Reviews

Reviews

Kansas Solar Incentives (Rebates, Tax Credits & More in 2024)

In this guide to making solar more affordable through incentives available in Kansas, you’ll learn:

- What solar benefit programs are currently available in Kansas?

- How do the solar perks and solar rebate programs in Kansas affect the average cost of going solar in the area?

- What are the most important and beneficial incentive programs to take advantage of in Kansas?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Kansas Solar Incentives Make It Affordable for Homeowners to Go Solar?

Yes, absolutely! Although there are fewer solar rebate and incentive programs than there are in most other states, the ones that are available can help bring down your conversion costs by thousands of dollars.

The typical up-front cost for solar conversion in the Kansas area is around $28,800, which is just below the national average. This number is based on the typical cost per watt for solar equipment — $3.20 in The Sunflower State — and the average solar system size — 9 kilowatts (kW) — required to offset typical utility bills in the area.

While the cost is about average, it’s still prohibitively expensive for many homeowners. Thankfully, the state’s Renewable Portfolio Standard (RPS) goal that 20% of a utility’s peak electricity demand be generated from renewable energy resources by the year 2020 has helped pave the way for a handful of benefit programs that help bring down the effective conversion costs in the area.

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Astrawatt Solar

Average cost

Pros

- Comprehensive service offerings

- Excellent reputation

- Award-winning company

- Educational, no-pressure sales approach

Cons

- Limited service area

- Relatively young company

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

In the table below, we’ll include a list of all of the perks available in the state, as well as a brief description and an estimated savings each can provide.

| Solar Incentives in Kansas | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Provides a credit for 30% of your entire system cost that gets applied to your income tax liability. | One-time: The credit is applied once when you file your taxes after installation. However, any remaining credit can be applied for four additional tax years. | $8,640, on average |

| Renewable Energy Property Tax Exemption | State | Prevents your property taxes from increasing following solar adoption. | Ongoing: You’ll see savings on your tax bill for every year your system holds value. | Varies based on your system size and value, as well as your local property tax rate |

| Net Metering | Local | Provides credits to your energy bills for all excess power your system generates and sends to the electric grid. | Always in Effect: This perk will provide energy credits for as long as your system continues to produce electricity. | Varies based on your system size, your monthly energy bills and more |

| Local Incentives | Local | Solar and energy efficiency rebate programs and other perks provided by local agencies, including municipalities and utility companies. | Varies based on the incentive. | Varies based on the incentive, your system size and more. Eligibility also varies. |

What Do Kansans Need to Know About the Federal Solar Tax Credit?

The federal tax credit is provided by the federal government to all solar adopters throughout the state and the rest of the country. When you install solar, 30% of the cost of your system — including panels, solar batteries and inverters — gets credited to your federal tax burden when you file for the credit.

Given the typical system cost of $28,800 in your area, the average credit totals about $8,640. Provided you owe at least that much in taxes over the five years following your installation, you can take the entire credit and effectively reduce your system cost by nearly $8,700.

We’ll get into why later on, but we believe batteries are going to become more or less a requirement for solar installations in Kansas in the future. Luckily, the ITC applies to all solar equipment, including batteries. Since batteries add between $10,000 and $20,000 to installation costs, on average, the average ITC value in the state could be as high as $14,640 in the future (using the current cost of panels and batteries).

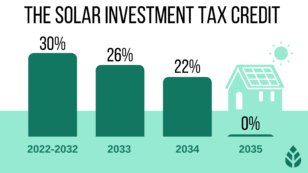

The federal solar tax credit was first offered to solar adopters in 2005. At that time, the bill that initiated the credit was set to expire in 2024, at which time the credit would no longer be available. The original credit amount was 30%, which then dropped to 26% at the start of 2022 and was scheduled to drop further to 22% in 2023 before it disappeared entirely.

In August of 2022, Congress signed the Inflation Reduction Act (IRA), which bumped the solar tax credit back up to 30% for 2022 installations — including those that took place between the start of 2022 and the signing of the new bill. The IRA also pushed out the expiration of the credit and revamped the rate schedule:

- All installations from 2022 through 2032 will receive the 30% credit

- Installations completed in 2033 will receive a 26% credit

- Installations completed in 2034 will receive a 22% credit

- Installations completed in 2035 or beyond will not receive any credit

How to Claim the Federal ITC in Kansas

Not only does the federal credit provide a massive financial benefit, but it’s also easy to apply for. You can follow the below steps to take advantage of this perk.

- Step 1: Complete your home solar system installation.

- Step 2: Print out IRS form 5695 and fill it out. You’ll need contact information for your solar contractor as well as some basic information about your solar panel system, including the cost, size and installation site.

- Step 3: Append the completed form to your tax return, or have your accountant include it with your filing for you.

If you use tax software to file, you should get a dedicated prompt regarding clean energy equipment, so you don’t need to print or fill out the physical form.

EcoWatch’s Opinion on the Federal ITC in Kansas

The federal credit is the most beneficial perk you can take, in our opinion. The credit value is an incredible $8,640, on average, and it typically takes less than five minutes to fill out the single form required to get the credit.

This credit is a great option in every state, but it’s especially helpful for making solar more affordable in areas like The Sunflower State, where there are relatively few other incentives available. Plus, if and when net metering rates decline or availability goes away altogether, the ITC will be a key player in making sure solar systems plus battery storage remain as affordable as possible.

We should note that while the credit is available to all homeowners, you can only take the credit if you owe that amount on your income taxes. If you don’t owe any money or the government owes you, the credit will still apply but not actually provide any benefit. You’ll need to owe an average of $1,728 per year for five years to be able to take the full amount.

Watch Below: Learn How Kansas City’s Plan for the Nation’s Largest Solar Array Will Affect You

What You Need to Know About the Exemption for Property Taxes in Kansas

Normally, any home improvement you carry out that increases the value of your home or property will cause your property taxes to go up, provided you file permits for the work. Your tax assessor will review the permits and any additions or improvements and then base your new taxes on your total assessed value.

Since solar conversion boosts your home value by an average of 4.1%, the improvement would normally cause your property taxes to increase.1 This tax exemption prevents that from happening.

It’s difficult to say exactly how much you’ll save by taking advantage of this perk. With an average solar power system cost in Kansas of $28,800 and a state property tax rate of 1.33%, you can expect a savings of about $383 per year, not accounting for system depreciation.

Over the 20 years your system is expected to hold value, that’s a total savings of $7,660. Since your system will naturally lose value, your actual savings would be lower.

How to Claim the Property Tax Exemption in Kansas

One of the best parts of the exemption for property taxes is that the savings happen automatically, so you don’t need to spend any time applying for the program. Your tax assessor will simply ignore the value added by your photovoltaic (PV) panels when assessing your home value for taxation.

EcoWatch’s Opinion on the Exemption for Property Taxes in Kansas

Property tax exemptions are a great way for states to reduce the financial burden and long-term costs associated with converting to solar power. We love seeing these exemptions, especially because the benefits are realized automatically and don’t take time or effort for an application process.

Plus, the expected savings are substantial, making this an all-around great perk.

Net Energy Metering in Kansas

Net energy metering is a policy that credits you for any excess power your panels produce that you send to the grid. Those credits act as “banked energy” that you can call on at a later date if your energy demands exceed your solar power production.

Net energy metering (NEM) provides a handful of massive benefits for customers:

- Maximizes the overall value your panels provide

- Maximizes the energy savings you’ll realize over time by reducing effective electricity rates

- Minimizes your carbon footprint and reliance on fossil fuels

- Reduces the typical solar panel payback period

The average savings you’ll see from net energy metering are hard to determine due to several factors. The average energy savings from converting to solar in your area total around $24,685, and net energy metering can help you achieve those savings more easily and quickly.

Net energy metering is mandated for all investor-owned utilities (IOUs) in your area, including Westar Energy, Kansas City Power & Light and Empire District Electric. Some electric cooperatives and public electric companies also opt to offer NEM.

The minimum rate at which credits are provided is set by the Kansas Corporation Commission (KCC), the Public Utilities Commission (PUC) in the state. The rate is set to the average cost rate, which is lower than the retail rate that was mandated prior to July 1, 2014.

We should caution you that NEM policies throughout the U.S. have been facing some turmoil in recent years. Many states are seeing the policy go away altogether, while others are seeing less beneficial credit rates or charges to partake in the program. California, the #1 state for solar incentives in the country, just rolled out NEM 3.0 in 2024, which drastically reduced the net metering credit rate. We expect net metering to disappear in Kansas in the future, so now is a great time to go solar to make sure you’re grandfathered in to the current policy.

How to Enroll in Net Metering in Kansas

If you choose a reputable solar contractor in Kansas, then chances are your installer will complete and file the net energy metering application for you. As such, the process of enrolling is automatic for most. Still, you should follow the steps below to ensure you partake of this solar perk.

- Step 1: Reach out to your utility company and ask if you have a bidirectional meter on your home. This is required for interconnection and should be provided for free if you don’t already have one.

- Step 2: Contact a reliable solar panel installation company in your area. We recommend confirming with the rep that the company will complete the NEM application on your behalf.

- Step 3: Proceed with the solar installation.

- Step 4: You can check your utility bills for a month or two following the installation process. You should see credits applied to your account for solar energy exportation. If you don’t, contact your installer to report the issue.

EcoWatch’s Opinion on Net Metering in Kansas

Net energy metering is an outstanding solar perk and, we believe, one of the most crucial to take advantage of. The application process is very often handled by your installer, which means you won’t have to spend any time enrolling. Even if you do have to apply yourself, the process is fairly simple.

In addition to being easy to enroll in, NEM helps increase the value of your solar energy system and save you more on electric bills over time. All in all, the value you get for the time investment is excellent.

Net metering is expected to go away in the future, but it remains a very valuable perk for current customers and people who go solar before it’s discontinued.

Local Solar Incentives in Kansas

Many states have local perks provided by utility companies or cities. Unfortunately, Kansas doesn’t have any additional incentives aside from the federal and state ones mentioned above.

This is always subject to change, so we recommend checking the Database of State Incentives for Renewables and Efficiency (DSIRE) for more solar or energy efficiency programs before installing your PV system.

Which Tax Incentives Are The Best In Kansas?

Above, we’ve discussed all of the incentives available in your area. If you don’t plan on taking advantage of every perk that you can, we suggest focusing your efforts on the incentives below, as these make converting to solar in Kansas most worthwhile.

The Federal Tax Credit

The federal credit is what we believe is the most valuable perk available in your area. It’s open to all solar customers and provides an average potential value of about $8,640. Plus, you can realize the entire credit amount the first year you have your panels installed, depending on how much you owe in taxes.

Net Energy Metering

NEM is another perk we strongly suggest taking advantage of if it’s available to you. The application process is often done for you by your installer, so there’s minimal effort required on your part. Plus, this perk helps improve the value provided by your panels and maximizes your overall energy savings.

Net metering effectively makes solar batteries a non-necessity, which means it effectively saves you between $10,000 and $20,000 on batteries in upfront cost as well. That’s a huge deal, and it won’t be around forever, so future customers might have to pay more for a system with batteries to see similar perks.

What’s The Near Term Outlook For More Incentives In Kansas?

As of right now, there are no plans in place to create new solar benefit programs or improve the existing ones in the state. While there is a Renewable Portfolio Standard goal in place, it isn’t mandatory or progressive and just calls for 20% of the state’s energy to come from clean sources each year after 2020. Solar is still a great way to save money in the long run and while Kansas incentives are less appealing than other states, there are still plenty of options to finance your solar system. Not to mention the payback period for most solar systems on average is 8 years- after which is pure profit.

If a new, more progressive RPS goal is set, it’s possible that additional incentives will be created to entice more Kansas homeowners to convert to solar. However, it doesn’t appear that there are any plans for that to happen. The local solar industry is expected to be stagnant in the coming years unless a change is made.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Kansas Solar Incentives

Below, we’ll answer some questions we see frequently from solar customers in your area looking to save money using solar benefit programs.

Solar Renewable Energy Certificates (SRECs) are credits that a state offers for every kilowatt-hour (kWh) of solar energy produced. Each SREC can be sold on a local SREC market, which yields a small profit.

SRECs are only available in areas where there are open SREC markets. Unfortunately, Kansas does not have an open market, so solar customers in the area cannot take advantage of this perk.

At this time, there is no legislation in the works to improve existing incentives, and there are no confirmed plans for new perks to pop up in the next two years. We’d love to see the state improve its RPS goal, which would likely lead to improved benefit programs. However, we don’t expect that to happen in the near future.

The Inflation Reduction Act (IRA) was a pleasant surprise for the solar industry that was passed in 2022.

It extended the federal credit — which was originally planned to be discontinued in 2024 — to 2034. It also increased the credit value from 26% for 2022 and 22% for 2023 up to 30%. This retroactively included installations completed in 2022 but before the bill was passed in August.

The IRA also had a positive impact on the electric vehicle (EV) industry. It bumped up the tax credit available for some makes and models. The credit now maxes out at $7,500 for some EVs

There are no plans to reduce the incentives available for solar systems in the next two years. However, many states are seeing their net metering policies get less appealing, or the programs going away entirely.

If there are reductions to incentives in the coming years, we expect that the net energy metering policy will be the first one affected.

Top Solar Installers in Kansas Cities

Comparing authorized solar partners

-

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

- Doesn't offer solar batteries (coming 2022)

A+Best Solar Financing2014Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe