Iowa Solar Incentives (Rebates, Tax Credits & More in 2024)

In this EcoWatch guide to Iowa’s solar incentives, you’ll learn:

- What solar incentives are available in Iowa?

- Is there a solar tax credit in Iowa?

- Does Iowa have solar rebates?

- Can you sell solar power back to the grid in Iowa?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Iowa Solar Incentives Make It Affordable for Homeowners to Go Solar?

Iowa’s solar incentives save homeowners money on solar panels, especially since it’s a little more expensive to go solar there. The cost of solar in Iowa is about $33,030 for the average 9 kilowatt (kW) system, compared to the national average of $29,970 for the same system size.

Unfortunately, the state government has done away with Iowa’s generous solar state tax credit as of 2021. It was previously one of the best solar incentives in Iowa—worth 50% of your federal investment tax credit (ITC) value.

On the bright side, you can still claim the ITC in Iowa, which leads to a tax credit value of $9,909 for the average Iowa solar installation. The Hawkeye State also offers other solar incentives such as a sales tax exemption, property tax exemption, net metering and local solar rebates.

Iowa was the first state to adopt a Renewable Portfolio Standard (RPS) back in 1983, which required its two investor-owned utilities (MidAmerican Energy and Alliant Energy Interstate Power and Light) to own or to contract for a combined total of 105 megawatts (MW) of renewable generating capacity and associated energy production.

While Iowa was the trailblazer for RPS, the state hasn’t done much to bring its goals into the 21st century. The state has since not only met but far surpassed its 105 MW goal — mainly due to wind energy — and hasn’t made much effort to set a new goal.

With that said, we recommend installing solar panels in Iowa sooner rather than later to capitalize on the incentives that are still available.

Purelight Power

Regional Service

Average cost

Pros

- Offers products from leading manufacturers

- Great warranty coverage

- Outstanding customer service

Cons

- Relatively young company

- Quality of installation may vary by location

Energy Consultants Group (ECG)

Local Service

Average cost

Pros

- Competitive pricing

- Comprehensive service offerings

- Many years of experience

Cons

- Limited service area

In the table below we’ve given you an at-a-glance look at all of the solar incentives available in Iowa. We’ll provide additional information about each, including some local incentives from specific municipalities and individual utility companies.

Please note that nearly all solar incentives in Iowa are only available if you pay for your solar panels with cash or a loan. Solar leases and power purchase agreements (PPA’s) will make you ineligible for most solar benefits.

| Solar Incentives in Iowa | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Residential solar panels purchased and installed by December 31, 2032, are eligible for a tax credit worth 30% of the total system cost | One-time: Credit is applied when you file your taxes during the year your system is installed. If the credit is greater than what you owe in taxes, it can roll over up to five years. | The average tax credit value is $9,909 in Iowa, but will vary based on system size and total cost |

| Solar Sales Tax Exemption | State | Qualifying solar energy equipment is exempt from Iowa’s 6% sales tax (and 1% local option sales tax, if applicable) | One-time: Tax savings received upon solar equipment purchase | Average savings of $1,981 |

| Solar Property Tax Exemption | State | The assessed value of your system is exempt from property values for five years after installation | Five years: After five years, your solar system may be assessed as part of your property value | Annual savings is around $495 (for a five-year total savings of $2,475) |

| Net metering | Local | Allows you to earn electricity credits for the energy your panels produce and send to the grid. | Ongoing: Your billing credits can be used on your monthly bills with expiration after a year. | Varies based on utility and solar energy production |

| Local incentives | Local | Certain utilities and municipalities in Iowa offer solar rebates | One-time: Rebate is issued upon solar system purchase | Varies based on location and utility |

What Do Iowa Residents Need to Know About the Federal Solar Tax Credit?

The best solar incentive in Iowa is the federal solar investment tax credit, or ITC. It’s important to note, though, that this isn’t a solar rebate, but rather a tax savings worth up to 30% of your solar project cost.

The average Iowa homeowner installs a 9 kW solar system, which costs $33,030 based on the $3.67 per watt price of solar in The Hawkeye State. Based on this price, the federal solar energy system tax credit value would be $9,909, which is higher than the national average of $8,991.

The ITC doesn’t save you money on solar panels up front. However, come tax season, you can deduct your tax credit value from the taxes you owe. If you owe less than 30% of your solar system, the ITC rolls over up to five years.

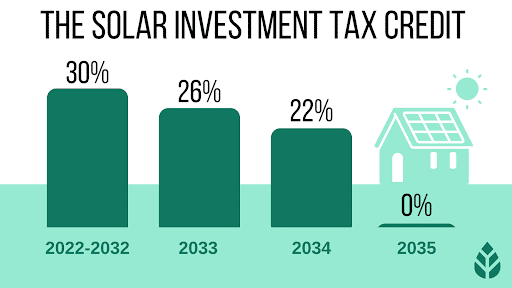

Thanks to the passage of the Inflation Reduction Act of 2022, the ITC is available to Iowans — and all Americans who install solar — at the following rate schedule:

- 30% of your total system value for solar photovoltaic (PV) systems installed between 2022 and 2032

- 26% of your total system value for solar PV systems installed in 2033

- 22% of your total system value for solar PV systems installed in 2034

- Credit discontinued for systems installed starting in 2035, unless extended again by Congress

How to Claim the Federal ITC in Iowa

We recommend working with a tax professional and one of the best solar companies in Iowa for guidance on how to claim the ITC. But if you’re wondering how to claim the federal government’s solar tax credit, below are the five steps:

- Download IRS Form 5695. This home solar tax credit form can be downloaded straight from the IRS.

- Calculate your credit on Part I of the tax form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

- If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

- On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet (found here). Then, complete calculations on lines 15 and 16.

- Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

Remember, your solar tax credit will only offset the taxes you owe on your return. If the taxes you owe are less than the credit you earn, the credit will roll over year after year for up to five years.

EcoWatch’s Opinion on the Federal ITC in Iowa

We love the ITC because it’s the best solar incentive available in Iowa. The average residential installation in Iowa can lead to a tax savings close to $10,000, which is huge.

The ITC is also easy to claim and, because it’s available to solar users nationwide, all solar companies are familiar with how it works.

That said, the ITC isn’t a great incentive for every taxpayer. For one, it’s not instant, so it doesn’t help with the up-front cost of solar. Plus, if you don’t owe up to 30% of your solar installation costs in taxes — even over five years — you won’t receive the full benefit.

Watch Below: Learn How Much This Homeowner Paid For Solar and If It Was Worth It

Solar Sales Tax Exemption in Iowa

Iowa law allows solar energy equipment to be exempt from the state’s 6% sales tax, plus the additional 1% local sales tax it applies. This leads to an average savings of between $1,981 and $2,312 for a 9 kW solar system.

The solar sales tax exemption in Iowa only applies to the equipment directly involved in “collecting, converting or transmitting” clean energy — like solar panels, inverters or solar roof shingles.1

Additional equipment, like the racking mounts for your solar array or solar batteries for energy storage, will not be exempt from the sales tax.

How to Claim Iowa’s Solar Sales Tax Exemption

Fortunately you don’t have to do anything to claim this Iowa solar incentive. When you go solar in Iowa, qualifying solar equipment will automatically be exempt from the sales tax, and your total cost will reflect the exemption.

EcoWatch’s Opinion on Iowa’s Solar Sales Tax Exemption

We’re a fan of anything that allows you to save money on solar panels, but Iowa’s solar sales tax exemption allows you to save roughly $2,000 on your solar project — that’s huge! It’s also nice that this solar incentive doesn’t involve any pesky paperwork or waiting lists.

However, we do wish the tax exemption covered the entire solar purchase and not just certain solar equipment. It’d be nice to see Iowa add an incentive for solar batteries, too, especially because batteries are likely going to be a necessity in the coming years — more on that later in the net metering section.

Solar Property Tax Exemption in Iowa

Believe it or not, adding solar panels increases the value of your home. But thanks to Iowa’s solar property tax exemption, you won’t have to worry about increased property taxes for the five property assessment years post solar installation.2

Based on the average property tax rate of 1.50% and Iowa’s average solar system cost of $33,030, you can expect an annual savings from solar of roughly $495, or a total property tax savings of around $2,475 over the five-year period.3

How to Claim Iowa’s Solar Property Tax Exemption

Similar to the sales tax exemption, taking advantage of Iowa’s property tax exemption doesn’t require any time or effort on your part. Your tax assessor simply won’t include the value of your solar system when determining your property taxes. That means the property value added by your solar array won’t be taxed for five years.

EcoWatch’s Opinion on Iowa’s Property Tax Exemption

Not every state offers a tax exemption, so we love to see that Iowa offers this solar incentive. Especially because Iowa has a higher property tax rate than average — the eleventh highest in the nation.4

However, we’d love to see Iowa extend the property tax exemption beyond a five-year period. Some states, like New York, offer a 15-year exemption that protects solar users for roughly half of the life of their solar panel system. Nonetheless, it’s a great incentive that will prevent your taxes from increasing until you have some electric bill savings to offset the bump.

Net Metering in Iowa

Net energy metering is an amazing solar incentive that allows solar users to earn energy credits for the excess energy their panels produce and contribute to their local electric grid.

Those credits can then be used to pay for the energy that solar users will be taking from the grid during periods when their panels aren’t producing electricity, like at night or during storms.

Iowa households used to be able to take part in net metering and earn credits that would roll over indefinitely, but net metering laws changed in July 2020 under the bill Iowa S.F. 583. As it currently stands, utilities have the option to offer net billing (which is similar to net metering) or an inflow-outflow billing plan to all new solar users, both of which have one-year expiration dates for credits accrued.

Net metering can be a bit confusing to understand, especially in Iowa where it has different names and processes for different solar users. But here’s the basic gist of how Iowa’s two processes (net billing and inflow/outflow solar billing) can work:

Iowa’s Net Billing:

- Any kWh of energy imported from the utility to a solar user will be paid for by the solar user at the retail electricity rate

- Any kWh of energy exported from the solar user to the grid will be credited back to the solar users at the full kWh rate

- Credits will be given monthly to offset solar users’ electric bills

- Credits will roll over for up to 12 months, with customers choosing either a January or April cash-out date

- Credit cash-out rate will equal the utility’s “avoided cost” rate, with one-half credited to customer and one-half going to utilities’ low-income home energy assistance program (LIHEAP)5

Iowa’s Inflow/Outflow Solar Billing:

- Any kWh imported from the utility by the solar user (inflow) will be paid by the solar user at the retail rate

- Any kWh exported from the grid (outflow) will be credited to the solar user at the outflow rate (pre-determined by utility, locked in for 20 years)

- Outflow credits will go towards offsetting monthly electric bills (not including monthly meter fee)

- Credit balances can be carried up to 12 months with January or April cash-out date

- At the end of the 12-month period, credits will be forfeited by solar user and instead be used by utility to lower costs for all customers

- Utility is allowed to recover customer credits for outflow through a rider on all bills6

The outflow rate — based on a predetermined Value of Solar (VOS) by each Iowa utility company — will be updated annually. That means that if you go solar this year and your neighbor goes solar next year, you may receive different credit amounts back on your utility bill.

We should mention that net metering is one of the most commonly changed solar incentives in the country, so you can expect changes to these rates and regulations as time goes on. Importantly, California rolled out net metering 3.0 in mid-2024, which made NEM less valuable by decreasing the credit rate per kWh a system exports to the grid. Most states, including Iowa, will probably follow this same trend in the coming years.

This is especially important to be aware of because it will mean that batteries are likely to become a necessity for any solar customer looking for a good solar panel payback period and savings over time. Batteries will push up your solar installation costs by between $10,000 and $20,000, on average, which means they’ll also cut into your all-in savings. Keep an eye out for changes to Iowa’s net metering policy to make sure you’re up to date on the credit rate you’ll receive via net metering.

How to Enroll in Net Metering in Iowa

Enrolling in net metering in Iowa will look different depending on your utility company.

If your utility is Alliant Energy, you can visit this webpage or contact Alliant’s Renewable Energy team at 1-800-972-5325 (8 a.m.–4:30 p.m. Monday–Friday) or by email at sellmypower@alliantenergy.com.

If your utility is MidAmerican Energy company, you can visit its website here for instructions or email net metering questions to privategeneration@midamerican.com.

Net metering and solar interconnection can be a complicated process, but fortunately your solar installer can help you out.

EcoWatch’s Opinion on Net Metering in Iowa

You’re not going to make money by cashing out your net metering credits in Iowa. However, you can use these energy credits to significantly reduce — or even eliminate — your utility bills altogether, which can save you money. That could change if and when net metering 3.0 comes to Iowa, but for now, net metering is still a good incentive that can help you maximize your electric bill savings.

Local Solar Incentives in Iowa

While the state of Iowa doesn’t offer any solar rebates, there are some local incentives available to residents in certain cities or customers of certain utilities.

We’ve outlined some of the solar rebates we found in Iowa below, but we encourage you to call your municipality or ask your solar installer about what additional solar incentives may be available to you. Sometimes solar companies offer their own solar rebates or promotional incentives.

- Ames Electric Department Residential Energy Efficiency Rebate Program: Ames residents can claim a photovoltaic rebate worth $300 per kW of electricity generated at the utility’s peak hours (5 p.m.).7 To claim this rebate, you’ll need to:

- Have your solar installation pre-approved by the City of Ames

- Fill out the application for the Photovoltaic Installation Rebate

- Calculate your solar system’s energy production — specifically the greatest output it produces at 5 p.m.

- Note that, as of a program update in September 2024, you can also get up to a $500 rebate when you install a level 2 electric vehicle (EV) charger.

- Waverly Utilities: Customers of this utility can apply for a solar water heater rebate worth $30 per square foot of collector area, capped at $3,500. You can visit Waverly’s website here for more information on qualifications and how to apply.

Which Tax Incentives Are The Best In Iowa?

Here’s our ranking of Iowa’s solar incentives based on what we think represents the greatest benefit to solar customers:

- Federal solar tax credit: Worth a whopping $9,909 on average, the ITC is by far Iowa’s biggest solar incentive.

- State sales tax exemption: Iowans save an average of $1,981 on solar panels thanks to the state’s sales tax exemption — which not every state offers.

- Net metering: While you’re not going to make money by selling your solar power to the grid in Iowa, you can earn valuable energy credits that can lower your electricity bills.

What’s The Near-Term Outlook For More Solar Incentives In Iowa?

Since we’ve seen Iowa’s extremely generous state tax credit disappear in 2021 and less-favorable net metering laws enacted, we don’t anticipate any new solar incentives will become available in Iowa anytime soon. In fact, if there is a change coming in the future, it’s probably going to be a downgrade for net metering to the new NEM 3.0 program that was recently put in place in California. This will make batteries a necessity and will severely cut into prospective net savings.

We recommend going solar sooner rather than later to capitalize on the current incentives available in Iowa because there’s a chance they’ll be rolled back even further.

While Iowa was the first state to enact an RPS goal back in 1983, it seems the state doesn’t have continued ambition for clean energy alternatives. That’s not to say that Iowa isn’t doing its part when it comes to renewable energy — more than half of the state’s electricity generation comes from wind power.8 But less than 1% of Iowa’s electricity comes from solar power, and the state ranks 27th for solar installations.9

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Iowa Solar Incentives

At EcoWatch, we’re happy to get questions frequently from Iowans about how to save money when converting to solar power. Below are some of the questions we see most often, along with our responses. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

Unfortunately, Iowa’s solar tax credit expired in 2021 and was not renewed by the state legislature. However, Iowans can still claim the federal solar tax credit.

Homeowners who install solar panels in Iowa in 2024 will be able to capitalize on solar incentives like the federal tax credit, the solar sales tax exemption, the solar property tax exemption and Iowa’s net metering program. Depending on where you live, you may also be eligible for solar rebates from your municipality or utility.

Most home improvements that increase your property value will also bump up your property taxes. Even though installing solar panels boosts your property value, they won’t cause your taxes to go up for five years because of Iowa’s property tax exemption. This solar incentive prevents you from having to pay more in taxes just because you converted to clean energy. But after five years, the exemption expires and you will have to pay an increased property tax rate.

No, Iowa does not have an SREC market, mainly because its RPS goals have been met (and never included a solar specification to begin with). Unless Iowa adopts a new RPS, we don’t anticipate the state offering SRECs.

Related articles

Top Solar Installers in Iowa Cities

Comparing authorized solar partners

-

- Offers products from leading manufacturers

- Great warranty coverage

- Outstanding customer service

- Relatively young company

- Quality of installation may vary by location

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe