Solar Leasing Vs. Buying Solar Panels: Which Option Is Best?

In this solar leasing vs. buying guide, you’ll learn:

- Is it better to purchase or lease a solar system?

- What is the difference between financing and leasing solar panels?

- What is the downside of leasing solar panels vs. buying?

- Who benefits most from solar leasing?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Earlier generations of solar panels were expensive, so leasing them was a more obvious choice. But the past decade has seen the cost of solar panels plummet, shifting that calculus and making it more accessible and profitable to outright own your home solar panel system.

In this guide to solar panel leasing vs. buying, we’ll explore the advantages, disadvantages and differences between these two solar panel payment methods.

What’s the Difference Between Leasing Solar Panels vs. Buying Solar Panels?

There are a few important differences between leasing and buying photovoltaic (PV) panels. The most obvious is that solar leases will never lead to full ownership of your panels, whereas purchasing your solar panels in cash or through financing will.

This single difference leads to a few additional implications, which we’ll discuss below.

Leasing vs. Buying Panels: Initial Cost

Most prospective solar customers who choose the solar leasing option do so because of the upfront savings. Leases generally don’t require any money down. And since they’re not loan agreements, your credit doesn’t need to be as good as it would need to be for financing solar panels.

Most leases are $0-down agreements, whereas an outright purchase would require paying the full cost of your system all at once — an average of $29,970 without any solar incentives applied. As such, leases are more accessible than most other payment options.

Leasing vs. Buying Panels: Payback Period

A less obvious difference between leasing and buying your PV equipment is the panel payback period. Since leasing never leads to panel ownership, you never actually pay off your system. Instead, you agree to pay a fixed monthly fee for the lease term, at the end of which the panels are removed, or your lease is renewed.

When you buy your panels, your upfront payment leads to instant system ownership, or your monthly payments with a solar loan eventually pay off your equipment costs plus interest.

Outright purchases have the shortest payback period — around 13 years in the U.S. — while loans have an average payback period of around 18 years. There is no payback period for leases.

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Sunrun

Regional Service

Average cost

Pros

- Regional

- Many financing options

Cons

- Some reported issues with customer service

- Some reported issues with door-to-door sales

Leasing vs. Buying Panels: Long-Term Energy Savings

Perhaps most importantly, your long-term energy savings and return on investment (ROI) with your panels are influenced heavily by your payment method.

Since leased panels are never owned and never lead to a payback period, your energy savings will be limited each month due to your lease payment. But if you buy your panels, you’ll start pocketing the extra energy savings as soon as you pay off your system, leading to much larger savings over time.

Leasing vs. Buying Panels: Property Resale

A crucial difference between leases and loans or paying with cash is how they’re dealt with if you sell your home.

When you finance your panels, you can either pay off your system before selling your home or transfer the loan to the new homeowner. Solar panels increase your home value, so the bump can often help pay off the remainder of the loan.

Leases are falling out of favor because financing and panel ownership are becoming more accessible and beneficial over time. Some new owners might not want to take on your lease agreement, in which case you might be on the hook for a large lease termination fee — sometimes totaling over $10,000.

Leases also generally don’t make your home more valuable since they don’t provide the same financial upside to buyers.

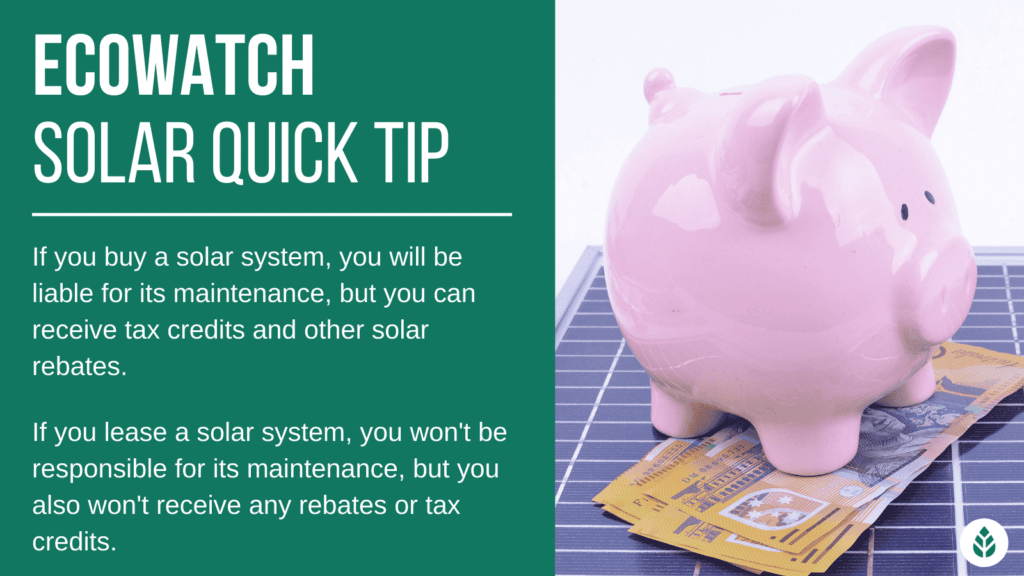

Leasing vs. Buying Panels: Solar Incentives

Finally, leases preclude you from taking the federal Solar Investment Tax Credit (ITC), an average potential tax credit value of $8,991 across the country. They also might prevent you from taking some state tax incentives.

Using cash and loans gives you access to this solar incentive, making these much better options in many cases and further improving the long-term savings you’ll experience.

The chart below includes a quick breakdown of leases and solar purchases and highlights the differences in upfront costs and savings over time.

Cost of Leasing Solar Panels vs. Buying Them

As you can see from the chart above, the upfront cost of leasing your panels will almost always be the most affordable option, as most don’t require any money down. They’re even more cost-effective in the short term than loans, as they lead to immediate savings and don’t need to wait for the payback period to come to an end.

Unfortunately, the short-term win in savings leads to lower overall savings in the long run. While no payback period means you can save on your first month with a lease, it also means your savings will be limited by your monthly lease payment and will never equal your average monthly electric bill like purchasing options often do.

Another thing to consider is solar power system repair and maintenance. When you own your system, you’re responsible for any maintenance that needs to be done unless it’s covered by your solar panel warranty. For leases, your solar leasing company typically includes maintenance, cleaning and all repairs for the term of the lease.

Thankfully, solar panel systems typically don’t need extensive maintenance that isn’t covered by warranty, and cleaning isn’t required in most areas. As such, the savings you’ll see on maintenance and repairs with a lease will usually not make up for the differences in energy savings to make leases a better option overall.

Solar Leasing vs. Buying: Which Payment Option is Best?

Paying with cash yields the greatest long-term savings, so it’s the best option from a financial perspective. However, since most homeowners will not be able to justify or afford to pay the average system cost of nearly $30,000 at once, we believe solar financing is the best option overall.

Recent declines in system pricing and improvements to solar financing terms from companies like SunPower and Blue Raven Solar mean that financing is about as affordable initially as a lease. Since they lead to greater savings over time, they’re also more beneficial overall.

Solar tax exemptions available for loans also help to bring down financing costs and can actually lead to a shorter payback period. If you can take the full federal credit, you could save money on your taxes the year you go solar. Those savings could help pay off an average of around $7,000 worth of your financing costs.

11 Alternative Ways to Finance Solar Panels

Since solar leasing isn’t as beneficial as financing, we’ll include some alternative ways to finance your panels and secure loans with good terms and affordable down payment requirements below. Your options include the following:

- A dedicated solar equipment loan

- A personal loan

- Solar financing through your installer

The below is not an exhaustive list, as there might be additional payment options offered by your local government, utility company or third parties. However, it includes a good variety of options from the three categories mentioned above.

Blue Raven Solar’s BluePower+ Loan Program

Blue Raven Solar is a national solar provider that is best known for its affordable system pricing and industry-leading loan options. It pioneered the BluePower+ program, which is a no-money-down loan option with no interest for an incredible 18 months.1

This option helps solar customers establish energy savings before they’re on the hook for system finances. It combines the initial perks of a lease with the long-term benefits of panel ownership.

Clean Energy Credit Union

This credit union offers solar equipment loans with lengthy terms of up to 20 years. This company has reasonable APR options and low money-down requirements to help make going solar affordable. However, some installers and homeowners shy away from this financier because funding timelines can be quite lengthy.2

Dividend Finance

Dividend is a solar financing company that offers long-term solar payment plan options with terms of up to 20 years. The company has no early-payment penalties, meaning you can reinvest your solar savings to get a shorter payback period and greater savings over time. Dividend is available across about half the country.3

EnerBank USA

EnerBank USA offers mid-term loans with a maximum length of 12 years for solar projects and other home energy efficiency upgrades. It serves all 50 states and works with a huge variety of installers across the nation.4

Unfortunately, its customer service is reportedly sub-par, and the company doesn’t have a convenient online portal for accessing loan information.

EZ Solar Loan

EZ Solar Loan offers large loans for PV equipment — called JackPot Solar Loans — of up to $80,000.5 The loans include a low APR — as low as 9.74% — and affordable money-down requirements to keep renewable energy as affordable as possible.

The company’s customer service is noted to be quite good and everything can be managed from your online loan portal for convenience.

Green Sky Credit

Green Sky Credit offers loans for solar equipment and other energy efficiency home improvements with terms of up to 12 years in all 50 states.6 The company doesn’t receive great reviews in terms of customer service, unfortunately.

In-House Financing From Your Installer

Some solar panel installation companies offer in-house financing, much like Blue Raven mentioned above and SunPower, which we’ll include in this list below.

If you choose a local or national solar installation company, you might consider financing directly through that provider if they offer in-house financing for a more streamlined experience.

LightStream

LightStream offers loans for up to $25,000 with 7-year term limits or loans for more than $25,000 and up to $100,000 with terms of up to 12 years.7 These terms are shorter than many lenders offer, so repayment may not work within your budget. The company is known to have decent customer service, and it provides loans throughout all 50 states.

Mosaic

Mosaic is one of the leading solar lenders in the country. It offers terms between ten and 25 years, as well as APRs between 2.49% and 7.99%.8 As with most solar financiers, there have been some reported issues with customer service, although it’s unclear in many cases whether these are the fault of Mosaic or the solar installer that facilitates the loan.

Technology Credit Union (SunPower)

SunPower is a leading solar panel installation company in the U.S. with one of the best and largest third-party financing options as well. SunPower partners with Technology Credit Union (TCU) to offer low-cost, low-interest loans with relatively positive customer service.9

Other Loan Options

Dedicated loans for solar equipment through installers and third-party financiers are perhaps the most popular options for securing PV financing, but there are some other options you can explore if these don’t work for you. Below are some additional options available in most cases:

- Unsecured personal loan: Many companies offer personal loans that can be used to cover the cost of solar conversion. You can reach out to your primary bank or credit card company to see if there are options, or you can choose from the personal loan options listed below:

-

-

- SoFi

- Marcus by Goldman Sachs

- Lending Point

- Upgrade

- Discover

-

- Home equity line of credit (HELOC): A HELOC is a line of credit — like a second mortgage — you take out. It gets secured by the equity you’ve accrued in your property, and it can be used for just about anything, including solar conversion.

- Property-Assessed Clean Energy (PACE) financing: PACE financing is an option offered by many state governments to make solar conversion more accessible for low-income residents. It typically requires no money down, and payments are added to your property tax bill to make payment convenient and easy.

- Local financing options: You might also have access to local financing options from non-profits or solar organizations in your state or local municipality. You can check the Database of State Incentives for Renewables and Efficiency (DSIRE) for more information on what’s available in your area.

How to Decide to Lease or Purchase Solar Panels

Choosing between leasing and buying or financing your panels, inverters and add-on products can be a tough decision, and there are a few things you’ll need to consider before you pick a payment option.

Consider Your Budget

First, we recommend you consider what kind of payment you can comfortably afford upfront for installation costs. If you can save enough to cover the entire system, then a cash purchase might be best for you. If you don’t think you can comfortably save anything toward your system, then a $0-down loan or a lease might be best for you.

Consider Solar Incentives

Next, we suggest considering solar incentives in your state. Some states offer large financial incentives to homeowners who go solar.

If your state doesn’t have many beneficial incentives, consider how much of the federal tax credit you could take if you did have access to it. Remember that the federal credit is not a rebate, so it’s not guaranteed. Since the credit gets applied to your income taxes owed, you will see no benefit if you don’t owe a significant amount in taxes, although the credit value will roll over up to five years after your solar panel installation.

Anyone who doesn’t expect to owe money to the IRS — or who is exempt from income tax, like some veterans — might want to opt for a lease since they won’t see any benefit from the ITC with a loan.

Consider Your Priorities

Finally, we recommend considering your priorities. If you’re just looking for an easy and affordable way to reduce your carbon footprint and carbon dioxide emissions, then a lease might be an easy and affordable way to go about that. If you care about finances and savings as well, then we believe a loan is a much better option.

In just about every case, we’d say a loan is the best payment option for homeowners looking to go solar. The chart below provides some information on the expected savings provided by the different payment options.

*Note that the negative savings reflected in this column are likely to be even higher as electricity costs — sourced from fossil fuels — continue to rise as it has historically.

**This number is calculated using the average monthly utility bill in the U.S. and a 20-year panel lifespan, which is average in the solar industry.9

Pros of Leasing and Cons of Leasing

As with any payment option, leases for solar panels have both upsides and drawbacks, which we’ll include in the table below.

| Pros of a Solar Lease | Cons of a Solar Lease |

| No money down required | Leads to lower savings overall than loans and outright purchases |

| Minimal credit requirements, if any | Doesn’t let you take the federal tax credit or some state tax benefits |

| Immediate savings are expected | Can come with massive charges for early termination |

| Panel maintenance is often included for free | Doesn’t add to your property value |

| Many leases have escalator clauses that bump up monthly payments over time and drop savings even further |

Who Should Lease Solar Panels?

PV leases might be good options for residents who cannot afford an upfront purchase and won’t qualify for a loan because of their credit score. They can also be decent options for customers just looking to contribute to the renewable energy movement and who don’t care much about savings over time.

Leases might also end up being better options for those who cannot take the federal credit, including individuals who won’t owe any money in income taxes.

Pros of Buying vs. Cons of Buying

The table below provides a quick look at the pros and cons of purchasing your panels using a loan.

| Pros of Purchasing Your PV System | Cons of Purchasing Your PV System |

| You get access to the federal credit | You pay for maintenance and repairs not covered by your solar protection plan |

| You’ll eventually own your panels | Sometimes a higher initial cost than a lease |

| Your savings over time will be significantly higher than with a lease | Savings often aren’t immediate |

| Typically doesn’t complicate the sale of your home | |

| Adds significant value to your home in most cases | |

| Can provide you with energy independence |

Who Should Buy Solar Panels?

We strongly recommend that all aspiring solar customers consider all of their purchasing options first before thinking about a lease or solar PPA.

Using cash or a loan to purchase your solar energy system will lead to panel ownership, which comes with a long list of financial benefits. Most importantly, these include greater savings in the long run, access to the federal solar credit and improved property value.

With the no-down-payment and low-interest rate solar loan options now available across the country, purchasing solar is more affordable and more beneficial than ever before.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

Frequently Asked Questions: Solar Leasing vs. Buying Solar Panels

In the sections below, we’ll answer some of the most pressing and common questions we receive about how to choose between a lease and buying your panels.

There are a few downsides to leasing solar panels that you should consider before choosing this payment option.

First, you’ll never own your panels, which means you’ll see fewer savings over time on your energy bills. Second, leases don’t let you take the federal credit, which provides an average potential savings of nearly $7,200.

Finally, leases can complicate the sale of your property and can come with hefty early termination fees. As such, they don’t improve the value of your home as a purchase would.

When you finance your panels, you take out a loan and agree to pay back the principal and interest over the loan term. You have a monthly payment to make — usually below your average electric bill prior to converting — but once your solar energy system is paid off, you get to enjoy net savings month after month on your electric bills.

When you lease panels, you get panels installed for free but agree to pay a monthly rental fee every month for the term of the lease. You get to use every kilowatt-hour (kWh) generated by your panels. However, you never own your panels, so you won’t have a payback period where your net savings really start to skyrocket.

Leases also don’t let you take the federal credit, and they don’t add to your property value as a loan would.

Unfortunately, no, leases generally don’t improve your home value like a loan would. Many home buyers won’t be willing to take on your rental agreement, as it isn’t as beneficial as owning solar panels outright and yields minimal energy savings.

If you terminate your rental agreement to sell your home, you could be responsible for paying an early termination fee. These penalties can sometimes reach above $10,000, so read your lease agreement carefully before proceeding.

233k

233k  41k

41k  Subscribe

Subscribe