Wisconsin Solar Incentives (Rebates, Tax Credits & More in 2024)

In this EcoWatch guide to solar incentives in Wisconsin, you’ll learn:

- What are the solar incentives in Wisconsin?

- Does Wisconsin offer a solar tax credit?

- Can you sell electricity back to the grid in Wisconsin?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Wisconsin Solar Incentives Make It Affordable for Homeowners to Go Solar?

Solar installation costs in Wisconsin are already more affordable compared to the national average, even before factoring in any solar incentives or rebates.

The average Wisconsin homeowner needs a mid-sized 7 kilowatt (kW) solar energy system to meet their energy needs, which costs $23,240 before applying any solar rebates or incentives. Comparatively, the national average is a 9 kW system priced at $29,970. After the federal credit, those costs could effectively come down to $16,268 and $20,979, respectively.

On a per-watt basis, solar costs $3.32 in the Badger State, which is just below the national average of $3.33. The low cost of solar makes going solar well worth it in Wisconsin in our opinion.

Aside from low costs, Wisconsin homeowners can take advantage of solar incentives to lower the cost of solar, like the federal solar tax credit (ITC), net energy metering and local solar power rebates.

For example, if you take advantage of the ITC in Wisconsin, you can effectively bring the cost of a 7 kW system from $23,240 down to a much more affordable $16,268. And that’s not factoring in the money you’ll save from lower electricity bills which you can calculate your solar energy savings for a better idea of how much you can save.

All Energy Solar

Regional Service

Average cost

Pros

- Full-service home energy solutions

- Excellent reputation

- NABCEP-certified technicians

Cons

- Expensive

Sun Badger Solar

Regional Service

Average cost

Pros

- Offers products from leading manufacturers

- Competitive pricing

- Offers rewards for customer referrals

Cons

- No leases or PPAs

- Relatively young company

Arch Electric

Local Installer

Average cost

Pros

- Excellent reputation

- NABCEP-certified technicians

- Competitive pricing

- Offers products from leading manufacturers

Cons

- No leases or PPAs

The table below provides an at-a-glance look at the solar incentives available to all Wisconsin homeowners. We’ll provide additional information about each below, along with some local incentives from specific municipalities and individual utility companies.

| Wisconsin Solar Incentives | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Residential solar panels purchased and installed by December 31, 2032, are eligible for a tax credit worth 30% of the total system cost. | One time: Credit is applied when you file your taxes during the year your system is installed. If the credit is greater than what you owe in taxes, it can roll over up to five years. | Roughly $6,972 in tax credits for the average 7 kW system. |

| Solar Sales Tax Exemption | State | To reduce the upfront costs of going solar, the state waives sales tax on all solar equipment. | One time: Tax is avoided when you purchase your solar panel system. | With an average sales tax rate of 5% in Wisconsin, the average savings is around $1,162.1 |

| Solar Property Tax Exemption | State | Most home improvements increase your property taxes because they bump up the assessed value on which your property taxes are based. | Ongoing: Your solar panel system won’t be included in your home’s assessed value where property taxes are concerned. | Varies based on home value, with average annual savings of around $350.2 |

| Net metering | Local | Net metering is a billing policy that lets you reduce your energy bills by sending excess energy produced by your system to your electric provider. | Monthly: Your net billing credits will be applied to your monthly electricity bills. | Varies based on how much power your solar panels produce and the rate offered by your local utility provider. |

| Focus on Energy Program | Local | The Focus on Energy Program in Wisconsin provides residential solar customers with cash rebates for their solar panel installation cost. This program applies to customers of most — but not all — local utility companies. | One time: Rebate is given after solar installation. | Up to $500 for Wisconsin residents in populated areas or up to $1,000 for rural residential solar installations. |

What Do Wisconsin Residents Need to Know About the Federal Solar Tax Credit?

The federal solar tax credit or ITC is the biggest solar incentive program available in Wisconsin, worth up to 30% of your entire system cost.

Wisconsinites tend to use less energy than the average American (about 694 kilowatt-hours (kWh) per month compared to 881 kWh per month).3 As such, most Wisconsin residents only need to install a 7 kW solar panel system — or about 20 solar panels — to cover all of their energy needs.

A 7 kW solar panel system costs $23,240 in Wisconsin, but that number drops significantly to $16,268 after applying the ITC — that’s a potential savings of $6,972.

Wisconsin solar users have been able to take advantage of the ITC since it was created back in 2005, but the credit has seen several changes since then. The most recent change came in August of 2022 when we saw the tax credit bump from 26% back up to 30% of the system value.

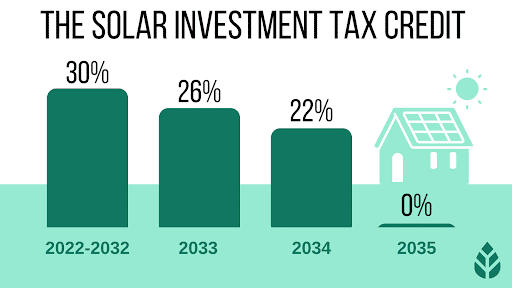

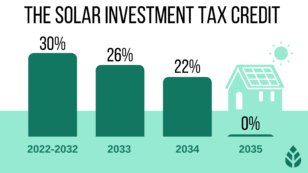

This August change was thanks to the passage of the Inflation Reduction Act, which now has the ITC available at the following rate schedule:

- 30% of your total system value for solar photovoltaic (PV) systems installed between 2022 and 2032

- 26% of your total system value for solar PV systems installed in 2033

- 22% of your total system value for solar PV systems installed in 2034

- Credit discontinued for systems installed starting in 2035, unless extended again by Congress

Needless to say, if you’re thinking about installing solar panels in Wisconsin, you’re better off doing it sooner rather than later.

How to Claim the Federal ITC in Wisconsin

Tax season can be overwhelming, but fortunately, a trustworthy solar company in Wisconsin can help you through claiming the federal government’s solar tax credit. However, we also recommend working with a tax professional when filing your return.

Below are the five steps you will follow when claiming your federal solar tax return in Wisconsin:

- Download IRS Form 5695. This residential energy tax credit form can be downloaded straight from the IRS.

- Calculate your credit on Part I of the tax form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

- If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

- On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet (found here). Then, complete calculations on lines 15 and 16.

- Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

Remember, your solar tax credit will only offset the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year for up to five years.

EcoWatch’s Opinion on the Federal ITC in Wisconsin

The EcoWatch team loves the federal ITC because it makes solar more accessible to more people. We nearly jumped for joy when the ITC was raised and extended by Congress in 2022!

Although the cost of going solar has dropped 52% in Wisconsin over the last decade, it’s still a big investment.4 Average solar panel system costs range from $13,280 to $33,200 in Wisconsin depending on system size. But after factoring in savings from the ITC, that cost range drops to a more-affordable $9,300 to $23,240.

Additionally, because the ITC is offered nationwide it’s widely understood by most tax professionals and not too complicated to claim.

The downside? The federal tax credit only makes sense if you owe several thousand dollars in federal taxes over the next five years.

Watch Below: How Well Will Your Solar Panels Still Work When Covered In Snow?

Solar Sales Tax Exemption in Wisconsin

Wisconsin imposes a 5% sales tax on all purchases.5 But thanks to Wisconsin’s solar sales tax exemption, qualifying solar equipment is exempt from that sales tax.

With an average solar project cost in Wisconsin of $23,240 and a state tax rate of 5%, most homeowners will save an average of $1,162. This exemption is not a rebate, so your estimate for going solar will include these savings already. Larger systems increase this amount and also lead to greater energy savings overall.

How to Claim the Solar Sales Tax Exemption in Wisconsin

The sales tax exemption is automatically applied to all solar equipment purchases in Wisconsin, so you don’t have to do anything to claim it.

EcoWatch’s Opinion on Solar Sales Tax Exemption in Wisconsin

Not every state offers a sales tax exemption, so it’s definitely a great solar benefit for Wisconsinites. It’s also applied automatically, which means you don’t have to take any extra steps to benefit from this solar incentive.

Property Tax Exemption in Wisconsin

Installing solar panels has been shown to increase home value in Wisconsin. But with the Wisconsin State property tax exemption, your property taxes won’t rise alongside it.

It’s hard to quantify how much you’ll save with the property tax exemption because it’s based on your home value, where you live and how many solar panels you install.

Based on the average property tax rate of 1.51% in Wisconsin you can expect an average annual savings of around $350.6 But of course, your savings could be higher if you live in a Wisconsin city with higher property taxes, like Madison or Milwaukee.

How to Claim the Property Tax Exemption in Wisconsin

You don’t have to take any extra steps to claim the solar property tax exemption in Wisconsin.

EcoWatch’s Opinion on the Property Tax Exemption in Wisconsin

Not every state offers a property tax exemption, so Wisconsinites are lucky to have it. It also offers extra peace of mind that installing solar panels is a good investment even if you’re planning to sell your home before the panels’ 25-year life expectancy is up.

A study from Zillow found that homes with solar panels sell for about 4.1% more than homes without.7 As of December 2022, the average Wisconsin home is valued at $286,891.8 So, adding solar panels could lead to an extra $11,762 in home value. But once again, the value will be higher depending on property values where you live.

Net Metering in Wisconsin

Net metering policies incentivizes solar by allowing you to reduce your energy costs and, in some cases, eliminate them altogether.

Most solar panel systems are grid-tied, meaning, through interconnection, they can send and receive energy to and from the grid. When your panels produce more energy than what you use, the excess energy is sent to the grid in exchange for credits. On the other hand, when your panels don’t produce enough energy to meet your needs, you can pull additional energy from the grid as needed.

Wisconsin’s net metering policy is unique because excess credits at the end of the monthly billing period roll over to future bills at around 3 to 4 cents per kWh for the largest utilities. However, municipal utilities and electric cooperatives set their own policies and net metering credits, so their policies may be different.

While not completely regulated, net metering is mandatory throughout the state according to Wisconsin State law, so every utility company must provide its customers with the option. However, the rate at which your electric provider buys back excess energy your system produces will vary depending on your utility company; some companies buy back at lower electricity rates than you pay for electricity.

Xcel Energy offers one of the best utility net metering program in the state. But make sure to check with your utility company and solar provider before committing. There is a cap on system size at 20 kW, but most Wisconsin homeowners only need a 7 kW system anyway.

We should mention that net metering policies are changing across the country. In mid-2024, California adopted net metering 3.0, which reduced the credit value for excess electricity generation. It’s likely that Wisconsin and other states will follow suit in the near future. At that point, it will likely become necessary for solar customers to install solar batteries to get effective net metering on-site rather than losing some of the value per kWh exported.

How to Enroll in Net Metering in Wisconsin

According to the Wisconsin Public Service Commission (PSC), you’ll follow the below steps to enroll in net metering. If this process seems confusing, don’t worry. Solar companies in Wisconsin are very familiar with the process and should be able to take care of the application and logistics on your behalf.

- Review PSC Chapter 119 of the Wisconsin Administrative Code and the DG Interconnection Guidelines.

- Contact the electric utility or cooperative association (electric provider) serving your distributed generator site to obtain the proper application and agreement forms. See Distributed Generation Points of Contact for the necessary information for each electric provider in Wisconsin.

- The application and interconnection agreement forms are for information only. Please contact your electric provider to obtain the appropriate application and interconnection agreement forms.

- Submit forms directly to the utility.

EcoWatch’s Opinion on Net Metering in Wisconsin

Wisconsin’s net metering program is an awesome benefit that’s not offered in every state. It’s one of the most valuable solar perks because you’ll benefit from it as long as it’s active. Plus, you can use all of the extra savings from your utility bills towards paying off your renewable energy system faster.

The average lifetime savings of going solar in Wisconsin is $28,737, which is slightly below the average U.S. savings of $31,513. But the savings increase when you factor in additional savings from net metering. Just remember that these savings will likely change if and when Wisconsin rolls out net metering 3.0.

Local Solar Incentives in Wisconsin

You may be able to claim even more solar incentives and energy efficiency rebates in Wisconsin depending on where you live, your utility provider and the type of photovoltaic solar system you install.

Below are some incentives and solar financing options we’ve found in Wisconsin, but we encourage you to ask your specific utility and municipality about other financial benefits for solar homeowners.

-

- FOCUS ON ENERGY®: Focus on Energy is a state-wide energy program that partners with local Wisconsin utility companies. Homeowners throughout Wisconsin can get rebates of up to $500 for qualified solar installations. Rural residential customers can receive an additional $500 per solar project from the program. The program also offers much higher incentives (up to $17,500, or $2,500 per kW) for solar installations that are part of new construction of owner-occupied affordable housing. You can check the eligible rural ZIP code list to see if your home qualifies. As of November 2024, there are some requirements for eligibility, but most Wisconsin solar customers should qualify if they have a professional installer install their system.

- Greenpenny: Greenpenny is a virtual bank dedicated to renewable energy financing. It offers solar loans to homeowners installing renewable energy systems in Wisconsin, as well as Illinois, Iowa and Minnesota. The loans are highly accessible and often come with low interest rates to keep long-term costs as low as possible.

- Clean Energy Credit Union: Similar to Greenpenny, Clean Energy Credit Union offers solar financing options and loans up to $90,000 to Wisconsin residents who are installing solar panels, along with other clean energy equipment. Many of the options come with below-average interest rates and are widely accessible.

- Milwaukee Shines solar program: The City of Milwaukee provides low-APR solar energy loans to homeowners within the city up to $20,000.

Which Tax Incentives Are The Best In Wisconsin?

We’ve outlined all of the solar incentives in Wisconsin, if you’re wondering which you should prioritize, here’s our ranking:

- Federal Solar Tax Credit: This is Wisconsin’s biggest solar benefit, worth a whopping 30% of your total solar system price. Applying won’t take you too much time and it can save you thousands of dollars.

- Net metering: In Wisconsin, your excess energy credits are credited at about 3 to 4 cents per kWh for larger utilities. Municipal and electric cooperatives can set their own rates, which may be lower. But at any rate, free money is free money, and it’s nice to be paid for the energy your home is generating rather than paying for your energy source.

- FOCUS ON ENERGY®: If your utility company offers Wisconsin’s FOCUS ON ENERGY program, you’ll get a $500 rebate just for installing solar panels. That’s easy money!

What’s The Near Term Outlook For More Incentives In Wisconsin?

While Wisconsin was one of the first states to enact a Renewable Portfolio Standard (RPS) goal back in 1999, it set a low bar for utilities to hit 10% of electricity from renewable energy by 2015.9

As of November 2024, the Badger State hasn’t officially implemented a new RPS. However, the Wisconsin Office of Sustainability and Clean Energy recently proposed goals for the state’s utilities to reach 60% renewable energy by 2030 and 100% by 2050.10 So, perhaps we’ll see more solar incentives in the coming years to help Wisconsin meet these goals.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Wisconsin Solar Incentives

The EcoWatch team regularly gets questions from Wisconsin homeowners about the solar incentives available throughout the state. Below are the questions we see most often, which you might have as well. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

Solar Renewable Energy Certificates (SRECs) or Transition Renewable Energy Certificates (TRECs) are credits that solar users can earn for their solar production. They sort of work like the stock market.

Unfortunately, Wisconsin doesn’t have an active SREC or TREC market at this time, although there is currently a petition to bring SRECs to the state.5

Unfortunately, Wisconsin does not have a state solar tax credit, and there is no evidence that there will be one available in the future. However, homeowners throughout the state have access to the federal solar tax credit, rebates and other incentives provided by the state.

Wisconsin residents can take advantage of the Focus on Energy program, which partners with local utility companies to provide homeowners with a substantial rebate after converting to solar power. Homeowners in urban and suburban areas can get up to a $500 rebate, and residents in rural areas can receive up to $1,000 in rebates from the program.

The Inflation Reduction Act bumped the federal solar tax credit up to 30% of the total cost of a home solar panel system. In Wisconsin, this leads to an average savings of $7,189.

The act also created several rebate programs for energy efficiency upgrades and electric vehicle owners. You can read more about how the Inflation Reduction Act rewards you for going green here.

Top Solar Installers in Wisconsin Cities

Comparing authorized solar partners

-

- Full-service home energy solutions

- Excellent reputation

- NABCEP-certified technicians

- Expensive

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe