Reviews

Reviews

West Virginia Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to saving money on your West Virginia solar conversion using local benefit programs, you’ll learn:

- What solar incentives are there in West Virginia?

- Do the solar perks and rebate programs make solar affordable in West Virginia?

- How do you file for solar incentive programs in West Virginia to get the maximum savings?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do West Virginia Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, incentives help make converting to solar more affordable and accessible by reducing up-front costs and increasing the potential for energy savings over time.

The average price of a solar array for West Virginians is around $36,960, based on the local price per watt for photovoltaic (PV) panels and the average system size — around 11 kilowatts (kW) — needed to compensate for electric bills.

This total price is quite a bit higher than the national average, in large part because residents need bigger systems to offset unusually high electricity use in WV.1

The state used to have a Renewable Portfolio Standard (RPS), but it has since been repealed — WV was the first state to annul an RPS. As there is no current standard to promote renewables, there are relatively few incentives available to push the local solar industry forward.

However, the perks that are still accessible do help bring down effective installation costs.

YellowLite

Regional Service

Average cost

Pros

- Representatives are experts on local policies

- Offers products from leading manufacturers

- Full-service home energy solutions

Cons

- No leases or PPAs

- Relatively short workmanship warranty

Paradise Energy Solutions

Regional Service

Average cost

Pros

- Outstanding customer service

- Many years of experience

- Offers products from leading manufacturers

- Slightly limited service offerings

Cons

- Great warranty coverage

- No leases or PPAs

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

In the table below, we’ll list the perks for PV system installation currently available in The Mountain State and include the typical savings each can provide.

| Solar Incentives in West Virginia | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Credits your income tax burden with 30% of your system installation cost | One-time: The credit gets calculated once when you first install solar. Any unused credit can apply to future tax years for up to five years in total. | $11,088 on average |

| West Virginia Solar Rights | State | Ensures all homeowners retain the right to install solar panels and enjoy the benefits of clean energy | Always in Effect: The rights offered by this perk are guaranteed and inalienable for as long as you remain a state resident | None (this is not a financial incentive) |

| Net Metering | Local | Tracks all excess energy your panels produce and sends to the grid. You earn credits for overproduction that pay down future bills. | Always in Effect: Net energy metering credits will continuously accrue and reduce your energy bills for as long as your system generates power | Varies based on your typical monthly energy consumption, the electricity rate you pay, your system size and more |

| Local Incentives | Local | There might be energy efficiency perks available from your local utility provider or municipality. There are none that apply specifically to solar conversion. | Varies based on the perk | Varies based on the benefit program, the efficiency home improvement you carry out and more |

What Do West Virginians Need to Know About the Federal Solar Tax Credit?

It’s a solar energy tax credit, which means the value of the credit offsets your income tax liability for the year you go solar. Unused credits — if you owe less than the credit amount — can carry over for four additional years after the first year the credit is filed for.

With the typical system cost in the area hovering around $36,960, you can expect your credit to be valued at approximately $11,088.

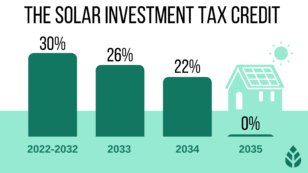

The credit has been around since 2005, and it was scheduled to drop from 30% to 26% in 2022, with an additional drop to 22% in 2023 before being discontinued in 2024.

In August of 2022, Congress passed the Inflation Reduction Act (IRA), which, among other things, improved the federal credit quite drastically. It increased the credit rate for 2022 and 2024 and pushed the expiration date forward by ten years. Below is a breakdown of the new rate schedule:

- The credit will remain at 30% for systems installed between 2022 and 2032 — this retroactively includes systems installed in 2022 before August, when the bill was signed

- The credit will drop to 26% for installations completed in 2033

- The credit will drop again to 22% for installations completed in 2034

- As of this writing, 2035 marks the end of the program altogether, and no credit will be offered thereafter

How to Claim the Federal ITC in West Virginia

The process for claiming the federal solar credit is simple and won’t take you much time at all. You can follow the instructions below to file for this incentive.

- Step 1: Have a solar company complete the installation process.

- Step 2: As part of your tax preparation the year after your system was installed and commissioned, print out IRS form 5695. This is the form used to claim residential energy credits on your taxes.

- Step 3: Fill out the form. You might need to look up contact information for your solar contractor or reach out to them to get the required information about your system. In any case, the form is short and should only take a few minutes to complete.

- Step 4: File the form with your taxes.

You can usually forgo these steps and just answer on-screen questions about renewable energy systems if you use software like TurboTax or H&R Block to file.

EcoWatch’s Opinion on the Federal ITC in West Virginia

The federal credit is one of our favorite incentive programs in the country, let alone the state. It’s particularly important to take this perk in West Virginia, as there are few other benefit programs to help reduce the cost of going solar.

The federal credit is a great incentive for a few reasons. First, it’s super simple to file for and just takes a few minutes of your time when you file your taxes. Second, it provides an average potential value of over $11,000 in your area. Finally, it’s available to all taxpayers and comes with no restrictions, so you’re guaranteed to be eligible if you haven’t claimed it in the past.

The only downside to the federal credit is that, even if you are eligible, you might not realize the entire value it offers. Since it’s a tax credit and not a solar rebate, the value gets deducted from your income tax liability. If you don’t owe money to the IRS for income taxes, you won’t be able to take the credit.

With that being said, you don’t have to take the full credit in year one, as any unused credit can be applied to the following year’s tax burden. This can be done for up to five years in total, so you should be able to take the full credit as long as you owe $2,217 per year for five years following your solar installation.

Watch Below: What Should You Know About Recent Changes to the Solar Tax Credit?

What You Should Know About Solar Rights in West Virginia

The state passed solar rights laws in 2012 that prevent homeowners associations, local government agencies and other governing bodies from restricting or prohibiting rooftop solar panel installation. With these rights in place, all residents can install and enjoy the benefits of solar.

This isn’t a financial incentive, so it won’t technically save you any money. However, since the average resident sees a lifetime savings of just under $28,609 from solar conversion — after the panels pay for themselves — it could act as a financial perk for you if it means the difference between going solar and not being able to install panels.

How to Claim the Solar Rights in West Virginia

The right to install PV panels on your home is inalienable thanks to this piece of legislation. That means you automatically retain the right to go solar, and you don’t need to file any application or paperwork to exercise that right.

EcoWatch’s Opinion on West Virginia’s Solar Rights

While we’d really love to see more financial perks for solar adoption in the area, we’re still happy that the state advocates for solar with these rights. It’s a good step toward legitimizing solar adoption, which is sorely needed in the state, according to the Solar Energy Industries Association (SEIA).2

Net Metering in West Virginia

Through a process called interconnection, your electric company will monitor your energy consumption and the excess power that your panels generate and send to the grid. The policy calls for bill credits to accrue for any net energy output. During months when you produce more than you consume, those credits will accrue.

The NEM credits you earn will automatically be applied to your future energy bills, which means overproduction in June can offset the electricity you pull from the grid in October.

Net energy metering is massively beneficial, especially in areas like West Virginia, where energy needs are above average. It provides several important benefits, including:

- A bump in long-term energy savings

- A shorter payback period for your solar panel system

- More value added to your home through your solar conversion

- A decreased effective electricity rate that’s locked in for years

NEM is mandated for all electric companies in the state, and the credit rate for excess power is set at the retail rate, which is ideal.

Net energy metering policies have been declining across the country in recent years due to added strain on the energy grid and RPS goals being met. Unfortunately, net energy metering in WV is at risk of being discontinued as well, especially since there is no current RPS. For now, though, it remains available to all residents.

How to Enroll in Net Energy Metering in West Virginia

To enroll in net energy metering, you usually just need to have your solar energy system installed and then fill out an NEM application for your electric company. However, if you choose a reputable solar installer in your area, chances are good that a representative will complete the application for you, so most residents can just follow the steps below.

- Step 1: Reach out to your electric company and confirm what NEM credit rate is available to you. You should also confirm that you have a bidirectional meter, which allows you to access interconnection. Most homes have been upgraded, and you can have one installed if you don’t have one.

- Step 2: Choose a solar installer to complete your solar project. We suggest screening companies and asking them to confirm if they will apply for net energy metering on your behalf. While this doesn’t always guarantee you get a reliable installer, it is a good sign.

- Step 3: Move forward with the installation process.

- Step 4: Check for accruing credits on your next few electric bills. You’ll likely see lower overall charges and earned credits if your production is outpacing your consumption.

EcoWatch’s Opinion on the Net Metering Policy in West Virginia

Net energy metering is a fantastic perk to have access to, especially in an area like West Virginia, where incentives are few and far between. We also are happy to see this benefit program in a state where energy needs and solar conversion costs are above average.

Best of all, most of the top-tier solar panel installers in the state will enroll you automatically in this program, which remains available to all residents. This makes enjoying the perk guaranteed and requires minimal effort from you to save money.

Local Solar Incentives in West Virginia

Unfortunately, there are no additional incentives pertaining to solar equipment, in particular, in the state. You might have access to cash-back incentives and other benefits for energy efficiency home improvements, though.

You can contact your public utility or check the Database of State Incentives for Renewables and Efficiency (DSIRE) to see if you have other perks available.

Which Tax Incentives Are The Best In West Virginia?

Since there are so few incentives available in the state, we strongly recommend you take advantage of everything you can. That really just means filing for the federal tax credit and taking part in net energy metering.

The federal credit is great because it’s available to all residents, requires just a few minutes to claim and provides a potential value of over $11,000. This is made all the more valuable by the lack of other perks in the area.

Net energy metering is another crucial perk to take advantage of. As of this writing, it remains available to all residents and serves as one of the only incentives to maximize long-term savings. NEM also improves the value of your PV system overall, which, of course, is a positive. Best of all, it usually requires no effort on your part to apply.

What’s The Near Term Outlook For More Incentives In West Virginia?

Unfortunately, the future looks bleak for solar perks in the state. Since the RPS was abandoned in 2015, there is little incentive for electric companies or local government agencies to offer new benefit programs or enhance existing ones.

Unless the state sets a new goal for using renewable energy sources, we don’t expect any new perks to appear in the near future.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs for Solar Incentives and Rebates in West Virginia

Below, we’ll answer some of the most common questions we see from West Virginians about solar incentive programs and potential savings.

SRECs — or Solar Renewable Energy Certificates — are credits solar customers can earn simply by generating electricity with their panels. Credits accrue for power sent to the grid and used on-site, so they’re different from net energy metering credits.

In some states, there is an open market where utility companies can purchase credits from customers to reach renewable energy goals and reduce reliance on natural gas and other fossil fuels. That can mean a profit for customers and a faster panel payback period.

Unfortunately, there is no SREC program in WV, so residents can’t earn or sell credits.

Unfortunately, no. There is no statewide sales tax exemption for PV equipment, nor is there a property tax exemption to keep property taxes from increasing after installing a solar power system.

There are no plans to increase incentives in the next two years. In fact, it’s more likely that current incentives will be dropped or decreased, as the RPS that pushed for incentives was abandoned in 2015.

The Inflation Reduction Act (IRA) passed by Congress upgraded two incentives at the federal level.

First, it bumped up the potential tax incentives for electric vehicles (EVs). Some makes and models are now eligible for up to $7,500 in tax breaks.

Second, it pushed back the expiration date for the ITC to 2035, and it increased the credit rate for installations completed between 2022 and 2034.

While there is no piece of legislation in the works that will cause incentives to decrease in the next two years, it’s certainly possible that there will be some negative changes soon. We believe this for two reasons.

First, there is no RPS goal to keep incentives relevant and necessary. Second, net energy metering is already declining in states that still have RPS goals, so we wouldn’t be surprised to see NEM be discontinued in the Mountain State altogether. It’s unclear, though, if this change will occur in the next two years.

Top Solar Installers in West Virginia Cities

Comparing authorized solar partners

-

- Representatives are experts on local policies

- Offers products from leading manufacturers

- Full-service home energy solutions

- No leases or PPAs

- Relatively short workmanship warranty

A+Solar Veteran

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe