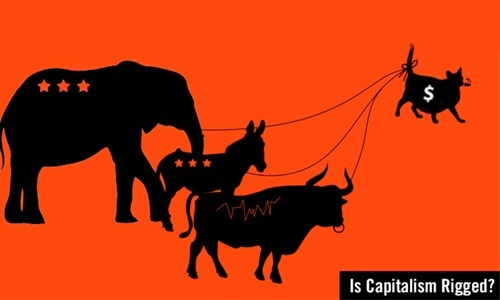

Can American capitalism be saved from its most predatory, selfish instincts?

Could the U.S. economy spread its wealth—if the public and political class understood how today’s unprecedented domination by monopolistic corporations have undermined opportunity, wages and income and public confidence in the future?

Exclusive excerpt from @RBReich's new book, SAVING CAPITALISM, out 9/29. #ForTheMany http://t.co/RHsKXp18xt pic.twitter.com/VbTwnHnwoF

— Alfred A. Knopf (@AAKnopf) September 22, 2015

In other words, what would it take to reshape the marketplace so Americans do not feel they are endlessly emptying their pockets almost every time they access health care, use bank or use credit cards, repay student loans or bills for necessities such as internet access—which have been steadily ticking upward and outpacing income growth.

This audacious question and challenge is the topic of Robert Reich’s new book, Saving Capitalism: For The Many, Not The Few. In it, the ex-Secretary of Labor and political economy scholar outs “the new monopolists,” debunks their “free-market” ideology and rhetoric and offers a pragmatic reform-filled path forward.

Reich wants to reframe the way Americans understand and talk about the economy. His starting point is to start correctly labeling today’s widespread corporate consolidation as the nation’s latest monopololy-filled era. He provides plenty of examples of name-brand businesses and sectors that have consolidated their control of the choices that consumers face, such as Apple’s operating system or Comcast’s telecom services. But his definition doesn’t stop there. These corporate behemoths also manipulate government to their great benefit, sometimes take advantage of state power—such as by gaining patents to ensure market dominance, while simultaneously lobbying other arms of government to impede possibly regulatory actions that might alter business models or profits.

But perhaps Reich’s largest target is taking on the very language used by the business world that perpetuates the myth that the private sector exists as magical sphere entirely unrelated to government. As he bluntly says and shows, there is no such thing as the “free market” or a natural governing economic principle that “the market knows best.”

“Few ideas have more profoundly poisoned the minds of more people than the notion of a ‘free market’ existing somewhere in the universe, into which the government ‘intrudes,’” Reich writes early in the book. “In this view, whatever inequality or insecurity the market generates is assumed to be natural and the inevitable consequences of impersonal ‘market forces’ … If you aren’t paid enough to live on, so be it. If others rake in billions, they must be worth it. If millions of people are unemployed or their paychecks are shrinking or they’ll have to work two or three jobs and have no idea what they’ll be earning next month or even next week, that’s unfortunate but it’s the outcome of ‘market forces.’”

Out 9/29! Amazon: http://t.co/5igdmg1gVR Barnes & Noble: http://t.co/4o99BmfOZx IndieBound: http://t.co/EQpeOJQmVk pic.twitter.com/GwQtHpxddx

— Constitution Sue (@constitutionsue) September 25, 2015

Reich’s point is governing classes and government have always created the rules of the economic game. These legal frames and the systems they support affect a nation’s well-being and daily life more than the size of any government program. Reich gives many examples tracing how wealthy interests have used a mix of contributing to candidates’ political campaigns and deployed post-election lobbying to create a system that’s neither free nor arbitrary, but rigged to benefit the few at the expense of the many. He does this by breaking down the building blocks of American capitalism in order to show how the economy is constructed and where it must change. He delves into what it means to own property, what degree of monopoly is permissible, how contracts have evolved, what are the options when bills can’t be paid and how the economy’s rules are enforced.

“The rules are the economy,” he writes, saying this is not a new observation. “As the economic historian Karl Polanyi recognized [in his book, The Great Transformation], those who are argue for ‘less government’ are really arguing for different government—often one that favors them or their patrons. ‘Deregulation’ of the financial sector in the 1980s and 1990s, for example, could more appropriately be described as ‘reregulation.’ It did not mean less government. It meant a different set of rules.”

Thus, it was not some amorphous free spirit that allowed Wall Street to start its ill-fated stampede of speculation “on a wide assortment of risky but lucrative bets and allowing banks to push mortgages onto people who couldn’t afford them” that lead to the global recession of 2008. It was the friendliest American government that campaign cash and lobbying could buy that ushered forth a “freer” marketplace. While that analysis is not unique nor even in dispute, the propagandistic phrase that drove the lobbying and was touted in Congress as it deregulated Wall Street endures. There is no shortage of “free market” champions and purveyors of “government-hands-off” ideology today.

The response to modern predatory capitalism, Reich said, can be found in America’s past but must be fine-tuned for today’s corporate practices. Simply put, government must step in and rewrite the economy’s rules in several key areas: how candidates for public office finance their campaigns; how monopolies are regulated and broken up—through federal anti-trust enforcement and what legal benefits are given to corporations, such as limited liability which lets businesses escape debt—which individual customers cannot always access when facing with unpayable bills.

Reich reminds readers that America has had federal anti-trust laws since the 1890s, when Ohio Republican Sen. John Sherman, who sponsored a landmark antitrust law, did not distinguish between political and economic power. “If we will not endure a king as a political power, we should not endure a king over the production, transportation and sale of any of the necessaries of life,” Sherman famously said, underscoring Reich’s point that the rules governing the economy “also reflect their moral values and judgement about what is good and worthy and what is fair.”

Unlike today’s libertarians, Reich does not think the average American’s economic fortunes are tied to how long or hard they work. He said that while “we are the author of our own fate,” most Americans “are not the producers or directors of the larger dramas in which we find ourselves.” Richer people are not “smarter nor morally superior to anyone else,” he said. “They are, however, often luckier and more privileged and more powerful. As such, their high net worth does not necessarily reflect their worth as human beings.”

Reich makes these points to underscore that it is not capitalism, per se, that has been the target of populist reformers over the decades who fought to reverse economic hardships. Rather “they rejected aristocracy,” he said and “sought a capitalism that would improve the lot of ordinary people rather than merely the elites.”

Thus, Reich touts a handful of well-known reforms to rebalance the current economy’s distortions. Federal antitrust enforcement would help smaller business compete and usher in new entrepreneurial energy. Reversing the decline of labor unions would increase the bargaining power of employees in many industries, who typically have seen their wages stagnate as executive suite pay has skyrocketed. And the benefits given by government to incorporating businesses should be tied to workplace practices. “Limited liability, life in perpetuity, corporate personhood for the purposes of making contracts and the enjoyment of constitutional rights—would be available only to entities that share the gains from the growth with workers while also taking the interests of their communities and the environment into account.”

Reich is under no illusions that any of this will come easily or without a massive fight.

“The moneyed interests have too much at stake in the prevailing distribution of income, wealth and political power to passively allow countervailing power to emerge,” he said. “While they would be wise to support it for all the reasons I have enumerated above—mostly, they will do better with a smaller share of a faster-growing economy whose participants enjoy more of the gains and will be more secure in an inclusive society whose citizens feel they are being heard—they will nonetheless resist.”

Yet Reich believes that the tides of history are on his side. Economic reforms and a rebalancing of the rules will come, he said, citing moments in American history where presidents with populist sentiments have triumphed over the wealthy by setting new economic rules: from Andrew Jackson in the 1930s, to the Theodore Roosevelt in the early 20th century, to Franklin Roosevelt’s New Deal.

For now, however, perhaps the best takeaway from his new book is to start talking about the monopolies that rule the economy using that word: monopolies. As important, is rejecting any use of the pernicious term, “free market,” whenever it appears in conversation or public discourse. As he repeatedly writes, there isn’t a “free market” there’s a market governed by manmade rules and laws that were written to advantage some and not others.

“The market is a human creation. It is based on rules that humans devise. The central question is who shapes those rules and for what purpose,” Reich concludes. “The coming challenge is not to technology or to economics. It is a challenge to democracy. The critical debate for the future is not about the size of government; it is about whom government is for.”

YOU MIGHT ALSO LIKE

5 Next Steps in the War Against Monsanto and Big Food

The Volkswagen Scandal: We Have Been Here Before

233k

233k  41k

41k  Subscribe

Subscribe