South Dakota Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to making solar more affordable using solar incentives in SD, you’ll learn:

- What solar incentives are available in South Dakota?

- How much can you save on your solar system in South Dakota using solar incentives?

- What are the best solar perks to take in South Dakota?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do South Dakota Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes. For most South Dakota homeowners, solar incentives help bring down the cost of installing solar panels and maximize the value you see from your system.

The typical cost of a solar installation in South Dakota is about $32,655, slightly more costly than the national average. This is primarily based on the above-average energy demands in the state. Though the cost-per-watt for installing solar photovoltaic (PV) systems is nearly 10% cheaper than average, the larger systems required in the Mount Rushmore State leave the all-in conversion costs above the nationwide average.

Unfortunately, solar customers have relatively few state-level solar incentives. However, federal and local programs can still save you thousands on your system over time.

GenPro Energy Solutions

Regional Service

Average cost

Pros

- NABCEP-certified technicians

- Competitive pricing

- Multitude of products and services

Cons

- No leases or PPAs

- Limited warranty coverage

Lakota Solar Enterprises

Local Service

Average cost

Pros

- Representatives are experts on local policies

- Focus on sustainable living

- Highly trained technicians

Cons

- Limited warranty coverage

- No leases or PPAs

- Limited brands of solar equipment available

Black Hills Solar

Local Service

Average cost

Pros

- Outstanding customer service

- Multitude of products and services

- NABCEP-certified technicians

- Relatively young company

Cons

- No leases or PPAs

- Limited service area

In the chart below, we list all of the available incentives in South Dakota, along with a description of how each works. We also include the average savings you’re likely to see when you take advantage of each of these perks.

| Solar Incentives in South Dakota | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Credits your income tax liability with 30% of your system costs, including panels, inverters and batteries. | One-time: The credit amount gets calculated once when you file your taxes. However, unused credits can carry over for up to five years. | $9,797, on average |

| Renewable Energy Systems Property Tax Exemption | State | Prevents the value of your system from driving up your home’s assessed value and your real property taxes. | Ongoing: You’ll see savings on your property tax bill for as long as your solar power system retains value. | $7,641, on average (not accounting for system depreciation) |

| Net Metering | Local | Credits you for any excess power you generate and push to the grid. Net energy metering is NOT mandated in the state. | Always in Effect: If you have access to this perk, you’ll continuously accrue energy credits that get applied to future electric bills. | Varies based on the size of your system and your monthly utility bills |

| Local Incentives | Local | Additional incentives offered by utility providers or local municipalities. | Varies, depending on the incentive. | Varies based on the perk, your energy efficiency upgrades and other factors |

What Do South Dakotans Need to Know About the Federal Solar Tax Credit?

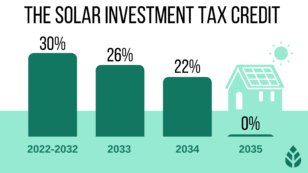

This perk has been available since 2005, although it has gone through some changes since then. The original rate schedule called for a 30% credit for systems installed between 2005 and 2021. Installations done in 2022 and 2023 were due for a 26% or 22% credit, respectively, and the credit would be discontinued in 2024.

In August 2022, Congress passed the Inflation Reduction Act (IRA), which changed the schedule quite a bit. The changes were as follows:

- Systems installed in 2022 will receive a 30% credit — this retroactively included those systems installed prior to August in 2022

- Systems installed between 2024 and 2032 will also get the full 30% credit

- Systems installed in 2033 will receive a 26% credit

- Systems installed in 2034 will receive a 22% credit

- Systems installed in 2035 and beyond will receive no credit, and the program will be discontinued

How to Claim the Federal ITC in South Dakota

We strongly recommend taking the federal credit, as there is no downside to filing for it. You can follow the steps below to make sure you get access to it.

- Step 1: Complete your solar system installation.

- Step 2: When you’re ready to file your taxes for the year, print out IRS form 5695.

- Step 3: Fill out the form with the size and cost of your system, the contact information for your solar contractor, and information about the location where the panels were installed. The form is just two pages long and shouldn’t take more than a few minutes to complete.

- Step 4: File the form with your taxes.

If you use tax software to file digitally, you’ll more than likely be asked if you completed any energy efficiency home improvements during the previous tax year. If you answer “yes” and then include information about your solar system, you can avoid having to follow the steps above.

EcoWatch’s Opinion on the Federal ITC in South Dakota

We love the federal credit for solar customers and were overjoyed when the IRA was passed to extend the program. In our opinion, this is the most valuable solar perk available in your area, and we strongly recommend not missing out on it.

It takes just a few minutes to complete the IRS application, but it can still potentially save you an average of almost $9,800.

We say “potentially” because this is not a solar rebate, and the savings are not guaranteed. This is a tax credit, which means you’ll see no actual value from it if you don’t owe money on your income taxes.

Thankfully, you don’t need to owe the entire amount the first year your solar system is commissioned. You can carry over unused credit for four additional tax years — a total of five years. Given the typical credit value, you’ll need to owe an average of $1,959 per year for the five years following your conversion to take the full amount.

Watch Below: What Should You Know Before Going Solar?

What You Need to Know About the Renewable Energy Systems Property Tax Exemption in South Dakota

Normally, when you carry out a home improvement project that raises your home value, your assessed value will also increase – and so will your property taxes. Installing solar panels usually bumps up your property value by approximately 4.1%.1 That means conversion could, under normal circumstances, make your taxes go up a bit.

Thankfully, the state offers an exemption for solar equipment from property taxes, which means your tax assessor will not consider the value added by your system when calculating your taxes.

Given the average system value of $32,655 and the statewide property tax rate of 1.17%, that’s an estimated annual savings of about $382.2 Since your panels should hold value for around 20 years, that’s a maximum lifetime savings of $7,641.

Your actual savings will be lower as your system depreciates in value, but since calculating depreciation is challenging, this maximum should illustrate the potential of the perk.

How to Claim the Exemption for Property Taxes in South Dakota

The best part about exemption for property taxes for solar equipment is that the savings are applied automatically. You don’t have to spend time or energy filling out applications or paperwork.

Instead, your tax assessor will automatically ignore any value added to your home by your PV equipment. The monthly tax bills you get for your home will reflect the savings right away and will continue to do so until your panels diminish in value.

EcoWatch’s Opinion on the Exemption for Property Taxes in South Dakota

We love to see exemptions for property taxes for solar energy equipment. Not only do they provide decent savings over the lifespan of your system, but they’re also automatic perks that apply with no effort on your part.

Unlike in other states, the local tax exemption is limited to systems up to $50,000 in value. This is an unusual limitation, but it shouldn’t affect many residential solar customers in the state and doesn’t diminish our opinion of the perk in general.

Net Metering in South Dakota

Net energy metering measures the power you pull from the grid as well as the excess energy your system generates and sends to the grid. The net energy — production minus consumption — gets credited to your utility account to help offset future energy bills.

Net energy metering helps maximize the value and the savings you’ll see from your panels, reducing your effective electricity rates based on your energy production.

Unfortunately, NEM is not mandated by the South Dakota Public Utilities Commission (PUC). However, some electric utility companies do opt to offer net energy metering. You’ll need to contact your electric company to see if you have access to the program.

How to Enroll in Net Metering in South Dakota

If NEM is available to you, chances are your solar contractor will enroll you automatically.. You can follow the steps below to see if net energy metering is open to you and enroll if it is.

- Step 1: Choose a solar installation company. You can ask your installer if a representative will enroll in NEM for you if it’s available. Most companies will agree to do this.

- Step 2: Contact your utility provider and ask about net energy metering. If it’s available, confirm that you have a bidirectional electric meter installed. Since interconnection is mandated in the state, you likely have one already. If you don’t, your provider should install one for free.

- Step 3: Have your solar energy system installed.

- Step 4: Check for accruing energy credits on your first few electric bills to make sure the process is working as intended.

EcoWatch’s Opinion on Net Metering in South Dakota

Net energy metering is an outstanding program that provides several benefits. Among other things, it:

- Maximizes the value and energy savings you see from your panels

- Helps recoup your upfront system costs more quickly

- Reduces the volume of electricity you use from fossil fuels4

Net metering is also great because it doesn’t require any action for most solar customers. Even if your solar company doesn’t enroll you automatically, the application process is quick and painless.

The only downside to net metering in South Dakota is that it’s not mandated by the PUC and it’s not likely to be required anytime soon. It’s left up to each individual utility company to decide if they will offer it or not, and many choose not to.

Local Solar Incentives in South Dakota

Unfortunately, local incentives for PV equipment are non-existent.

However, there are some incentives and cash-back perks available for other energy efficiency upgrades – like LED lights, solar water heaters, insulation installation and energy-efficient appliances – from the following companies:

- Beresford Municipal Utilities

- Big Stone City Municipal Utilities

- Black Hills Energy

- Brookings Municipal Utilities

- Burke Municipal Utilities

- City of Faith

- City of Pickstown

- Flandreau Municipal Utilities

- Fort Pierre Municipal Utilities

- Montana-Dakota Utilities

- Otter Tail Power Company

- Pierre Municipal Utilities

- Southeastern Electric Cooperative

- Vermillion Light & Power

- Watertown Municipal Utilities Department

- Winner Municipal Utilities

We recommend contacting your electric company to see if there are benefit programs available for efficiency upgrades. You can also check the Database of State Incentives for Renewables and Efficiency for more information on available perks.

Which Tax Incentives Are The Best In South Dakota?

There aren’t many incentives available in South Dakota, which means taking advantage of everything that’s available is crucial. As such, we suggest applying for the federal credit and taking advantage of the exemption for property taxes and net energy metering if it’s available.

Applying for the federal credit is a must, simply because there are so few other perks available to help make solar more affordable. Plus, this perk requires so little time and energy to apply for, making the average credit value of $9,797 well worth the effort.

The tax exemption for property taxes is another great perk that provides long-term savings and reduces the financial burden of adopting solar power. This incentive should be considered a must as well, especially since you don’t have to apply for it.

Finally, we strongly suggest enrolling in net energy metering if you have the option. This perk helps maximize your long-term energy savings and increase the value of your solar energy system overall. If the program is available to you, enrolling is a breeze, and your installer will likely complete the process for you.

What’s The Near Term Outlook For More Incentives In South Dakota?

There are no pieces of legislation in the works that will increase solar perks in the state in the near future. It’s unlikely that there will be new perks popping up in the coming years.

That could change if a new renewable energy goal is set. Usually, a progressive goal will trigger local utility companies and government agencies to offer more incentives to increase the use of renewable energy.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQs: Solar Incentives in South Dakota

Below, we’ll answer some of the questions we see most often from South Dakota homeowners pertaining to incentive programs and solar rebates.

At this time, there are no plans in place for new incentives to be offered or for the existing ones to be upgraded in any way. This could change if a new Renewable Portfolio Standard goal is set — the most recent one expired in 2015 — but we don’t expect that to happen in the next two years.

The Inflation Reduction Act (IRA) extended the federal tax credit program by ten years to 2034. It also increased the credit rate for 2022, 2023 and 2024 to 30%. Previously, these sat at 26%, 22% and 0%, respectively.

The IRA also made the tax credits for electric vehicles (EVs) more valuable, increasing the maximum credit to $7,500.

There doesn’t appear to be any threat to the solar perks available in the state, at least for the next two years. In most cases, we’d say states with an expired RPS goal are at risk of losing net energy metering, but the policy already isn’t mandated in South Dakota as it is.

The federal credit is guaranteed through 2034, and it’s unlikely that the property tax exemption in the state will be reduced or discontinued in the near future.

No, Solar Renewable Energy Certificates (SRECs) are not available in North Dakota. These certificates earned for every 1,000 kilowatt-hours (kWh) your solar system generates. These are separate from net energy metering credits and accrue for all production, even if you consume some or all of the energy on-site. SRECs can be sold for a profit if there is a local market for them.

Unfortunately, there is no open SREC market in South Dakota. This is largely due to the fact that the state doesn’t have an active RPS goal, which means there is little incentive for electric companies to buy clean energy credits.

Unfortunately, the state does not offer an exemption for sales tax for residential systems. That means you should expect to pay sales tax on all solar components, as well as the solar panel installation. There is a sales tax exemption for larger solar PV systems, but this only applies to things like community solar farms and larger commercial systems.

Related articles

Top Solar Installers in South Dakota Cities

Comparing authorized solar partners

-

- NABCEP-certified technicians

- Competitive pricing

- Multitude of products and services

- No leases or PPAs

- Limited warranty coverage

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe