ESG 101: What Is ESG, and Does It Matter?

What's behind the controversial investment strategy?

Why you can trust us

Why you can trust us

Founded in 2005 as an Ohio-based environmental newspaper, EcoWatch is a digital platform dedicated to publishing quality, science-based content on environmental issues, causes, and solutions.

Environmental, Social and Governance, or ESG, is a framework of standards measuring a company’s risks and impacts alongside financial factors. Companies use ESG reporting as a tool to disclose data on emissions, waste management, employee satisfaction, anti-corruption practices and more.

ESG reporting promotes transparency and engagement in business practices, especially when considering sustainability and social equity. ESG reporting intends to hold investors and companies accountable for their business practices and emissions.

As more investors weigh the potential impact of global warming and climate change on the long-term returns of investments, ESG reporting has rapidly become more popular.

But companies can also recognize benefits from ESG compliance. Companies that take the time and resources to become more sustainable and equitable can attract more investors, improve their credit ratings and outperform competitors.

In essence, ESG aims to identify and mitigate risk within a business or organization. ESG reporting also empowers investors to make more informed decisions and helps companies adjust to (and benefit from) changing consumer priorities.

What Is the Purpose of ESG?

Undeniably, it’s far easier to quantify a company’s financial performance than more nebulous aspirations like “sustainability” and “social responsibility.” Vague definitions and metrics for environmental, social and governance goals leave room for greenwashing and fail to hold companies accountable in a meaningful way.

ESG reporting attempts to measure sustainability metrics so that we can compare practices between companies and clearly understand which areas a company has room to improve in. Although ESG reporting is not perfect, it is meant to serve as a holistic framework for communicating the real, positive differences that companies are making in their business practices.

What Does ESG Stand For?

ESG stands for environmental, social and governance. ESG frameworks allow organizations to report these non-financial factors to identify and mitigate risk across their businesses.

Environmental

Big questions: What impact does a company have on the environment? How could climate risks affect the future of a business in its respective industry? What is a company or organization doing to negate its negative impacts?

According to the CFA institute, “climate change will be one of the most economically impactful events in human history.” And yet, the financial sector and environmentalism rarely intersect.1

However, the environmental factors of ESG framework attempt to reconcile the two and create a way for entities to uphold the highest environmental standards relevant to their industry and operations.

An ESG reporter not only considers how a company is impacting the environment but also how climate risks may impact the future of the business and how management is addressing these risks.

For instance, if a vehicle manufacturer is not considering EV development and phasing out fossil fuels, that company may be “behind the times” and unable to meet future regulations. On the other hand, if a hotel located in a high-risk coastal area is not considering the potential impacts of sea level rise and beach erosion, it may also be putting its financial future at risk.

There is no exhaustive list or standardized method of reporting environmental metrics. ESG reporters must collect, interpret and report data deemed appropriate for the company and the industry it operates within. Here are some top environmental considerations:

- Carbon emissions

- Energy efficiency

- Waste management

- Deforestation

- Air and water pollution

- Resource scarcity

- Climate risk management

Social

Big questions: Does the company promote diversity, equity and fairness for their employees and within the community? What are the risk areas surrounding the social practices of a company? Is there diversity of thought within the company?

Although the environmental aspect of ESG reporting is the most prominent, there’s evidence that social and governance factors are increasingly influential when investors are considering which organizations to support.2

The CFA Institute released a report summarizing the actions of 41 investment institutions that improved their diversity, equity and inclusion (DEI) within their organization, and offers some actionable tips.3 The CFA Institute recommends garnering leadership support and encouraging involvement from every employee in the company. Among others, offering all employees unconscious bias training, book clubs and discussion groups were recommended actions to take to increase DEI in the workplace.

The CFA Institute also recommended hiring dedicated DEI employees, increasing funding to improve DEI practices and achieving maturity and momentum of DEI programs to see continued success.4

Here are some of the top considerations when reporting the social aspect of ESG frameworks:

- Human rights standards

- Diversity and gender inclusion

- Employee engagement

- Community relations

- Staff turnover

- Labor standards

- Customer satisfaction

- Data protection and privacy

Governance

Big questions: Is the leadership of a company committed to fairness, transparency and honesty in their business practices? How is the leadership of the organization held accountable to its employees and stakeholders?

Governance factors within an ESG framework are important because they mitigate risk from corruption and discrimination within the leadership of an organization.

The most popular ESG reporting framework, the Global Reporting Initiative (GRI) requires companies to report the role of their leadership and the values and strategies of the company’s governing body.5

Companies with strong corporate ethics, balanced leadership compensation and otherwise legitimate practices are perceived as having a lower risk for investors in the market. On the other hand, organizations with conflicts of interest, poor or unfair delegation and other failures to uphold the integrity of leadership are at higher risk of long-term failure in the market.

Here are the top considerations for the governance piece of ESG:

- Board diversity and inclusion

- Bribery and corruption

- Leadership compensation

- Audit committee structure

- Lobbying

- Whistleblower schemes

- Political contributions

ESG Investing: Why Is it Important?

Individuals and institutions become investors when they allocate funds to a company or some other entity in hopes of seeing a financial return. Essentially, investors are “lending” their money in hopes that the endeavor they invest in will grow and earn more profits.

Investing can grow your wealth. However, the organizations you invest in also have a global impact. That’s why ESG investing is so important.

Investing in ESG stocks and funds can help us align our investments with our values. When we invest our money in a company, we are basically saying that we believe the company will do well and that we support its mission and actions.

ESG can empower investors (including normal people like us) to make educated decisions when investing. It is a way to mindfully “cast our vote” for companies that are making positive changes for the environment, its employees and customers and the community.

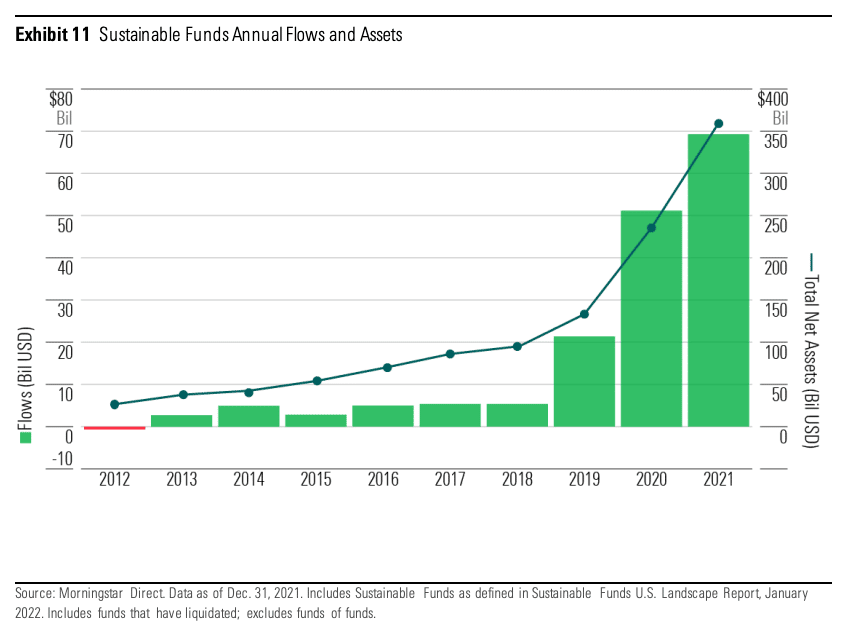

The result of this choice? More and more investors are selecting ESG stocks and funds; 2021 was a record year for sustainable funds. In fact, 2021 marked the sixth consecutive year of increases in total net assets held for sustainable funds.6

How Are ESG Investments Different From Traditional Investments?

You’ll commonly hear that, in order to start investing in stocks, you should invest in low-cost index or mutual funds. Index funds are portfolios of stocks that investors expect to closely mirror the overall growth of the market. Similarly, mutual funds are also portfolios of stocks, but they are designed to (ideally) outperform the market and give you a higher return.

For instance, if you invest in the very popular S&P 500 index fund, you are investing your money in the top 500 publicly traded U.S. companies. Over time, you can expect to see your investment grow at the same rate that these companies grow, a close reflection of the overall market.

So, how are ESG investments different from traditional investments? Well, companies in traditional index funds, especially oil and fossil-fuel stocks, are not necessarily dedicated to environmentally friendly practices. The general idea of ESG reporting is that, if a company is not providing detailed, transparent ESG reports, it may not be as transparent about the practices and impacts of that company.

There are “green” alternatives to traditional stocks and funds. Investing in ESG index funds contributes to companies that are making strides in sustainability and social equity. There are many ways to invest your money, including in stocks, bonds and funds, all of which have ESG counterparts.7

There’s an abundance of investment advice out there, and the best choice for investing will vary depending on your financial situation and goals. It’s best to speak with a financial advisor or professional before you begin investing.

How Do ESG Investments Perform?

This all begs the question: Do ESG investments perform as well as traditional investments? Current data suggests that ESG-weighted investments provide just as good, if not better returns in the stock market. However, these returns can vary depending on market conditions.

One study from the Kenan Institute of Private Enterprise suggested that investors clamoring for ESG compliant stocks may raise the value of the company’s stocks in the short-run, but would even out in the long run. However, a company could continue to see long-term benefits from ESG compliance if the company started operating more efficiently, improved its brand image and customer loyalty and increased employee retention and satisfaction through its efforts.8

Another model published in the Journal of Sustainable Finance & Investment concluded that ESG investments likely experience higher long-term returns because companies with superior ESG factors were less volatile, and thus, less risky.9

Although current data is favorable toward ESG investments, it will require further research and time to definitively conclude how well ESG compliant investments perform over time.

How to Start Investing In ESG

Financial advisors typically recommend that beginners invest in mutual funds rather than individual stocks. Generally, investing in a stock index or mutual fund will lower your risk of loss in the stock market.

There are many ESG funds out there, some better than others. We recommend speaking with a financial advisor or professional if you want to learn more about investing.

You can explore sustainable investment mutual funds here.

Limitations of ESG

ESG investing has recently experienced an explosion in popularity, thanks to a growing movement demanding companies to make real, measurable improvements in their business practices and do good by their people and the earth.

Although ESG reporting is massively popular, it is not immune to criticism and controversy. A lack of standardization, a shortage of skilled ESG reporters and the inability of smaller companies to invest in extensive data disclosure are all major flaws of ESG reporting efforts.

Lack of Standardization

There are six major ESG reporting frameworks and dozens more less-popular options. Companies can choose whichever framework they would like to use and which parts of the framework they will incorporate.

Because there is not one standardized ESG reporting framework, companies have more room to report information as they see fit. This raises questions of reliability and accuracy, as companies may be able to avoid reporting unfavorable information about their operation.

However, there has been some progress made toward standardization. The International Sustainability Standards Board (ISSB) was formed in 2021 as a consolidation of three existing ESG frameworks.10

The ISSB was founded with the intention of establishing a “global baseline” of sustainability reporting and disclosure.

Lack of Skilled ESG Reporters

The skills required to complete accurate, thorough and impactful ESG reporting include research, data analysis and technical writing, among others.

Considering ESG has experienced its fastest growth in popularity within the past three years, there is a severe lack of skilled ESG reporters that have the amount of experience that organizations are looking for.11

Bias Towards Larger Companies

90% of S&P 500 companies have submitted ESG reports.12 Some companies have created entire teams of people dedicated to ESG data collection and reporting within the company. Obviously, not all businesses have the opportunity and resources to do this, especially small businesses.

Unfortunately, companies that cannot afford to do in-depth data studies and analysis required to release an ESG report might be perceived as less trustworthy or sustainably-minded than companies that can.

So what’s the bottom line on ESG reporting? It’s not an end-all-be-all, but it’s helping us make informed decisions and giving us real measures of how companies are doing. As ESG frameworks become more standardized and more tools become available, ESG reporting will likely become more accessible and accurate.

Note: This article is for informational purposes only and is not investing advice.

Subscribe to get exclusive updates in our daily newsletter!

By signing up, you agree to the Terms of Use and Privacy Policy & to receive electronic communications from EcoWatch Media Group, which may include marketing promotions, advertisements and sponsored content.

233k

233k  41k

41k  Subscribe

Subscribe