Reviews

Reviews

South Carolina Solar Incentives (Rebates, Tax Credits & More in 2024)

In this EcoWatch guide to solar incentives in South Carolina, you’ll learn:

- Which solar incentives are the best in South Carolina

- How to claim the federal solar tax credit in South Carolina

- How to enroll in net metering in South Carolina

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do South Carolina Solar Incentives Make It Affordable for Homeowners to Go Solar?

Solar power incentives in South Carolina help make renewable energy resources more accessible for all. There is no denying that solar panels are expensive, and avg costs of panels in South Carolina can lead residents to pay anywhere from $26,160 to $45,780, with an average of $35,970, for their solar systems.

South Carolinians pay more for their systems than residents of other states. This is due to the combination of the $3.27 per-watt cost and the larger solar systems installed locally. Compared to some state residents that only need 5 kW to 6 kW solar systems, South Carolina residents often need 11 kw solar panel systems to offset energy costs.

Unlike some states that have initiated a mandatory renewable portfolio standard (RPS) and have lofty goals of using more than 30% or even 50% renewable energy sources by a certain year, South Carolina currently has a rather weak RPS with a non-mandatory goal for all utility companies to produce 2% of their aggregate energy from renewable sources.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Because solar panels cost more for residents of the Palmetto State, incentive programs have become increasingly important to help residents of all socioeconomic classes access renewable energy. Although South Carolina may have fewer solar incentive programs available and a weaker RPS compared to other states, it does have plenty of money-saving programs to offer. We’ll give you a quick look at these below.

| Solar Incentives in South Carolina | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | The federal tax credit for home solar energy systems allows residents to claim 30% of their solar installation costs as a tax credit. | After installation | $10,791 |

| South Carolina Solar Energy Tax Credit | State | South Carolina’s state tax credit for solar energy allows residents to claim 25% of their solar installation costs as a tax credit, up to $3,500. | After installation | $3,500 |

| Net metering in South Carolina | Local | Net metering allows South Carolinians to receive credits from their utility company for excess power their panels produce. | After installation | Opportunity to apply overproduction of electricity to future energy bills for monthly savings |

| Local incentives | Local | Some utilities, such as Santee Cooper, may offer solar rebates | During or after installation | Depends on utility company |

What Do South Carolina Residents Need to Know About the Federal Solar Tax Credit?

Regardless of which state you live in, all homeowners in the U.S. are eligible for the federal solar investment tax credit, or ITC, for installing solar panels as well as solar batteries and other energy storage equipment. You can claim the ITC on your federal tax return to deduct 30% of the total cost of your system from the taxes you owe.

With the average cost of a solar system in South Carolina at about $35,970, the federal tax credit can lead to a savings of about $10,791.

The ITC was first developed through the Energy Policy Act of 2005. Initially, it was set to last for just two years, but due to its success has continually been extended.

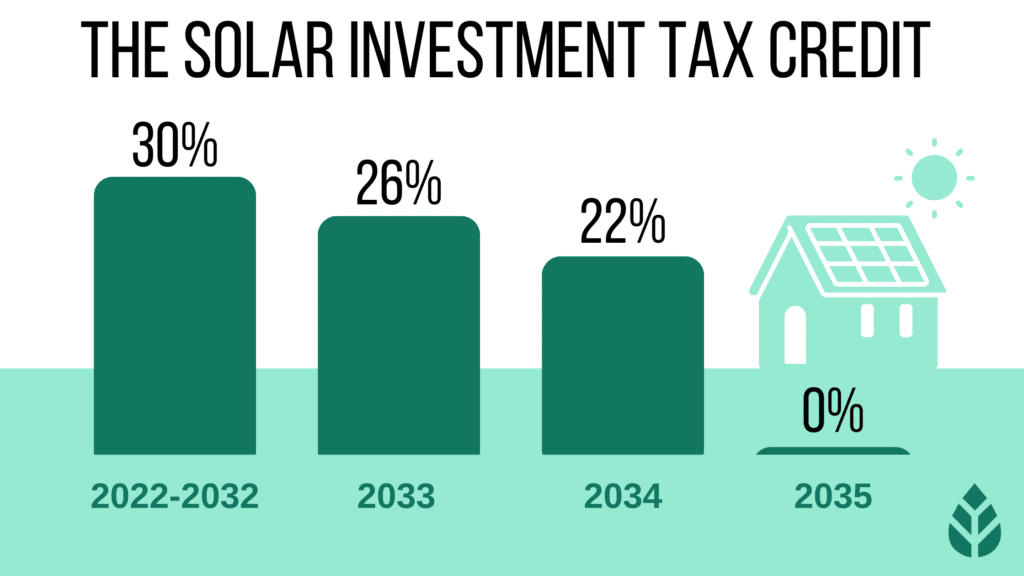

Most recently, the Biden administration renewed the ITC in 2022 through the passage of the Inflation Reduction Act. That bumped the ITC up from a 26% credit to a 30% credit for solar equipment installed through 2032. It’s set to reduce to 26% for systems installed in 2033 and 22% in 2034 before expiring in 2035, unless it’s renewed by Congress again.

To be eligible for the solar tax credit, homeowners must meet the following criteria:

- You have installed a residential solar energy system before 2035.

- You have placed the solar energy system in a residential location. It does not have to be your primary residence.

- You own the solar energy system, either having paid for it in cash or by taking out a solar loan. Homeowners who lease solar panels are not eligible to claim the ITC.

How to Claim the Federal ITC in South Carolina

Nearly everyone will qualify for the federal ITC as long as you own your own residential solar system. To claim the federal solar tax credit, residential customers must do the following:

- Claim the federal solar tax credit on your annual federal tax return

- Download IRS Form 5695

- Calculate your credit — 30% of the total cost of your solar energy system

- Add the calculations on lines 6a and 6b

- Complete line 14 using the Residential Energy Efficient Property Credit worksheet

- Do the calculations on lines 15 and 16

- Enter your calculations from lines 15 and 16 on line 5 of your 1040 form

- Your federal credit will go toward taxes owed

EcoWatch’s Opinion of the Federal ITC in South Carolina

The federal solar tax credit is one of our favorite incentives programs because it’s so widely available. Although it’s true that it requires some paperwork and financial knowledge, the 30% that you get back is well worth the extra effort.

The major downside of a tax credit is that you only see the money you get back applied to your taxes. Unlike other solar rebate programs that credit the money straight to the amount you owe, this money can only be used to go toward your annual taxes. The federal solar tax credit does roll over for five years, so talk to your tax advisor to come up with a plan to make sure you see this money applied to your taxes.

South Carolina Solar Energy Tax Credit

Good news for South Carolinians going solar: You’re eligible for one of the best solar state tax credits in the country. Residents of the Palmetto State can cut the cost of their solar energy systems by up to a quarter through the Solar Energy Tax Credit.

The credit allows solar users to claim 25% of their total system cost, capped at $3,500, as a tax credit. If 50% of the amount you owe to the IRS is lower than $3,500, then you can only take that amount as a credit. This means that if you spend the average amount of $35,970 on your home solar before the ITC, you stand to pay $32,470 instead. If you don’t pay enough in taxes to reap the full value of the credit in a single year, don’t sweat it. The tax credit carries over for up to 10 years.

The South Carolina Solar Energy Tax Credit isn’t just for solar photovoltaic (PV) systems — it also applies to solar water heaters, solar space heaters, geothermal heat pumps and small hydroelectric systems.

Combine this state tax credit with the 30% federal solar tax credit, and South Carolina residents can offset a huge chunk of a solar installation — assuming they have the tax liability to do so.

How to Claim the South Carolina Solar Energy Tax Credit

Similar to the federal solar tax credit, this state solar tax credit is meant to help South Carolina homeowners afford renewable energy. The application for this tax credit, which is credited toward the taxes you owe, is relatively simple:

- Find a reputable solar panel installer

- Your solar panels are installed

- Your solar panels are verified

- Fill out the application for SC’s clean energy credit

- Get approved for up to 25% back on your taxes

- See the credit applied at tax time

EcoWatch’s Opinion of South Carolina Solar Energy Tax Credit

The state of South Carolina offers an excellent tax credit for its residents to go solar. This perk comes highly recommended because the application is easy to fill out and is one of the highest potential financial benefits offered in the country. We also like that this tax credit is good for 10 years. When you compare this timeline to the federal tax credit’s five years, the South Carolina solar tax credit is definitely a winner.

The obvious downside to this incentive program is that it is a tax credit. Instead of going directly toward the amount you owe on your solar system, you only see this money when you have to pay your taxes. Because not everyone owes significant amounts of money come tax time, not everyone will be able to take full advantage of this incentive. If you’re worried you won’t benefit from this program, be sure to talk to your tax advisor.

Watch Below: Learn How Much This Homeowner Paid For Solar and If It Was Worth It

Net Metering in South Carolina

Net metering policies are important to consider when switching to solar energy. These policies allow homeowners to earn credits for the extra energy their solar systems produce. Then, when they use more energy than their solar energy system generates, they can use their credits for the difference. It’s a great way to minimize electricity bills.

In South Carolina, residents benefit from generous net metering policies, although lawmakers enacted a cap on net metering that became effective in June 2021, so customers who have gone solar since may not see as steep savings as customers who did so previously.

All South Carolina utilities (excluding cooperatives) with over 100,000 customers must offer net metering in the state. In April 2021, the South Carolina Public Service Commission approved a bid to keep net metering in place while gradually transitioning to Dominion Energy’s existing time-of-use (TOU) rate schedule.

How to Enroll in Net Metering in South Carolina

When you’re installing solar panels on your home, you’ll already be in touch with your current energy provider with the help of your solar installer. As part of this communication and your solar installation, you’ll need to enroll in net metering if your utility offers it.

Once you know for certain that your energy company offers net metering, the process will look like this:

- Before your installation, you’ll submit an application for interconnection to the utility. You’ll need to pay a $100 application fee.

- The utility will review your application and notify you of its approval. You’ll sign an agreement for net metering.

- Complete your installation and secure the final approval needed from your local jurisdiction.

- Once the utility has been notified of your local jurisdiction’s approval, it will come and inspect your system and install a bidirectional meter.

- Receive approval from the utility, turn on your system and begin saving on energy.

EcoWatch’s Opinion of Net Metering in South Carolina

Many net metering programs in South Carolina are generous and many homeowners have access to them. However, South Carolina lawmakers enacted a net metering policy that places a cap at 2% of each utility’s peak capacity. This means that the amount of solar that can subscribe to net metering is capped at 2% of the company’s average peak electricity demand over the past five years. In addition, residential customers can only install systems of 20 kW or less, which should amply accommodate most home solar arrays.

In addition to this cap, not all utility companies in South Carolina offer a one-to-one or full retail net metering plan. When an energy company does offer full retail, it means that the energy produced by your solar panels is equal in value to the electricity that is produced by your utility company. In South Carolina, some utility companies have plans that offer less than a one-to-one ratio, so this may negatively impact savings.

The best way to understand the net metering benefits available to you in South Carolina is to contact your utility for the specifics about what it offers, subject to state law.

Local Solar Incentives in South Carolina

Because solar and other forms of renewable energy are quickly becoming vital in today’s energy economy, some utility companies in South Carolina have begun to offer their own rebate programs. Contact your local utility to see what incentives it has available.

Which Tax Incentives Are Best in South Carolina?

We’ve mentioned all of the incentives available for installing solar equipment in South Carolina above, but not all perks are equal in the value they provide. Below, we’ll offer our opinion on which incentives are the most valuable for solar customers in the Palmetto State.

Federal Solar Tax Credit

In our opinion, the federal credit is the best incentive available to South Carolinians. The credit can effectively bring down your system costs by 30%, and the time it takes to apply is minimal.

This incentive is worth the time it takes to request and can offer an average potential savings of over $10,700. Plus, it’s offered by the federal government, so it’s guaranteed to be available to all property owners in the Palmetto State.

South Carolina Solar Energy Tax Credit

This is another impressive solar perk available to all South Carolinians – worth 25% of your total system cost or 50% of your income tax burden, whichever is less. There’s a cap of $3,500, and a rollover period of ten years. This benefit is still worth up to $3,500 on a system cost of $35,970 – and you get a longer rollover period than with the federal ITC.

Net Metering

Net energy metering is another hugely beneficial solar perk in South Carolina. This benefit program helps you achieve maximum energy savings with your PV system.

What’s the Near-Term Outlook for More Incentives in South Carolina?

South Carolina currently has a non-mandatory RPS, so there is little incentive for the state and local energy companies to offer renewable energy incentives. However, many local utility companies have begun to offer excellent rebate programs despite South Carolina’s minimal push to solar and other renewable energy.

The most exciting bill that could move forward in 2024 is one that would exempt solar equipment from sales tax. This bill was proposed in 2021 and remained relatively stagnant throughout 2022, but there is hope that it will come to fruition in the next year.

Read More About Going Solar in South Carolina

- The Best Solar Companies in South Carolina

- South Carolina Solar Panel Cost Guide

- Are Solar Panels Worth It In South Carolina?

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Solar Incentives in South Carolina

Here at EcoWatch, we field many questions from South Carolina homeowners who are interested in going solar. Here are some of the more common queries we see. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

Be on the lookout in 2024 for a bill at the South Carolina state legislature that could exempt solar equipment from sales tax.

There have been no new major incentives programs in South Carolina since the passing of the Inflation Reduction Act. More local utility companies continue to offer incentives and rebates for qualifying residential customers.

There is no current plan or legislation to reduce incentives for rooftop solar in South Carolina in the next 24 months.

South Carolina does not currently have a market for SRECs or TRECs and there is no indication that it will offer these credits in the near future as it does not have a mandatory RPS.

Top Solar Installers in South Carolina Cities

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe