a “price escalator.” That means the amount you pay for solar will increase each year, which is an even bigger disadvantage considering the cost of solar PV systems has been decreasing year over year.2

- Lastly, having a solar PPA agreement also makes you ineligible for several solar incentives, like the federal investment tax credit (ITC) and solar renewable energy credits (SRECs), which could greatly lower the overall cost of your solar panel system.

Other Solar Financing Options

The average U.S. solar panel system costs roughly $29,970 before applying any tax credits, so it’s understandable that most homeowners cannot shell out that kind of cash up front. But that doesn’t mean solar leases or PPAs are your only option.

Most of the top solar companies provide plenty of options to finance a solar panel system that you can actually own, or you can look into getting a loan from a government program or your bank.

- Financing through a solar installer: Many installers partner with lenders to provide lower-interest solar financing to their customers.

- Getting a PACE loan: Also known as an R-PACE loan, Residential Property-Assessed Clean Energy loans are long-term, low-cost options to fund your solar purchase. This type of loan attaches the cost of the panels to your property tax bill through a special tax assessment.

- Getting a standard bank loan: Solar loans can be secured through credit unions, banks, utilities or state programs. In certain cases, you can choose an on-bill financing option, in which the loan is repaid through your monthly electric bill with your utility provider. With this option, part of your monthly utility savings can be put toward your loan payment.

Should You Get a Solar PPA?

Ultimately, the way you decide to utilize solar energy is entirely up to you. We typically recommend that homeowners buy their solar panels outright to maximize all of the financial benefits of going solar. But we also recognize this isn’t a realistic option for everybody.

A solar lease or PPA is a good option for homeowners who aren’t in a good position to purchase their own system (whether financially or otherwise), are ineligible for solar tax credits or simply don’t want to deal with system maintenance.

One word of caution: Those advertisements for “free solar panels” are misleading. It’s unlikely that solar panels will ever be free, but you can install solar panels on your home with a $0-down financing option through a solar PPA, lease or solar loan.

If you want to know for sure how many panels you need, you can click below to connect with an EcoWatch-vetted installer and get a free estimate.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: Solar PPAs

A PPA, or power purchase agreement, is a way to use solar energy without having to pay for a solar panel system. With a PPA, you essentially borrow solar panel equipment and pay directly for the electricity it produces each month.

A solar PPA is a type of solar lease, but they’re not the same. With a solar lease, you pay a fixed monthly payment for access to solar equipment. With a PPA, you’re not paying for the equipment, but rather for the solar energy produced by the panels — similar to how you’re currently paying for electricity from your utility provider.

If you want to get the maximum financial benefit from your solar panels, you should buy them outright. However, a solar PPA may be worth it for homeowners who aren’t able to purchase their own solar panel system or those who are ineligible to receive solar tax credits.

The benefits of choosing a solar PPA are: no upfront cost of a solar panel system, reduced energy costs and no equipment maintenance. In theory, you get to reap many benefits of going solar without having to deal with the costs or headaches associated with owning your solar panel system.

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe