Reviews

Reviews

Utah Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to saving money on your solar energy system in Utah, you’ll learn:

- What solar incentives are available in Utah?

- How can the solar benefit programs help reduce your system installation costs in Utah?

- How do you file for the federal tax credit in Utah to make sure you get the full amount?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Utah Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, Utah’s incentive programs definitely make it cheaper to go solar. Converting your home to solar power is expensive, but the perks available in the state definitely help to ease the financial burden.

The average cost of a new solar panel system in Utah is around $25,200, before any incentives. This is a few thousand dollars below the national average, largely because you can install a smaller-than-usual system to meet your state’s typical energy demands.

The state also has a voluntary Renewable Portfolio Standard (RPS) goal that encourages Utahns to adopt solar energy. The state’s goal is to produce 20% of its electricity using clean energy sources by 2025. Since this goal is only voluntary, residents have access to fewer incentives than in some other states. Still, the ones that are available can save you thousands on your system.

ES Solar

Local Service

Average cost

Pros

- Representatives are experts on local policies

- Lifetime workmanship warranty

- Outstanding customer service

Cons

- No leases or PPAs

- Energy audits only available 12 months after installation

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Below, you’ll find a list of all of the solar perks available from the federal government, the state and local utility companies. We also include each program’s estimated savings to give you an idea of which incentives are most valuable.

| Solar Benefit Programs in Utah | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Credits your income tax liability with 30% of your system cost, including panels, inverters, batteries and labor. | One-time: The credit applies once during the tax year in which you install your panels. However, unused credit can get applied to your tax bills for up to five years total. | $7,560, on average |

| Rocky Mountain Power (PacifiCorp) Wattsmart Battery Program | State | Provides an upfront solar rebate for $400 per kilowatt (kW) of battery installed alongside panels. | One-time: Your rebate amount will be determined once when you install batteries. | $4,000, on average (for two batteries) |

| Net Metering | Local | Offers electricity bill credits for all power that your system overproduces and sends to the grid. Net energy metering is NOT mandated in the state but is still widely available. | Always in Effect: Provided your panels continue generating electricity, you’ll always be eligible to earn net energy metering credits. | Varies based on your system efficiency, system size and monthly electricity bills. |

| Local Incentives | Local | Rebates and other perks provided by individual utility providers, municipalities and other local entities. | Varies based on the incentive. | Varies based on the incentive and the size of your solar power system. |

What Do Utahns Need to Know About the Federal Solar Tax Credit?

The federal investment solar tax credit allows you to write off a large chunk of the cost of a new solar power installation on your taxes. It’s one of the most valuable perks available in the U.S., and it’s offered by the federal government to all taxpayers. Currently, this tax credit can be worth up to 30% of the entire upfront cost. Given the average local cost of going solar — around $25,200 — that means the typical credit in the area will sit at about $7,560.

That amount is applied to the taxes you owe on your income for the year your system is installed. For example, if you owe $7,500 in taxes, your new tax bill will be reduced to $60, providing an effective savings on your system.

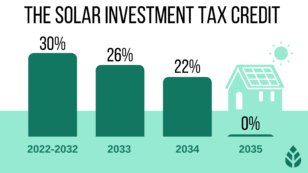

This credit has been available since 2005. Originally, the credit rate was scheduled to drop to 26% in 2022, 22% in 2023 and 0% in 2024.

Thankfully, the credit was extended when the Inflation Reduction Act (IRA) was signed in August 2022. The rates were also bumped back to 30% for tax years 2022 through 2024. The new rates are as follows:

- 30% for all systems commissioned between 2022 and 2032

- 26% for all systems commissioned in 2033

- 22% for all systems commissioned in 2034

- The credit will be discontinued in 2035

The bump to 30% for 2022 installations applied retroactively to systems installed that year but prior to the bill being signed in August.

How to Claim the Federal ITC in Utah

Claiming the federal credit is simple and doesn’t take more than a few minutes for most homeowners. You can follow the steps below to file for the credit.

- Step 1: Complete your solar conversion.

- Step 2: When you’re ready to file your taxes following installation, print out form 5695 from the IRS’s website.

- Step 3: Fill out the form using information about your solar contractor, your system and the site where it was installed (your home). In most cases, the form only takes a few minutes to complete.

- Step 4: File the form with your taxes.

If you use tax software to file your taxes — like TurboTax or HR Block — you don’t need to follow the steps above. Instead, just report in the software that you installed renewable energy equipment on your home, and the program will generate the proper paperwork.

EcoWatch’s Opinion on the Federal ITC in Utah

In our opinion, the federal credit is the one perk that you absolutely shouldn’t miss. The average potential value of the credit sits at nearly $6,500, and it takes just a few minutes to apply for. The value you get for the time investment is unmatched.

A credit like this is especially valuable in areas like Utah, where there aren’t many other incentives that can effectively reduce solar conversion costs.

We should mention here that, as a tax credit, this perk doesn’t guarantee you savings on your system. You can only get value from this incentive if you owe money to the IRS for income taxes. If you don’t owe that $7,500 the year you install your system, you can’t take the full credit right away.

Luckily, the government lets you push unused tax credit forward four times to apply to a total of five tax years. If you owe at least $1,500 per year on your taxes for five years following the installation, then you’ll still get the full credit over time.

Watch Below: Will Solar Panels Save / Make You Money?

What You Should Know About the Rocky Mountain Power Wattsmart Battery Program in Utah

Rocky Mountain Power (RMP) — now operating under PacifiCorp — offers an incentive to solar customers who install solar batteries along with their panels. Batteries help reduce the load on the power grid, which helps energy companies better manage the equipment and can end up saving them money as well.

The company offers a rebate of $400 per kilowatt of battery capacity installed. The total capacity eligible for the rebate is capped at 30 kW, for a maximum of $12,000.

As of right now, this perk only applies to Sonnen batteries, which average 5 kW of capacity. Each battery you install would yield a cash-back incentive of $2,000, and the total average rebate is around $4,000, assuming you install two batteries for emergency backup power.

How to Claim the Wattsmart Battery Rebate in Utah

Enrolling in this rebate program shouldn’t take long at all, which makes it even more valuable. You can follow the steps below when you’re ready to apply.

- Step 1: Complete your solar installation, including batteries.

- Step 2: Head over to RMP’s web page for the battery rebate program and click “Apply Now.”

- Step 3: Create a profile and complete the application. You’ll need information about your batteries and the total capacity, as well as contact information for your solar panel installation company.

- Step 4: A program administrator will let you know if any additional information is required.

EcoWatch’s Opinion on RMP’s Battery Rebate Incentive in Utah

Solar rebates are a great way to bring down the upfront cost of converting to solar, and this perk is no exception. Solar batteries are quite common in the Beehive State due to an above-average number of power outages, which means this perk will appeal to many customers.1

We’d love to see the perk include other batteries and brands, like Tesla Powerwalls and Generac PWRCells. Still, the value provided for the time investment is excellent, and the application process is simple and straightforward.

Net Metering in Utah

All of the net metering credits you earn are applied automatically to energy bills in the future, so overproduction in July can offset energy costs and total electric bills in August and beyond.

NEM provides a few key benefits:

- Increases your long-term savings, pushing the average in the area over $10,000.

- Helps reduce your energy bills, even when your panels generate less electricity than you’re consuming.

- Improves the overall value of your panels.

Net energy metering is not mandated by the Utah’s Public Service Commission (PSC), which means not all residents will have access to this perk. However, many of the state’s largest utility companies – including RMP (PacifiCorp) – do provide it. That means most residents will be able to enjoy the benefits of NEM.

The current rate offered by most providers in the area is below the retail rate — usually the wholesale or avoided-cost rate. This isn’t as ideal as the full retail rate, but it’s still massively helpful.

Net energy metering may not always be available in your area, which is something to keep in mind when converting to solar. Many states are seeing decreases in the credit rates offered, and others are seeing the incentive get discontinued. There is no plan for the net metering program in UT to be downgraded, but that is possible.

How to Enroll in Net Metering in Utah

Signing up for net energy metering is a simple process that, in most cases, your solar installer will do on your behalf. You can follow the steps below to make sure you get access to this perk.

- Step 1: Contact your local utility company and inquire about net energy metering. If the policy is available, ask about installing a bidirectional meter at your home. If you don’t have one already, your electric company should install one at no cost to you. For example, Rocky Mountain’s net metering enrollment process is easy to follow.

- Step 2: Choose a solar installer. We recommend asking each installer to confirm that a representative from the company will handle the NEM application for you. Most reputable installers will do this automatically

- Step 3: Install your solar project.

- Step 4: After your panels are installed, confirm that credits are accruing on your utility bills. If they aren’t, you should contact your installer to determine what the issue is.

EcoWatch’s Opinion on Net Metering in Utah

Net energy metering is one of our favorite perks, and it’s one of the most valuable ones you can take advantage of. We especially love that it’s easy to apply for and that most solar customers won’t need to do anything to enroll. Installers usually handle it for you.

We would, of course, love to see NEM be mandated throughout the state and not just voluntarily offered by utility companies. We would also like to see the full retail rate offered for energy credits rather than an avoided-cost rate or wholesale rate.

Still, the savings you can see from this perk are excellent, so it remains a favorite of ours in the area.

Local Solar Incentives in Utah

- City of St. George Net Energy Metering: Residents of St. George have access to NEM like many other Utah homeowners. However, the credit rate within the city is set to the full retail rate, which is outstanding.2

- Murray City Power NEM Program: Similarly, residents of Murray have access to net energy metering and receive the full retail rate for every kilowatt-hour (kWh) of excess energy passed to the grid.3

There might be other perks for energy efficiency upgrades — like solar water heaters, smart thermostats and geothermal heat pumps — offered by your utility company. We recommend reaching out to your power company or looking on the Database of State Incentives for Renewables and Efficiency to see what’s available.

Which Tax Incentives Are The Best In Utah?

Some solar incentives are more valuable than others, but in a state with relatively few perks, we recommend taking as many as you possibly can. The two we suggest focusing on are the federal tax credit and net energy metering.

The federal tax credit offers perhaps the most valuable upfront benefit, given the potential savings and the minimal time investment required to apply for it. It’s also available to all residents, unlike NEM and some of the local incentives available.

Net energy metering is also crucial to file for if you have access to it. While you won’t earn the retail value for your energy in most places, it can still help save you money over time and maximize the value you see from your panels.

Plus, applying for NEM is a breeze, and most residents won’t even need to fill out the application, as many installers tackle this on the solar customer’s behalf.

What’s The Near-Term Outlook For More Incentives In Utah?

There is no plan in place for additional photovoltaic (PV) incentives to become available in the Beehive State in the coming years. This could change if the state implements a mandatory RPS goal. For now, though, it doesn’t appear that will happen any time soon.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ’s for Utah Solar Rebates and Incentives

In the sections below, we’ll answer some of the most pressing and common questions we see about incentive programs available to Utahns.

No, Utah does not have Solar Renewable Energy Certificates (SRECs). SREC are credits that solar customers earn in accordance with their solar production, and utility companies purchase them to offset fossil fuel usage, usually to comply with RPS goals. Since the state goal is voluntary, there is no active SREC market, so you cannot turn a profit by accruing and selling energy credits.

There is nothing to suggest that new incentives will become available for home solar power systems in the next two years. As mentioned above, the state has a non-mandatory RPS goal, which means there is little incentive for utility providers and the state government to offer additional perks.

In fact, this has led to other incentives — like Utah state’s renewable energy systems tax credit previously offered by the Office of Energy Development — to expire rather than be renewed.

If a new goal is set and made mandatory, then there’s a chance new perks will become available. This could also reinstate the state solar tax credit for solar PV systems, although this is unlikely.

The Inflation Reduction Act (IRA) greatly improved the federal credit for installations completed in 2022 and beyond. First, it increased the credit rate back up to 30% for installations done in 2022 and 2023. Second, it extended the credit’s expiration date by a decade to 2034.

The IRA also improved credits offered for purchasing electric vehicles (EVs). The maximum credit was pushed up to $7,500 for specific makes and models.Calculate how much you can save thanks to the IRA with our IRA calculator.

There is no plan for any currently available perks to decrease or disappear in the next two years. The most recent negative change to incentives in the area was to the Utah solar tax credit, which ended in 2023. Although the RPS goal remains voluntary, there isn’t any evidence to suggest that the other perks will be negatively affected in the coming years.

Net energy metering is one of the most common perks to get reduced or discontinued, as many states are seeing credit rates decrease or disappear. Since NEM isn’t mandated in the Beehive State anyway, any negative changes would happen on a local level. There isn’t any evidence to suggest that companies like RMP will drop net energy metering in the near future.

Unlike in many other states, there is no sales tax exemption or property tax exemption available for solar conversions. That means you’ll have to pay the state sales tax on all equipment, and your property taxes will increase as a result of going solar.

Top Solar Installers in Utah Cities

Comparing authorized solar partners

-

- Representatives are experts on local policies

- Lifetime workmanship warranty

- Outstanding customer service

- No leases or PPAs

- Energy audits only available 12 months after installation

Not RatedOutstanding Local Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe