Reviews

Reviews

2024 Solar Incentives and Rebates (Top 9 Ranked States)

In this EcoWatch guide on solar incentives, you’ll learn:

- How do you take advantage of solar incentives?

- What states have the best solar incentives?

- Will there be a solar tax credit in 2024?

- What are solar renewable energy certificates (SRECs)?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

If you’re like the majority of homeowners, you’re looking to install solar panels to save some money on your skyrocketing electricity bills. But when you look into how much it costs to install solar panels, you might get a little uneasy.

However, there are several solar incentives and rebates that can make going solar a more affordable option.1 In this guide, we’ll explain the different solar incentives and tell you about the top nine best states for solar incentives.

If your state is not on this list, you can search through our site for a specific page dedicated to solar incentives in your state — we have guides for the best solar incentives in all 50 states.

What Solar Incentives Are Available in 2024?

There are some solar incentives available to every U.S. who installs solar panels, while other incentives or rebates are only available in certain states, cities or municipalities.

These are the most common solar incentives in the U.S.:

- Federal solar tax credit

- State solar tax credit

- Net Metering

- Solar property tax exemption

- Solar sales tax exemption

- Solar rebates

- Solar renewable energy certificates (SRECS)

- Performance-based incentives (PBIs)

- Subsidized loans

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

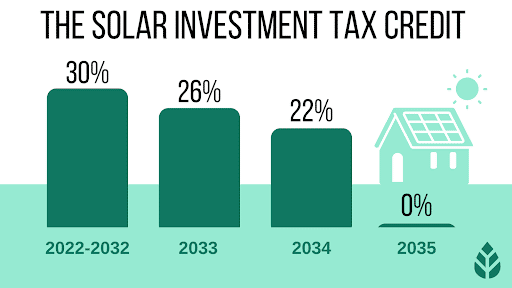

The federal solar tax credit, or investment tax credit (ITC) allows taxpayers to claim a percentage of the total installation cost of a home solar project on their federal income taxes. It’s been around since 2005 at 30% with a tiered system that would decrease over time.

The incentive had dropped to 26% for 2022, but after the Inflation Reduction Act was passed under the Biden administration in August 2022, the credit was bumped back up to 30%. Plus, a separate standalone tax credit was added for solar batteries.

The average American will receive a solar tax credit value of about $8,991 for installing solar panels, based on the average solar system cost of $29,970.

Here’s where the ITC currently stands:

- 30% of your total system value for solar photovoltaic (PV) systems installed between 2022 and 2032

- 26% of your total system value for solar PV systems installed in 2033

- 22% of your total system value for solar PV systems installed in 2034

- Credit discontinued for systems installed starting in 2035 unless extended again by Congress

The below video further explains how the Inflation Reduction Act will affect solar incentives.

State Tax Credits

Some states offer tax credits similar to the one from the federal government. Combined with the ITC, this incentive can add up to significant savings for homeowners who go solar. Currently, there are only about ten states that currently offer some form of a state solar tax credit and exact credit amounts vary from state to state.

For example, South Carolina offers a solar tax credit worth up to 25% of their total system cost, while New Mexico offers a tax credit of up to $6.50 per square foot of solar panel installation (until 2032).

Net Metering

Net metering is a way for you to earn credits from your utility company for the electricity your solar panels produce.

Here’s the deal: Your solar panels are going to produce more electricity than what is needed to power your home each day, and all that extra energy is fed back to your local electric grid. In exchange, your utility company gives you credits that you can use against your monthly electric bill.

Net metering laws vary across the nation and no two states’ policies look exactly the same. Some laws credit customers at the retail rate, while others offer lower-value credits.

Solar tends to be more popular in states with favorable net metering laws, as the incentive shortens your solar panel payback period and yields a higher return on investment.

Visit our page on net metering to learn more.

Property Tax Exemptions

Most states and local municipalities offer property tax exemptions for renewable energy systems. This means that even though solar increases the value of your home, you won’t have to pay the additional property taxes that would otherwise accompany a home upgrade.

The exact form of these exemptions will vary depending on the state. For example, a popular California solar incentive called the “Active Solar Energy System Property Tax Exclusion” ensures that adding solar panels doesn’t raise homeowner property taxes. Currently, 36 states offer some form of property tax exemption for solar or other renewable energy systems.2

Sales Tax Exemptions

Depending on the state, your solar power system may also be exempt from sales tax. Most states have sales taxes hovering around 4 to 7%, which means homeowners could save over $2,000 on an average-sized solar system.

Currently, 25 states offer sales tax exemptions for the purchase of solar equipment.3

Visit our page on solar tax exemptions to learn more.

Solar Rebates

Some states, local governments and even utility and solar companies offer solar rebates to homeowners or low-income service providers who install solar equipment. Sometimes solar rebates are given directly to the resident and other times they’re given to the solar contractor who can then charge less for installations.

Many utilities will offer additional rebates for solar energy storage systems or other energy efficiency upgrades. For example, California utility PG&E offers rebates of 15-20% of the solar battery cost for all customers and rebates of up to 100% for customers who live in areas prone to power outages.4

Be sure to ask your solar installer what types of solar programs and rebates may be available near you.

Solar Renewable Energy Certificates (SRECs)

Currently, 30 states and the District of Columbia have renewable portfolio standards (RPS) or clean energy standards (CES) that require electric utilities to deliver a certain amount of electricity from renewable sources. Eight more states have non-binding or “voluntary” renewable portfolio goals.5

This incentivizes governments to reward residents who help the state reach its goal. In 12 states and the District of Columbia, there are more ambitious goals set: to hit 100% renewable energy by 2050 or earlier.6

If you live in one of these states, your solar panels may earn solar renewable energy certificates (SRECs) for each megawatt-hour (or 1,000 kWh) of clean energy generated. Public utilities will purchase these certificates from you in cash to meet the requirements of a state’s RPS because SRECs allow public utilities to count the clean energy your panels produce towards their clean energy goals.

Though complex to understand, SRECs offer tremendous upside in the form of additional income to both residential and community solar customers. Eligibility will vary depending on your location, but any reputable solar company will be able to walk you through the process of earning and selling your renewable energy certificates.

See Also: Inflation Reduction Act Savings Calculator

Performance-Based Incentives (PBIs)

Similar to net metering, a performance-based incentive, or PBI, will reward you for the electricity your PV system produces. A PBI will pay you a per kilowatt-hour credit for the power your solar panels produce.

PBIs may be offered by the state, local government or utility company.

Subsidized Loans

Some states, local utilities and organizations may offer subsidized loans to help you finance your solar panel system. When you get a free quote from a solar company, you can ask them about solar loan programs.

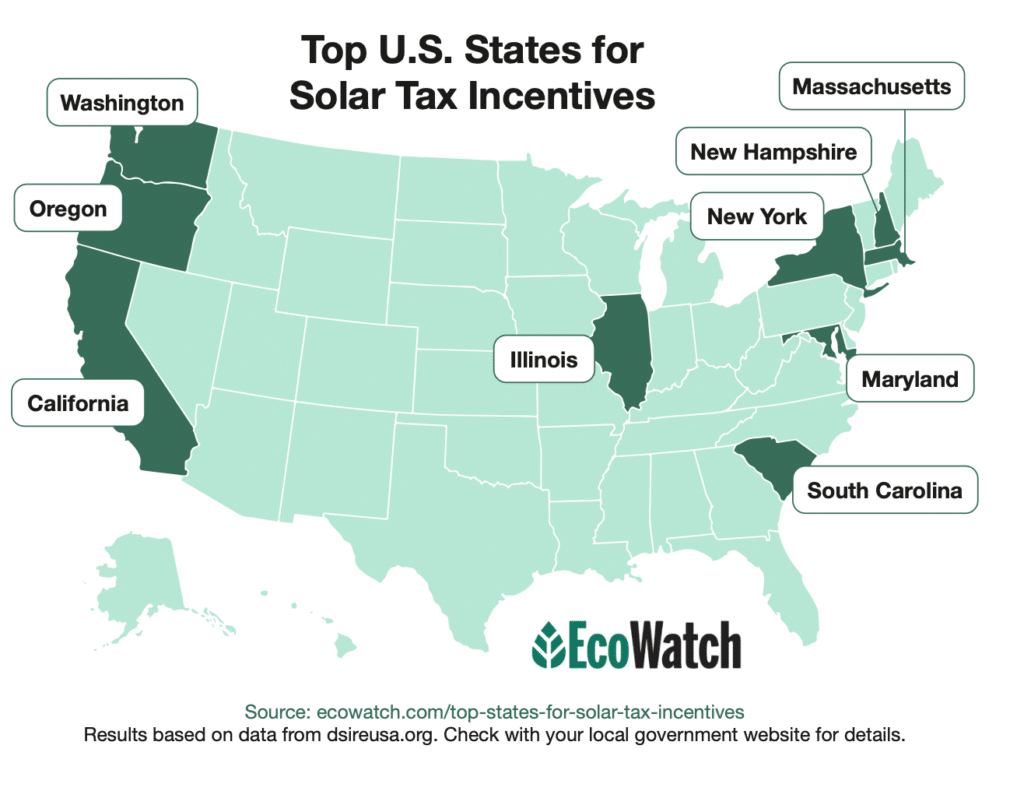

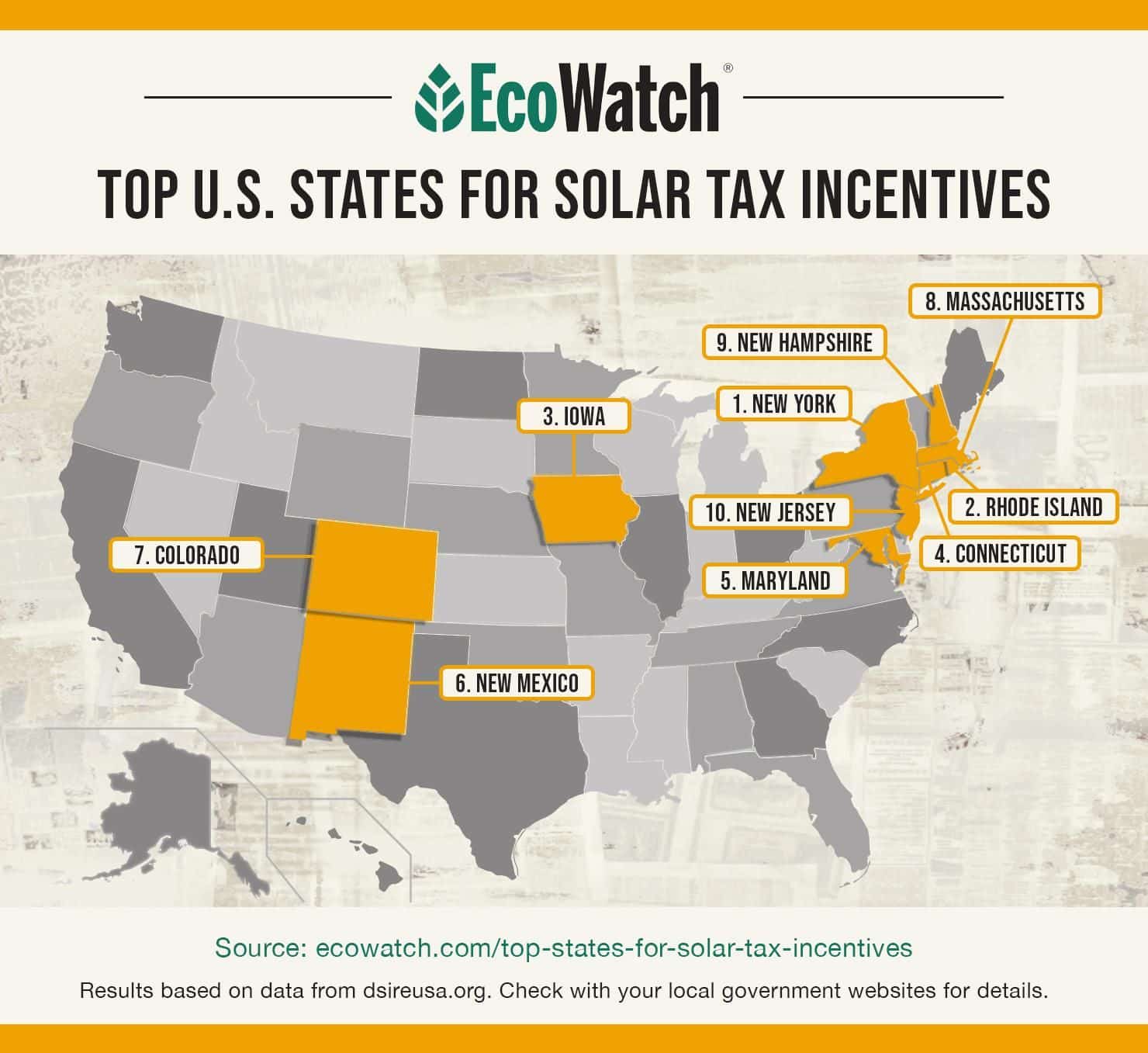

Top 9 States for Solar Energy Tax Incentives

Now that we’ve looked at the most common solar incentives in the U.S., we can look at which states offer the most of these perks and other incentives to make solar adoption as beneficial and as accessible as possible.

EcoWatch’s team of solar experts has carefully reviewed the solar incentives available in all 50 states to determine which states were the most solar-friendly. The following are the top nine best states for solar rebates and incentives:

- New York

- Massachusetts

- Maryland

- Oregon

- Illinois

- New Hampshire

- California

- Washington

- South Carolina

New York Solar Incentives

New York ranks as the top state for solar incentives because it combines what we consider to be the basics — including sales and property tax exemptions — with affordable loan programs, several local incentives and an outstanding net metering policy.

We’ll list and briefly explain all of the incentives available in the Empire State below.

- Federal tax credit: The federal tax credit is available in NY just as it is in most other states. With an average system cost of $22,880, the credit is valued at an average of $6,864 in the state.

- New York solar energy system equipment credit: This is New York’s state tax credit for photovoltaic (PV) equipment. It credits an incredible 25% of your system value to your income taxes, with a maximum credit value of $5,000.7 Most New Yorkers will see a credit averaging the full $5,000, given the typical system costs in the area.

- NY-Sun Megawatt Block Incentive: This block incentive is a solar rebate program that provides rebates between $0.20 and $0.80 per watt. The actual amount is based on which utility company serves you and where in the state you live. For example, PSEG offers $0.40 per watt, and ConEdison offers between $0.20 and $0.40 per watt.8,9

- Sales tax exemption: Like many other states, NY strives to keep the upfront cost of solar conversion as low as possible by waiving sales tax on all PV equipment and installation labor.10 With a state sales tax rate of 4%, this perk saves solar customers an average of around $915.11

- Property tax exemption: New York began offering the Energy Conservation Improvements Property Tax Exemption in 1977.12 This perk prevents the home value your system provides from being taxed.

- NYSERDA residential financing options: The New York State Energy Research and Development Authority (NYSERDA) provides solar loan opportunities with low interest rates and affordable down payment requirements.13 This program helps keep long-term conversion costs down and makes solar more accessible.

- Net metering: The New York Public Service Commission (PSC) has historically mandated net metering at the full retail rate per kWh of excess energy sent to the grid. The state is moving away from traditional net metering toward a Value of Distributed Energy Resources (VDER) program.14 The new credit rate is based on a few factors and usually comes out to be slightly below the retail rate. This isn’t as good as a one-to-one credit system, but it’s still massively beneficial, especially since the electricity rate in the state is well above average.15

- Local incentives: As if the state perks weren’t beneficial enough, there are also some local incentives available to certain residents. Some examples of these include the City of Riverhead Energy Conservation Device Permitting Fees, the New York City (NYC) Property Tax Abatement for PV and Energy Storage Equipment and the NYC Residential Solar Exemption for Sales Tax, which waives local sales tax in addition to state sales tax.16,17,18

Learn More About Solar Incentives In New York

Massachusetts Solar Incentives

Massachusetts is another state where incentives abound for solar customers. In addition to the federal credit offered to all residents, the state also provides property and sales tax exemptions, an outstanding net metering program, local incentives and more. Unlike New York, Massachusetts also has an open and active SREC market.

Below is a quick list of all of the perks available in the Bay State and how they work to make your equipment more valuable.

- Federal tax credit: The federal credit is available to all Bay Staters and can save an average of $7,254, provided you owe enough in taxes to take the full credit.

- State tax credit: Massachusetts has a state tax credit called the Residential Renewable Energy Income Tax Credit. It provides a credit of up to 15% of your system costs or $1,000, whichever is less.19 Given the average system cost in the state, most residents will be able to take the full $1,000.

- SREC program: Massachusetts used to have a traditional SREC program but recently replaced it with the Solar Massachusetts Renewable Target (SMART) program. This program works similarly by crediting solar customers between $0.20 and $0.30 per kWh generated, regardless of where that energy is used.20 The credits continue to accrue for ten years following your installation.

- PACE financing: Property-Assessed Clean Energy (PACE) financing is an accessible payment option for low-income households looking to convert to solar energy. It includes affordable down payment options and a low APR, and monthly payments are conveniently paid via your tax bill.21

- Sales tax exemption: With a state sales tax rate of 6.25%, the sales tax exemption in Massachusetts will save the average homeowner nearly $1,511 on the upfront cost of conversion.22,23

- Property tax exemption: The property tax exemption functions just like it does in other states, but it saves Bay Staters more, on average, due to above-average home values.24

- Net metering: The net metering policy in the state is as good as it can be, with the local Public Utilities Commission (PUC) mandating access to NEM for all residents and setting the credit rate at the full retail value per kWh.25 This is an especially big deal given that the average price for electricity in the state is nearly double the national average.26

- Local incentives: In addition to solid statewide incentive programs, Massachusetts homeowners have access to a variety of local incentives as well. These include the following:

-

- Hudson Light & Power photovoltaic incentive program27

- Concord Municipal Light Plant solar rebate28

- Taunton Municipal Light Plant residential PV rebate program29

- Reading Municipal Light Department residential renewable energy rebates30

- Holyoke Gas & Electric residential energy conservation loan program31

- Chicopee Electric Light residential solar rebate program32

- Cape Light Compact residential energy efficiency rebate program

- Shrewsbury Electric & Cable Operations solar rebate program

- Wakefield Municipal Gas & Light Department solar rebate program

Learn More About Solar Incentives In Massachusetts

Maryland Solar Incentives

Maryland takes our third spot for having the best incentive programs in the country. While it doesn’t have a state tax credit, it does offer a solar rebate program, which is arguably a stronger incentive because you’ll collect it up front and not only in tax deductions.

Solar adopters in Maryland also have access to property and sales tax exemptions, local incentives, SRECs and one of the best net metering programs in the country. We’ll explain all of the solar perks available to Marylanders below.

- Federal tax credit: As is the case in all other states, MD residents have access to the 30% ITC to effectively bring down the cost of converting to clean energy.

- State solar rebate program: Maryland is one of the few states that have a statewide solar rebate. It’s called the Residential Clean Energy Rebate Program, and it provides a cash-back incentive of $1,000 for systems over 1 kW, which includes virtually all residential solar systems.33 There’s also a $500 rebate for solar water heaters.

- Sales tax exemption: With a state sales tax rate of 6%, the solar sales tax exemption saves residents an average of $2,022 on their upfront solar conversion costs.34,35

- Property tax exemption: Maryland exempts PV equipment from property taxation, which means the value added to your home by your solar electric system won’t cause your property taxes to increase.36

- Net metering: The PSC in the Free State mandates net metering for all residential solar customers, which means all residents will have access to credits for excess power exported to the grid. Not only that, but the Commission also mandates that credits are offered at the full retail rate, which is the best-case scenario and helps maximize the long-term savings you’ll see with your equipment.37

- Local incentive programs: Depending on where you live in MD, you might have access to additional incentives offered by your utility company or your local municipality. Below are some of the most appealing incentives offered in the state.

Learn More About Solar Incentives In Maryland

Oregon Solar Incentives

Oregon has secured a spot in our list of the best states for solar incentives by offering a statewide rebate for solar energy storage systems, sales and property tax exemptions, a best-case scenario net metering program and great local incentives.

Below is a quick breakdown of all of the solar perks and rebate programs available in the Beaver State.

- Federal tax credit: The federal credit is available to all Oregonians. Given the average price of a solar PV system in the area — around $31,160 — you can expect a total credit of approximately $9,348.

- Oregon Solar + Storage Rebate Program: This is a rebate offered by the Oregon Department of Energy (ODOE) for customers who install panels or panels coupled with solar batteries. The rebate for panels is up to $5,000, and the additional rebate for adding a battery to the system is up to $2,500.42

- Solar Within Reach cash incentives: This is a rebate coordinated by the Energy Trust of Oregon that’s specific to Pacific Gas & Electric (PGE) and Pacific Power customers. PGE residents can get cash-back incentives of $1.20 per watt, up to a maximum of $7,200, and Pacific Power customers can get rebates of up to $1.00 per watt, up to a maximum of $6,000.43

- Sales tax exemption: Technically, there is no sales tax exemption specifically for solar in Oregon. However, the state doesn’t charge sales tax in general, so residents still enjoy the benefits of such an exemption.44 This helps bring down the upfront cost of converting to solar energy for Oregonians.

- Property tax exemption: The Beaver State excludes the value of your system from your assessed value, so the long-term costs of converting to solar are significantly reduced.45

- Net metering: The PUC in Oregon mandates net metering for all investor-owned utilities (IOUs) except Idaho Power, so the program is available to most residents. The credit rate is also set at the full retail rate for electricity, which helps solar customers save the maximum amount of money over time.46

- Local incentives: Some Oregonians can take advantage of local incentives, depending on where they live in the state and which utility company serves them. We’ll list some of the most widely available local perks in Oregon below:

Learn More About Solar Incentives In Oregon

Illinois Solar Incentives

- Federal tax credit: The federal tax credit, which is available statewide, provides an average potential value of $7,740 in Illinois, making it one of the most appealing incentives in the area.

- Local SREC market: The Illinois Shines Program is the state’s equivalent of an active SREC program. This is an adjustable block program that works similarly to SRECs, providing credits for all solar production for 15 years after installation. The credits can be sold for a profit or to offset your system costs.50

- Illinois Solar for All financing program: The Solar for All program provides affordable and accessible financing options for low-income residents living in the Prairie State.51 It helps to make clean energy accessible to all residents, regardless of financial status.

- Property tax exemption: Illinois provides a property tax exemption for all solar equipment.52 That means that your panels will not cause changes to your property taxes, even though they are expected to boost your home value.

- Net metering: The PUC in IL mandates that net metering be offered to all solar customers, including those that are serviced by major providers, like Ameren and Commonwealth Edison (ComEd). The policy also sets the net metering credit rate at the full retail value per kWh, which means every kWh you send to the grid will offset one kWh you pull from the grid during times of under-production.53 However, that retail rate is only mandated for investor-owned utilities (IOUs).

- Local incentive programs: Illinois residents also have access to local incentive programs. Specifically, residents of Chicago can save some money with the expedited Solar Express permitting program.54 Commercial solar customers that are served by ComEd can also take a sizeable solar rebate from the utility provider.55

Learn More About Solar Incentives In Illinois

New Hampshire Solar Incentives

With one of the highest rates of renewable energy production in the country, it’s no surprise that New Hampshire made our list with its highly beneficial solar incentives. These include the ITC, a solar rebate program, property and sales tax exemptions, a good net metering policy, state-supported solar financing options and local perks.

Below are brief descriptions of all of the incentives available in the Granite State.

- Federal credit: All NH residents can take the federal tax credit, which provides an average potential value of $7,352 in the state.

- Statewide solar rebate program: Unlike most other states, New Hampshire has a statewide rebate program for solar conversion called the Residential Renewable Electric Generation Rebate Program. The rebate is for up to $200 per kW installed, with a maximum rebate of $1,000.56 Most residents with an appropriately-sized system will see the maximum value of $1,000 from this perk.

- Exemption for property taxes: The Granite State exempts solar equipment when calculating property taxes, which means your taxes won’t increase even though your system adds value to your property.57

- Net metering: The PUC in New Hampshire mandates net metering for most of the larger utility companies, including Eversource, Unitil, Liberty Utilities and the New Hampshire Electric Cooperative. The NEM rate isn’t set by the PUC, and it recently went down a bit with the implementation of net metering 2.0.58 It’s expected to dip again in the future when the 3.0 version is implemented. You should contact your power company to confirm the credit rate specific to your home. Keep in mind that any net metering program in New Hampshire is going to be more beneficial than it would in most other states, given the high cost of electricity in New England and NH, specifically.59 You should also be aware that the PUC limits the amount of excess customer generation that will count toward NEM, so the program is limited.

- Commercial PACE financing: PACE financing is available to commercial solar customers in New Hampshire to help make solar adoption as accessible as possible.60

- Local incentive programs: Some New Hampshire homeowners will also have access to local incentives. One of the most beneficial options is the Eversource ConnectedSolutions Program.61

Learn More About Solar Incentives In New Hampshire

California Solar Incentives

California is well-known as one of the best states in the country for solar adoption and ranks first for conversions according to the Solar Energy Industries Association (SEIA).62

Of course, a big part of why solar is so popular here is the access to solar incentives, which include the federal credit, statewide solar rebates, numerous state-backed financing options, a property tax exemption, a great net metering program and access to local solar perks. We’ll briefly explain all of these options below.

- Federal credit: As is the case in all other states, CA residents have access to the federal tax credit. This perk provides an average potential value of $5,994 in the Golden State.

- Self-Generation Incentive Program (SGIP): This is a statewide rebate made available to all solar customers who couple their panels with solar batteries. The rebate is for $200 per kWh of battery storage installed.63

- Equity Resiliency Program: This program is offered within the SGIP option mentioned above, but it’s exclusive to income-qualifying customers. It provides a rebate of up to $1,000 per kWh of battery storage installed, which very often covers the full cost of installing solar batteries.64

- PACE financing: California’s PACE financing program, called California FIRST, functions just like PACE programs in other states. It provides low-APR, no-money-down loans for solar customers who have qualifying incomes.66

- Property tax exemption: The Golden State exempts your solar system’s value when assessing property taxes under its Active Solar Energy System Exemption program.67 As such, going solar will not negatively affect your property taxes.

- Net metering: As of this writing in early 2024, California offers net metering 2.0, but the state is moving to NEM 3.0 in April of 2024. This new policy will make NEM credits less valuable overall. However, any net metering policy in CA will be more beneficial than the equivalent in most states, as residents pay some of the highest electricity rates in the country.68

- Local incentives: Californians have some of the most valuable and plentiful local incentives to supplement the federal and state perks. The most beneficial local perks include the following:

Learn More About Solar Incentives In California

Washington Solar Incentives

Washington provides a good selection of solar incentives, securing the eighth spot on our list of the top states for solar perks and rebates. Among the incentives offered are a sales tax exemption, local perks, statewide financing options and a great net metering policy.

Below are all of the incentives available to Washingtonians for solar conversion.

- Federal solar tax credit: The federal credit in Washington provides an average potential value of an incredible $10,080. The credit value is so high because of the above-average system costs in the area, but still, this provides excellent value to residents.

- Feed-in tariffs: Washington’s Renewable Energy System Incentive Program is a standing perk that provides value for every kWh your system generates, regardless of how or where that energy is used. You earn these credits for eight years following installation, and they net you an average of $720 per year based on the average system size in the area.73 As of this writing, the program is waitlisted, but this still provides massive opportunities to Washingtonians.

- Sales tax exemption: To reduce the financial burden of going solar, the Evergreen State waives sales tax on all photovoltaic equipment and the labor for installation.74

- Net metering: The Washington Utilities & Transportation Commission (WUTC) ensures that net metering is offered to all residential solar customers.75 The credit rate is not set by the WUTC, so your rate may vary based on your provider. Regardless of the rate, net energy metering is extra beneficial for WA residents, as monthly energy consumption is above average.76

- Local incentives: There are several local incentives available to Washington residents as well, depending on where the system is being installed. The most prominent local perks are listed below.

Learn More About Solar Incentives In Washington

South Carolina Solar Incentives

Rounding out our list of the best solar incentives in the U.S. is South Carolina. The Palmetto State has an outstanding state tax incentive in addition to the federal one, a strong net metering policy and some local perks. We’ll explain each of the solar incentives available in SC briefly below.

- Federal tax credit: All South Carolinians have access to the federal tax credit for solar systems. Given the average cost of converting to renewable energy in the area, residents can expect to see an average credit value of around $10,791. This is well above the national average.

- State tax credit: The South Carolina Solar Energy Tax Credit is one of the largest state tax credits for solar in the entire country. It provides a tax credit in the amount of 25% of your system up to a maximum of $35,000 over ten years.80 This comes out to an average of $8,992 over time, with up to $3,500 taken per year. Coupled with the federal credit, this can potentially bring your solar installation cost down from $35,970 pre-incentives to $16,187. This lower amount is much more reasonable and well below the national average.

- Property tax exemption: South Carolinians have the benefit of exempting their solar energy systems from property taxation.81 This helps reduce the long-term costs of going solar in the area.

- Net metering: The PSC in SC mandates net metering for all power providers (not cooperatives) with over 100,000 customers. That includes Duke Energy, Dominion Energy, Santee Cooper, Lockhart Power and Municipal Electric Utilities. The credit rate is not set by the PSC and will depend on your utility company.82 NEM is of particular value to South Carolinians because they use well over the average amount of energy per month; a higher consumption means a greater potential for savings.83 There is a cap of 2% for residential generation, meaning spots in the program are limited.

- Local incentive programs: Some SC residents will also have access to local perks, depending on their electricity provider. We’ll include a list of the available local incentives in the Palmetto State below.

Learn More About Solar Incentives In South Carolina

Methodology: How We Determined the Top States for Solar Incentives

EcoWatch’s solar experts researched solar incentives available in each state as of 2024 to determine which states offered the most benefit to solar adopters. The data was collected and used to rate and rank each state depending on the availability of the following criteria:

- State tax credit or rebate offered (20%): States were given more points if they offer a state-wide tax credit or rebate for residential solar projects.

- Net metering programs (20%): States with more rewarding net metering programs scored higher. We specifically evaluated criteria such as whether net metering is mandated and the retail electricity rate at which residents were credited.

- Unique solar perks (20%): States that offered additional incentives for going solar — such as New York’s NY-Sun Megawatt Program — or many solar financing options were awarded more points.

- Tax exemptions for solar projects (20%): We gave full points to states that offer complete property tax exemptions for solar projects. Partial credits were awarded to states that offer property tax exemptions for a limited number of years, property tax reductions or feature certain cities or counties that offer full exemption. Additionally, states with full sales tax exemption for solar projects (including states that don’t have sales tax) were awarded full points. Partial credits were awarded for states that have sales tax exemptions for solar in certain counties or states.

- Local municipality or city incentives offered in populous areas (10%): We gave extra consideration to states that have solar incentive programs or offerings in their more populous areas.

- Solar Renewable Energy Certificate (SREC) market (5%): States that have an open SREC market were awarded additional points because it gives residents an extra financial benefit from the solar energy their panels produce.

- Availability of Solar Financing Programs (5%): While you can receive solar payment help in any state through bank loans, state governments that lay out statewide solar financing or loan programs were ranked higher through our system.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: U.S. Solar Incentives

At EcoWatch, we routinely get questions from readers about solar programs from the federal government and state legislatures. Here are some of the more common queries, along with our answers.

The solar incentives available to you in 2024 will depend largely on which state you live in. However, all U.S. residents will have access to the federal solar investment tax credit (ITC), which is offered by the federal government. Thanks to the Inflation Reduction Act signed in 2022, the ITC credit rate for 2024 was pushed up from 22% to 30%.86

Several other perks are likely to be available to you, although actual eligibility will depend on your location. Many states have sales tax exemptions and property tax exemptions, which reduce your upfront and long-term costs of converting to solar energy.

Another common option throughout the U.S. is net metering, which credits you for overproduced energy and lets you use those credits to reduce your future electric bills. Again, not all states have access to this incentive, but it’s one of the more prominent perks in the country.

You can always check out our individual state incentive articles for more information on what perks you can take advantage of.

The federal tax credit is a solar incentive provided by the federal government that offers a credit to your income taxes. The credit value is equal to a percentage of your total solar conversion costs, with the year you install your system playing a role in the credit value as well.

Below is a quick breakdown of what percentage of your system value you’ll receive as a tax credit based on the year you go solar:

- 30% for systems installed between 2022 and 2032

- 26% for systems installed in 2033

- 22% for systems installed in 2034

- The program will no longer be available as of 2035

The credit value gets applied to your income taxes owed for that year. Provided you owe more than the calculated credit value to the government, you’ll be able to take the entire credit.

For most Americans, solar is absolutely worth the investment. The average U.S. resident pays $29,970 for their solar array before the ITC or around $20,979 after the federal credit is considered.

Despite the high cost of conversion, the panels are expected to provide energy savings that pay off the entire system within 13 years. Over the remaining nine years of system life (the minimum lifespan estimate), the system will save an additional $29,077, on average.

Your actual savings are likely to be even higher if you live in a state with robust solar incentives, like the ones we mentioned above or if you live in a state with above-average energy needs or electricity rates. Savings will also tend to be higher over time, as energy prices have climbed historically and are expected to continue in that direction.

There is no single best way to get solar panels that is equally as beneficial for everyone. Every solar customer has a unique story, so the financing option that works best for you might not be ideal or accessible to other customers.

With that being said, a cash purchase is the most valuable option over time. It leads to instant panel ownership, yields the shortest panel payback period and provides the greatest energy savings in the long run. Plus, it doesn’t prevent you from taking the federal credit, as a lease or power purchase agreement (PPA) would.

A solar loan is generally considered the next best option, although the total system cost will be a bit higher because of interest, and savings will be a little lower overall.

The best way to get started is to request a free solar quote from one of the EcoWatch-vetted solar installers. These professionals will know the best way for you to get solar panels on your home.

What are the Solar Incentives in Your State?

- What Are the Solar Incentives in Alabama

- What Are the Solar Incentives in Arizona

- What Are the Solar Incentives in California

- What Are the Solar Incentives in Colorado

- What Are the Solar Incentives in Connecticut

- What Are the Solar Incentives in Delaware

- What Are the Solar Incentives in Florida

- What Are the Solar Incentives in Georgia

- What Are the Solar Incentives in Hawaii

- What Are the Solar Incentives in Illinois

- What Are the Solar Incentives in Kentucky

- What Are the Solar Incentives in Louisiana

- What Are the Solar Incentives in Maryland

- What Are the Solar Incentives in Massachusetts

- What Are the Solar Incentives in New Jersey

- What Are the Solar Incentives in New York

- What Are the Solar Incentives in North Carolina

- What Are the Solar Incentives in Texas

- What Are the Solar Incentives in Utah

- What Are the Solar Incentives in Virginia

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe