Reviews

Reviews

Maine Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to the solar incentives available in Maine, you’ll learn:

- Are there solar incentives available in Maine?

- Do Maine’s solar incentives help bring down the cost of converting to solar energy?

- How do you file for the federal tax credit in Maine?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Maine Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, absolutely. In Maine, the incentives available can reduce your overall solar project costs while maximizing your savings over time.

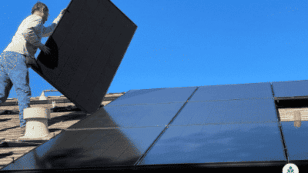

The average cost to install a solar energy system in Maine is around $21,840 before any incentives, which is about $8,000 under the national average.

This price is accurate assuming you pay the typical cost of $3.64 per watt — which is well above the U.S. average of $3.33 — and require a 6 kilowatt (kW) system to offset your electric bills — which is about two-thirds the size that most property owners in America need.

Maine is a relatively eco-friendly state with an outstanding Renewable Portfolio Standard (RPS) goal of producing 100% of the state’s electricity from renewable resources by 2050, but it’s still not the best place in terms of solar incentives.

ReVision Energy

Regional Service

Average cost

Pros

- Comprehensive service offerings

- Certified B Corp

- Many years of experience

Cons

- Relatively short workmanship warranty

- No leases or PPAs

Maine Solar Solutions

Local Service

Average cost

Pros

- Comprehensive service offerings

- Outstanding customer service

- Locally owned and operated

Cons

- No leases or PPAs

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

There are, however, a few perks available that can effectively help you save thousands of dollars, shorten your solar panel payback period and increase your energy savings in the long run. We’ll discuss each of the perks available in the table below.

| Solar Incentives in Maine | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Credits your income tax liability with 30% of your solar project cost. This can be rolled over for up to five years. | One-time: Applied once when you file taxes for the year you install your equipment. | $6,552 on average in ME. |

| Solar and Wind Energy Property Tax Exemption | State | Exempts the value added by your solar power system when assessing your taxes, thereby preventing them from going up as a result of solar conversion. | Ongoing: This perk applies each year when your property taxes are assessed. | Varies based on the system value and your local property tax rate. |

| Property-Assessed Clean Energy (PACE) Financing | State | Provides a low-cost financing option for low-income households to convert to solar. Bills are added to the property tax bill for easy payment. | One-time: Program and benefits take effect when you get approved for the program. | Varies based on your system size, energy needs and more. |

| Net metering | Local | Credits your utilities account for every kilowatt-hour (kWh) you overproduce and send to the grid. Credits can pay down future bills. | Always in Effect: All excess energy you generate will produce credits for your account over the life of your renewable energy system. | Varies based on your system size, your energy needs and more. Helps solar customers reach the average lifetime savings of $48,257 in ME. |

What Do Mainers Need to Know About the Federal Solar Tax Credit?

The federal solar investment tax credit — commonly referred to as the ITC — is a perk offered by the federal government and remains available to all Maine residents. It was first offered in 2005 and, in our opinion, has remained the best incentive you can take when converting to solar power.

The ITC is a credit and not a solar rebate, so it doesn’t provide actual “savings.” Instead, the credit gets applied to any income taxes you owe for the year you go solar. Provided you owe money to the government for taxes, you can take at least a part of the federal credit. If you can’t take the entire thing, you can roll over any excess credit for up to five years.

The federal credit was originally offered at 30% of the system value in 2005, and it was set to phase out by 2024. However, the federal government passed the Inflation Reduction Act (IRA) in September of 2022. Among other things, this piece of legislation increased the credit back up to 30% and extended it by a decade. The new credit schedule is as follows:

- 30% credit for systems installed between 2022 and 2031

- 26% credit for systems installed in 2033

- 22% credit for systems installed in 2034

- 0% credit for systems installed in 2035 and beyond

Given the average upfront system cost of $21,840 in Maine, most residents will see a credit of approximately $6,552. You can calculate your federal credit by multiplying the total you pay for your system — including labor, panels, batteries and electric vehicle (EV) chargers — by 0.3.

How to Claim the Federal Solar Credit in Maine

Claiming the federal credit is a simple process. We’ll detail the steps you’ll need to take below.

- Step 1: Go to the IRS’s website and print out IRS form 5695.

- Step 2: When you’re ready to file your taxes, fill out the form. This step should only take a few minutes, but you will need some information about your installer — including name and address — and your system — including the address where it was installed and the total cost.

- Step 3: File the form along with your taxes, or have your accountant file it for you.

If you file your taxes using a software like TurboTax or HR Block, you can skip these steps. Instead, just answer “Yes” when the program asks you if you’ve made any energy efficiency home improvements to your home. The software will then prompt you for the required information.

EcoWatch’s Opinion on the Federal ITC in Maine

In our opinion, the federal credit is the most crucial incentive to take no matter where you live in the U.S., but it’s especially important and helpful in a state like Maine where other incentives are lacking. The federal credit is one of the few benefit programs you’ll have available in the Pine Tree State, so it’s one of the only ways to reduce the cost of solar panels for your home.

Plus, the credit takes just a few minutes of your time to claim and provides an average potential return of over $5,000.

The only downside to this perk is that not everyone will be able to take the entire credit. If you don’t expect to owe at least $1,300 per year in income taxes over the next five years, you won’t benefit as much as you could from this perk.

What You Should Know About the Solar and Wind Energy Property Tax Exemption in Maine

This exemption prevents your property taxes from increasing as a result of converting to solar energy. It’s more a way to avoid additional financial burden when converting to solar than it is to save money upfront.

In most cases, when you complete any home improvement project that bumps up the value of your property, your taxes will go up as a result. Installing solar equipment is expected to raise your home value by an average of 4.1%, so, in theory, it should also cause an increase in your tax bill.1

In an effort to eliminate any downside to adopting solar, the state government exempts photovoltaic (PV) equipment from property taxation. That means your tax assessor will ignore any value your system adds, so your taxes won’t go up even though your home value has.

It’s difficult to estimate the actual savings this perk will provide. However, if we use the average solar system value of $21,840 in Maine and the property tax rate of 1.09%, we can estimate an annual savings of around $238.2 Over your system’s expected minimum lifespan of 20 years, that’s a total savings of $4,761.

Your actual savings will be lower due to system depreciation, but the perk overall will save a few thousand dollars in most cases.

How to Claim the Solar and Wind Energy Property Tax Exemption in Maine

The best part about this tax exemption for solar equipment is that it doesn’t take any effort or time to apply for. This is an automatic perk, so your assessor simply won’t include your system value when assessing the value of your home for taxation.

EcoWatch’s Opinion on Maine’s Solar and Wind Energy Property Tax Exemption

We love perks that don’t require any work to apply for, and this is one of them. This exemption saves a few thousand dollars over time, on average, and you don’t have to spend any time or energy applying for the program.

Watch Below: How Well Will Your Solar Panels Still Work When Covered In Snow?

What You Should Know About Property-Assessed Clean Energy Financing in Maine

PACE financing adds your monthly loan payment to your property tax bill, and the idea is that the savings you see on your utility bills should offset the money added to your tax bill.

How to Claim PACE Financing in Maine

You can begin the application process for PACE financing by going to Efficiency Maine’s website and seeing if you’re eligible. Once you’re approved, a program administrator will discuss the next steps with you. These typically include income verification, employment verification and choosing a Maine-based solar installer that’s certified by Efficiency Maine.

EcoWatch’s Opinion on Maine’s PACE Financing Program

PACE financing is a great tool for low-income residents to afford solar when they otherwise couldn’t. It helps more taxpayers gain access to renewable energy, which undoubtedly has a positive effect on the environment.

However, there is one major downside to the program. The payments get added to your tax bill, which means the loan will travel with your house and not the owner. If you try to sell your home before the loan is paid off, buyers could very well be turned off by the addition to the tax bill. PACE financing could lower your home value while repayment is in effect.

As such, we don’t recommend PACE financing to property owners who can afford other financing options. We’d suggest PACE over a lease — because you’ll at least own your system after it’s paid off — but we’d recommend most other solar financing solutions over PACE in Maine.

Net Metering in Maine

Net metering — also called net energy metering, NEM, net energy billing — is a popular billing policy that Public Utilities Commissions (PUCs) in many states mandate from local utility companies.

Basically, the program credits you for any energy your panels generate that you don’t use in your home. Each kWh you send to the electric grid gets credited to your account, and you can call on those banked kWhs if your panels ever fail to produce enough power for your home.

In Maine, utility companies are required to credit you for each kWh you send to the grid, but the credit rate varies by supplier. The rate is approved by the PUC annually, so it can change for a single supplier, as well. The best-case scenario for solar customers is the full retail rate, yielding the greatest savings over time.

It’s important to note that net energy metering policies are becoming less beneficial or disappearing altogether in states across the country. Given ME’s lofty RPS goals, it’s unlikely that the program will disappear in the coming years. However, it is possible, and the state has already had issues keeping up with the demand for acceptance into the program.

How to Enroll in Net Energy Metering in Maine

Chances are that most reputable solar installers in Maine will handle the logistics behind your net metering arrangement. However, there are a few preliminary steps you can take to ensure you receive a quick and smooth net metering process. These include:

- Step 1: Your solar installer will confirm that you have a bidirectional meter installed on your home. This is the piece of equipment that ensures you can take advantage of interconnection. If you don’t have one installed, your electric company should install one.

- Step 2: Your solar installer will apply for interconnection with your local utility company.

- Step 3: Have a solar installer complete the installation on your property.

- Step 4: Pass your inspection and receive PTO (permission to operate) from your utility company before turning your system on.

- Step 5: We recommend monitoring your energy bills for a month or two to confirm that the credits are registering. You should see a significant reduction in your electric bills, plus net energy metering credits.

EcoWatch’s Opinion on Net Energy Metering in Maine

NEM is an outstanding program that helps solar customers offset and even eliminate their energy bills in some cases. Maine’s net energy metering policy sometimes offers the full retail credit rate for all excess energy, while other customers might get a lower avoided cost rate. Either way, this perk is especially useful in areas like Maine, where electricity rates are well above the national average.3

The exact amount of money you save will vary, but the program is one of the best options for helping you pay off your system quickly. Net metering is a huge part of the below-average solar payback period of ten years or fewer in Maine. It also helps you maximize your long-term savings — an average of over $48,247 after panels are paid off, thanks in large part to NEM.

We should mention that the PUC in Maine has struggled to keep up with demand in terms of new customers joining the program. However, the state has a progressive RPS goal that incentivizes utility companies and local energy authorities to maintain its NEM program. As such, we expect that it will continue to benefit homeowners for years to come.

Which Tax Incentives Are The Best In Maine?

Above, we’ve discussed all of the benefit programs you can take to maximize the value of your solar PV system. However, not all of these perks are equally as beneficial. Below are the incentives that we believe provide the most value to Mainers and make converting to solar in Maine worthwhile.

- The federal credit

- Net energy metering

- Solar and Wind Energy Exemption for Property Taxes

We’ll explain why we think these are the best solar perks in your area in the sections below.

The Federal Solar Tax Credit

The federal credit is, in our opinion, the best perk for saving money on your home solar array. If you only have time to apply for one incentive, this is the one we’d recommend. Not only does it save an average of over $6,500 for Maine property owners, but it also takes just a few minutes to apply for.

Net Energy Metering

NEM is another outstanding incentive program that helps increase how valuable your system is over time. It helps Maine residents pay off their systems more quickly, which means it pushes up your long-term energy savings. This program is especially important in states with high energy prices, like Maine, where energy rates are about 1.5x the national average.

Exemption for Property Taxes

Finally, the exemption for property taxes is great for Maine residents because it doesn’t require anything on your part to apply, and it can save you thousands of dollars over the lifespan of your solar equipment.

What’s The Near-Term Outlook For More Incentives In Maine?

Right now, there are no pieces of legislation in the works to increase or decrease solar incentives in Maine in the next few years. It’s likely that, if any changes do occur, they will be in favor of solar customers to help the Pine Tree State reach its lofty Renewable Portfolio Standard goal by 2050.

With that being said, there’s always the possibility that incentives will become less appealing or disappear entirely. Net energy metering is the most likely incentive to become unavailable or get downgraded in Maine if that does happen. However, if you install your solar system while the current NEM policy is in place, you won’t lose your rate schedule should the policy undergo changes in the future.

Several states across the country are seeing NEM credit rates drop below the retail rate, and some programs are being discontinued entirely. The fact that the Maine Public Utilities Commission has struggled to keep up with demand for NEM suggests that it is possible that the program will be paused or that the credit rate will drop to even out demand.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ

Below, we’ll provide answers to some of the most common questions we see from Maine homeowners about saving money on solar electric systems.

No, ME currently does not have an active SREC market. SRECs are energy credits customers earn for solar energy production, usually earning one credit for every 1,000 kWh generated. Since ME doesn’t have a solar carve out in its RPS goal, there is no active SREC market.

However, the Generation Information System (GIS), which was set up by New England Power Pool (NEPOOL), tracks energy generation for registered customers. It tracks production from solar, biomass, wind power and other renewables used by electricity customers. It even tracks contributions made by those enrolled in community solar.

It’s possible that, at some point in the future, the credits earned via the GIS will become sellable. If that’s the case, then it’s a good idea to register with NEPOOL as soon as you convert to solar.

At this time, there are no plans for new solar incentives to become available in Maine in the next two years. There are also no pieces of legislation that are expected to make the existing benefit programs any more valuable or appealing.

The IRA passed in September of 2022 did two important things for Maine solar customers.

First, and most importantly, it extended the federal credit by a decade, which provides massive benefits to Maine residents. The full 30% solar credit is now available through 2032.

Second, it improved the credits available for electric vehicles, which will take effect in 2023. Some credits are as high as $7,500 per vehicle.Find out how much you could save with the IRA using EcoWatch’s IRA Calculator.

There are currently no plans to decrease solar incentives in Maine in the next two years, but that’s not to say that some of the existing perks won’t become less beneficial.

If there are negative changes to incentives, they would likely be a drop in the net energy metering credit — to an avoided-cost rate or some other rate below retail value — or elimination of the program entirely.

However, since the current net energy billing (NEB) program was just established in 2019 — after a switch from gross metering — we don’t expect any changes to the policy in the near future.

Comparing authorized solar partners

-

- Comprehensive service offerings

- Certified B Corp

- Many years of experience

- Relatively short workmanship warranty

- No leases or PPAs

A+Outstanding Social Impact

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe