Health Insurers Are Starting To Roll Back Coverage for Telehealth, Even Though Demand Is Way Up

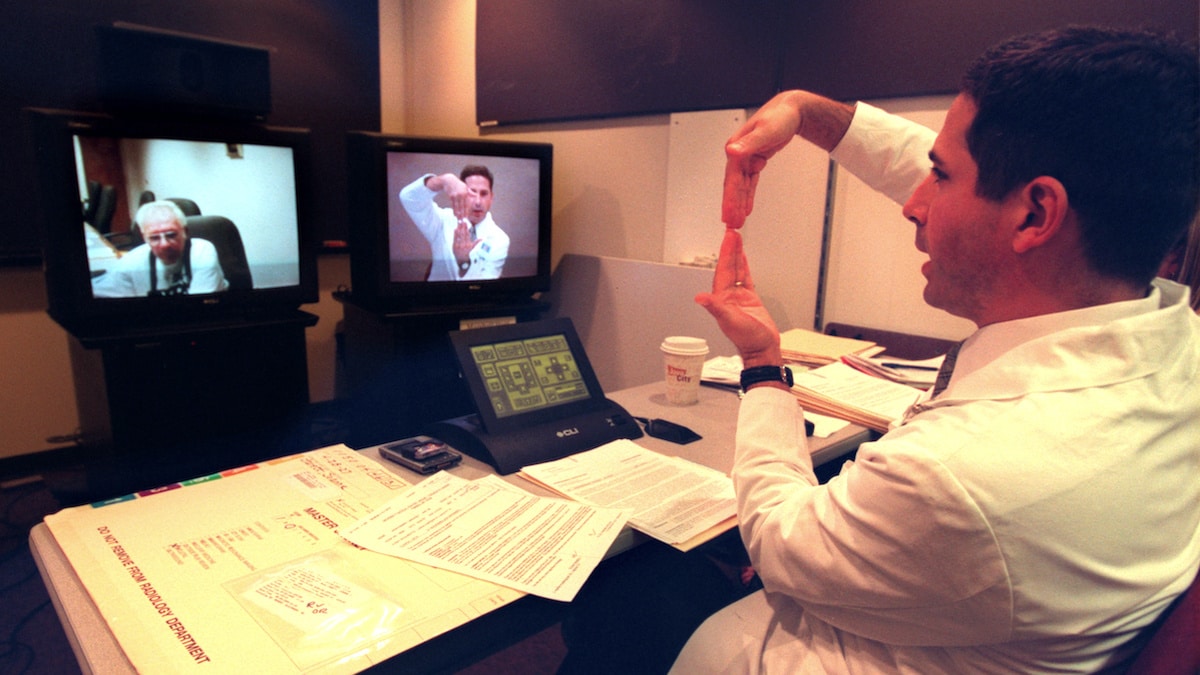

Private insurers saw telehealth claims increase over 4,000% from 2019 to 2020. JOEY MCLEISTER / Star Tribune via Getty Images

By Jennifer A. Mallow and Steve Davis

In less than a year, telehealth has gone from a niche rarity to a common practice. Its ability to ensure physical distance, preserve personal protective equipment and prevent the spread of infection among health care workers and patients has been invaluable during the COVID-19 pandemic.

As health care specialists and researchers, we have long seen the potential of telehealth, providing health care remotely with technology, which has been around for several decades. Despite evidence it could safely treat and manage a range of health conditions in a cost-effective manner, widespread adoption of the practice had been limited by issues including insurance coverage, restrictions on prescribing and technology access.

On March 27, 2020, The Coronavirus Aid, Relief and Economic Security Act, or CARES Act, removed many of the barriers to widespread telehealth use. Soon after, the Centers for Medicare & Medicaid released a toolkit encouraging state Medicaid agencies to adopt CARES policy changes to promote the expansion of telehealth. Many private insurers followed suit. Collectively, these policy changes facilitated the explosion of telehealth. Now, due to the financial strain on health care systems and insurers, the increase in telehealth use may be forced to shrink even though the public health crisis remains.

Sudden Changes

At the very beginning of the pandemic, the use of telehealth went from 13,000 to 1.7 million visits per week among Medicare recipients. Between mid-March and mid-June 2020, during the height of the national lockdown, over 9 million telehealth visits were conducted for Medicare recipients. Private insurers, who mimicked the CARES Act policy changes, also reported exponential increases – with telehealth claims increasing over 4,000% from the previous year.

Telehealth is typically used for new health concerns like a sore throat, psychotherapy and in-home monitoring with mobile devices for chronic conditions like diabetes, high blood pressure or heart failure. Telehealth is convenient because it can be done from anywhere and more frequently than in-person visits.

The changes triggered by the CARES Act were intended to last only until the public health emergency was considered over. Making telehealth coverage expansions permanent could lead people to use their insurance coverage more often by making care more convenient, thus costing private insurance companies more money.

Provider compensation is traditionally based on the amount of time spent with the patient and how complicated and risky the exam and procedures are to perform. Historically, telehealth was reimbursed at a lower rate than in-person care. The CARES Act had addressed this payment disparity by mandating the same rate for telehealth visits as in-person visits for those insured by Medicare, with more than 80 new telehealth services being reimbursed at the same rate as in-person services.

Many private insurers followed suit and paid providers who conducted telehealth visits at the same rate as office visits. Now, that’s all changing due to financial loss by insurance companies. As of Oct. 1, telehealth visits are not always paid at the same rate as in-person visits by these private insures.

Several big private insurers are pulling back some of their coverage of telehealth for non-COVID issues. Companies including UnitedHealthcare have already rolled back policies that waived co-pays and other fees for non-COVID-related appointments. Other plans such as Anthem BlueCross BlueShield have extended their coverage through the end of the year, but only the first two sessions are free for the consumer.

Further complicating matters is that every private insurance plan and many state-funded Medicaid plans have different sets of rules and dates for what telehealth treatments they cover. This means some patients are paying more. Costs are getting confusing. Patients may end up with a surprise bill – or they may delay care due to cost.

A System Under Pressure

Health care providers and hospital systems are also in limbo. They don’t know whether they’ll lose telehealth payments when the federal public health emergency for the pandemic lapses or what to expect from private health insurance companies.

Hospitals and health systems have had to meet unprecedented challenges in 2020 – increasing testing, treating infected patients, expanding intensive care unit capacity, safeguarding staff and non-COVID-19 patients, procuring personal protective equipment and canceling nonemergency procedures. These challenges have created historic financial pressures for health care offices and hospitals. The American Hospital Association estimates that the country’s health care systems are losing an average of .7 billion per month.

This financial crisis puts telehealth in jeopardy. Providers and health systems still have to pay salaries and purchase expensive technological equipment, making it difficult to accept a reduced rate for telehealth visits. Without payment parity, in the current financial crisis, health care systems will not be able to continue to offer telehealth services.

What’s Next

A continued increase in COVID-19 cases is expected this fall, just as insurance providers are starting to diminish coverage for telehealth visits.

Our team – and teams across every state – will undertake rigorous evaluation of each of the CARES Act policy changes (and similar Medicaid and private insurer changes) and their impact. These evaluations will provide information on how telehealth affects cost and cost effectiveness in the future.

Clearly, telehealth is in jeopardy now as patients are paying more, health care practices are receiving less and the risk of infections increases. While the diminished risk of infection through the use of telehealth seems positive, it is clear to us that insurers are trying to drive patients back to the in-person care model. How will vulnerable populations and the fragile health care system respond? Will patients and providers still have a choice in how they receive and provide care, or will we lose the innovation gained during this period?

Jennifer A. Mallow is an associate professor of nursing at West Virginia University.

Steve Davis is an associate professor of health policy, management and leadership at West Virginia University.

Disclosures: Jennifer A. Mallow receives funding from the US DHHS-Centers for Medicare & Medicaid Services & National Institutes of Health/National Cancer Institute. Steve Davis receives funding from the WV DHHR-Bureau for Medical Services & the U.S. Department of Health and Human Services, Centers for Medicare & Medicaid Services.

Reposted with permission from The Conversation.

- Is Telehealth as Good as In-Person Care? - EcoWatch

- Online Therapy Is Showing How to Expand Mental Health Services ...

233k

233k  41k

41k  Subscribe

Subscribe