Tennessee Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to saving money on your solar installation in Tennessee, you’ll learn:

- What solar perks and tax incentives are available in Tennessee?

- How do the solar incentives in Tennessee affect the cost of converting to clean energy?

- How do you file for the federal credit in Tennessee to take full advantage of the perk?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Tennessee Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, the incentive programs available in Tennessee definitely make it more affordable to install a solar panel system.

The average price to convert to solar in Tennessee is about $38,520. This is slightly higher than the national average, primarily due to a larger-than-normal system size you need in Tennessee to keep up with energy demands. It’s slightly cheaper than average to install solar power systems on a per-watt basis, but the larger system size means you’ll end up paying more overall.

Fortunately, there are federal state and local incentives to help bring down this cost. But there are fewer incentive programs overall in Tennessee than you’ll find in other states. The Volunteer State doesn’t have a Renewable Portfolio Standard (RPS) goal, which is usually the catalyst for solar benefit programs.

Shine Solar, LLC

Regional Service

Average cost

Pros

- Many financing options

- Great warranty coverage

- Offers a panel buy-back option

- Outstanding workmanship

Cons

- Relatively young company

- Limited brands of solar equipment available

LightWave Solar

Local Service

Average cost

Pros

- NABCEP-certified technicians

- Excellent reputation

- Offers products from leading manufacturers

Cons

- No leases or PPAs

- Limited service area

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

In the table below, we’ll include information about each solar incentive available in TN, as well as an estimated savings each can provide.

| Solar Benefit Programs in Tennessee | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Offers a credit to income taxes for 30% of your entire system installation cost. The credit is based on the cost of labor, panels, solar batteries and inverters. | One-time: Your credit amount is determined once when you file your taxes after going solar. However, you can roll over unused credit for up to five years in total. | $11,556, on average |

| Green Energy Property Tax Assessment | State | This perk limits how much your property taxes will increase after converting to solar power. Only 12.5% of your solar power system’s value will be taxed. | Ongoing: You’ll see financial benefit from this perk every year your taxes are assessed and your system still holds value. | Around $4,516 over the life of your solar power system. This varies based on system value and size |

| Net Metering Program | Local | Provides bill credits for all excess energy you generate with your panels and send to the grid. Net energy metering is NOT mandated in the state. | Always in Effect: If you have access to this perk, your excess solar production will always be put toward accruing energy credits. | Varies based on the credit rate available to you, your system size and efficiency, and your monthly energy bills. |

| Local Incentives | Local | Some utility companies and municipalities may offer financial incentives or other perks for energy efficiency upgrades. | Varies depending on the perk. | Varies depending on the perk and your system size. |

What Do Tennesseans Need to Know About the Federal Solar Tax Credit?

The federal solar tax credit allows you to write off a large portion of the cost of a new solar power installation on your federal taxes. This incentive is offered by the federal government, which means it’s available to every U.S. taxpayer.

It’s not a cash-back program, but instead can bring down how much you owe for that year. Unused credit can carry over for up to five years in total. Currently, you can take a credit of up to 30% of the cost of your solar power system.

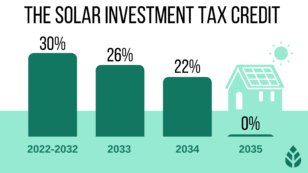

The credit was first available for solar installations completed in 2005 and was equal to 30% of the system value. That rate was available until 2022, when it dropped to 26%. It was then scheduled to dip to 22% in 2023 and get discontinued in 2024.

However, in August 2022, legislators passed the Inflation Reduction Act (IRA), which made significant and positive changes to the credit. First, it pushed the expiration date back to 2035. Second, it bumped up the rate for installations done before that year. The new rates based on the year you go solar are below:

- 30% for systems installed between 2022 and 2032 — this retroactively increased the rate for installations done in 2022 but prior to August when the bill was signed

- 26% for systems installed in 2033

- 22% for systems installed in 2034

- The credit will no longer be available starting on January 1st, 2035

Given that the typical cost of a solar energy system in the area hovers around $38,520, the 30% credit would be equal to as much as $11,556. Solar systems are more expensive in Tennessee than in most other states, so the credit amount is well above average. You can use a solar calculator to estimate your total potential credit amount.

There are two important things to note about the ITC. First, it’s not a rebate, so you can only take advantage of it if you owe money on your taxes. Second, it applies to batteries as well. We’ll explain this in greater depth later, but we believe batteries are going to be more of a necessity for seeing substantial solar savings in the future than they are now. If that happens, you’ll be paying between $10,000 and $20,000 more for your solar installation than you otherwise would, but the ITC can also effectively save an additional $3,300 to $6,600.

How to Claim the Federal ITC in Tennessee

Claiming the federal credit is a simple process that shouldn’t take more than a few minutes. You can follow the steps below to make sure you get access to this perk.

- Step 1: Complete the installation of your solar energy system.

- Step 2: When you’re ready to file your taxes for your installation year, print out IRS form 5695.

- Step 3: Complete the form and provide it to your accountant or file it alongside your taxes.

If you use TurboTax, HR Block or another tax software to file, you won’t need to follow those steps. Your tax prep program should automatically ask you about renewable energy systems you installed. In that case, you can skip printing the IRS form and just answer the questions in the software.

EcoWatch’s Opinion on the Federal ITC in Tennessee

The federal credit is one of the most advantageous perks available in most states, and that’s certainly the case in Tennessee. With no state tax credit or other significant perks available, solar customers should absolutely file for the federal credit.

Not only does it take just a few minutes to get access to the credit, but it provides a massive potential value of as much as $11,556.

We should mention, though, that this amount isn’t guaranteed. It isn’t a solar rebate. You’ll only be able to see that kind of return if you owe more than that on your income taxes. You can push unused credit forward for four additional years, which means you’ll need to owe at least $2,311 per year for five years to take full advantage.

Add batteries to your system, and your total average installation cost rises to $53,820, on average. That would mean you’d need to owe $10,764 in year one, or $2,152 per year for five years to take the full credit.

Watch Below: Is Going Solar Worth It?

What You Should Know About the Green Energy Property Tax Assessment in Tennessee

Thankfully, the Green Energy Property Tax Assessment program limits how much of your system’s value is considered when determining your property value. It caps the tax rate on PV equipment at 12.5% of the system value, which is about $32 per year or $645 over the life of your system based on the average system in Tennessee. As such, you’ll see your property taxes go up after installing solar panels, but not nearly as much as you typically would without this exemption.

Given the typical property tax rate of 0.67%, that’s around $225 per year you’ll save on your tax bill or around $4,516 in total over the 20 years your system is expected to hold value.2 Keep in mind this doesn’t take into account depreciation.

This perk can also be used for other renewable energy sources, including hydropower, biomass, geothermal and wind power.

How to Claim Tennessee’s Property Tax Exemption

One of the best parts about this exemption is that it’s automatically applied, so you don’t have to take any action to ensure you get access to the perk. When your local tax assessor is determining your assessed value, he or she will just ignore the bulk of your system’s value. The savings will automatically be reflected on your property tax bill.

EcoWatch’s Opinion on the Property Tax Exemption in Tennessee

This is an outstanding perk to have access to because it’s automatic and doesn’t take any effort or time to claim. You simply install your panels, and your property tax hike will be limited automatically. The potential savings of over $4,000 make this a great value.

We do, however, wish that this was a 100% property tax exemption for solar equipment. Most other states that have a property tax exclusion for solar panels have the rate set at 100% of the system value, and this would be more beneficial.

Net Metering in Tennessee

When your panels generate more energy than your home is using, you earn bill credits, which roll over and keep utility bills down. NEM is an outstanding policy that helps limit the panel payback period and maximizes your energy savings over time.

Unfortunately, the Tennessee Public Utilities Commission (PUC) doesn’t mandate that utility providers offer NEM. Most of the major energy providers in the state don’t choose to offer the policy, including the Tennessee Valley Authority (TVA).

However, TVA does offer a similar incentive known as the Green Power Providers Program, which buys back excess energy through interconnection at the avoided-cost rate.

If you do have access to the program, it will help push you up to and beyond the average lifetime savings in the area of $25,152. It’s difficult to say exactly what the program will save you, as that depends on many factors, like your system size, your typical monthly electric bills and more.

While NEM has been popular and, historically, massively beneficial to solar customers, the policies in many states are becoming less and less appealing. Customers are increasingly finding rates dropping and programs disappearing entirely. Most notably, the NEM 3.0 policy that took effect in California — historically, the most solar-friendly state — in 2023 downgraded the credit rate by around 75%.

We’re thinking that if California downgraded its policy, chances are other states will soon follow suit. If that happens, you might need to install batteries to get access to effective net metering. Batteries increase installation costs by between $10,000 and $20,000, so installation costs would skyrocket.

Even if your local utility company does offer NEM, it’s possible that the availability or credit rate will change in the future, so keep that in mind when converting to clean energy.

How to Enroll in Net Metering in Tennessee

Enrolling in net energy metering is a more or less automatic process for most customers to whom it’s available. You can follow the steps below to make sure you get access if you are eligible.

- Step 1: Contact your energy company and ask if NEM is available to you. If it is, confirm the credit rate and ask the representative to confirm if you have a bidirectional meter installed. This is required for your power provider to keep track of energy being imported and exported from and to the electric grid.

- Step 2: Choose a solar panel installation company. We recommend asking the sales rep of each company you’re considering if they will enroll you in NEM. Most reputable local installers in the area will handle the application for you if the policy is made available to you.

- Step 3: Complete your solar project installation.

- Step 4: Check your utility bills after the installation to make sure your bill credits are being applied to your account.

EcoWatch’s Opinion on Net Metering in Tennessee

Net energy metering is an outstanding perk in Tennessee, but only if you have access to it. Unfortunately, most customers will not.

We’d love to see the policy adopted throughout the state, but given the lack of an RPS goal and the slow adoption rate for photovoltaics in general, according to the Solar Energy Industries Association, we don’t see that happening any time soon.

For homeowners who do have access, this perk can significantly boost long-term energy savings, help pay down the system much more quickly and reduce monthly energy bills.

This policy is helpful no matter where you live, but it’s especially useful for Tennesseans, who have well-above-average energy consumption each month.3 Plus, it takes no time or effort for most customers to enroll, making it even more valuable.

Local Solar Incentives in Tennessee

In some states, local electric companies and individual cities offer additional perks for solar customers. While there are no rebates or benefit programs specifically for installing solar equipment in the state, below are some perks for energy efficiency home improvements.

- Knoxville Utilities Board Electric Vehicle (EV) Charging Station Rebate Program: Customers of this utility provider can get up to a $400 rebate for installing a level-2 EV charger in their homes.4

- Bristol Tennessee Electric Service (BTES) Energy Savings Loan Program: BTES customers have access to affordable and low-interest loans for up to $10,000. This financing option can be used to purchase heat pumps, insulation and new energy-efficient windows and doors.5

- Middle Tennessee Electric Membership Corporation (EMC) Residential Heat Pump Loan Program: This is a financing option for customers of this electricity provider to get low-cost loans for installing heat pumps. Financing is available for between $2,000 and $15,000 and for up to 10 years. The interest rate is capped at 10%.6

- Murfreesboro Electric Department (MED) Residential Heat Pump Loan Program: As the name suggests, this is a financing option for MED customers seeking to purchase heat pumps. The financing terms include a maximum 7% interest rate, a maximum 10-year loan term and a maximum financed amount of $15,000.7

- MED Energy Efficiency Rebate Program: This is a rebate offered to MED customers who carry out energy efficiency home improvements, including heat pump installations and water heaters. The maximum rebate amount is $1,000 for single-family homes.8

- Electric Power Board of Chattanooga Energy Efficient New Homes Program: Builders constructing new energy-efficient homes in the service area of this utility provider are eligible for a rebate of up to $3,000.9 In some cases, the savings provided can be passed onto the homeowner.

Which Tax Incentives Are The Best In Tennessee?

Not all of the incentives available in Tennessee are equally valuable. Below, we’ll discuss the top three can’t-miss perks we recommend. For two of them, you won’t need to anything at all to enjoy the benefits.

The Federal Solar Tax Credit

As is the case in most states, the federal credit is by far the most valuable perk available in Tennessee. It takes just a few minutes to apply for and provides an average potential value of over $11,500. Plus, it’s available to all customers, unlike net energy metering and the local energy efficiency incentives.

The Property Tax Exemption

The solar panel property tax exemption is another valuable perk that we absolutely love to see offered for PV equipment. This incentive helps reduce the financial burden of going solar over time, helping solar customers avoid over $4,000 they would otherwise pay in property taxes over the lives of their systems. This perk is also automatic and requires no effort or time to enroll.

What’s The Near-Term Outlook For More Incentives In Tennessee?

At the moment, there are no plans in place for Tennessee’s solar incentives to get more or less valuable in the next few years. The federal credit is available until 2035, and the local perks — namely, the tax exemptions — don’t appear to be in danger. These exemptions are rarely discontinued, even in states like Tennessee with no RPS goal.

Unless the state sets its first RPS goal, we also don’t foresee new perks becoming available. We’d love to see NEM get mandated throughout the state, but that’s very unlikely, especially since the program has been downgraded in many other areas rather than improved. We expect the same to happen eventually in Tennessee.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ’s Solar Incentives in Tennessee

Below, we’ll provide responses to some of the questions we commonly see from residents in your area about saving money on PV equipment with local incentives.

Solar Renewable Energy Certificates (SRECs) are currently not available in Tennessee. These credits accrue for all solar production and can be sold for a profit to utility providers that need to offset fossil fuel consumption to meet local RPS requirements. With no RPS goal in place, there is currently no need for an active SREC market in the Volunteer State.

No, at this time, there is no plan in place for new incentives to become available in the area or for existing perks to become more beneficial. If the state sets its first RPS goal, we may see some new benefit programs pop up. However, there’s no evidence to suggest that a goal will be set any time soon.

The IRA increased the federal credit rate for PV system installations done in 2022 and 2023 to 30% — up from 26% and 22%, respectively. It also extended the credit by 10 years, so it’s now set to expire in 2035 rather than 2024. Calculate how much you can save with our IRA calculator, you might even be surprised with the EV credits offered. The highest credit available is now $7,500 for some makes and models.

In our opinion, it’s highly unlikely that the state will reduce incentives available for home solar systems in the next two years. Since the available perks are limited, the only real changes could be to the property tax and sales tax exemptions. These perks are unlikely to be discontinued, even if the state fails to set an RPS goal in the near future.

Related articles

Top Solar Installers in Tennessee Cities

Comparing authorized solar partners

-

- Many financing options

- Great warranty coverage

- Offers a panel buy-back option

- Outstanding workmanship

- Relatively young company

- Limited brands of solar equipment available

A-Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe