IEA Says World Coal Demand Will Rise, Despite Slashing Forecast Growth in India

iStock

By Simon Evans

The International Energy Agency (IEA) has once again forecast that world coal demand will rise, despite halving its outlook for growth in India.

The IEA’s Coal 2017 report, published Monday, sees a small increase in global coal demand from 2016 to 2022, with growth in India and southeast Asian countries outweighing declines in rich nations and China.

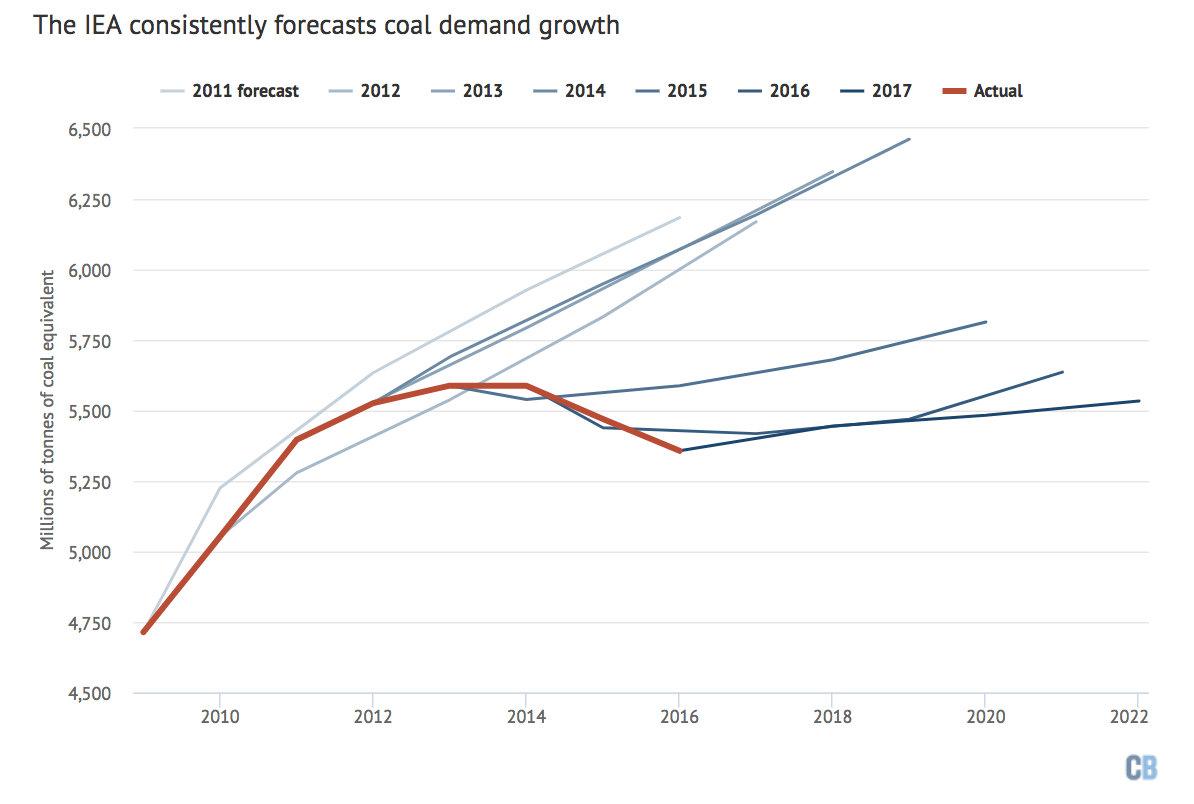

Since 2011, the IEA has consistently forecast rising coal demand, even as it has repeatedly adjusted its figures downwards in light of lower-than-expected growth. Some analysts believe the agency remains behind the curve in its outlook for coal (see below).

Carbon Brief runs through the IEA’s changing coal forecasts for India and other key world regions.

Decade of Stagnation

Each year, the IEA publishes a series of six-year forecasts for key energy markets. For example, Coal 2017 looks at the market for the fuel out to 2022, broken down by country and sector.

The report’s top line notes how global coal demand fell in 2015 and 2016, with the combined fall being the largest it has ever recorded in more than 40 years of data. It goes on to say that coal demand will increase by 177 million tonnes of coal equivalent (Mtce, 3 percent) in the years to 2022.

After two years of declines, this low growth will round off a “decade of stagnation” for coal, the IEA said. In a foreword to the report, IEA Executive Director Fatih Birol wrote:

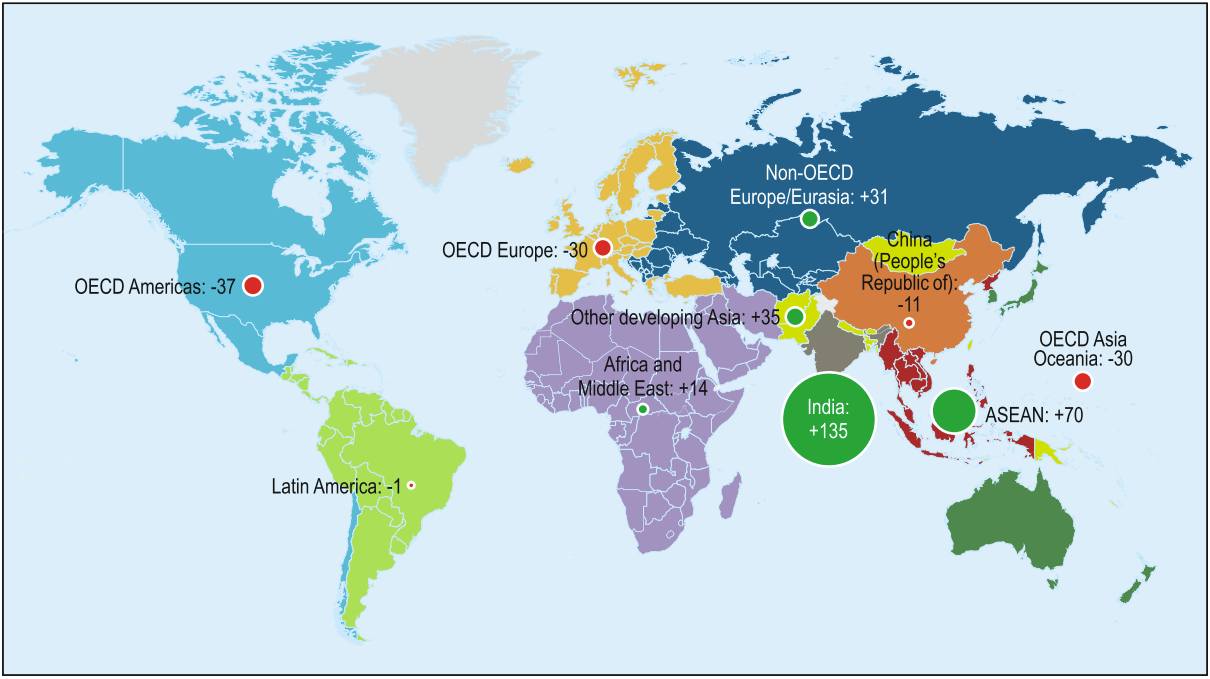

“Looking ahead, this stagnation masks important regional variations. As coal use continues to decline in many parts of the world these declines are offset by continued growth in India [+135Mtce], Southeast Asia [+70Mtce] as well as several other countries where today coal’s role is small but is on the rise, such as Pakistan and Bangladesh [+35Mtce].”

You can see this regional variation in the map, below.

IEA Coal 2017

Change in coal demand from 2016 to 2022, by country and region, in millions of tonnes of coal equivalent. The bubble sizes indicate the magnitude of change, with green for increases and red for decreases.

The IEA said global coal demand will reach 5,534Mtce in 2022, up from 5,357Mtce in 2016. Note that this would leave demand in 2022 at 1 percent below the level seen in 2013, a decade earlier. Note also that pathways to 1.5 or 2C require rapid and immediate reductions in global coal use.

Growth Forecasts

This picture of rising coal demand, even after adjustments for slower-than-expected growth, fits into a pattern of IEA forecasts over recent years (see chart, below). For example, its 2011 forecast overestimated global coal use in 2016 by 827Mtce (15 percent), which is equivalent to today’s demand in the U.S. and EU combined.

Carbon Brief analysis of IEA coal market reports. Chart by Carbon Brief using Highcharts.

Forecasts for global coal demand, made by the IEA in 2011 through 2017 (blue lines), compared to data on actual use (red), in millions of tonnes of coal equivalent. Note the y-axis is truncated.

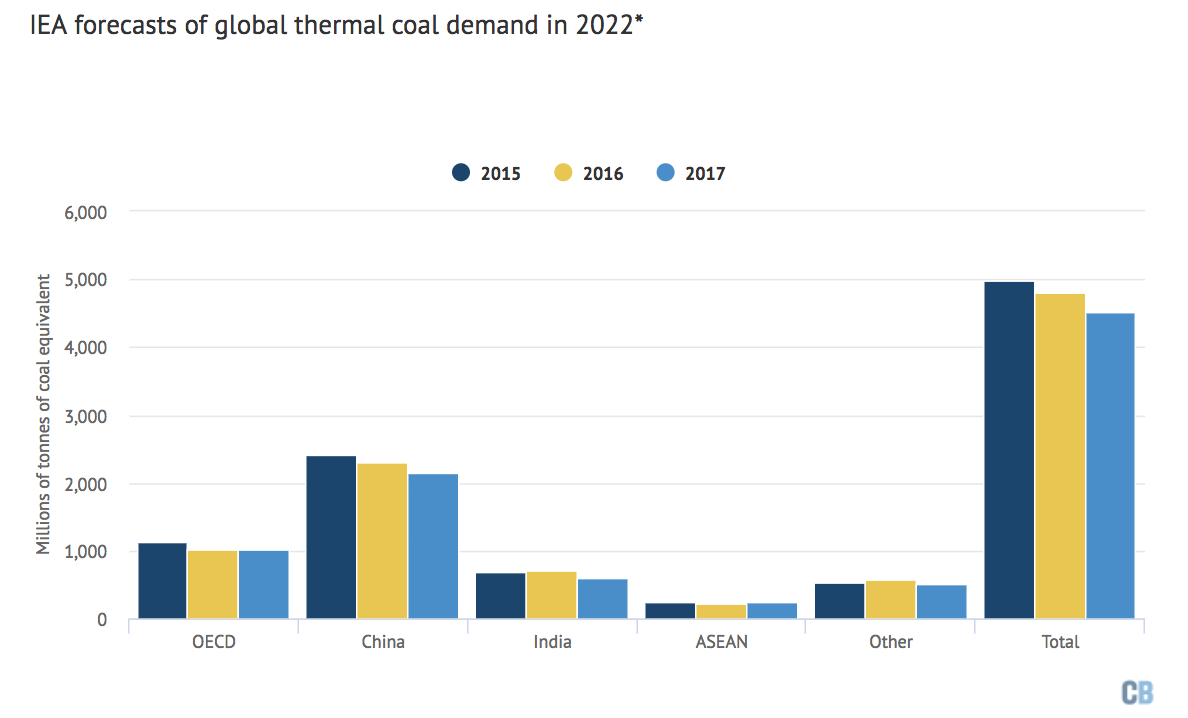

Last year, the most significant shift saw the IEA align with others in saying that Chinese coal demand had peaked in 2013. The IEA cuts its forecast for China again in this year’s report, pushing the outlook for demand in 2022 even lower (see chart, below).

This shift for China reflects a drive to cut air pollution by replacing small coal boilers with gas, as well as expanding low-carbon supplies and building huge high-voltage power cables to replace coastal coal plants with a mixture of coal and renewable power from the country’s interior.

The chart shows expected demand in 2022, for the thermal coal used in power plants, as forecast by the IEA in 2015 (dark blue columns), 2016 (yellow) and 2017 (light blue).

Carbon Brief analysis of IEA coal market reports. Chart by Carbon Brief using Highcharts.

Outlooks for thermal coal demand in 2022, by country and economic grouping, as forecast by the IEA in 2015, 2016 and 2017. OECD is the Organization for Economic Cooperation and Development, made up by the world’s wealthiest nations. ASEAN is the Association of Southeast Asian Nations, comprising Thailand, Vietnam, Indonesia, Malaysia, the Philippines and others. *The 2015 and 2016 forecasts were extrapolated in a straight line to 2022, based on the last three data points.

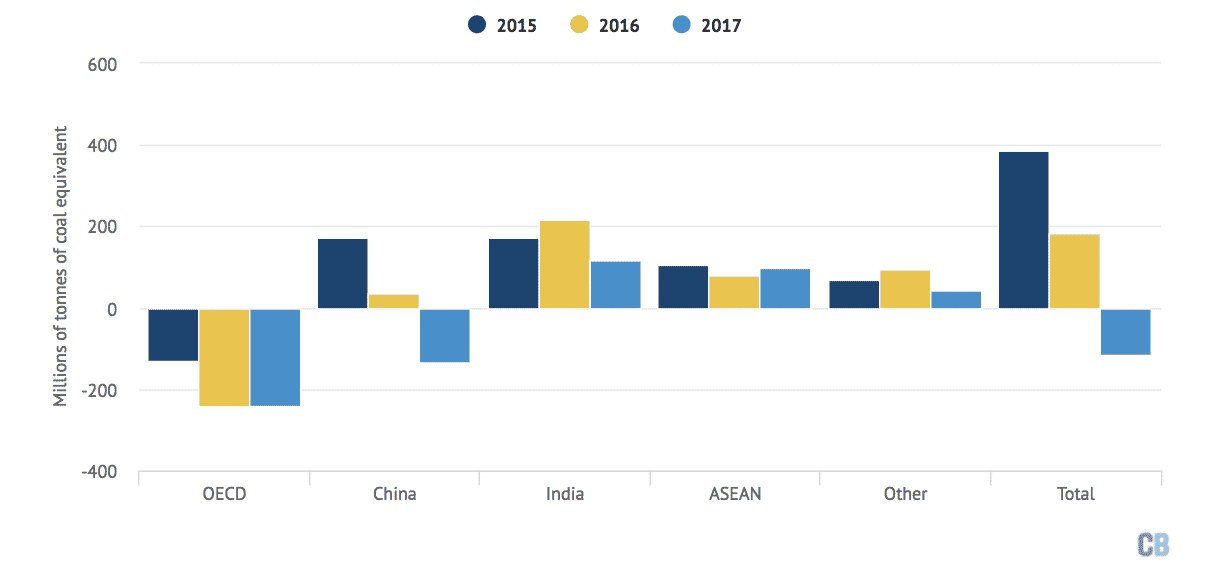

This year, however, perhaps the more notable shift in outlook is for India. Last year, the IEA forecast saw Indian thermal coal demand rising by 215Mtce between 2014 and 2022. This year, the figure is 115Mtce, effectively halving the rate of growth for power sector coal demand.

The chart below shows the change in thermal coal demand between 2014 and 2022, as forecast by the IEA in (dark blue columns), 2016 (yellow) and 2017 (light blue).

Carbon Brief analysis of IEA coal market reports. Chart by Carbon Brief using Highcharts.

Outlooks for the change in thermal coal demand between 2014 and 2022, by country and economic grouping, as forecast by the IEA in 2015, 2016 and 2017. OECD is the Organization for Economic Cooperation and Development, made up by the world’s wealthiest nations. ASEAN is the Association of Southeast Asian Nations, comprising Thailand, Vietnam, Indonesia, Malaysia, the Philippines and others. *The 2015 and 2016 forecasts were extrapolated in a straight line to 2022, based on the last three data points.

Coal India

This change in outlook for India is significant because India now drives the IEA’s forecast of continued global coal demand growth. If the IEA is starting to change its view on Indian coal demand growth, then the global picture could change direction, too.

Plans to bring electricity to all citizens, plus rapid economic growth, mean an increasing role for coal power in India, the IEA said.

“There is a reality in electricity access and demand,” said Keisuke Sadamori, director of energy markets and security for the IEA, in a call with journalists. Demand will grow, Sadamori said, even though countries such as India will probably follow a less energy-intensive path to development than those that came before them.

Growth in Indian coal power demand is also despite the IEA being “optimistic” about India’s renewable energy targets, he said.

The IEA outlook for coal demand in India has clearly already shifted, reflecting the rapid expansion of renewables, slower-than-expected demand growth and financial troubles for coal and utility firms.

Priyavrat Bhati, energy group program director of the Delhi-based thinktank the Centre for Science and Environment told Carbon Brief:

“I would agree with the IEA assessment. While coal’s demand growth is slowing, it is still hard to envisage a scenario under which coal will stall around 2022. Renewable energy has grown spectacularly in the past year…[but] power demand will continue to grow and renewable energy won’t be sufficient.”

Still, there are reasons to believe that the IEA remains behind the curve. Tim Buckley, director of energy finance studies at the Institute for Energy Economics and Financial Analysis (IEEFA), told Carbon Brief:

“India is the key market revision by the IEA in this report and the changes [compared to last year] are material, but still nowhere near sufficient to address how quickly the Indian renewable energy story is unfolding.”

India has set what have been seen as highly ambitious targets for renewables, aiming for 175 gigawatts (GW) in total by 2022, including 100GW solar and 60GW wind. Then, in November, the Ministry of New and Renewable Energy set out plans to meet these targets early, with power minister R K Singh saying the country could reach 200GW by 2022 instead of the “conservative” 175GW goal. Today’s IEA coal forecast assumes that only 70GW solar will be installed by 2022.

In July, the IEA itself reported that Indian coal-power investments are drying up. Last month, it said solar would be cheaper than coal in India in the second half of the 2020s.

There is a large pipeline of roughly 43GW of new coal-fired power stations already under construction in India, with an even larger number at the planning stage. It is not clear how many of these plants will be completed, however.

Ted Nace, director of NGO CoalSwarm, told Carbon Brief: “In India, at least 31 coal-fired power plants under construction at 13 locations remain on hold, most often due to lack of financing as investment money shifts to cheaper renewables.”

In contrast to the IEA, which sees Indian coal demand rising non-stop out to at least 2040, recent IEEFA analysis suggests the country’s power stations could peak demand by 2027.

This view is partially supported by Varun Sivaram, fellow for science and technology at the Council on Foreign Relations. He told Carbon Brief:

“I personally think the IEA’s forecast [for India] is reasonable. There are factors to suggest both that the Indian government is aggressive and conservative in its projection. A tonne of coal plants are in various stages of the permitting/construction pipeline, so very powerful interests are pushing to build at least some plants. On the other hand, coal utilisation is low and renewables are undercutting new coal plants on price, making the economic argument for new coal plants very difficult. So the middle ground projection is what the IEA projects, with the understanding that beyond 2022, India probably will not be powering an increase in global coal demand.”

German Challenge

One intriguing aspect of the IEA report is its outlook for the EU. It said EU coal use will continue to fall, with remaining demand becoming ever-more concentrated in Germany and Poland.

In Germany, the IEA said coal demand will fall, even though the country plans to close all its remaining nuclear plants by 2022. This is because generation from renewable sources will increase strongly, overtaking coal to become the largest source of power around 2022.

Furthermore, the IEA said the balance is tight between running Germany’s hard coal plants or switching to its large spare gas generation capacity. The report says: “Lower-than-anticipated gas prices or higher-than-expected coal or EU-ETS prices could trigger a decline in coal demand.” It also points to the risk of new policy on coal, once a new government is formed.

This situation mirrors the picture across the EU, where coal plants are under pressure as a result of falling electricity demand, rising renewable generation and tightening air pollution rules, which will affect a significant portion of the EU coal fleet.

“One-third to one-half of the EU fleet needs to be retrofitted to comply with the new emission standards, or be shut down,” the report notes. It adds:

“Investing in new abatement technologies would raise the cost of electricity generation…putting pressure on coal plants when wholesale electricity prices have reached record lows. In such an environment, recovery of any investment is uncertain: coal power plants have become high-risk assets in the EU due to the high political uncertainty and unfavourable market conditions that deter investment.”

Under these conditions, a small increase in carbon prices on the EU ETS, or relatively small shifts in coal or gas prices could trigger significantly accelerated reductions in EU coal use.

It’s worth noting, in this context, that the IEA forecasts an EU carbon price of €7 per tonne of CO2, whereas analysts expect recently agreed EU ETS reforms to raise prices to €10 in the short term and possibly much higher into the 2020s.

Conclusion

Over the past five years, the global conversation on coal—and its role in a world hoping to tackle climate change—has shifted dramatically. This change has followed the dawning reality that Chinese coal use has peaked, allowing global greenhouse gas emissions to level off, too.

This has turned the spotlight on India, seen by industry figures as the engine to drive coal growth forward. It’s in this context that today’s IEA forecast is significant, showing that in India, too, the outlook for coal is changing.

For Sivaram, that future engine of growth will come from southeast Asian countries, where there is “no end in sight” for coal plant construction. He told Carbon Brief:

“Renewables have been super-sluggish in ASEAN—pathetically slow growth because of a patchwork of regulations and a terrible investment climate. This will change slowly—it could take years for renewables to take off. So I am deeply worried about coal growth, as governments eagerly look to invest in plants now.”

Not everyone shares this sense of gloom. Matthew Grey is senior analyst for utilities and power at the Carbon Tracker Initiative, an NGO. He told Carbon Brief:

“The incumbency is betting on India and southeast Asia as the main source of new demand and appear to be making the same mistake they made with China. Pollution policy and industrial strategy drive [renewable energy] deployment and [price] deflation. This virtuous cycle is now an unstoppable force. All the coal industry can do is try and entrench themselves in markets where the renewables sector is in its infancy. India and southeast Asian countries increasingly see an alternative to coal. This reality would have been unimaginable five years ago.”

Reposted with permission from our media associate Carbon Brief.

233k

233k  41k

41k  Subscribe

Subscribe