Reviews

Reviews

Oregon Solar Incentives (Rebates, Tax Credits & More in 2024)

In this EcoWatch guide to solar incentives in Oregon, you’ll learn:

- What the Oregon Solar + Storage rebate program is

- Which solar tax breaks and other incentives Oregonians can take advantage of

- How Oregonians can profit from the solar energy their homes produce

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Oregon Solar Incentives Make It Affordable for Homeowners to Go Solar?

Solar power is more affordable in Oregon now than ever before, and more homeowners have been adopting this renewable energy source. Federal, state and local governments offer Oregonians a number of incentives to reduce the cost of going solar and make it more accessible.

The average price of solar panels in Oregon is around $3.28 per watt, which is less than the national average of $3.33, but a standard 9.5-kilowatt system in Oregon will still set you back approximately $31,160. This is prohibitive for many homeowners, and some Oregon residents will undoubtedly find it difficult to justify the cost of going solar.

Sunlight Solar Energy

Regional Service

Average cost

Pros

- Many years of experience

- Offers products from leading manufacturers

- Excellent reputation

Cons

- No leases or PPAs

- Limited warranty coverage

- Expensive

GenPro Energy Solutions

Regional Service

Average cost

Pros

- NABCEP-certified technicians

- Competitive pricing

- Multitude of products and services

Cons

- No leases or PPAs

- Limited warranty coverage

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Luckily, taking advantage of government and electric utility incentives can drastically reduce the price tag of going solar and make it more accessible. We’ll outline the incentives available to Oregonians in the table below.

| Oregon

Solar Incentive |

Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | The federal solar tax credit is available to all Oregon homeowners and gets credited to your federal income tax liability for the year your system is installed and commissioned. The credit is for 30% of your total cost to go solar.1 | Credited toward your annual federal tax returns | In Oregon, where most homeowners pay around $31,160, the typical credit is $9,348. |

| Oregon Solar + Storage Rebate Program | State | The Oregon Department of Energy (ODOE) provides a rebate on the installation of solar panels and batteries under the Solar + Storage Rebate Program. | Rebate is paid to your solar contractor and applied to the total cost of your solar project | Receive a rebate of up to $5,000 for a solar electric system and up to $2,500 for an energy storage system. |

| Solar Within Reach | State | Oregon provides the Solar Within Reach program to make clean energy equipment more accessible to low-income residents. | Amount provided will be used to reduce the cost of your installed system | This program provides cash incentives to PGE and Pacific Power customers in the amounts of $0.90 per watt (up to $5,400) and $1.00 per watt (up to $6,000), respectively, for those who qualify.2 |

| Renewable Energy Systems Exemption | State | This is a property tax exemption provided by the State of Oregon. In most cases, home improvements cause your property value and your property taxes to go up. Solar panels do increase your property value, but this exemption prevents your taxes from going up as a result of going solar.3 | After installation | Over the lifespan of your panels, this could save you thousands of dollars, especially if you live in a high-tax area like Salem. |

| Net metering | Local | Net metering programs help customers offset or eliminate their electric bills with the excess power their panels overproduce.4 We’ll discuss the specifics of Oregon’s net metering programs below. | Once your system is up and running you will receive credit toward your future energy bills if your panels overproduce | Investor-owned utilities that conduct net metering credit you for excess electricity at the retail rate. |

| Local incentives | Local | Local incentives may be available from your utility company, county or city. Check with your solar installers to make sure you’re taking advantage of all available incentives. | Upon or after installation | Varies |

What Do Oregon Residents Need to Know About the Federal Solar Tax Credit?

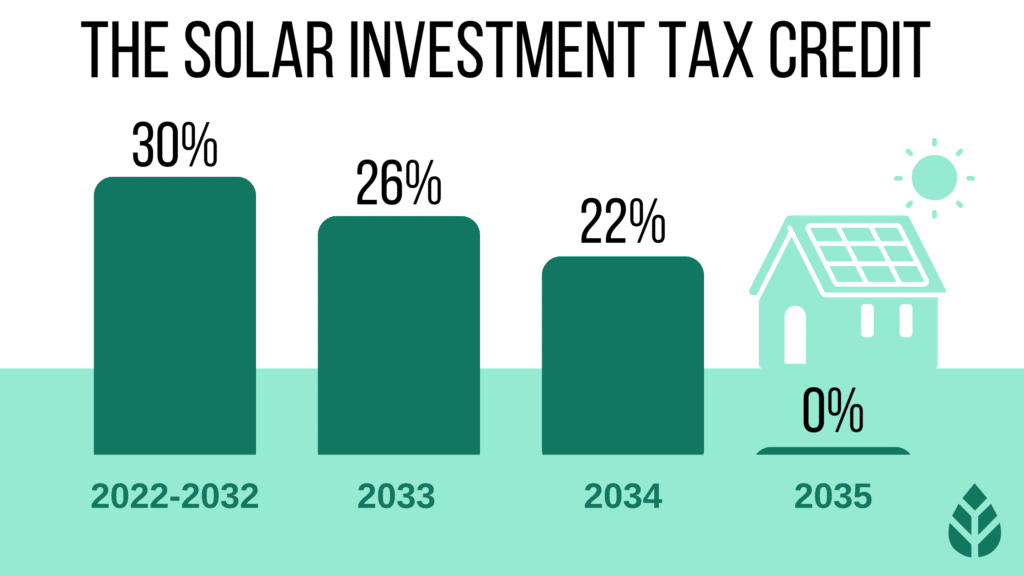

The federal solar tax credit (ITC) is one of the best ways to save money on solar panels. In August 2022, the Inflation Reduction Act was signed into law and increased the ITC from 26% to 30%. Available to all U.S. citizens until 2032 at the 30% level, this credit will save Oregonians an average of $9,348 on their solar panel systems.

Notably, this perk applies to all solar equipment, including EV chargers and solar batteries. As we’ll explain later on, we expect that the net metering program in Oregon is going to be downgraded in the future, which would mean batteries will become far more beneficial and possibly even a necessity if you want to see significant savings on your electric bills over time.

Solar batteries increase installation costs by between $10,000 and $20,000 in most cases, which means the ITC would increase in potential value by between $3,300 and $6,600. Since it’s already a massively beneficial incentive, this is a huge deal, especially for the future of solar in Oregon.

How to Claim the Federal ITC in Oregon

Like all of the solar incentive and rebate programs we’ll discuss in this article, securing the federal tax credit requires a little planning. Because it’s a tax credit, the money take the form of a reduction of your federal income debt as calculated on your annual tax return.

We’ve outlined below the steps for using the solar ITC. If you have any questions, your solar installer and financial advisor can be good sources of guidance and information.

- Claim the federal solar tax credit on your annual federal tax return

- Download IRS Form 5695

- Calculate your credit — 30% of the total cost of your solar energy system

- Complete the calculations on lines 6a and 6b

- Complete line 14 using the Residential Energy Efficient Property Credit worksheet

- Perform the calculations on lines 15 and 16

- Enter your results from lines 15 and 16 on line 5 of your 1040 form

- See the credit applied to taxes owed

EcoWatch’s Opinion of the Federal ITC in Oregon

Overall, the federal solar tax credit is easy to claim and see applied toward your federal taxes. This is particularly true if you have a tax balance due at tax time each year. If you either owe nothing additional or often see a tax refund, you’ll need to rethink how you do your taxes. You may need to re-file your W2 so that you have less money taken out of each paycheck, so keep this in mind as you file your taxes.

The federal solar tax credit can be applied on top of other rebates and incentive programs, so can save you major money on your solar system. Since the ITC has been extended, more homeowners across Oregon stand to save money when they go solar thanks to this generous 30% tax credit, although as shown above the percentage credited decreases for 2033 and 2034.

It’s important to note that this is not a rebate but rather a tax credit. That means you won’t be able to take advantage of it unless you owe money on your income taxes. You’d have to owe an average of $9,348 the year you go solar to take the credit all at once. However, you can roll unused credit forward for five years, which means you can still take the entire thing as long as you owe $1,869 per year for five years following the installation.

That would increase to $13,848 in year one if you also need to install batteries, or $2,769 per year for five years with batteries included in your installation.

Watch Below: Learn How Solar Energy Has Gotten So Cheap

Oregon Solar + Storage Rebate Program

Oregon Solar + Storage is a solar rebate program offered by the Oregon Department of Energy that can provide significant savings on a solar electric or paired solar electric and storage system.

The maximum you could save on your solar panels with this rebate program is $7,500, meaning your $31,160 solar system would cost you as little as $23,660, disregarding any other rebates or incentives you might take advantage of. Keep in mind that the limit is $5,000, unless you install batteries and receive the additional $2,500 rebate on paired solar energy storage equipment.

We would like to point out that we expect a decline in net metering in the future, as many states are seeing the same — most notably California in 2024 with the adoption of NEM 3.0. If and when that happens, solar batteries are going to become far more popular because they provide effective net metering and help maximize savings in areas without NEM. This perk will, in turn, become more beneficial and relevant, even though it’s already quite impressive and helpful.

How to Secure a Oregon Solar + Storage Rebate

Through Solar + Storage, homeowners can receive a rebate of up to $5,000 for a solar electric system and up to $2,500 for an energy storage system (for a maximum total of $7,500). The rebate allocation differs based on whether or not your household qualifies as low- or moderate-income, as outlined below:5

| Income Bracket | Maximum Rebate |

| Low- or moderate-income household | $1.80 per watt of installed solar capacity, up to 60% of the net cost or $5,000, whichever is less. |

| Not low- or moderate-income, but still quality for electric utility incentive program | $0.20 per watt of installed solar capacity, up to 40% of the net cost or $5,000, whichever is less. |

| Not low- or moderate-income, and are not eligible for an electric utility incentive | $0.50 per watt of installed solar capacity, up to 40% of the net cost or $5,000, whichever is less. |

Follow these steps to benefit from the Solar + Storage program when you install your solar system:

- The rebates are paid directly to the specific ODOE-approved contractor who installs your system, so start by reaching out to an approved contractor. The ODOE’s approved list can be downloaded here.

- The total rebate amount paid to the contractor will be passed on as savings to you. The amount you pay the contractor will be discounted by the amount of the rebate you qualify for.

There are three pathways to confirm eligibility as a low-or moderate-income household:

- You’re determined to be eligible for certain Oregon Housing and Community Services programs.

- You’re determined to be eligible for certain Oregon Department of Human Services or Oregon Health Authority programs.

- You can prove qualifying household income by providing an Oregon Department of Revenue tax transcript for each tax filer residing at the household physical address.

If you don’t qualify for the Oregon low-income incentives, don’t fret- there are other solar rebates programs geared for lower-income homeowners which can have different qualifiers for income.

EcoWatch’s Opinion of the Oregon Solar + Storage Rebate Program

The Oregon Solar + Storage program aims to help all households gain access to solar energy and storage, whether or not they are low- or moderate-income.

On the average 9.5 kW system in Oregon, if you are not low- or moderate-income you could save between $1,900 and $4,750 on your solar panels. If you are low- or moderate-income, you are likely to save the full $5,000.

And while some rebate programs only cover your solar panels, Solar + Storage also helps you get access to solar battery capacity. Oregon does have great net metering programs, but it’s beneficial to keep energy stored in case of power outages to keep your home’s electricity up and running when the grid is down.

Oregon Solar Within Reach

Solar Within Reach is a cash incentive program administered by the Energy Trust of Oregon. It’s meant to help expand access to solar panels and energy storage systems to income-qualified families.

If you’re a customer of Portland General Electric, the incentive is $0.90 per installed watt up to a maximum of $5,400. For Pacific Power customers, the incentive is $1.00 per installed watt up to a maximum of $6,000.

How to Claim Solar Within Reach in Oregon

The Solar Within Reach program provides an excellent opportunity for income-qualified households to gain access to solar technology. To quality for this incentive, you must:

- Be an Oregon customer of Portland General Electric or Pacific Power

- Work with an Energy Trust solar trade ally contactor that participates in the program

- Meet income requirements6

If you qualify, complete the following tasks in order to receive the financial incentive:

- Request proposals from Energy Trust solar trade ally contractors eligible to provide Solar Within Reach incentives. You’ll do this through the Energy Trust of Oregon website here. You should receive bids/proposals from several contractors.

- The contractor you choose will ask you to sign an incentive application and income verification form to confirm your eligibility.

The contractor will handle all the paperwork, and submit your income verification form, prior to installation. - The cash incentive will be paid directly to the contractor to reduce the cost of your solar system. The contractor can also help you apply for any other incentives you may be eligible for, like the Oregon Solar + Storage Rebate.

- The contractor installs your system and the Energy Trust of Oregon will verify that it meets technical standards.

EcoWatch’s Opinion of Solar Within Reach

The Solar Within Reach program is easy to apply for. The Energy Trust of Oregon website provides an online form to complete that directs approved contractors to reach out to you — you don’t have to choose from a list and reach out to them. The Trust works closely with the contractors, which it calls “trade allies,” to make sure systems are appropriate for your home and are installed properly, and to make the whole process easy for homeowners.

Perhaps best of all, Solar Within Reach benefits can be combined with Solar + Storage and the federal tax incentive to save you significant dollars on a solar or solar and battery system — putting costly solar systems within your reach, as the program name implies.

Renewable Energy Systems Exemption in Oregon

Many states provide sales and property tax exemptions for solar equipment to make renewable energy more appealing overall, and Oregon residents can benefit from both. You won’t pay sales tax on solar equipment in Oregon simply because Oregon doesn’t impose sales on anything, so you’ll simply avoid that expense on your solar system.

Oregon also provides residents with a property tax exemption for installed solar systems. Typically, home improvements that bump up the value of your home will also cause a spike in your property taxes. For some homeowners, that can mean several thousands of dollars in additional taxes paid over the lifespan of their solar equipment.

Although solar panels boost your home value, the tax exemption means you won’t pay any additional property taxes just because you install solar panels.

With the average property tax rate in Oregon sitting at 0.82% and the average system totaling $31,160, that puts the annual savings at around $255 without batteries or $378 annually with batteries included. Since panels hold value for around 20 years and batteries for around 10 years, that puts the maximum value of this perk at around $5,110 for panels only or $6,340 including batteries. Keep in mind that actual savings will be lower because of system depreciation.

How to Claim the Renewable Energy Systems Exemption in Oregon

As there’s no sales tax in Oregon, you don’t need to do anything to avoid paying this tax or get a refund on it.

Homeowners must apply for the solar property tax exemption through their county assessor on or before December 31 of the year in which they installed solar.7 You’ll need to state the capacity of your system and confirm that it’s intended to offset your onsite electricity consumption.

It’s possible that the Oregon State Legislature will not renew this policy, so keep an eye out for updates. You can check on the DSIRE database or with your local municipality or solar installer for more information.

EcoWatch’s Opinion of the Renewable Energy Systems Exemption in Oregon

In Oregon, your property taxes won’t increase if you install qualifying renewable energy systems — at least as of right now. If you’re an Oregonian looking to install solar, we recommend keeping an eye out for changes to the property tax exemption to see if it will continue to be a contributor to your solar energy system savings.

Net Metering in Oregon

Net metering is one of the biggest benefits afforded to solar customers because it reduces or even eliminates electric bills. While solar panels can be highly efficient, none will provide enough power to fulfill your energy needs all the time — including at night or on cloudy days.

Some homeowners couple their panels with solar batteries to supply power when their panels are not producing, but net metering is a solution that doesn’t require you to make a major equipment investment. Net metering lets you offset your electric bills by sending electricity you generate but don’t use to the electric grid (“overproducing”). Your electric company gives you credit for this excess electricity which is subtracted from your electric bills.

Oregon’s net metering policy ensures the excess energy you produce is credited at the full retail rate. That means every kilowatt-hour (kWh) you overproduce will offset a kilowatt-hour you pull from the grid. This policy covers all investor-owned utilities (IOU) except for Idaho Power, which services Eastern Oregon. Idaho Power has its own net metering policy that is currently undergoing changes.

We should mention that net metering policies throughout the country have been in decline over the past decade or so, with the biggest hit coming to California recently with the adoption of net metering 3.0. This new policy decreased credit rates by around 75%. Since this occurred in the most solar-friendly state in the country, we expect less solar-friendly states to follow suit in the future.

If net metering does go away or see a decrease in credit rates, the likelihood is that solar customers will need to install batteries — which provide effective, on-site net metering — to see significant solar savings over time. Batteries increase system costs by between $10,000 and $20,000, but the long-term positive effects of batteries would likely offset the upfront cost.

How to Enroll in Net Metering in Oregon

Oregon legislation requires all public utility service providers to have net metering options for solar energy. Follow these steps below to get net metering set up for your installed system.

If you’re a customer of Idaho Power:

- Prior to system installation review their eligibility requirements, system size limits and technical requirements to make sure your system will quality. You can find these here, and your solar installer should also be ready to help you out with this step (and the entire process).

- Complete an application for customer generation here and pay the required $100 fee. Idaho Power will notify you of system approval.

- Once your system has been installed and approved by your local jurisdiction, submit Idaho Power’s System Verification Form. Idaho Power will conduct a site visit within 10 business days to ensure your system meets standards and to install your new bidirectional meter. You’ll then be good to go for net metering.

If you’re a PGE or Pacific Power customer, the process is similar to Idaho Power’s. If you’re not a customer of any of these investor-owned utilities, check with your local electricity provider.

EcoWatch’s Opinion of Net Metering in Oregon

Like many states, Oregon requires public utility companies to have some form of net metering opportunity for consumers. This allows Oregon homeowners to benefit from solar panel overproduction and save money year-round.

Because net metering offers money-saving opportunities year after year after your solar system has been installed, it’s one of our favorite incentives.

Just be aware that net metering policies are expected to decline in the future in Oregon, as they have in many other states, so we strongly recommend going solar sooner rather than later to lock in the current rates and associated savings.

Local Solar Incentives in Oregon

It’s common for local utility companies and jurisdictions to have solar incentives of their own, so always make sure to check with your electricity service provider, city/town or county. Local incentives programs in The Beaver state include:

- City of Eugene: The Eugene Water & Electric Board (EWEB) offers an incentive program that gives qualifying customers a rebate of $0.40 per watt installed or $2,000, whichever is less. In Oregon, where most customers need a 9.5-kilowatt system to offset electric usage, it’s common to qualify for the full $2,000 rebate. However, there is a limited yearly budget for this incentive, which is given on a first come, first served basis.

- Salem Electric: Salem Electric customers can get a rebate of up to $300 per kW installed or $1,500, whichever is less.

- City of Ashland: Starting in January 2024, Ashland residents can receive a $600 rebate for installing home solar.

Which Tax Incentives Are Best in Oregon?

We’ve mentioned all of the incentives available for installing solar equipment in Oregon above, but not all perks are equal in the value they provide. Below, we’ll offer our opinion on which incentives are the most valuable for solar customers in Oregon.

Federal Solar Tax Credit

In our opinion, the federal credit is the best incentive available to Oregonians. The credit can effectively bring down your system costs by 30%, and the time it takes to apply is minimal.

This incentive is worth the time it takes to enroll and can offer an average potential savings of over $9,300. Plus, it’s offered by the federal government, so it’s guaranteed to be available to all property owners in the Beaver State.

Solar + Storage Rebate

With a potential savings of up to $7,500, Solar + Storage could end up saving you even more than the federal tax credit. And if you qualify for Solar Within Reach, you’ll save thousands more on your solar system.

This perk will be especially beneficial in the future if net metering policies decline and necessitate batteries.

Net Metering

Net energy metering is another hugely beneficial solar perk in Oregon. This benefit program helps you achieve maximum energy savings with your PV system.

What’s the Near-Term Outlook for More Incentives in Oregon?

Oregon has an admirable range of solar incentives for residents. We especially like to see the effort to make solar accessible to low- and middle-income households.

If you aren’t in a position to install your own solar panels, you should look for growing community solar programs that you can invest in. These programs allow you to benefit from solar and contribute to sustainability without making a major cash investment.

Sometime in the future, we do expect to see at least a decline in the net metering policy, but there are currently no plans for that to happen in Oregon.

Read More About Going Solar in Oregon

- The Best Solar Companies in Oregon

- Oregon Solar Panel Cost Guide

- Are Solar Panels Worth It In Oregon?

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Oregon Solar Incentives

Many Oregon homeowners ask us questions about solar incentives available in the state. Below are some of the questions we see most frequently, along with our responses. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

Oregon does not currently trade Solar Renewable Energy Credits (SRECs) — credits you earn for all solar energy production — or Transition Renewable Energy Certificates (TRECs)8 because its Renewable Portfolio Standard, which requires that 50 percent of the state’s electricity come from renewable sources by 2040, does not have a specific carve-out for solar.

There is currently no legislation or plans to increase incentives for solar energy systems in Oregon over the next two years. The state is progressing toward its RPS goal for 2040, so it’s less likely that additional incentives will be added in the near future. Different solar financing options are always available and can help you save money in different ways.

However, the Solar Energy Industries Association (SEIA) ranks Ohio as 22nd in the country for solar adoption.8 Perks may become more prevalent if the state finds its current rate of solar adoption is not on track to meet its RPS goal.

The Inflation Reduction Act (IRA), which took effect in September of 2022, brought two important changes to solar and clean energy in Oregon.

Most importantly, the IRA made the federal credit — one of the best incentives in Oregon — more appealing. The legislation increased the credit rate back up to 30%, and extended the program for the next decade. Calculate how much you can save today!

It also increased the tax credits for electric vehicles — increasing the credit for specific makes and models to $7,500.

There are no plans for Oregon incentives to become less appealing or disappear in the next two years. The state’s RPS goal is still in effect until 2040, and until that goal is reached, Oregon’s current incentives will likely remain available.

With that being said, incentives can change or become unavailable at any time, so before you take the plunge with solar verify that any incentives you’re counting on will still be around.

Comparing authorized solar partners

-

- Many years of experience

- Offers products from leading manufacturers

- Excellent reputation

- No leases or PPAs

- Limited warranty coverage

- Expensive

A+Solar Veteran

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe