Reviews

Reviews

Alabama Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to solar benefit programs in Alabama, you’ll learn how you can save money while converting your home to solar energy. We’ll cover:

- What solar benefit programs are available in Alabama?

- How much can the solar benefit programs in Alabama save you?

- Which Alabama solar perks are the most beneficial?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Alabama Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, there are several incentive programs available to homeowners in Alabama that can help save money while going solar. While the state doesn’t have much in the way of dedicated solar benefit programs strictly for Alabamans, there are programs available locally and nationwide that can bring down your effective costs by thousands of dollars.

The average cost of a complete solar array in the state of Alabama is about $42,780 without any incentives, which is around $12,000 higher than homeowners pay in other states. This is mostly due to larger-than-normal systems required in this Southern state. But thanks to incentive programs, that won’t represent your true cost. The perks that are available can make converting to solar a better financial decision and ultimately lead to an average net savings of around $30,270 after your panels pay for themselves.

Eagle Solar & Light

Regional Service

Average cost

Pros

- NABCEP-certified technicians

- Offers products from leading manufacturers

- Locally owned and operated

- Award-winning company

Cons

- Relatively young company

- Limited information available on website

- Slightly limited service offerings

Creative Solar USA

Local Service

Average cost

Pros

- Representatives are experts on local policies

- Comprehensive service offerings

- Many years of experience

Cons

- No leases or PPAs

- Limited brands of solar equipment available

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

The chart below includes all of the solar perks available in Alabama. We’ll also include an estimated amount of savings each incentive can provide to help you decide which are the most crucial to take advantage of.

| Solar Perks in Alabama | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Applies a tax credit to your income tax liability equal to 30% of your total solar energy system cost. | One-time: Your credit amount is calculated once when you file your taxes, but unused credits can be carried over and taken for four additional tax years. | $12,834, on average |

| Property Tax Exemption for Renewable Energy Facilities | State | Prevents your property taxes from increasing due to the value added by your solar array. | Ongoing: As long as your system holds value, you’ll see savings automatically on your property tax bill. | Varies based on the value of your home and solar energy system |

| Net Metering | Local | Credits your energy bills based on the solar power you have sent to the grid in the past rather than using on-site. Net energy metering (NEM) is NOT mandated in the state. | Always in effect: If you have access to NEM, then you’ll consistently accrue credits when your system ports electricity to the electric grid. | Varies based on the program available to you, the size of your system, your monthly energy bills and more |

| Local Incentives | Local | Rebates and other perks for energy efficiency upgrades, electric vehicle (EV) chargers and more. | Varies based on the specific perk available. | Varies based on the incentive program and more |

What Do Alabamans Need to Know About the Federal Solar Tax Credit?

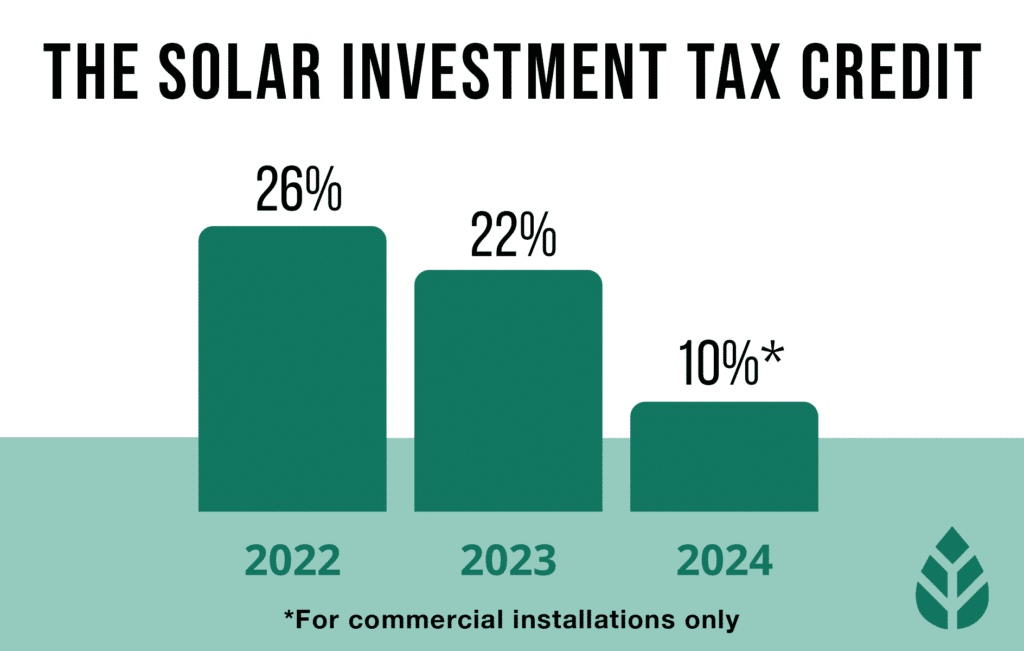

The federal solar tax credit allows you to reduce your federal income tax by up to 30% of the cost of a new solar energy system on your home. The program was created by the federal government in 2005 to make converting to solar energy more affordable for taxpayers. When Congress passed the bill that initiated the perk, the rate schedule was as follows:

- 30% for systems installed between 2005 and 2021, inclusively

- 26% for systems installed in 2022

- 22% for systems installed in 2023

- The credit was set to disappear in 2024

In August 2022, Congress passed the Inflation Reduction Act (IRA), which effectively extended the program by a decade. The new credit rate schedule is below:

- 30% for systems installed through 2032

- 26% for systems installed in 2033

- 22% for systems installed in 2034

- In 2035, the credit disappears

The value of your credit depends on the cost of your system, so the amount will vary. Based on the average system cost in the area of $42,780, most residents will see a credit value of $12,834. This is significantly higher than what most Americans see from this perk — with the national average sitting at $8,991 — due to the above-average cost of going solar in the area.

How to Claim the Federal ITC in Alabama

Claiming the federal credit is a breeze, which makes it even more valuable overall. You can follow the steps below to ensure you get access to this perk.

- Step 1: Complete your solar conversion.

- Step 2: When you’re ready to file your income taxes, print out IRS form 5695. This is the form for registering for residential energy credits.

- Step 3: Fill out the form. You’ll need information about the company that installed your PV panels, the address where they were installed, how much you paid for them in total, and the system capacity.

- Step 4: File the form with your taxes.

If you use software like TurboTax or HR Block to file your federal income taxes, the program should automatically ask you whether you installed clean energy equipment in the previous year. In that case, you can skip printing out the IRS form and just provide the information requested through your tax software.

EcoWatch’s Opinion on the Federal ITC in Alabama

The federal credit is an outstanding incentive no matter where you live, but it’s especially crucial in Alabama. This is one of the only benefit programs available to directly defray the cost of your system, and it’s by far the best incentive available to you for solar conversion.

Not only can this credit potentially save you an average of $12,834 on your effective system costs, but it takes just a few minutes to apply for and has no restrictions that preclude homeowners from taking it.

The only real downside to this perk is that you can only take full advantage of it if you owe money on your taxes. This isn’t a solar rebate, so you’re not guaranteed the savings. Instead, the credit is applied to your tax burden and brings down the amount you owe to the government.

Thankfully, though, you can take the credit over a span of five years. Since the typical credit value in your area is $12,834, you only need to owe $2,566 per year over that timespan to take full advantage of it.

What You Need to Know About the Property Tax Exemption for Solar in Alabama

Normally, a home improvement project that makes your home more valuable also means you’ll pay more in taxes. Property taxes are generally based on how much your home is worth, so the more valuable your home, the more you’ll pay. In some states, this can be a negative effect of converting to solar energy. New solar energy systems make your home more valuable, and can increase your taxes.

Not in Alabama. Thankfully, there is a statewide exemption for solar equipment when it comes to property taxes. That means the value your system adds to your home — an average of around 4.1%, according to research done by Zillow — isn’t considered when your taxes are assessed.1 This prevents your taxes from increasing because of solar adoption.

It’s impossible to calculate exactly how much this perk will save you because it depends on your local property tax rate, the value of your system and the rate of depreciation.

However, given the average system value of $42,780 in the area and the statewide property tax rate average of 0.37%, that’s a savings of around $158 per year or $3,957 over 25 years of your system holding value.2 This is higher than the actual savings you’ll see, as this doesn’t account for equipment depreciation.

How to Claim the Exemption for Property Taxes in Alabama

One of the best parts about this exemption is that it’s automatic and doesn’t require any time or effort from you to apply. Your local tax assessor will just ignore the value your panels add to your property when determining your taxes.

EcoWatch’s Opinion on the Property Tax Exemption in Alabama

We love to see exemptions for property taxes because they reduce the financial burden of converting to solar energy. They’re also automatic perks that don’t require an application process of any kind.

The exemption is a great thing to have in general, but it’s less advantageous in the Yellowhammer State than in most other areas in the U.S. The local property tax rate is lower than almost anywhere else in the country, which means this incentive provides less value than it would in other states. Still, it does provide some savings and is, overall, beneficial.

Net Metering in Alabama

Net energy metering allows you to maximize your savings on energy bills by linking your solar power system to your region’s electrical grid. When your solar panels generate more electricity than you need, you can send this excess power to the grid and earn credits that offset your costs when you need to bring in energy from the grid to power your home. The Solar Energy Industries Association (SEIA) says that it’s one of the most valuable perks available to residents who adopt solar in the country.3

Unfortunately, not all Alabamans who go solar will be able to take advantage of this program. Net energy metering is not mandated by the Alabama Public Service Commission, which means utility providers don’t have to offer it to customers. Some companies, like Alabama Power, do offer net metering, but many electric companies don’t. As a result, most homeowners won’t have access to this perk, but solar owners can still opt to harness their energy and store it in solar batteries.

Alabama Power’s NEM policy is called the Rate PAE, or Purchase of Alternative Energy, program. The company pays for excess power sent to the grid, but the rate is lower than the retail rate. The customer still pays the full retail rate for all imported energy.

The Tennessee Valley Authority (TVA) also offers something similar — the Green Power Providers (GPP) program — and credits customers using the avoided cost rate, which is well below the retail value. The TVA policy is similar to what customers get from Alabama Power. It’s available for a number of renewable energy sources, including solar and biomass.

We should mention here that NEM policies have been changing across the country, usually for the worse. For example, California just recently rolled out net metering 3.0, which decreased the credit rate for exported energy and made solar without battery storage less beneficial overall. Some solar customers are losing access altogether, while others are getting reduced rates for exported energy.

With net metering policies changing for the worse in most cases, it’s probably a good idea to couple your panels with solar batteries in Alabama even if you do currently have access to net metering. Batteries give you the option to store excess energy to use later for free, and while they add between $10,000 and $20,000 to your installation costs, they’re almost always worth the added investment.

How to Enroll in Net Metering in Alabama

Opting in to net energy metering is an easy process if the program is available to you. You can follow the steps below to check if it is and enroll.

- Step 1: Contact your utility provider to ask if net energy metering or a similar program is available to you. If it is, you can also ask the representative to confirm that you have a bidirectional meter installed. This is required to take part in net metering and should be provided to you for free if you don’t already have one installed.

- Step 2: Choose a solar installer and contact them to ask if a rep will enroll in NEM for you. The process just involves an application submitted to your power provider, but most reputable installation companies will handle it for you automatically.

- Step 3: Have your system installed.

- Step 4: Check for credits accruing on your electric bills following the solar panel installation. This step is just to ensure that the application was processed and your credits are being earned as expected.

EcoWatch’s Opinion on Net Metering in Alabama

Net energy metering is an outstanding perk no matter where you live, but it provides more value to Alabamans than it does to residents of just about any other state. Residents pay slightly below-average electricity rates per kilowatt-hour, but they have some of the highest energy consumption rates and energy bills in the U.S.

Since net energy metering offsets electricity consumption, Alabama residents can benefit immensely from the policy. We’d really love to see the state offer this perk statewide, but unfortunately, we don’t see that happening anytime soon. Instead, you can more or less get the perks of net metering by investing in solar batteries.

Watch Below: Learn How Solar Panels Are Becoming So Efficient

Local Solar Incentives in Alabama

The state doesn’t offer much in the way of solar-specific perks, but there are some related local incentives that make improving your home’s energy efficiency more affordable. Here are a few of the available perks.

- Alabama Power Energy Efficiency Rebates: Customers of this power company can get up to $200 in rebates for installing Smart Thermostats and up to $650 for installing hybrid or heat pump water heaters.4

- Central Alabama Electric Cooperative Residential Energy Efficiency Loan Program: This program provides low-interest loans for improving energy efficiency in your home. Financing is available up to $10,000 for weatherization and $20,000 if that includes installing a heat pump system.5

- Dixie Electric Cooperative Residential Energy Efficiency Rebate Program: This power company offers free energy audits and cash-back incentives for installing heat pumps.6

- Dixie Electric Cooperative Residential Energy Efficiency Loan Program: This is a financing program offered in partnership with Regions Bank that provides affordable, low-interest loans for improving home energy efficiency.7

- South Alabama Electric Cooperative Residential Energy Efficiency Loan Program: Customers of this provider can get access to affordable financing for heat pumps, insulation, doors and windows.8

- Central Alabama Electric Cooperative Residential Energy Efficiency Rebate Program: This power provider offers rebates between $235 and $700 for water heater and heat pump installation.9

- Wiregrass Electric Cooperative H2O Plus Program: This company offers cash-back perks for installing a wide range of heat pumps, including geothermal equipment. The incentives fall between $300 and $400 per ton installed.10

Which Tax Incentives Are The Best In Alabama?

Unfortunately, there aren’t many incentives to choose from in your area, so taking every perk you can is crucial for keeping solar conversion costs low.

We believe that the federal credit is the most valuable incentive you can file for. It takes just a few minutes to apply and provides an average potential value of just under $12,834. Given that this is the only major perk you can file for in the area, we strongly recommend you take advantage of it.

The exemption for property taxes is another great incentive, but it’s an automatic perk that you don’t need to file for.

Other than these two incentives, we suggest contacting your local electric utility company to see if there are any additional energy efficiency benefit programs available to you. You can also check on the Database of State Incentives for Renewables & Efficiency for more information.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: Alabama Solar Incentives

Below are some of the questions we get asked most frequently by residents in your area.

At this point in time, there are no plans to create new incentives or make the existing ones more valuable in the area. The state has fewer incentive programs available than most other states, mostly because the state is one of the few left that has not set a Renewable Portfolio Standard (RPS) goal.11 An RPS goal typically is a statewide plan to promote the adoption of new clean energy incentives.

Alabama currently doesn’t have an RPS goal in place. If the state decides to adopt one, there’s a chance new perks will become available. However, we don’t foresee this happening in the next two years.

The most important change the IRA had on the solar industry was to the federal credit program. It pushed the expiration date for the credit from 2024 to 2035, and it also increased the credit percentage from 26% and 22% in 2022 and 2023, respectively, to 30%.

The IRA was also responsible for making the tax credits for EVs higher. It targeted cars produced in the U.S. and bumped the potential incentive up to $7,500.

No, it does not. Solar Renewable Energy Certificates (SRECs) are credits you earn for every kWh your solar energy system generates. They can be sold for a profit to energy companies that need to offset their fossil fuel consumption, but only in areas where there is an open SREC market.

Unfortunately, there is no active market in Alabama, so you are ineligible to earn SRECs.

There are no plans in place to reduce the solar perks in Alabama in the next two years. The only real change that could be made — since the federal credit is not offered by the state — is that the exemption for property taxes could be discontinued. We don’t expect this to happen in the near future, and certainly not in the next two years.

Unfortunately, no, the property tax abatement is the only tax perk available to Alabama homeowners. That means you’ll have to pay sales tax on all equipment and installation labor for your solar panel system, in accordance with the state tax rate of 4%.12

Top Solar Installers in Alabama Cities

Comparing authorized solar partners

-

- NABCEP-certified technicians

- Offers products from leading manufacturers

- Locally owned and operated

- Award-winning company

- Relatively young company

- Limited information available on website

- Slightly limited service offerings

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe