Top 3 Solar Panel Financing Options (Tips to Maximize Your ROI)

In this EcoWatch guide on solar panel financing, you’ll learn:

- What’s the best way to pay for solar panels in 2022?

- What are the pros and cons of different solar financing methods?

- Is solar loan interest tax deductible?

- What banks are best for solar loans?

This guide has helped thousands of homeowners save money when going solar by helping them find the best financing option for their home. Let’s get started!

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

What Are the 3 Most Common Solar Panel Financing Options?

When buying solar panels, there are generally three ways for homeowners to pay for their systems from a solar company: cash, loan or lease. Although paying for your solar panels in cash upfront will maximize your savings and allow you to start saving on your energy bills right away, it’s not a realistic option for most homeowners, and it will become less realistic as net metering policies continue to decline in the U.S. Instead, many homeowners take out a loan to finance their solar panels. With a good solar loan, homeowners will still see energy savings and be able to pay off their solar panels over time. Just make sure that your loan conditions, including origination fees and the interest rate, are suitable.

We do not recommend solar leases for most homeowners. Unlike paying for your panels in cash or with a loan, with a solar lease, you will not own your solar panels. Instead, you will be paying monthly “rent” for your solar equipment. With that being said, low-cost options like leases and power purchase agreements (PPAs) are likely going to become more and more popular in the coming years as net metering rates decline and the average payback period — currently around 11 kW — gets extended.

So which solar financing option is best for you? Keep reading to learn more about the pros and cons of each.

SunPower

Nationwide Service

Average cost

Pros

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

Cons

- Expensive

- Customer service varies by local dealer

SunPower designs and installs industry-leading residential solar and storage solutions across all 50 states. With a storied history of innovation dating back to 1985, no other company on this list can match SunPower’s experience and expertise.

SunPower earns its position as the top national installer on our list for a handful of reasons: It installs the most efficient solar technology on the residential market, offers the most expansive service area and backs its installations with a warranty well above the industry standard. All the while, SunPower pioneers sustainability efforts within the industry.

If that weren’t enough, SunPower systems come packaged with products all manufactured in-house by its sister company, Maxeon. This means that your panels, solar cells, inverters, battery and EV chargers are designed to work together and are all covered under the same warranty.

SunPower’s biggest downside? Its high-efficiency panels are considerably more expensive than most of its competitors’ products. However, its powerful panels are workhorses that make up for the initial cost with more backend production (think about this like spending more money for a car that gets more miles per gallon).

Facts and Figures: SunPower

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 5 |

| A+ |

| 1985 |

| $$$$ |

| Solar Panels, Solar Batteries, EV Chargers, System Monitoring |

| SunPower Panels |

| 25-year all-inclusive warranty |

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

We like Blue Raven Solar because it understands that, for most homeowners, the cost of solar presents the biggest barrier to entry.

For that reason, Blue Raven Solar developed an innovative solar financing plan that offers in-house, flexible, zero-money-down options. The results speak for themselves, as Blue Raven Solar is now one of the fastest-growing solar companies in the nation and was recently acquired by SunPower. Its BluePower Plus+ plan (exclusive to Blue Raven) mimics the flexible structure of a lease while still providing the greatest benefits of owning your system.

Eligible homeowners enjoy 18 months of solar power before having to pay their first bill. When coupled with the federal solar investment tax credit (ITC), the initial energy savings can offset more than a third of the overall cost of a system before requiring a dollar down.

In contrast, other installers can only offer similar financing through solar leases, PPAs or third-party providers (such as Mosaic or Sunlight). Third-party loan providers can complicate the process, while opting for a loan or PPA will disqualify you from some of solar’s biggest benefits (additional property value, federal solar tax credit and local solar incentives).

Facts and Figures: Blue Raven Solar

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 4.5 |

| A+ |

| 2014 |

| $$ |

| Solar Panels, System Monitoring |

| Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower |

| 25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee |

Paying for Solar Panels in Cash

For homeowners who wish to maximize their savings, paying in cash is the optimal way to go. After all, by buying a residential solar power system outright, you’re essentially paying in advance for 25 to 30 years of electricity to use in your home.

This means your home energy rates are locked in for decades, and you don’t have to worry about inflation or rising utility costs. The big problem with paying in cash is that the upfront system cost of solar power equipment tends to be fairly high.

Even when you take into account incentives like federal tax credits and rebates, you’re looking at an investment of at least $13,986 to $27,972. This isn’t going to be feasible for every homeowner, not to mention that the full ITC won’t be available to all customers.

Solar Panel Loans

Another option is to borrow money from a solar lender, using it to finance your solar installation, then paying it back over time. The most common types of solar loans include unsecured personal loans, home equity loans (or home equity lines of credit), home improvement loans, and in-house financing through your solar panel installation company.

If you choose a loan as your solar financing route, pay special attention to your annual percentage rate (APR), origination fees and loan terms. How much you pay in interest, fees, and your repayment period will often increase the overall cost of your renewable energy system.

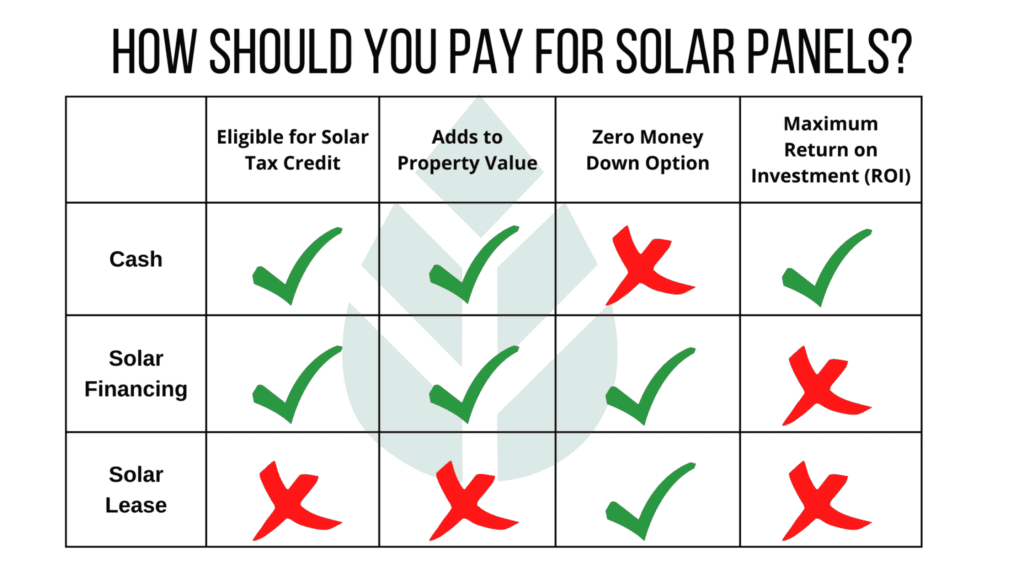

However, rest assured that homeowners who finance their systems with a loan are still eligible for the federal government’s solar investment tax credit (ITC)—an average potential value of $8,991—which may make it a bit easier to pay off that loan. Some states and local governments have low-interest rate loan programs for clean energy systems that you can take advantage of, such as Property Assessed Clean Energy (PACE) loans.

Borrowers sometimes have solar programs as well, like Fannie Mae’s HomeStyle® Energy mortgage. If you’re interested in paying for a solar installation via a loan, make sure you research all low-interest financing options available to you.

Additionally, with congress recently passing the Inflation Reduction Act, there will be a significant expansion in government loans for solar energy systems.

Leasing Solar Panels

Homeowners may also choose to either lease their solar panels or participate in a power purchase agreement (PPA), through which you buy the electricity the panels on your roof are producing. Solar leases and solar PPAs are pretty similar, but with one significant difference:

A solar lease means you’re making fixed monthly payments to use solar panels and other solar equipment, whereas a PPA means you’re making monthly payments simply for the electricity produced by solar panels. Naturally, the amount of electricity may fluctuate quite a bit from month to month.

Solar leases can seem attractive at first, but for most homeowners, they don’t make much financial sense. One reason for this is that homeowners in PPAs or leases are not eligible for the federal solar tax credit—an average value of close to $9,000. Another thing to note is that solar leases don’t enhance your property values, which can be one of the big financial incentives of a residential solar system. Other financing options will allow you to save a lot more money in the long run.

With that being said, one of the best ways to save money with solar panels is through net metering, which is a policy where you’re compensated for all excess energy you export to the grid. A good net metering rate makes it easier to pay off your panels and even see a quick return on investment on your system, while a poor net metering rate extends your payback period and cuts into your long-term savings. With California recently rolling out net metering 3.0 and many states following suit, the benefits from NEM are declining. As such, the overall savings associated with solar is expected to dip in the near future, which means the value will also go down a bit.

As a result, we expect solar leases and PPAs to become more popular as the value of cash purchases and solar loans will go down. These low-cost options will also make solar more affordable upfront. Cash purchases and loans will still be more beneficial, but they won’t be as widely available.

Click below to get started with a quote from one of our preferred partners.

How Do These Solar Financing Options Compare?

Solar panels can be expensive, and deciding whether to pay with cash, choose solar financing or sign a solar lease can be confusing and a bit stressful. The short answer is that all of these options have their upsides and drawbacks, so it’s up to you to decide which is right for you.

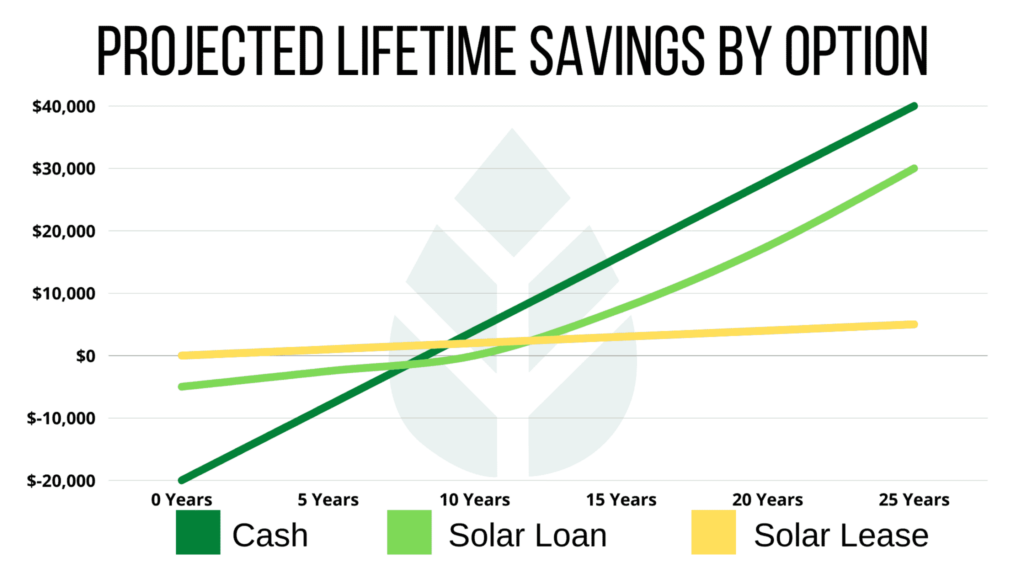

Generally speaking, cash purchases are the best option because they save you the most money in the long run. Solar loans are a great alternative, and signing a solar lease should typically be avoided, although they do have their place in the solar industry, especially as NEM changes for the worse throughout the U.S.

In the following sections, we’ll explain some of the pros and cons of the different solar financing and payment options to help you decide which options work for you and which don’t.

Paying in Cash: Pros & Cons

As you can see in the chart above, paying cash for your solar panels provides the greatest long-term value. However, it also requires the most significant amount of money upfront, so many people are unable to go this route.

The average cost of solar panels is around $29,970 before the federal solar investment tax credit (ITC) or $20,979 after the 30% credit is applied. This is assuming the national average cost of solar panels of $3.33 and the average solar system size of 9 kilowatts (kW).

If you’re able to afford this upfront cost, you stand to save thousands of dollars that would otherwise cover the interest over the lifetime of a solar loan. Paying in cash also allows you to begin saving money right away with your solar production rather than waiting for your monthly energy savings to cover your loan payments. Below, we’ll include some pros and cons of paying for your solar system with cash.

Pros

- No interest paid, meaning lower overall costs

- Start saving money right away on your monthly electric bills

- Maximize your return on investment (ROI)

- Take advantage of solar tax credits

- Boosts your home value

Cons

- High upfront cost

Financing Solar Panels: Pros & Cons

Most homeowners choose to finance their solar power systems rather than pay with cash due to the high upfront cost of installing solar. Solar panel loans let you defer the total price of your solar panel system and pay it back over a period of several years, usually between five and seven years.

The primary downside to this option is that you’ll end up paying interest every month, which means you stand to save less over time than if you paid with cash. Solar loans average between 5% and 10%, which cuts into savings each year.

Of course, solar loans come with major upsides, too, like far less money required upfront, which has lowered the barrier to entry for most homeowners. Those who purchase a system via a loan still maintain eligibility for solar tax credits, including the federal solar tax credit. We’ll briefly list the benefits and drawbacks of securing a solar loan below.

Pros

- Minimal money required upfront

- Lower barrier to entry than a cash purchase

- Allows you to invest your money elsewhere

- Still lets you take advantage of tax credits

- Boosts your home value

Cons

- You’ll pay interest on your loan, which prolongs your solar payback period

- You’ll end up paying more for your system over time

Read Also: Paying For Solar – Tips For Financing (or Refinancing) a Residential System

Leasing Solar Panels: Pros & Cons

Solar leases were once a popular option because they require little to no money down and still let you support the adoption of clean energy sources. However, they’ve increasingly become considered a last-ditch effort to convert to solar for many homeowners because they typically save you the least amount of money. However, with NEM policies changing and solar payback periods getting longer as a result, we do see solar leases making a comeback thanks to the low upfront cost.

Solar leases do tend to be promoted by less reputable companies trying to make a quick buck, so you have to be careful when choosing a provider. The majority of complaints toward solar companies come as a result of low-quality solar leases.

Here’s another key disadvantage of leasing your system: The company you lease from maintains ownership of the panels, which means it cashes in on any available tax credits and rebates rather than you benefitting from them.

Because you don’t own the system, solar leases also won’t add to your home value like solar loans and cash purchases do. In fact, solar leases can complicate the process of selling a home, as not all home buyers will want to assume the lease, and it can cost thousands of dollars to terminate your lease early.

Pros

- No down payment required

- Minimal barrier to entry

- Allows low-income families to support clean energy

- No maintenance required

- More accessible, especially as NEM policies decline

Cons

- Doesn’t increase your home value

- Can complicate the process of selling a home

- You lose eligibility for solar tax incentives

- Sometimes sold by unethical companies

- Often come with hefty cancellation fees

Before we move on, let’s take another look at the biggest advantages and disadvantages of each option.

Which Solar Panel Financing Option Is Right for You?

Ultimately, the way you choose to pay for your solar panel system will depend on a number of factors, including your expendable income, your credit score and ability to get a good loan rate, and more. Here’s a breakdown of which type of solar panel financing may be right for which homeowners:

| Solar Financing Option | Who it May Be Right For |

| Cash payment |

|

| Solar loan |

|

| Solar lease or PPA |

|

What’s a Good Interest Rate When Financing Solar Panels?

Solar loan interest rates typically range from around 3.99% to up to 16.99% (with the highest interest rate possible being 24.99%). As is the case with any loan, the lower your interest rate, the better the deal and the less money you’ll pay in interest over time. Lower interest rates help reduce your repayment timeline, ultimately allowing you to save more money in the long run.

The average interest rate for a solar loan is between 3.99% and 5.99%, so we recommend searching for an interest rate below 6%. We’ll discuss some tips for reducing your APR below.

Is Interest From Solar Loans Tax Deductible?

Yes, interest from solar loans is tax deductible, so going solar with solar financing will benefit you when it’s time to do your taxes.

Installing solar equipment — provided you don’t opt for a solar lease — is considered a capital improvement, so it will bump up your home value. Since all capital improvement payments and interest charges are considered tax deductible by the IRS, your solar loan interest will also be tax deductible.

Many states also have sales and property tax exemptions on solar equipment, meaning your property taxes will not increase after solar installation despite it being an improvement. Solar sales tax exemptions can also shave a few thousand dollars off of your installation if you live in a state with sales tax.

Taking advantage of these tax incentives can be a bit confusing, but tax programs — like HR Block and TurboTax — or an accountant can help guide you through the process to ensure the maximum savings on your investment.

Which Banks Are Best for Solar Loans? (And Where to Apply)

Countless lenders now offer solar loans, so you’ll have plenty of options to choose from. In many cases, your solar installer will have relationships with specific solar loan providers, but you can always choose an outside lender for your solar system. As such, it’s wise to shop around and see which company offers you the lowest solar loan rate and the best terms.

We recommend applying to one or two of the big names that service your area in addition to the companies your solar installer offers. This way, you get a better sense of the options available to you.

We’ll include some information on specific banks for solar loans below, as well as some tips for finding the lowest rate available.

Best Solar Financing Banks

The most popular solar loan providers in most areas throughout the country include Mosaic, LightStream Financial, Sunlight Financial and GoodLeap. These companies have relatively low credit score requirements and can lend between $1,000 and $100,000 for your solar system, depending on your home and eligibility.

You can also turn to the bank or credit union you use for your checking or savings accounts. Many major banks and lenders — including Chase and Bank of America — don’t offer solar-specific loan products, but others — like Wells Fargo and Fannie Mae — do.

You might be eligible for a lower interest rate or more appealing terms if you choose to finance your solar panels with your primary banking institution.

How to Apply to Get the Best Rates

Just like when buying a house, it’s important to get as low an interest rate as possible on your loan. Lower interest rates can make the difference of several thousand dollars in the long run. There are a few things you can do to land more appealing solar loan terms.

- Improve your credit score: Lenders look favorably on borrowers with higher credit scores, and they’re often willing to provide a lower APR to those individuals. It might take some time, but improving your credit score — especially if you’re in the 600-700 range — can do wonders for your solar loan interest rate. To do this, you can pay off credit card debt and ensure you’re not missing any monthly payments.

- Shop around rather than settle for the first rate you get: Different lenders have varying tolerances for risk, which means one lender might offer you a significantly lower rate than another. We recommend getting two or three APR estimates from different top lenders to see which one can serve you best while saving you the most money.

- Choose a secured loan over an unsecured loan: A secured loan, sometimes called a home equity loan or a home equity line of credit (HELOC), utilizes collateral — meaning you’d borrow money against the value of an asset like your home — as a guarantee that you’ll make your monthly payments. Secured loans show you have more “skin in the game,” which lenders see as a sign of commitment and will often lower interest rates for.

- Offer a higher down payment: For the same reasons mentioned above, a higher down payment shows your lender that you’re committed to owning your solar system. Interest rates tend to drop as down payments increase.

- Opt for a fixed interest rate over variable loan options: Loans with fixed interest rates are more predictable and generally a better option than variable rates.

- Have someone co-sign your loan: A co-signer agrees to secure your loan using their own credit score and reputation, so having a co-signer with a high credit score and good credit history is likely to land you a better rate.

How Long Is a Typical Solar Loan?

Like all other loans, solar loans can vary quite a bit in their length. Most fall between 10 and 20 years, but you could find a lender for a three-year loan or a 30-year loan, depending on your specific situation.

The average length of a solar loan is around 15 years, which is longer than most solar systems take to pay for themselves. Keep in mind that longer loan terms tend to decrease your interest rate, but they also lead to higher overall payments for your system.

What Credit Score Do You Need for a Solar Loan?

Generally speaking, you’ll need a credit score above 550 to secure a solar loan. However, there are exceptions to that rule of thumb, and your loan approval or denial is really based on your individual situation.

We’ll explain what you can reasonably expect as far as an interest rate and overall loan experience based on different credit scores below.

Solar Financing for Credit Score Below 550

If you have a credit score below 550, you’re very likely to have some trouble securing a solar loan. You might be able to find a lender who will make an exception, especially if you provide collateral for the loan — via a secured solar loan — and offer a large down payment.

However, at this credit score, it’s likely a better option to opt for a solar lease or, better still, to work to improve your credit score before applying for a solar loan. These come with the added benefit of no downpayment.

Rates for Credit Scores Between 550 and 650

If your credit score is between 550 and 650, you shouldn’t have too much of an issue finding a mainstream lender to approve a loan for you. Lenders like Upgrade, PenFed, Alliant, BestEgg and LightStream have been known to approve loans in this range.

Keep in mind that if your credit score is in this range, your APR on a solar loan will likely be above the average of 6%, which will cut into your long-term savings.

Financing Solar With a Credit Score of 650+

Once your credit score surpasses 650, you’ll have many options available to you and no shortage of lenders that will approve loans at reasonable annual percentage rates.

In addition to the companies mentioned in the previous credit score range, a 650+ credit score will open you up to loans from SoFi, Mosaic, Discover, SunLight Financial, SunPower Financial and GoodLeap.

Your APR will likely be under 10%, with higher credit scores moving you closer to the 6% average or the lowest rates around 4%.

Watch Below: The below video quickly explains what you should look for in a solar panel loan and how to find the best deal for your needs.

How Can You Save Money When Going Solar?

While the initial solar investment can be steep, there are options available to homeowners who wish to save money on their solar installation.

- Federal solar tax credit: Currently, installing a solar system qualifies you for a tax credit that’s worth 30% of the total equipment and installation cost. That’s an average of $8,991.

- Local utility rebates: Many municipal utility companies offer rebates (such as a property tax exemption) to homeowners who go solar. Research your local utility providers to learn more.

- Net metering: Also see if there is a net metering program available in your area. Net metering gives you the opportunity to funnel any surplus energy you generate back into the electrical grid, in exchange for a credit from your utility company. Note that net metering policies are expected to decline in the near future, as some states, like California, have already rolled out the less appealing net metering 3.0.

- Shopping around: Finally, remember that not all solar installers are created equal. Shop around and compare quotes to ensure you’re getting the best value.

Find out how much you can save by going solar with our Solar Calculator. Find out how much you could save on energy costs and what incentives and tax credits you qualify for.

Wrap Up: Is Financing Solar Panels Worth it?

As we’ve mentioned, purchasing solar panels with cash upfront will provide the best long-term returns — but we understand that won’t be feasible for most people.

However, for many homeowners, financing solar panels is absolutely worth it. With a solar loan, you get all the same perks of system ownership that you would if you paid in cash but with a minimal down payment — or none at all. Think about it as renting-to-own.

Here are a few of the biggest advantages of financing a system:

- Minimal or zero money down

- Maintains eligibility for the federal tax credit and local rebates

- Boosts your property value

Financing your solar panels will require you to pay more in the long run than you would with cash, as you’ll have the total system cost plus the interest you pay on your loan. However, most homeowners repay their loans within five to 10 years using the energy savings provided by their solar panels.

In closing, solar financing has become an excellent way to convert to renewable energy, minimize your upfront payment and still receive all the tax incentives and energy-saving benefits that come with owning a system.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: Financing Solar Panels

Below are a few questions EcoWatch readers regularly send in about financing their solar panels. If you have anymore, do not hesitate to contact us!

If you have the funds, paying in cash is the most advantageous way to finance solar. For those without the funds, a solar loan is usually the best way to go. For most homeowners, leasing doesn’t make as much financial sense. However, as net metering policies continue to decline and payback periods get extended, leases and PPAs will make more and more sense.

Yes, there are plenty of ways to finance solar panels. Banks, credit unions and even some solar installers offer their own lines of credit, specifically to be used for installing solar equipment.

For those without the funds to buy solar equipment outright, financing solar panels can be a flexible and affordable way to lower monthly utility bills and reduce environmental impact.

Taking out a solar loan delays your break-even point, but it still lets you cut your electric bills and enhance your property value. For many homeowners, solar loans are well worth it.

Yes, leasing solar panels is an option. However, for most homeowners, it is not financially prudent to do so.

Comparing authorized solar partners

-

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

- Expensive

- Customer service varies by local dealer

A+Best National Provider1985SunPower Panels25-year all-inclusive warranty

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe