Compare Electricity Rates by State (2024 Energy Suppliers)

Here’s a quick overview of electricity rates in the U.S.:

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Feel like you’ve been paying more for electricity than ever before? You’re not imagining things. The average cost of electricity in the U.S. is currently sitting at 15.95 cents per kilowatt-hour, which is up more than two cents compared to 2022.

Whether you’re moving to a new area and looking for power connection or simply shopping for the best electricity rates, EcoWatch is here to help. We’ve narrowed down the top renewable-source electricity providers in America, and by using this tool or clicking the links below, you can compare prices and find the right plan for you.

Comparing Electricity Prices by State

Energy rates vary greatly between states — from 10.37 cents per kilowatt-hour (kWh) in Washington State all the way up to 45.74 cents/kWh in Hawaii.8

Keep in mind that these figures are just state averages. You might see different electricity prices depending on which area of the state you live in.

Electric rates can fluctuate depending on the following factors:

- Where you live

- Supply and demand

- Weather conditions

- Utility provider

Most utility rates are regulated by your local public utility commission.

Cost of Electricity per kWh by State

The tables below show electricity rates by state as of December 2022. At the time of publication, this is the most recent data published by the U.S. Energy Information Administration (EIA).

Cost of Electricity per kWh by State

| State | Electricity Rate (cents/kWh) | Average Monthly Bill for 2022 | % Increase Year over Year (2021/2022) | Deregulated Electricity Market? |

| U.S. | 15.95 | 16% | N/A | |

| AK | 23.73 | $140.96 | 10% | No |

| AL | 15.59 | $177.73 | 21% | No |

| AR | 12.62 | $132.26 | 25% | No |

| AZ | 13.18 | $146.83 | 11% | No |

| CA | 27.27 | $147.80 | 21% | Yes |

| CO | 14.86 | $104.61 | 18% | No |

| CT | 26.64 | $189.94 | 20% | Yes |

| DC | 13.77 | $96.94 | 11% | Yes |

| DE | 13.36 | $126.92 | 12% | Yes |

| FL | 14.11 | $154.65 | 17% | No |

| GA | 16.2 | $173.66 | 32% | No |

| HI | 45.74 | $242.88 | 33% | No |

| IA | 10.76 | $92.64 | 1% | No |

| ID | 10.76 | $101.79 | 7% | No |

| IL | 16.99 | $123.69 | 28% | Yes |

| IN | 15.64 | $147.95 | 22% | No |

| KS | 14.91 | $132.70 | 20% | No |

| KY | 13.53 | $146.67 | 23% | No |

| LA | 13.85 | $165.09 | 31% | No |

| MA | 26.66 | $158.89 | 16% | Yes |

| MD | 14.31 | $139.24 | 12% | Yes |

| ME | 21.18 | $123.69 | 22% | Yes |

| MI | 17.9 | $119.93 | 5% | Yes |

| MN | 15.12 | $117.33 | 17% | No |

| MO | 14.63 | $171.32 | 36% | No |

| MS | 12.61 | $144.51 | 14% | No |

| MT | 11.55 | $100.72 | 7% | No |

| NC | 12.4 | $131.81 | 15% | No |

| ND | 12.72 | $132.42 | 26% | No |

| NE | 11.73 | $117.89 | 20% | No |

| NH | 27.47 | $173.34 | 31% | Yes |

| NJ | 17.35 | $119.19 | 7% | Yes |

| NM | 15.09 | $97.48 | 17% | No |

| NV | 13.58 | $130.23 | 15% | No |

| NY | 21.2 | $126.99 | 14% | Yes |

| OH | 15.08 | $132.55 | 21% | Yes |

| OK | 14.45 | $157.22 | 38% | No |

| OR | 11.59 | $108.48 | 5% | Yes |

| PA | 16.5 | $140.42 | 21% | Yes |

| RI | 21.49 | $125.72 | -9% | Yes |

| SC | 14.85 | $160.08 | 19% | No |

| SD | 13.03 | $132.78 | 16% | No |

| TN | 11.51 | $136.16 | 10% | No |

| TX | 13.98 | $152.94 | 18% | Yes |

| UT | 11.43 | $88.58 | 12% | No |

| VA | 14.35 | $156.99 | 23% | Yes |

| VT | 20.2 | $114.53 | 9% | No |

| WA | 10.37 | $102.04 | 6% | No |

| WI | 15.79 | $108.95 | 11% | No |

| WV | 13.86 | $147.75 | 19% | No |

| WY | 11.88 | $103.00 | 12% | No |

Source: U.S. Energy Information Administration. Average monthly bills have been updated to reflect the most updated electricity increase per kilowatt hour.

Constellation Energy

Nationwide Service

Average cost

Pros

- Many years of experience

- Great industry reputation

- Award-winning company

- No.1 producer of carbon-free energy in the U.S.

- Makes charitable contributions

Cons

- Charges contract cancellation fees

- No prepaid or no-deposit plans

It’s easy to tout Constellation Energy from a sustainability standpoint. Constellation is the top producer of carbon-free energy in the U.S. and offers a 100% renewable energy plan option.4

Constellation serves residents in Connecticut, Delaware, Georgia, Idaho, Illinois, Kentucky, Massachusetts, Maryland, Michigan, Nevada, New Jersey, Ohio, Pennsylvania, Texas, Virginia and Washington, D.C.

Constellation also offers unique incentives to its customers, like a 12-month plan that offers protection for two AC units and HVAC diagnostics. Under this plan, you’ll get a $35 bill credit if you use more than 1,000 kWh per month and an extra $15 credit if you use more than 2,000 kWh per month.

On top of that, Constellation Energy has many years of experience and has maintained an excellent reputation, which isn’t easy for electricity providers to do. The company currently has an A+ rating with the Better Business Bureau (BBB).

Unfortunately, there are some unfavorable sides to choosing Constellation Energy. According to its electricity facts label (EFL), it only offers 20.2% renewable energy content in some areas.5 Constellation also charges contract cancellation fees (most electricity providers do) and doesn’t offer prepaid or no-deposit plan options.

Facts and Figures: Constellation Energy

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Average Cost ($-$$$$$) |

| Solar Services |

| 5 |

| A+ |

| $$$$ |

| 100% Renewable Energy Plans, Fixed-Rate Plans, Variable-Rate Plans, Home Solar |

Green Mountain Energy

Nationwide Service

Average cost

Pros

- Green-e certified plans

- Wide variety of contract term options

- Low number of customer complaints

- Many years of experience

- Makes charitable contributions

Cons

- Charges contract cancellation fees

- No prepaid or no-deposit plans

- No satisfaction guarantee

Of all the sustainable electricity providers, Green Mountain Energy seems to be the greenest of the green. The majority of its electricity plans are 100% powered by solar or other renewable energy sources, and the company operates with a zero-carbon footprint.

Additionally, Green Mountain Energy offers Green-e® certified plans. Green-e® is a certification for renewable energy that meets the highest standards in North America.

Green Mountain was founded in 1997, making it the longest-serving renewable energy retailer. Its Local Solar plan allows you to tap into its 100% solar energy plan by sourcing electricity from solar parks in your area.

Unfortunately, there are some things we don’t love about Green Mountain Energy. While the company has an A+ BBB rating, it is not BBB accredited. Other downsides to Green Mountain include contract cancellation fees, lack of prepaid and no-deposit plans, and no satisfaction guarantees.

Facts and Figures: Green Mountain Energy

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Average Cost ($-$$$$$) |

| Solar Services |

| 4.5 |

| A+ |

| $$$ |

| 100% Renewable Energy Plans, Fixed-Rate Plans, Variable-Rate Plans, Home Solar, Month-to-Month Plans |

Verde Energy

Regional Service

Average cost

Pros

- No early termination fees

- Many years of experience

- Low rates

Cons

- History of issues with misleading marketing

- No prepaid plans

Verde Energy USA is based in Texas, but it also serves residents in Connecticut, Massachusetts, New Jersey, New York, Ohio and Pennsylvania.

While most renewable energy providers tend to be on the more expensive side, Verde offers comparatively low prices — typically near or below the statewide averages when compared per kWh.

We like that Verde Energy’s mission is to provide clean power to all customers instead of simply offering a few “green” plans among its “non-green” ones. Verde provides a few different 100% renewable energy plans that are affordable and accessible. It also doesn’t charge sign-up or cancellation fees, which is huge for an electric company.

Verde Energy has mostly positive reviews from customers online and it maintains an A+ rating with the BBB.

Facts and Figures: Verde Energy

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Average Cost ($-$$$$$) |

| Solar Services |

| 4 |

| Not Rated |

| $$$ |

| 100% Renewable Energy Plans, Fixed-Rate Plans, Business Energy Plans |

Overview of U.S. Energy Rates

As of December 2022, the average cost of electricity in the U.S. is 15.95 cents per kWh, according to data from the U.S. Energy Information Administration (EIA). The agency projects we’ll end 2022 with a 12-month average of 14.9 cents/kWh.6

That’s a huge difference from recent years.

For some perspective, the average cost of electricity went from 13.2 cents per kWh in 2020 to roughly 14.9 cents in 2022. That might not sound like much, but it’s the difference between an average monthly utility bill rising from roughly $118 to $136 in just three years. And it’s only expected to keep rising in 2024.7

In an EcoWatch solar energy study, 79% of homeowners surveyed said they’ve been financially stressed over electricity bills.

Fortunately, people living in deregulated energy markets can have a bit more control over how much they spend on electricity because they can choose their own provider. Trying to understand the concept of deregulated energy can be complicated, so we’ve broken down what you need to know in this article.

10 States With the Highest Electricity Rates

Hawaii consistently has the highest electricity prices — the state currently faces a rate of 45.74 cents per kWh. That’s nearly double the cost of the second highest state, New Hampshire, with a rate of 27.47 cents per kWh.

Why is the cost of electricity so high in Hawaii? Well, because fuel to generate the electricity has to be imported. Hawaiian Electric reports that only 38% of local power comes from renewable energy — all other energy sources have to be shipped in.9

(If you’re reading this from the Islands, it’s definitely worth going solar in Hawaii. Just saying.)

As for other states, prices are mostly dependent on the energy markets. All six New England states rank in the top ten states with the highest electricity rates, and that’s mostly because homes in the northeast are more reliant on natural gas. Natural gas accounts for about 38% of electricity in the U.S., but 53% of electricity in New England.10

The chart below shows the top ten states with the highest electricity prices as of December 2022:

| State | Electricity Rate (cents/kWh) | Deregulated Energy Market (Y/N) |

| HI | 45.74 | No |

| NH | 27.47 | Yes — Electric only |

| CA | 27.27 | Yes — Gas and Electric* |

| MA | 26.66 | Yes — Gas and Electric |

| CT | 26.64 | Yes — Gas and Electric** |

| AK | 23.73 | No |

| RI | 21.49 | Yes — Gas and Electric |

| NY | 21.20 | Yes — Gas and Electric |

| ME | 21.18 | Yes — Gas and Electric*** |

| VT | 20.20 | No |

*California’s electric choice comes through a limited lottery system called DirectAccess.

**Connecticut’s gas choice is partial and limited.

***Maine’s gas choice is only available to industrial and commercial consumers at this time.

10 States With the Lowest Electricity Rates

States with lower electricity rates typically have higher reliance on renewable energy sources or are in closer proximity to energy sources.

For example, Washington State currently has the lowest electricity rates in the country at 10.37 cents per kWh. That’s because nearly 75% of Washington’s electricity comes from hydropower from the many rivers that flow through the state.11 Washington also offers competitively priced natural gas, delivered from nearby British Columbia and Alberta, Canada, but its residents also consume less natural gas than those in most states.12

Idaho and Iowa are tied for the second lowest electricity rate in the country at 10.76 cents per kWh. More than half of Idaho’s electricity comes from hydropower and more than half of Iowa’s electricity comes from wind power.13,14

Needless to say, it pays to switch to renewable energy alternatives.

| State | Electricity Rate (cents/kWh) | Deregulated Energy Market (Y/N) |

| WA | 10.37 | No |

| ID | 10.76 | No |

| IA | 10.76 | Gas only (limited consumers) |

| UT | 11.43 | No |

| TN | 11.51 | No |

| MT | 11.55 | Gas only |

| OR | 11.59 | Yes — Electric only |

| NE | 11.73 | Gas only |

| WY | 11.88 | Gas only (limited consumers) |

| NC | 12.4 | No |

What Is Deregulated Energy?

Deregulated energy markets give consumers the power to choose their own electricity supplier, their own natural gas supplier, or both. Lawmakers see this as a way to eliminate regulated energy rates and monopoly providers, creating competition and, theoretically, lowering the price of your energy bill.

Remember, while you can choose your energy supplier in a deregulated market, you cannot choose your energy delivery provider (i.e., your public utility company).

For example, in Houston, most residents will have their electricity delivered by CenterPoint Energy, but they can choose which Houston electricity company will be their energy supplier (i.e., Frontier Utilities, TXU Energy, 4Change Energy, etc.).

If you take a look at the electric rates by state charts above, you may have noticed that states with high electric prices also tend to be the states with deregulated energy markets. So, you may be wondering: is it beneficial to live in an area with deregulated energy?

Let’s explore some of the advantages and disadvantages of deregulated energy markets.

Pros of a Deregulated Energy Market

- You can choose which company you want to supply your electricity

- You can choose to support green energy plans

- Competition can help drive down prices

- Competition can drive up quality of provider service

- There are no monopolies

Cons of a Deregulated Energy Market

- Prices don’t always drop as expected

- There may be added administrative costs on behalf of the company

- Rates can increase to benefit energy companies, not consumers

- There may be less energy supply security, which can disproportionately affect people who live in rural communities

- Private electricity companies may not be as closely watched or regulated

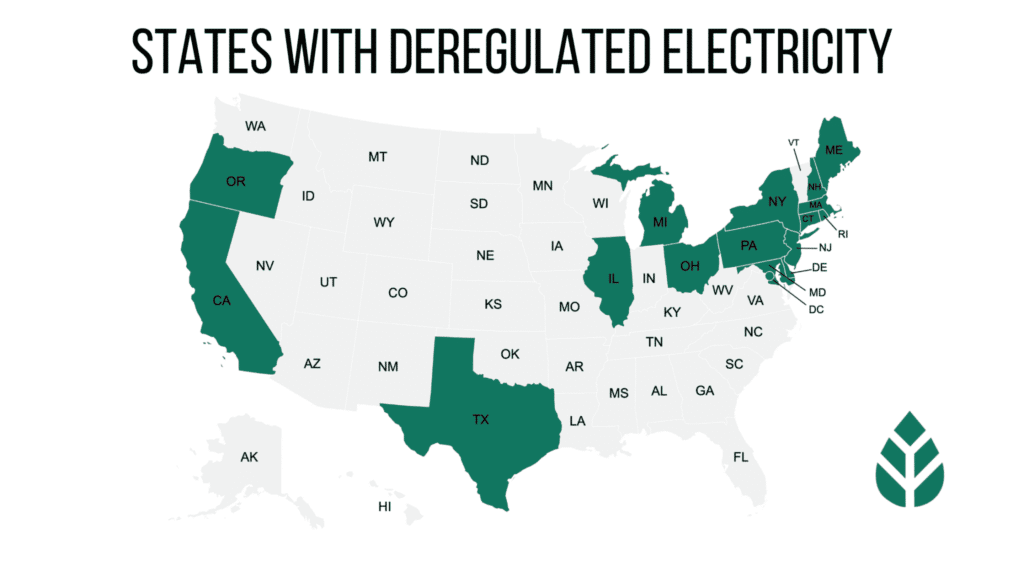

States With Deregulated Energy Markets

As of December 2022, 28 states and Washington D.C. have deregulated energy sectors.

Seventeen states allow residents to choose their own electricity provider. Of those,16 states also allow for the choice of natural gas provider — these are referred to as “fully deregulated” or “completely open market” states.

It’s important to note that even in a state with a deregulated energy market, some cities may not be deregulated. Let’s look at Texas, for example. Residents in Houston and Dallas can choose their own energy supplier, while those living in Austin and San Antonio are paired with the energy provider that has a claim to those cities.

States with deregulated electricity include:

- California

- Connecticut

- Delaware

- Illinois

- Massachusetts

- Maryland

- Maine

- Michigan

- New Hampshire

- New Jersey

- New York

- Ohio

- Oregon

- Pennsylvania

- Rhode Island

- Texas

- Virginia

- Washington D.C.

There are 12 states that allow residents to choose their natural gas provider but not their electricity provider. They include:

- Colorado

- Florida

- Georgia

- Indiana

- Iowa

- Kentucky

- Montana

- Nebraska

- New Mexico

- South Dakota

- West Virginia

- Wyoming

What to Expect When Moving to a State with Deregulated Energy

Planning to move to an area with deregulated energy? You’ll soon have the power to choose who supplies your energy needs, similar to the way you choose your internet or cell phone provider.

However, unless you’re moving to Texas (more on that below), you don’t have to choose an independent electricity provider. If you don’t shop for a competitive supplier, you’ll still receive electricity from your utility company.

Can You Switch Energy Providers in Deregulated States?

Yes, you can switch electricity providers in deregulated states. Many consumers choose to switch energy providers because they’re seeking better electricity rates or they want to choose a provider that supplies power from renewable sources.

If you’re currently under contract with an energy provider, we recommend sticking out the contract before switching providers to avoid paying early termination fees.

Click here to find electricity plans near you.

Shopping for Texas Electric Rates

If you are moving to a deregulated area in Texas you’ll have a slightly different experience. Unlike other open energy markets, Texas mandates that customers pick their own providers (unless you live in areas like Austin or San Antonio that have regulated markets).

If you’re moving to Texas, we recommend checking out our guide to Texas electricity rates. We review all of the Texas electric suppliers available in the state and rank them based on rates and sustainability profiles.

Top 3 Tips for Finding the Best Electricity Rates in States with Deregulated Energy

If you’re looking for the best energy plan for your needs, there are a few things you need to keep in mind.

The average cost of electricity can vary based on numerous factors. That means you may be given a different electric rate than that of your neighbors, even if you choose the same energy provider.

Here are three tips to finding the best-value electricity plan:

Compare Energy Providers

Don’t just pick the energy provider your neighbor has. Do your research! What’s best for one household may not be what’s best for yours.

You could spend hours looking up each electric provider near you and sifting through their basic power plans, energy rates and electricity facts labels (EFLs). But if that sounds like too much hassle, you can also use this quick and easy tool to be connected with local energy providers near you.

Remember that the cheapest energy provider isn’t necessarily the best energy provider. We’ve found that electricity companies that prioritize renewable energy aren’t always the cheapest option. But the “cheap” companies often have negative reviews for hidden fees or poor customer service.

Bottom line: Even if you get matched with a provider through a service, do your due diligence. Make sure the energy company you choose is reputable and trustworthy before signing the contract.

Choose a Plan That Fits Your Energy Usage

To find the best electricity provider and rates for your needs, you need to first understand your energy needs.

The amount of electricity your household consumes typically will affect the energy rate you pay per kWh. Most retail electricity providers, or REPs, offer tiered plans based on average energy usage.

Tiered-rate energy plans are often called “V-shaped plans” because the rates are more expensive for people who use the least and most amounts of energy and are lowest for those in the middle.

For example, in a typical tiered plan, customers who use around 500 kWh or 1,500 kWh per month will pay more than those who use around 1,000 kWh per month. According to the EIA, the average U.S. homeowner uses 886 kWh per month.15

Some companies also offer incentive plans like free nights or weekends. This is a smart plan if you’re a night owl or consume the bulk of your electricity on the weekend. But be aware that these plans typically involve a higher electricity rate during the non-free hours to make up for the loss. That’s why it’s important to get a good grasp of your energy usage before choosing a plan.

Weigh the Contract Lengths

The length of your contract will also play a role in the cost of electricity. As with most services, the longer you commit to one provider, the better deal you’ll get. We’ll discuss the different types of electricity plans in the next section.

A word of caution: Read the fine print and ask questions before you sign. Many contracts come with startup fees as well as cancellation fees for early termination. And while some electricity providers advertise a $10 cancellation fee, the fine print may read that it’s really $10 per month left on the contract.

5 Types of Energy Plans in Deregulated Markets

Most electric companies have a few plan options for customers to choose from. Here’s an overview of the different types offered by most companies, as well as their advantages and disadvantages, so you can pick what’s best for your household.

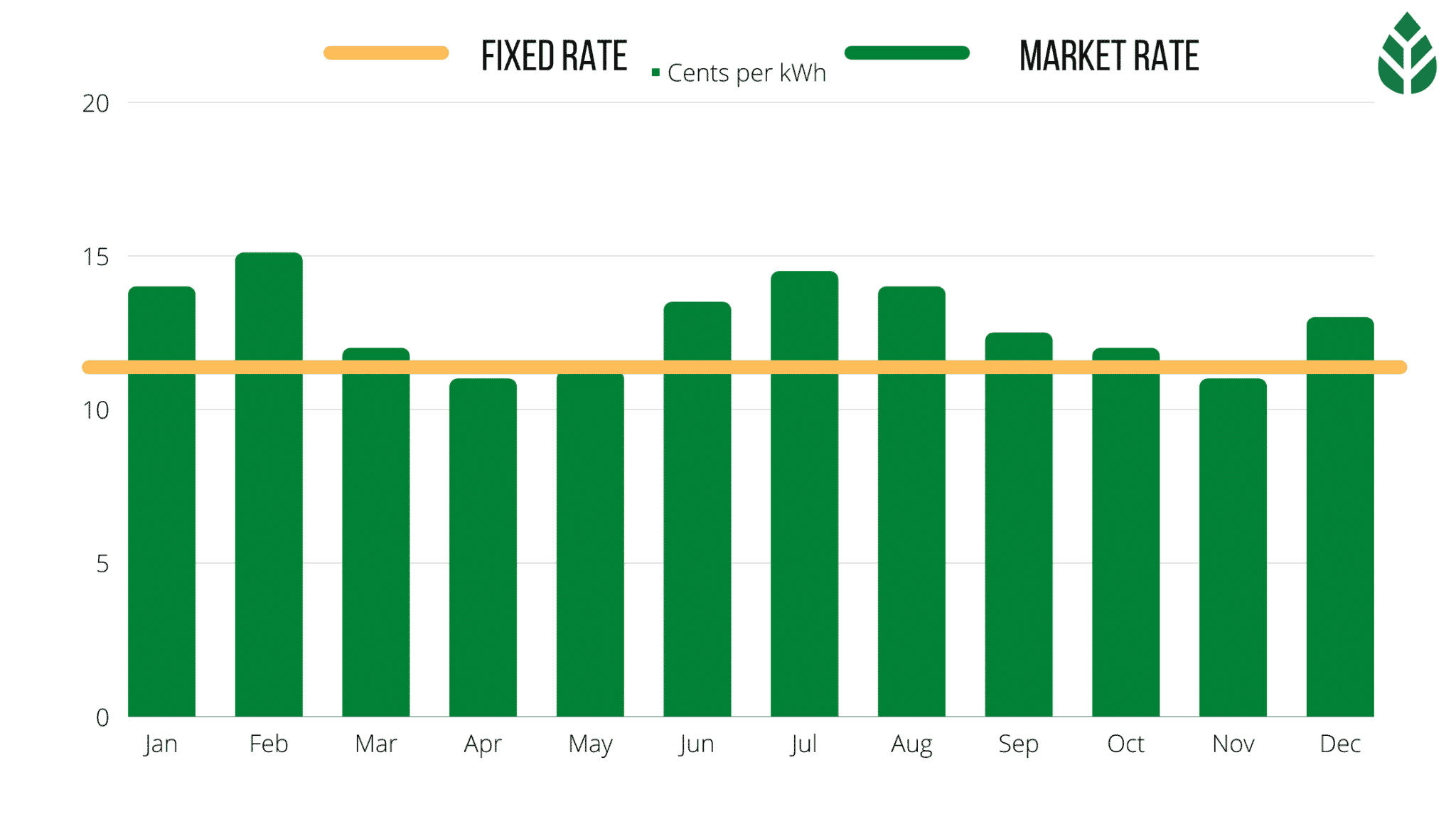

Fixed-Rate Plans

Just as it sounds, a fixed-rate plan allows you to secure a rate that will stay the same throughout the entire duration of your contract.

Note that “fixed rate” does not mean that your electric bill will be exactly the same every month. Instead, it means the rate you pay per kWh of electricity won’t change. So, your bills will still be higher during months you use more electricity.

| Pros of a Fixed-Rate Energy Plan | Cons of a Fixed-Rate Energy Plan |

| You’ll have a better idea of what to expect when it comes to budgeting. | If you cancel early, you could be subject to an early termination fee (ETF) — unless you’re moving to an address outside the provider’s service area. |

| Your rates remain locked in if energy costs rise. | Some fixed-rate plans will turn into variable-rate plans upon contract expiration. Be sure to read the fine print and ask your energy provider specific questions about length and price. |

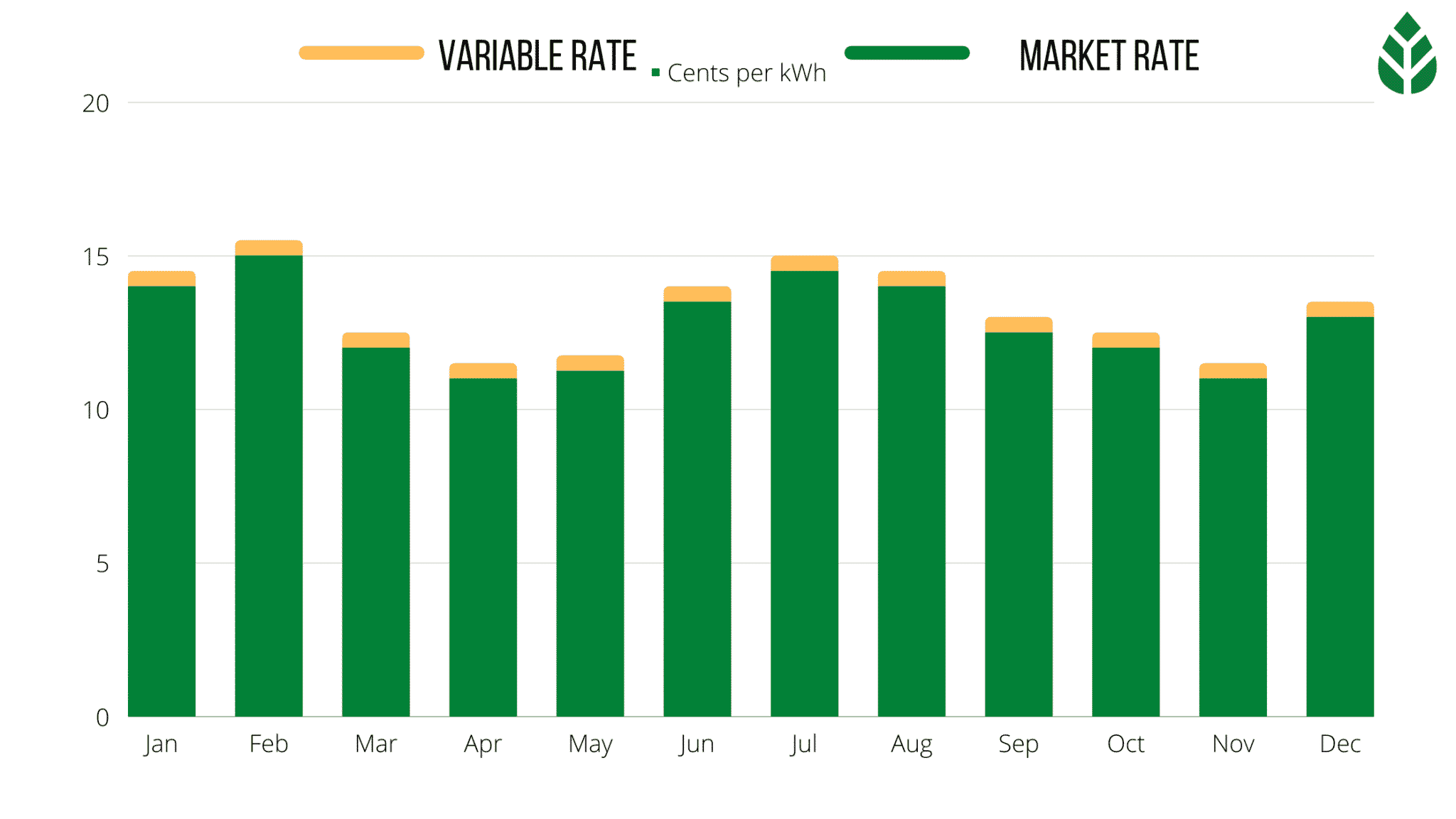

Variable-Rate Plans

If you prefer paying month to month instead of being locked into a length-based contract, you may consider a variable-rate electric plan. Variable rate means — you guessed it — the price you pay is based on variables in the energy market. The price per kWh will increase or decrease depending on supply and demand.

| Pros of a Variable-Rate Energy Plan | Cons of a Variable-Rate Energy Plan |

| If the price of energy drops, there may be some months where a variable-rate electric customer will be paying less per kWh than someone on a fixed-rate plan. | Variable rates can be very risky given that extreme weather or other factors can suddenly — and drastically — increase the price of electricity. |

| Contracts usually don’t have early termination fees. |

No-Deposit and Prepaid Energy Plans

Many power plans require a deposit upon signing a contract to protect the REP from losses should a customer be unable to pay their energy bill. However, certain companies will offer a no-deposit electricity plan option so long as a customer passes a credit check.

If the customer doesn’t have a high enough credit score for a no-deposit plan, they can still avoid paying a deposit by opting for a prepaid, or “pay-as-you-go,” electricity plan.

With a prepaid plan, the customer pays in advance for a set amount of electricity, then can track their electricity usage online and reload the account when it runs low. However, rates are not fixed in a prepaid plan, so it can be harder to plan out expenses.

| Pros of a Prepaid Energy Plan | Cons of a Prepaid Energy Plan |

| The obvious — no deposit. | You’ll have to pay for your electricity up front and remember when to top up your meter. |

| You have total control over how much you spend on your electricity. | Your power will be automatically shut off if you hit the threshold of electricity you paid for (this can be avoided by actively monitoring your usage or enrolling in an auto-pay plan). |

| You don’t have to sign a contract that may come with cancellation fees. | You’ll often pay a higher rate per kWh compared to other plans. |

Green Energy Plans

Green energy plans are those that supply electricity from renewable energy sources, like wind, hydro or solar energy.

Some REPs may have Green-e® verification or a similar certification to ensure that the electricity is responsibly generated, transmitted and distributed. Non-green energy plans will often include a percentage of their total energy from renewable sources, usually ranging from 6-25%.

Most green energy REPs will still offer variable- and fixed-rate plan options — the main difference is where the energy comes from.

| Pros of a Green Energy Plan | Cons of a Green Energy Plan |

| You can feel good about where your electricity is coming from | On average, renewable plans cost around one cent per kWh more than non-renewable plans (if you use 1,000 kWh per month, that will be about a $10 to $15 difference) |

| You can support clean energy without the high up-front cost of solar or wind | They’re not offered by all energy companies, so you’ll have more limited options when choosing a provider |

Business Energy Plans

Not all REPs provide residential electricity. If you need an energy supplier for your business, you’ll want to look for a provider that offers business energy rates. Business energy plans may also be needed for industrial and government buildings, as well as schools and churches.

Most business energy plans come in variable- or fixed-rate options. Commercial electricity rates also tend to be cheaper than residential ones.

Best Electricity Companies and Providers in America

There are thousands of energy providers across the country, some serving multiple states. Here at EcoWatch, we strive for a healthier planet and encourage our readers to live more sustainably when feasible.

So we’ve chosen to highlight some of the best electric companies that offer 100% renewable energy options. You can click here to start comparing rates from these providers and more.

| Provider | States Served | Estimated Energy Rate* (¢/kWh) | Plan Length (Months) | Percent of Renewable Energy |

| Clearview Energy | DE, IL, MA, ME, MD, NJ, NY, OH, PA, RI, & D.C. | 10.09 | 12 | 100% |

| Constellation Energy | CT, DE, GA, ID, IL, KY, MA, MD, MI, NE, NJ, OH, PA, TX, VA, WY & D.C. | 13.2 | 36 | Offers 100% options; other plans are 20% renewable |

| Green Mountain Energy | IL, MA, MD, NJ, NY, PA, TX | 18.4 | 12 | 100% |

| Gexa Energy | CA, TX | 10.9 | 3 | 100% |

| Verde Energy | CT, MA, NJ, NY, OH, PA | 10.3 | 12 | 100% |

Rates will vary depending on where you live.

What to Look For When Choosing an Electricity Provider

Whether you’ve just moved to a deregulated energy market or you’re looking to save money by switching companies, here are five main things you should look out for when choosing an electricity provider:

- Types of plans offered: Not every REP will offer fixed-rate, variable and no-deposit energy plans. If you’re looking for cheap electricity rates, check to see if a company offers “saver” plans or monthly bill credits or incentives that can lower your rates.

- Where the energy is coming from: We recommend companies that offer 100% renewable plans from solar or wind energy. If the company does not specify where its electricity comes from, it’s likely natural gas.

- Electricity rates – and the fine print: Many customers shopping for a new energy provider will be looking for the cheapest electricity rates, but if the prices look too good to be true, be sure to read the fine print. Some companies will offer low rates for short-term contracts with a fine-print clause that eventually turns the plan into a variable-rate or higher-priced option. Be wary of this, as companies with misleading advertising may not have your best interests in mind.

- Company history: In most cases, you’ll want to choose an energy supplier with a proven track record of quality service in your area. You also may want to do some research to find out if there’s a parent company. Some companies that offer renewable energy plans are backed by oil companies like Shell.

- Customer reviews: No one enjoys having to pay for electricity service, and outages can be frustrating no matter your energy supplier. But an excessive number of negative customer reviews is probably a warning sign to steer clear of a company. On the other hand, tons of positive reviews are a good sign that a company is likely honest and accommodating.

Other Popular Providers in America

EcoWatch has chosen to feature providers that align with our mission and, in most cases, offer 100% renewable energy. Here are some of the other electricity providers that may or may not hit that goal but that are popular options:

| Provider | States Served | Estimated Energy Rate (¢/kWh)* | Plan Length (months) | Percent of Renewable Energy |

| Direct Energy | CT, DE, IL, IN, MA, MD, MI, NH, NJ, NY, OH, PA, RI, TX, D.C. | 16.9 | 12 | 21% in each plan; 100% renewable option |

| Frontier Utilities | IL, NJ, OH, PA, TX | 10.8 | 3 | 26% in each plan; 100% renewable plan options in some areas |

| Just Energy | IL, DE, MA, MD, NJ, NY, OH, PA, TX | 10.8 | 3 | 25% in each plan; 100% renewable options |

| NRG (Reliant Energy in TX) | CT, DE, IL, MA, MD, NJ, NY, OH, PA, TX, D.C. | 16.9 | 12 | Offers 100% renewable plans; other plans are at least 25% renewable |

| Payless Power | TX | 11.5 | 3 | 26% in each plan |

| Pulse Power | TX | 14.7 | 36 | At least 21% in each plan; 100% renewable plan options |

| Reliant Energy | TX | 15.9 | 12 | 21% in each plan; 100% renewable plan option |

| TriEagle Energy | TX | 15.2 | 36 | 6% in each plan; 100% renewable option |

*Rates are subject to change and will vary based on your utility and location. All information is accurate as of December 2022.

FAQ: U.S. Electricity Plans

At EcoWatch, we receive questions every day about the energy market in the U.S. Here are some of the most common questions we see, along with our answers.

Washington state currently has the lowest electricity rates in the country at 10.37 cents per kWh as of December 2022. This is because the majority of Washington’s electricity comes from hydroelectric power.

Hawaii has the most expensive energy in the country. The Aloha State faces an average rate of 45.74 cents per kWh as of December 2022. Hawaii consistently has the highest electricity rates because most of the fuel to make its energy has to be imported from the mainland.

It’s hard to answer this question because the best energy provider for you may be different from the one that’s best for your neighbor. If you’re mainly focused on sustainability, we believe Green Mountain Energy is the greenest energy provider.

The average electric bill in the U.S. is $121.01 as of December 2022.16

If you live in a deregulated energy state, one of the easiest ways to lower your electricity bill is by using this tool to shop around for the best value energy rates.

Looking for other ways to lower your energy bill? Consider adding solar panels, getting an energy efficiency audit or reading some of our energy-saving guides:

There’s no solid answer to this question, as the best energy plan is dependent on your unique household needs. We recommend looking at the plans offered by Constellation, Clearview Energy and Green Mountain Energy to find a sustainable electricity plan that fits your budget and lifestyle. Or, use this link to get connected to the best energy providers near you.

More Energy Guides

- Best Energy Rates in Texas

- Best Energy Rates in California

- Best Energy Rates in Massachusetts

- Best Energy Rates in New York

- Best Energy Rates in Delaware

- Best Energy Rates in Maine

- Best Energy Rates in New Jersey

- Best Energy Rates in Maryland

- Best Energy Rates in New Hampshire

- Best Energy Rates in Connecticut

- Best Energy Rates in Ohio

- Best Energy Rates in Pennsylvania

- Best Energy Rates in Illinois

233k

233k  41k

41k  Subscribe

Subscribe