Solar Incentives in Texas (Rebates, Tax Credits & More in 2024)

Here’s what we’ll cover in this guide to solar perks and incentives in TX:

- How impactful are solar incentives in Texas when it comes to system installation costs?

- What incentives are available in Texas and how much they can they save you?

- Which Texas incentives are the most valuable and shouldn’t be missed?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Is Texas a Good State for Solar Incentives?

Installing solar panels has continued to be come a growth industry as more people continue to find that the benefits and overall electricity savings that solar permits outweigh the upfront costs associated with them. But still that upfront costs continues to be one that many identify as the primary reason why they wont install solar. To combat this many government rebates and incentives exist on a local as well as State and Federal level. With Texas being the second largest state to adopt solar according to Statista, it’s no question that the popularity stems from some great saving wins.

The average cost of installing solar equipment in Texas ranges between $28,620 and $47,700 before any tax credits, rebates or incentive programs are considered. This is higher than the national average of around $29,970 in many cases.

However, after the federal solar investment tax credit (ITC) is considered, the average system cost in Texas can drop to between $20,034 and $33,390. Of course, additional incentives can be applied to bring these costs down even further, making them a critical part of going solar in the Lone Star State.

In terms of solar adoption in Texas, as previously mentioned the state is ranked second in the country in terms of solar adoption, sitting just behind California. Unlike California’s solar adoption, the rate of photovoltaic (PV) adoption has more to do with the enormous energy needs of Texas residents and the abundance of sunlight rather than the availability of valuable incentives.

The Lone Star State is a decentralized one, opting to set the rules more at a city or county level rather than at a state level. As such, it is home to only a few statewide benefit programs, which are less appealing than in most other states. However, there are numerous local incentives available from local governments and utility companies that you might be able to take advantage of.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Freedom Solar Power

Regional Service

Average cost

Pros

- Outstanding customer service

- Representatives are experts on local policies

- Great warranty coverage

- Offers products from leading manufacturers

Cons

- Expensive

- Limited service offerings

- No leases or PPAs

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

In the chart below, we’ll provide a quick list of all of the solar incentives that are currently available to Texas homeowners. Below that, we’ll provide additional information for each and explain how important each one is to keeping your conversion costs to a minimum.

| Solar Incentives in Texas | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | This is a credit to your income taxes for 30% of your entire system cost | One-time: Applied when you file your taxes for the year your system is installed | $10,971 |

| Renewable Energy Systems Property Tax Exemption | State | This prevents your property taxes from increasing as a result of installing solar equipment | One-time: Applied automatically by taxation department | Varies based on property value, base taxes and system value |

| Texas Solar Rights | State | This law gives all TX residents equal access to solar panel systems and renewable energy | Continuous: Always in effect | N/A |

| Net metering | Local | This is a billing policy that provides credits to future bills for excess energy produced with your solar panels. NEM is NOT mandated at the state level | Continuous: Either automatic or when you apply for the perk, depending on your utility provider | Varies based on your energy needs and solar production |

| Local incentives | Local | Some of the most appealing incentives are available on a local level, from individual cities or electric companies | Varies based on the perk and which entity offers it | Varies based on the incentive |

Federal Solar Tax Credit (ITC) for Texans

The federal tax credit is the most valuable incentive available in Texas. This is provided by the federal government and guarantees a tax credit applied to your income tax burden for 30% of your system value.

It’s important to note that you can only take advantage of the full credit if your income taxes owed are higher than the credit value. You can, however, roll over any unused credit for five years. This helps you take advantage of the full amount, even if your income tax liability is too low the year you install your system.

In Texas, where the pre-incentive solar power system can cost over $36,500, the typical credit amount is $10,971. This assumes that you install a system size of 11.5 kilowatts (kW) and pay the average cost per watt in the area, which is around $3.18.

The federal credit was originally offered in 2006 to all U.S. residents. At that time, the credit amount was also 30%. The rate dropped to 26% in 2022 and was meant to drop again to 22% in 2023 and then expire in 2024.

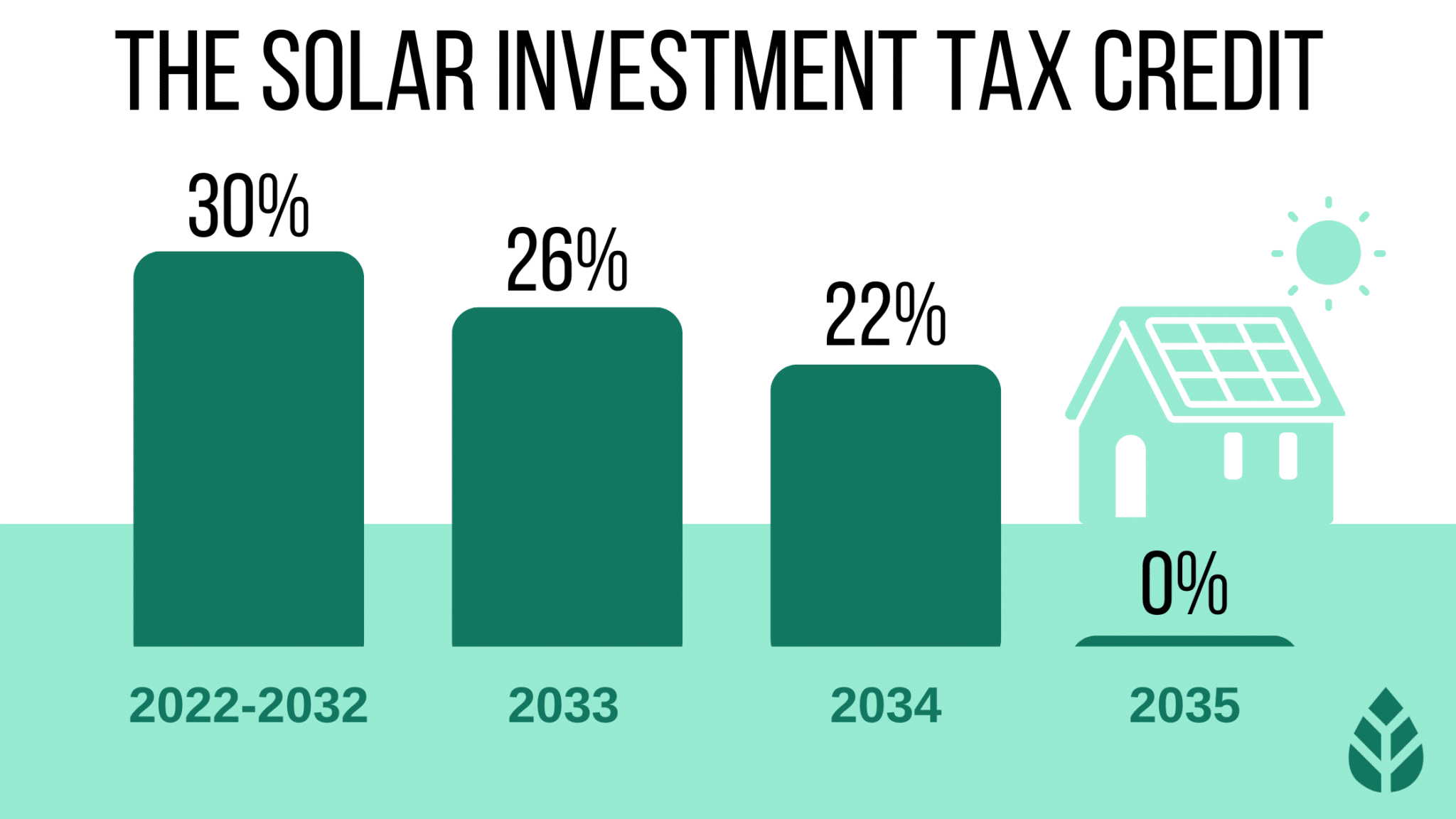

Thankfully, as part of the Inflation Reduction Act, and in an effort to continue to promote solar adoption throughout the country, the federal government extended the credit and reinstated the original credit rate. The rates are now scheduled to change as follows:

- 30% for all systems installed through 2032

- The rate will drop to 26% for systems installed in 2033

- It will drop again to 22% for systems installed in 2034

- The credit will no longer be available for systems installed in or after 20352

How to Claim the Federal ITC in Texas (click to expand)

Claiming the federal credit is not terribly time-consuming, and the process itself is simple. You’ll be ready to claim the credit when you file your taxes for the year your system is installed and commissioned. You can follow the steps below at that time.

- Step 1: Print out IRS form 5695 to fill out, or notify your accountant that they’ll need to fill out the form for you.

- Step 2: Go through the form and fill in any applicable information. You’ll usually need to know things like the address where your system was installed, the total price you paid for the system, the system capacity, the name of your solar company and more. You should have any paperwork provided by your solar installation company handy before you begin.

- Step 3: File the form along with your taxes. If you’re using automated filing software, you’ll usually be prompted to answer a question about whether you installed a solar array for that tax year.

Is the Federal ITC Worth the Time/Effort of Claiming in Texas? (click to expand)

There are some incentives that you can do without, especially if the benefit you receive is minimal and the time investment to file is significant. However, the federal credit is an absolutely essential incentive, in our opinion.

This perk is the most appealing because it can provide a credit of up to $10,971 in some cases, and the form you need to fill out usually takes less than 10 minutes. The minimal time it will take you to file for this credit is well worth it, especially since you can get a credit of nearly a third of your entire system cost.

Texas’ Renewable Energy Systems Property Tax Exemption

The property tax exemption prevents your taxes from increasing after you install your solar system.

Under normal circumstances, a home improvement that raises your property value will also bump up your assessed value. Since your taxes are determined using your assessed value, they will go up as well.

Installing a solar energy system is expected to bump up your Texas home value by over 4%, which is a significant increase.3 This would typically cause your taxes to increase, but the tax exemption in the state of Texas prevents that from happening.

Instead, your system value is not considered when determining your assessed value, which means your taxes shouldn’t change at all as a result of going solar.

It’s challenging to estimate exactly how much this will save you over time, as the savings depend on your home value, your taxes and your system size and value.

However, if we assume you pay around $36,570 for your solar array, the 1.6% property tax rate in TX would equate to an annual savings of over $585 every year on your tax bill.

Disregarding system depreciation, that’s over $11,700 saved on taxes over the life of your system. This benefit is more valuable in areas with high property value, like Dallas, Austin and Houston.

How to Claim the Property Tax Exemption in Texas (click to expand)

Similar to the federal credit, the property tax exemption just requires a single form to be filed for your home. You can follow the brief instructions below to claim the exemption:

- First, download Form 50-123 from the Texas Comptroller’s website, which is the Exemption Application for Solar or WInd-Powered Energy Devices

- Next, fill out the form. It’s just a few pages long and will require general information about your solar power system

- Finally, file the form with the Comptroller’s office

Once you file the form, your property taxes will be adjusted, and the value of your solar system will be disregarded.

Is the Property Tax Exemption Worth the Time/Effort of Claiming in Texas? (click to expand)

This tax exemption is another crucial piece of the puzzle when it comes to maximizing your solar savings. This exemption is a great incentive in any state where it’s offered, but it’s especially important in Texas.

The Lone Star State doesn’t have a state income tax and instead uses an above-average property tax rate to collect taxes. It ranks seventh in the country for the highest property tax rate, with an average rate of 1.6%.4 Since the property tax rate is high in Texas, taking the property tax exemption is especially important.

Taking advantage of this exemption also only takes a few minutes and minimal paperwork, so the amount saved is absolutely worth the time and effort, in our opinion.

Texas Solar Rights

The last statewide incentive in Texas is the solar rights afforded to property owners. These ensure that all residents have equal and unimpeded access to solar panel installation and solar energy.

The solar rights laws in Texas prohibit homeowners associations (HOA), villages and other entities from preventing rooftop solar installations.

This isn’t a financial incentive, but it does help promote the legitimacy and importance of solar energy in Texas.

How to Claim the Texas Solar Rights (click to expand)

The solar rights afforded to you in TX don’t require anything to claim. They are automatically granted to you, so you’ll always have access to them.

Are the Texas Solar Rights Worth the Time/Effort of Claiming? (click to expand)

While they don’t provide any financial assistance for converting to clean energy, the solar rights in Texas are a great policy that helps more property owners adopt solar.

Net Metering Programs in Texas

Net metering is often cited as one of the most appealing solar policies available in the U.S. It affects how you’re billed for electricity as a residential customer.

Basically, you earn credits for any surplus energy you produce with your solar panels. Those credits then roll over and get applied to future utility bills. If your energy demands ever outpace your production, your accrued credits will be used to reduce your bills. Effectively, net metering helps reduce utility bills, maximize savings and reduce your panel payback period.

Net metering is not mandated by the State of Texas, so not all residents will have access to the policy. Instead, the state legislature makes net metering possible and leaves the policy offered up to individual retail electricity providers (REPs).

The rate at which you’re credited is an important consideration. The full retail rate is the best-case scenario, followed by a blended rate and then the avoided-cost rate or wholesale rate. The more you get per kilowatt-hour (kWh) for your excess energy production, the more valuable the policy will be.

Since the electricity market is restructured in Texas, consumers have the opportunity to choose their electricity provider. Below is a brief list of all of the local retail electricity providers and municipalities in Texas that offer net metering, along with the rate each one uses to credit excess energy generation (full retail rate is the best option):

- City of Brenham: Offers the program using the avoided-cost rate5

- El Paso Electric Company: Offers the program using the avoided-cost rate to customers in its service area. All unused credits are paid out via check once they top $506

- Austin Energy: offers the program using variable rates based on system size.7 All unused credits are rolled over indefinitely

- Green Mountain Energy: This company’s Renewable Rewards Program is basically net energy metering (NEM). All energy is credited at the full retail rate, which is outstanding8

- San Antonio City Public Service (CPS Energy): Offers the program using the avoided-cost rate9

- American Electric Power (AEP): Offers the program using the avoided-cost rate

- TXU Energy: This company’s Home Solar Buyback program is equivalent to net metering. It provides credits at the avoided-cost rate10

Green Mountain Energy offers one of the strongest solar buyback plans for Texans.

In some states, net metering policies are becoming less appealing, as Public Utilities Commissions (PUCs) are beginning to mandate lower credit rates in states like California.

Since Texas already doesn’t mandate net energy metering and instead leaves it up to individual utility providers, the likelihood is that the policy won’t change on a state level anytime soon. However, each energy company can always change its credit rate or discontinue net metering altogether.

As such, you should always check with your electric company before installing solar to see if the policy, or an equivalent, will be open to you.

How to Enroll in Net Metering in Texas (click to expand)

In most cases, your solar installer will automatically enroll you in net metering. If your electric company has updated your meter by replacing it with a two-way meter, then the likelihood is that you’re all set up to begin taking advantage of the policy.

In some rare cases, you might have to fill out and submit an interconnection agreement yourself before the provider will begin metering back-flowing energy.

We recommend reaching out to your solar provider before converting to see if there’s any action you need to take to access this benefit. You should also check your electric bills after opting into net metering to double-check that your production is being credited.

Is Net Metering Worth the Time/Effort of Enrolling in Texas? (click to expand)

If it’s available to you from your electric company, net metering is an outstanding incentive to take advantage of. It’s best if your provider offers energy credits at the full retail rate per kWh, but even policies that offer a lower, avoided-cost rate are well worth the time and effort to apply for.

If your retail electric provider (REP) requires you to file documentation, it’s usually just a few pages long and shouldn’t take much time. Your solar installer can help you with this process as well, if it doesn’t handle it outright.

Net metering is always worth opting into because it helps offset energy bills when solar production lags behind your energy usage — like at night or on sunny days. Ultimately, this policy helps you pay off your system more quickly and save more money on electric bills over time.

Pro-tip: Since Texas offers its consumers the ability to choose electricity providers, you can always switch providers to one that offers solar buyback plans at full retail rate.

Local Solar Incentives in Texas

As mentioned above, the state incentives in Texas, unfortunately, leave a lot to be desired. However, the local incentives provided by utility companies and municipalities throughout Texas can sometimes make up for the lack of state incentives.

We’ll briefly discuss all of the local incentives available in Texas below.

- Oncor Electric Delivery Residential Solar Program: This is Oncor’s rebate program for new, grid-connected solar installations. The rebate amount varies based on eligibility.

- CPS Solar PV Rebate Program: This is a solar rebate from CPS for newly installed solar arrays. The rebate amount varies but averages around $2,000 per system.

- City of San Marcos Distributed Generation Rebate Program: This is a rebate for residents of San Marcos, TX. It provides up to $1 back per watt installed up to $2,500 per solar project.

- Austin Energy Residential Solar PV Rebate Program: This rebate is for up to $2,500 per project for Austin Energy customers who install grid-connected systems.

- Austin Energy Value of Solar Program: This incentive from Austin Energy is similar to Solar Renewable Energy Certificates (SRECs). You get paid for every kWh your system generates at a rate determined by your system size and eligibility.

- Garland Power & Light EnergySaver Solar Rebate Program: This perk from Garland Power & Light is also similar to SRECs. You can earn credits in the amount of $0.0469 for every kWh of energy your panels generate.

- Denton Municipal Electric (DME) Residential GreenSense Energy Efficiency Rebate Program: This is a great solar rebate from DME that provides cash back amounts between $0.40 and $1.50 per watt up to $30,000.

- CenterPoint Energy Residential and Hard-to-Reach Energy Efficiency Program: This is a rebate program for CenterPoint Energy customers. The credit amount is $0.04/kWh produced, which can add up to hundreds of dollars over time.

- CPS Residential Energy Efficiency Rebate Program: This rebate program from CPS provides up to $2,500 or 50% of your system total — whichever is lower — as an upfront rebate.

- City of Plano Smart Energy Loan Program: This is an affordable and accessible loan program afforded to residents of Plano, TX. It provides financing up to $25,000 with low APRs and down payment requirements.

- AEP Texas North and Central Companies SMART Source Solar PV Rebate Program: This incentive provides up to $3,000 back for grid-tied solar arrays, depending on the size of your system and remaining funds. Some restrictions apply, like the requirement for system warranties.

- City of Sunset Valley PV Rebate Program: Finally, residents of Sunset Valley can get up to $1.00 per watt installed in rebates up to 3,000 watts or up to $3,000 total per system.

Watch Below: How Much Should You Expect to Pay for Solar in Texas?

Which Solar Tax Incentives Are The Best In Texas?

Above, we’ve discussed all of the incentives available in Texas, but not all of them are as worthwhile as the others. Below, we’ll discuss the top incentives that you should be sure not to miss.

The Federal Investment Tax Credit

If you only file for one solar incentive, it should absolutely be the federal tax credit. The federal credit requires just one relatively simple form submitted alongside your taxes for the year your system is installed. Despite the minimal time investment, though, it provides a huge benefit, potentially on the order of over $10,900.

Net Metering (Also Called Solar Buyback Plans in Texas)

If you have net metering available to you, you should definitely take advantage of it. In our opinion, this is nearly as important as the federal credit in Texas.

We recommend contacting your electricity provider before converting to solar to see if there’s anything paperwork you need to file to enroll. In many cases, you’ll get automatic access to this program. Even if it requires filling out an interconnection agreement, though, it’s worth your time.

Net metering helps you reduce your solar costs by reducing your utility bills, and it also helps maximize your long-term savings. Therefore, net metering is worth filing for even if your electric company offers a less-than-ideal avoided-cost rate for the credits.

Remember, customers have the power to choose electricity rates and providers in Texas. So if your current provider does not offer any form of net metering, you can always choose a different provider that does.

Property Tax Exemption

The property tax exemption can also save you several thousands of dollars over the lifespan of your system. Unlike some other states, you will need to file some documents with the Comptroller’s office to take advantage of this perk. Still, it’s well worth the time investment required.

It’s important that you don’t pass this incentive up as Texas has one of the highest property tax rates in the country. That means you’ll be accepting significantly higher tax bills for no reason if you neglect to file the required documentation.

Local Incentives

Finally, we recommend looking through the list of local Texas solar rebates we mentioned above and filing for the ones that provide cashback incentives. These include:

- Oncor Electric Delivery Residential Solar Program

- CPS Energy Solar PV Rebate Program

- City of San Marcos Distributed Generation Rebate Program

- Austin Energy Residential Solar PV Rebate Program

- Denton Municipal Electric (DME) Residential GreenSense Energy Efficiency Rebate Program

- CPS Residential Energy Efficiency Rebate Program

- AEP Texas North and Central Companies SMART Source Solar PV Rebate Program

- City of Sunset Valley PV Rebate Program

Most of these rebate options provide between $2,000 and $2,500 back. Although they typically require that you file some paperwork, none of them require much, so all of them are worth your time and effort if you qualify.

What’s The Near-Term Outlook For More Incentives In Texas?

Incentives across the country change quickly and without warning, sometimes making solar conversion more appealing and sometimes making it less beneficial.

There is also no evidence that the PV incentives in TX will improve in the next two years. If something were to change, it would likely be a statewide push to mandate net metering from all electric companies.

In 2021, TX revamped its Renewable Portfolio Standard (RPS) goal. The new goal was for 28% of the state’s energy to come from clean sources by 2030 and 40% by 2035. The old goal of 25% by 2025 remained in effect.

If local incentives continue to remain available as they are now, TX might not have to change much on a statewide level to reach those goals. However, it’s possible that it will provide additional incentives — like mandated net metering — if the state is in danger of failing to meet its 2025 goal.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: Texas Solar Incentives

At EcoWatch, we’re happy to get questions about the process and costs of getting rooftop solar from Texas residents. Below are some of the questions we see most often, along with our responses. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

Thankfully, there have been no reports of TX starting to reduce or pull back incentives for solar PV systems.

The most likely policies to change in most states are the state tax credit and net metering. TX doesn’t have a state credit, and the net metering policy only allows for electric companies to offer net metering on a company-to-company basis. It’s unlikely that this will change for the worse any time soon.

Many customers wonder if the rebates mentioned above from cities and electric companies count as taxable income. Thankfully, they do not, and you don’t need to report these rebates when you file your taxes. In reality, this is money that you paid that you’re getting back, so you will have already been taxed on the original income.

There is not an SREC market in TX, so you cannot sell SRECs in the state. SRECs (solar renewable energy certificates) are certificates earned for generating a certain amount of clean electricity with a solar array. Customers in select states can then sell these certificates to utility companies looking to increase the amount of renewable energy added to the grid.

Top Solar Installers in Texas Cities

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe