Delaware Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to saving money on solar panels in Delaware by taking advantage of solar incentives, you’ll learn:

- What solar incentives are available in Delaware?

- How much money can the solar benefit programs in Delaware save you on solar equipment?

- How do you file for the federal solar credit in Delaware to make sure you take full advantage of the incentive?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Delaware Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, absolutely. On average solar incentives bring down the cost of solar panels by thousands of dollars in the first state.

The typical price of a photovoltaic (PV) system in Delaware averages around $29,070 before incentives, which is just below the national average. Since the state doesn’t charge sales tax, this is the average all-in price to go solar.

This price is based on the local cost of solar equipment — approximately $3.06 per watt, which is below what most Americans pay — and the average system size required to offset energy needs of 9.5 kilowatts (kW). This is a bit larger than is needed throughout the rest of the country due to above-average electricity demand.

The state has a healthy Renewable Portfolio Standard (RPS) goal, which mandates that 40% of the electricity used in the area comes from renewable resources by 2035. Unfortunately, this RPS goal hasn’t translated to many solar incentives, and the solar incentives in DE are still not as plentiful as they are in most other states.

Green Street Solar

Regional Service

Average cost

Pros

- NABCEP-certified technicians

- Locally owned and operated

- Many financing options

Cons

- Limited service offerings

Solar Energy World

Regional Service

Average cost

Pros

- Excellent reputation

- Independently owned and operated

- Offers products from leading manufacturers

Cons

- Some reported communication issues

- Less personalization than competitors offer

Clean Energy USA

Local Service

Average cost

Pros

- Excellent reputation

- Many years of experience

- NABCEP-certified technicians

Cons

- Slightly expensive

- Limited information available on website

However, there are still a handful of solar perks available in your area that help bring down the cost of and boost the long-term savings of going solar. We’ll include a complete list of solar perks you can take advantage of and an estimate of how much each saves in the table below.

| Solar Incentives in Delaware | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | 30% of your system total gets credited to your income tax liability for the year you install your system. This can be rolled over for up to five years | One-time: Gets applied once when you first file your taxes after installation. Any unused credit can be rolled over to future years, but the credit only gets assessed once | $8,721, on average |

| Solar Renewable Energy Certificate (SREC) Program | State | Provides energy credits based on your solar production. Credits can be sold to electric companies for a profit | Ongoing: As of this writing, credits will accrue for 20 years following installation. However, acceptance into the program is not guaranteed | Around $5,760 over the lifespan of your system |

| Net Metering | Local | Provides credits for all excess energy generated. Credits can be used to reduce future electric bills. Credits are worth the full retail rate for energy | Always in Effect: You’ll enjoy the perks of net energy metering for as long as your solar panels are producing electricity | Varies based on system size, energy needs and more |

| Local Incentives | Local | Local municipalities and electric companies offer a variety of perks, including rebates and credits | Varies based on the incentive | Varies based on the incentive type, your system size, your energy bills and more |

What Do Delawareans Need to Know About the Federal Solar Tax Credit?

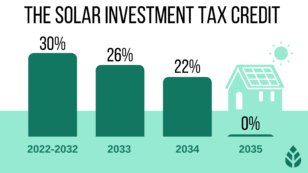

The federal solar tax credit was first offered by the federal government in 2005 and provided a 30% credit to income taxes for all solar equipment installed. The federal credit is applied to the solar customer’s tax liability for the year the equipment was commissioned.

The credit was scheduled to drop to 26% in 2022, 22% in 2023 and then no longer be available in 2024.

In August of 2022, however, the federal government passed the Inflation Reduction Act (IRA), which pushed the credit amount back up to 30% — retroactively for installations completed in 2022 — and extended the credit for a decade. The new rate schedule is as follows:

- 30% credit for systems installed through 2032

- 26% credit for systems installed in 2033

- 22% credit for systems installed in 2034

- No credit for systems installed in 2035 and beyond

The average resident in your area needs a 9.5 kW system to offset their energy bill. At the average $3.06 per watt in the area, that solar equipment in Delaware would cost about $29,070. This puts the average federal solar investment tax credit at $8,721. That amount gets credited to your income tax bill.

How to Claim the Federal ITC in Delaware

Claiming the federal credit is a simple process and just requires a single form to be filed alongside your income taxes. When you’re ready to file your taxes for the year you installed your equipment, you can follow the steps below to take this credit.

- Step 1: Go to the IRS’s website and print out form 5695.

- Step 2: Fill out the form using information about where the system was installed — your home address — the cost and size of the system and contact information for the company that installed your equipment. In most cases, the form should only take a few minutes to complete.

- Step 3: Include the form alongside your other tax documents when you file. If you use an accountant to file your taxes, make sure you send the completed form to them.

If you use a tax software like TurboTax to file, you should get on-screen prompts about solar equipment or energy-efficiency home improvements. You can forego the above steps and follow those prompts instead.

EcoWatch’s Opinion on the Federal ITC in Delaware

The federal credit is, in our opinion, the most crucial solar perk to take in any area. Not only does the state offer very few incentives for solar conversion, but this one from the federal government provides massive upside for minimal effort on your part.

With just a single form that takes a few minutes to complete, you can effectively reduce your system total by an average of over $8,700.

It’s important to note that the credit doesn’t necessarily bring down your installation cost. The one downside to the credit is that it’s not a rebate and instead can reduce the income taxes you owe. If you don’t owe an average of $1,744 per year on your taxes for the five years following installation, you won’t be able to take the entire credit.

Watch Below: What Should You Know About Recent Changes to the Solar Tax Credit?

What You Should Know About the Solar Renewable Energy Certificate (SREC) Program in Delaware

This is mostly due to the legislation that the state passed that pushed the burden of purchasing SRECs to distribution companies rather than electricity providers.

You earn one SREC for each megawatt-hour (MWh) your system produces, and each credit averages around $32.1 Most residents earn around nine credits per year, given the typical system size, putting the annual credit value at $288. Over the 20 years your SREC program lasts, that totals $5,760 in credit value.

How to Claim SRECs in Delaware

Unfortunately, the SREC program is quite competitive, which means there’s no guarantee you’ll be accepted into it. Still, you can follow the steps below to enroll and be considered for eligibility.

- Step 1: Go to Delaware’s online SREC portal to create an account.

- Step 2: Follow on-screen prompts and complete the application for the program. You’ll need system and installer information, so make sure you have that readily available.

- Step 3: Wait for acceptance into the program. Once you are accepted, your production will be monitored, and your credits will automatically be sold to your energy distribution company — most likely Delmarva Power.

EcoWatch’s Opinion on SRECs in Delaware

SRECs, in general, are a great way for states to promote and incentivize solar adoption. They provide an easy way for solar customers to increase the value their system provides and earn some money that can help reduce the panel payback period and maximize savings.

Unfortunately, the SREC program in the state is competitive, so many solar customers will not have access to the program. The application process is simple and quick, and the average return is good at over $5,700.

However, the return isn’t guaranteed, and you’ll have to wait 20 years for the full amount to be earned by your system. If acceptance into the program was automatic, we’d say go for it, but many customers will pass on this perk given the relatively low return and the risk of not being accepted into the program at all.

Net Metering in Delaware

Net energy metering (NEM) is one of the most popular solar perks across the country. The policy ensures solar customers see a benefit for all of the power their systems produce, even if that electricity isn’t used right away.

Through interconnection, your energy production and usage are monitored, and all excess power gets sent to the electric grid. Net Metering lets you use those credits in the future if you ever use more electricity than your system generates in a month. That means overproduction during the summer can offset high usage and low production in the winter.

The net metering policy in DE ensures that you get credited at the full retail value for all excess power, which is the best-case scenario. This program helps maximize your long-term energy savings, reduces your solar payback period and makes your panels more valuable overall.

We should note that net energy metering policies are changing across the United States as solar becomes more popular and RPS goals are met. In some areas, the additional strain placed on the electric grid from net metering — leading to outages — pushes utility companies to discontinue NEM or reduce eligibility.

This is a distinct possibility in DE, as the Solar Energy Industries Association (SEIA) predicts a pretty substantial uptick in solar conversion in the area over the next five years.2

Although it’s not currently the case in your area, the credit rate is dropping in other states, and some customers are seeing the perk disappear altogether. It’s possible this could happen in the First State in the future as well.

How to Enroll in Net Energy Metering in Delaware

For most solar customers, enrolling in net energy metering will be more or less automatic. The process does require some paperwork, but most reliable solar installers in the area will enroll your system for you. You can follow the below steps to make sure you take advantage of this perk.

- Step 1: Contact your electric company to ensure you have the proper meter installed. If you don’t have a bidirectional meter on your home, your provider should install one at no cost to you.

- Step 2: Confirm with your preferred solar panel installation company that a representative will enroll you in the state’s net energy metering program. Most reputable solar providers in Delaware will do this automatically.

- Step 3: Proceed with the solar installation.

- Step 4: Check your electric bills for the first few months after conversion to make sure your credits are accruing.

EcoWatch’s Opinion on Net Energy Metering in Delaware

NEM is a massively beneficial perk to take advantage of no matter where you live, but it’s especially important in Delaware, where the energy consumption is above the national average.3 NEM provides a few key benefits to solar customers:

- It maximizes energy savings over time

- It helps pay down your solar PV system more quickly

- It makes your solar panel system more valuable and increases your home value accordingly

- It further reduces your carbon footprint

Best of all, claiming net energy metering is a breeze and usually requires no effort on your part. Enrollment is guaranteed as well, making it one of the best perks available in your area.

Local Solar Incentives in Delaware

While the state doesn’t have the greatest perks available for solar conversion, local governments and utility companies also provide a handful of perks to make converting to solar in Delaware more worthwhile. We’ll include a quick list of the available local incentives below, along with a brief description of each.

- Delmarva Power Green Energy Program: This is a rebate offered to all Delmarva Power customers for solar conversion. It provides cash-back incentives of up to $0.70 per watt, with a total rebate amount of $6,000. Given the average 9.5 kW system size in your area, the typical rebate will come out to the full $6,000.4 Rebate amounts are expected to decrease over time.

- Delaware Electric Cooperative (DEC) Green Energy Program: DEC customers can take advantage of this rebate that provides between $0.50 back for every watt up to 5 kW and $0.20 back per watt after that.5 There is a program cap of $2,000, so given the average system size and cost in your area, most customers can expect to take the full $2,000 rebate.

- Delaware Municipal Electric Corporation (DEMEC) Green Energy Grants: DEMEC customers have a rebate available to them as well for home solar, wind and geothermal systems. This rebate is for up to $1.00 per watt for the first five kW (up to $5,000) and $0.50 per watt for each additional kW installed.6 The average rebate will sit around $7,250, given the typical 9.5 kW system size.

Which Tax Incentives Are The Best In Delaware?

The Federal Solar Credit

First and foremost, the federal credit is the single most beneficial solar perk in your area, in our opinion, and it’s the one we recommend over all others if you only apply for one.

Not only does the credit take just a few minutes to apply for, but it’s available to all customers and provides a total potential value of over $8,700. The value you get for the time investment is outstanding.

Net Metering

Net energy metering is currently another great perk in your area that’s mandated throughout the state and is offered at the full retail value. This program helps maximize your long-term savings, reduces the effective cost of electricity and provides added value to your system and your home after conversion.

Enrollment in Delaware net metering is also more or less automatic, as most reliable solar installers will complete the paperwork for you. As such, you get massive value for little to no time or energy investment.

The Local Solar Rebates

Finally, we strongly suggest you take whichever rebate program is available to you. Most homeowners will have access to one of the cash-back incentives mentioned above. These are easy to apply for and provide between $2,000 and $7,250 back, lowering your all-in conversion cost.

The rebate offered by DEMEC is the best, followed by Delmarva’s and then DEC.

What Delawareans Need To Know About SRECs?

Solar Renewable Energy Credits (SRECs) are credits you earn for all solar production. Energy companies that need to offset fossil fuel usage for energy production purchase the credits, which means you can earn a profit just for having a solar energy system installed on your home.

The SREC program has limited availability, which makes it a bit less valuable than it is in many other states. However, those that enroll successfully and are approved can earn an average of one SREC per month, which averages around $32 per credit as of January 2024. Selling your credits for the 20 years they’re available should net you approximately $5,760, although these aren’t guaranteed earnings.

Are SRECs taxable in Delaware?

Yes! SRECs are taxable and will need to be reported as income. This is another downside to the credits, but they’re still worthwhile if you’re approved for the SREC program.

What’s The Near Term Outlook For More Incentives In Delaware?

As of right now, there are no proposed changes for solar incentives in DE that are taking place in the next few years. The recent change to the RPS goal — an increase that took place in 2021 — does suggest that incentives could become more beneficial in the near future, as electric companies must do more to reach the new goal.

You might see SREC prices increase or eligibility become more widely available. It’s also possible that additional perks will be made available in response to this positive change.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ

Below, we’ll answer some pressing questions we see commonly from Delaware residents about the prospect of converting to solar.

As of right now, there are no plans set in stone to make solar perks more valuable or appealing in the next two years. However, as mentioned above, recent improvements to the RPS goal could lead to additional solar incentives in that time. We might see higher rates for SRECs, better program availability and even new rebate programs as a result.

Additionally, the local Department of Natural Resources and Environmental Control (DNREC) initiated the Low- to Moderate-Income Solar Pilot Program. This program provides massive credits — up to around 70% of the total system cost — for income-eligible customers. This DNREC perk can effectively yield free solar panels if the federal credit is also taken.

Most importantly, the IRA extended the federal credit by ten years and bumped the credit rate from 26% to 30% for systems installed in 2022. This retroactively included systems installed in 2022 prior to August, when the bill was signed.

Additionally, the IRA made credits for some electric vehicles (EVs) more appealing. Some makes and models come with a possible credit of up to $7,500. If you want to learn more about how the IRA passing can benefit you, calculate your IRA savings with our free tool!

There are no plans or pieces of legislation currently in place to reduce solar perks in DE in the next two years.

However, this is always subject to change. If there are any changes, it would likely be to the net metering policy. Many states are seeing credit rates decrease — below the retail value for energy — and policies disappear altogether. This could happen in your area as well.

With that being said, we’d guess that this will not happen in the next two years. The state recently improved its RPS goal, which means local utility providers and the state as a whole will more likely move in the direction of improving solar incentives rather than making them less beneficial.

Unfortunately, no, there is no property tax exemption for PV equipment in Delaware. That means your property taxes will increase as a result of converting to solar.

Related articles

Top Solar Installers in Delaware Cities

Comparing authorized solar partners

-

- NABCEP-certified technicians

- Locally owned and operated

- Many financing options

- Limited service offerings

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe