2024 Maryland Solar Incentives, Tax Credits, Rebates (And More)

In this guide to Maryland’s solar incentives, you’ll learn:

- What are the solar incentives offered in Maryland?

- Does Maryland give a tax credit for solar panels?

- What are the Solar Renewable Energy Credits (SREC) in Maryland?

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Do Maryland Solar Incentives Make It Affordable for Homeowners to Go Solar?

The average solar installation in Maryland costs $33,700 before applying solar incentives, which is much higher than the national average of $29,970.

However, this is based on the presumption that Maryland residents are installing more solar panels — usually a 10 kilowatt (kW) system — than average to meet their high-energy demands. The average American household uses a 9 kW system.

Maryland solar costs may be high, but energy prices in Maryland being higher than average, switching to solar yields far greater savings than in the average state. Plus, with the federal solar tax credit, state solar rebate program, tax exemptions and more, Maryland residents can offset their total solar installation costs by well over 30 to 40%.

Many homeowners have been finding it’s well worth it to go solar in Maryland, with a big boost of homeowners installing solar since 2014.1

Maryland’s Renewable Portfolio Standard (RPS) requires 50% of overall electricity generation sales in the state to be met by renewable energy resources by 2030, including a solar carve-out at 14.5% by 2028.2 So we anticipate these incentives will stick around.

If you’re ready to start getting free quotes from the best solar companies in Maryland, you can do so by using our solar calculator tool.

Lumina Solar

Regional Service

Average cost

Pros

- Comprehensive service offerings

- Offers products from leading manufacturers

- NABCEP-certified technicians

Cons

- Relatively young company

- Slightly limited service area

Blue Raven Solar

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

Trinity Solar

Regional Service

Average cost

Pros

- Many financing options

- Family-owned and -operated

- Makes charitable contributions

- Relatively short workmanship warranty

Cons

- Limited service area

As one of the top states for solar incentives, Maryland has several additional incentives and rebate programs that have allowed the Free State to quadruple its solar capacity since 2015.3

Here’s an overview of current solar incentive programs available in Maryland:

| Solar Incentives in Maryland | Incentive Type | Description | Occurrence | Estimated Dollar Amount You Can Receive |

| Federal Solar Investment Tax Credit (ITC) | Federal | Residential solar panels or solar batteries purchased and installed by December 31, 2032, are eligible for a tax credit worth 30% of their home solar project cost. | One time: Credit is applied when you file your taxes during the year your system is installed. If credit is more significant than what you owe in taxes, credit can roll over up to five years. | Roughly $10,110 in tax credits for the average 10 kW system. |

| Residential Clean Energy Rebate Program | State | Homeowners are eligible for a $1,000 payment after installing a solar energy system of at least 1 kW. For installing solar water heating systems, homeowners can claim a $500 rebate. | One time: Payment is given after solar installation. | $1,000 for a solar system and $500 for a solar water heater. |

| Solar Sales Tax Exemption | State | To reduce the upfront costs of going solar, Maryland waives sales tax on all solar equipment. | One time: Tax is avoided when you purchase your solar panel system. | With a sales tax rate of 6% in Maryland, the average savings is around $2,022.4 |

| Solar Property Tax Exemption | State | The value added to your home by the solar installation will not raise your property taxes in Maryland. | Ongoing: Your solar panel system won’t be included in your home’s assessed value where property taxes are concerned. | Varies based on home value, with average annual savings of around $3,336 based on a 0.99% property tax rate.5 |

| Net metering | Local | Maryland has a statewide net metering program that allows you to sell excess solar energy back to the grid in exchange for credits that can go toward any future utility bills. | Ongoing: Your net billing credits will be applied to your monthly electricity bills. | It varies depending on how much excess energy your solar panels produce and which utility provider you have. |

| Local incentives | Local | Certain Maryland counties offer additional incentives for solar, geothermal and other energy-efficiency upgrades. | Varies | Varies |

What Do Maryland Residents Need to Know About the Federal Solar Tax Credit?

The federal solar investment tax credit (ITC) is the best financial incentive available in Maryland in our opinion, worth a whopping $10,110 for the average solar panel installation. However, credit values will vary depending on the size and cost of your solar panel system — calculating your IRA return is the ideal way to get a better estimate.

If you already have solar panels but are looking to install a solar energy storage system, you can also use the ITC to claim 30% back on that purchase starting in 2024.

It’s also important to realize that your tax credit won’t come as a check. Instead, it’s a deduction on the federal taxes you already owe. If you don’t owe 30% of your solar system’s cost in the tax year you installed the panels, the credit rolls over up to five years.

Maryland taxpayers who install solar panels have been able to take advantage of the ITC since it was created back in 2005. But the credit has seen several changes since then.

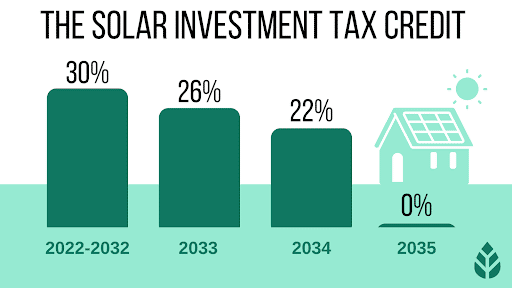

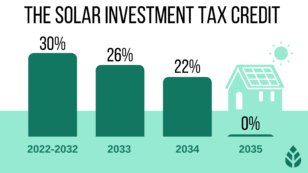

Most recently, in August of 2022, we saw the tax credit bump from 26% back up to 30% of the system value thanks to the passage of the Inflation Reduction Act, which has renewed the ITC’s availability at the following rate schedule:

- 30% of your total system value for solar photovoltaic (PV) systems installed between 2022 and 2032

- 26% of your total system value for solar PV systems installed in 2033

- 22% of your total system value for solar PV systems installed in 2034

- Credit discontinued for systems installed starting in 2035, unless extended again by Congress

Needless to say, if you’re thinking about installing solar panels in Maryland, you’re better off doing it sooner rather than later.

How to Claim the Federal ITC in Maryland

Follow these five steps to claim your federal solar tax credit in Maryland:

- Download IRS Form 5695. This residential energy tax credit form can be downloaded straight from the IRS.

- Calculate your credit on Part I of the tax form (a standard solar energy system will be filed as “qualified solar electric property costs”). On line 1, enter your overall project costs as written in your contract, then complete the calculations on lines 6a and 6b.

- If solar is your only renewable energy addition, and you don’t have any rollover credit from the previous year, skip down to line 13.

- On line 14, calculate any tax liability limitations using the Residential Energy Efficient Property Credit Limit Worksheet (found here). Then, complete calculations on lines 15 and 16.

- Be sure to enter the figure from line 15 on your Schedule 3 (Form 1040), line 5.

EcoWatch’s Opinion on the Federal ITC in Maryland

Too many people — solar users or otherwise — leave money on the table during tax season because of the confusion that comes with filing. We strongly recommend working with your solar company and a tax professional to make sure that doesn’t happen to you!

Although the cost of going solar has dropped 52% in Maryland over the last decade, it’s still a big investment.6 Being able to shave $10,000 or more off of the total cost of your system can make a huge difference come tax season. That takes the average $33,700 system down to a more affordable $23,590.

Additionally, because the ITC is offered nationwide it’s widely understood by most tax professionals and not too complicated to claim.

The downside? The federal tax credit only makes sense if you owe several thousand dollars in federal taxes over the next five years.

What You Need to Know About Maryland’s Residential Clean Energy Rebate Program

The state of Maryland has one of the most simple solar incentives in the nation to understand. The state will pay you a flat $1,000 if you install a solar panel system or solar roof shingles of at least 1 kW. That’s it, simple as that.

There are a few stipulations, though. First, the solar project must be installed at your primary residence and be completed by an installer certified by the North American Board of Certified Energy Practitioners (NABCEP).

Here’s a full list of eligibility requirements, per the Maryland Energy Administration (MEA):

- Application must be submitted to the MEA within 12 months of installation.

- The installation property must be a residential property and the primary residence of the applicant at the time of application.

- Project size must exceed:

- Solar Photovoltaic: 1 kW

- Geothermal: 1 ton

- Solar Water Heating: 10 sq. ft.

- The property may not be held in an irrevocable trust.

The biggest downside is that, according to the application process, your solar project must be paid for in full to claim the credit.

How to Claim Maryland’s Residential Clean Energy Rebate

You must submit an application on the MEA website to claim your $1,000 rebate and it is awarded on a first-come, first-served basis. You can visit the MEA website here for more information or go to the application page here.

Once you get onto the application page, here’s what you’ll need to do:

- Provide information about yourself, the installation (property, system, contractor), and the required permits.

- Submit photos showing all components of the installed clean energy system. If the system is a roof-mounted PV or SWH system, the photograph must clearly demonstrate where the system has been installed, with all panels or collectors clearly visible.

- Submit proof that the project is paid for in full (a copy of the final invoice showing a zero balance).

- Submit copies of all issued inspection and permit documents as provided by the local authority having jurisdiction (a ‘Passed Final Inspection’ report, sticker or picture).

- Submit proof that the install address is at your primary residence. MEA accepts the State Department of Assessments and Taxation (SDAT) Real Property Data Search printout showing the R-CERP applicant as owner and principal resident of the home where the system is installed.

EcoWatch’s Opinion on the Residential Clean Energy Rebate in Maryland

Maryland’s residential clean energy grant program is an amazing incentive that very few other states offer. It’s essentially a $1,000 “thank you” from the state just for switching to solar resources. Technically you only need to install 1 kW of solar to get the $1,000, which would only cost you $3,370 in Maryland. But a system that small wouldn’t offset much of your energy needs.

Just remember — you won’t be eligible for this incentive if you lease your solar panels. While paying for your solar panels in cash gives you the most energy savings, it’s a huge investment that not every Maryland resident can afford to do in the same calendar year. If you opt for a solar loan, most MD homeowners pay their systems off with savings between 8 and 14 years.

What You Need to Know About the Energy Storage Income Tax Credit in Maryland

To help residents afford solar storage technology, Maryland instituted a statewide energy storage tax credit. Residents were able to claim up to 30% of the cost of an energy storage system on their state returns.

The state capped this credit at $5,000 for residential properties (for context, some of the top-rated solar batteries cost around $10,000). Commercial solar installations, however, could claim a credit of up to $150,000, depending on the size of the solar panel system.

Unfortunately as of August 2024, all of the funds allocated for the energy storage tax credit have been claimed. It is doubtful the state will renew the incentive.

EcoWatch’s Opinion on Maryland’s Energy Storage Income Tax Credit

This was an awesome incentive that encouraged homeowners to go beyond creating their own renewable energy, but storing and relying on it as well. Unfortunately, the funds have all been allocated as of August 2024 and there’s no word on if the incentive will come back.

However, you can still claim a 30% solar battery rebate from the federal government starting in 2024, thanks to the Inflation Reduction Act.

Solar Sales Tax Exemption in Maryland

All home solar equipment is exempt from Maryland’s 6% sales tax.7 While this may not seem like a huge benefit, the sales tax exemption leads to a savings of roughly $2,022 for the average $33,700 solar panel system in Maryland.

How to Claim the Solar Sales Tax Exemption in Maryland

The sales tax exemption is automatically applied to all solar equipment purchases in Maryland, so you don’t have to take any extra steps to claim it.

EcoWatch’s Opinion on Maryland’s Solar Sales Tax Exemption

You don’t have to pay taxes on a solar equipment purchase in Maryland, saving you more than a thousand dollars on your purchase. What’s not to like?

Solar Property Tax Exemption in Maryland

Solar panels have been shown to increase home value in Maryland, but fortunately, your property taxes won’t budge. That’s thanks to Maryland’s solar property tax exemption.

While most home improvement projects — like an inground pool — would raise your annual property taxes, your solar panels won’t be included in your home value assessment thanks to this law.

It’s hard to quantify exactly how much you’ll save with the property tax exemption because it’s based on your home value, where you live and how many solar panels you install. But here are some numbers we can gather:

- The average home value in Maryland is $402,625

- The statewide property tax rate in Maryland is 0.99%9

This leads to average annual savings of around $333 if you take the average system cost of $33,700 in the state. But of course, you can expect these numbers to be greater or lesser depending on the average home price in your city. For example, savings will be greater in Harford or Somerset.

How to Claim Maryland’s Property Tax Exemption

You don’t have to take any extra steps to claim the solar property tax exemption in Maryland.

EcoWatch’s Opinion on the Property Tax Exemption in Maryland

We wouldn’t want anyone to second-guess improving their home because they’re worried about their property taxes increasing. Not every state exempts solar users from a property tax increase, so we applaud Maryland for implementing this incentive.

Net Metering in Maryland

Net metering is a solar incentive that credits solar customers for the excess electricity generated by their panels during the day. Most solar arrays produce more energy than one home can consume at any given time when the sun is up.

Think of net metering like a backup battery — it’s a way to store the excess energy your system produces so none goes to waste.

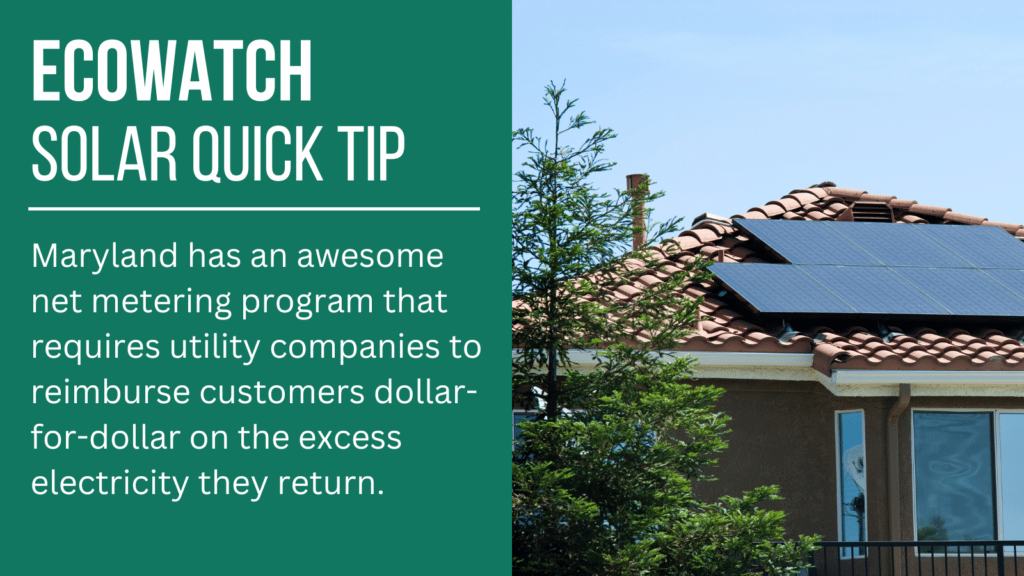

In Maryland, if you route the excess electricity back to the local electric grid, you can receive compensation for that power at the full retail rate, offsetting a huge chunk of your electric bills.

Contrary to most states, where individual electric companies set their own net metering rates (often for less than the retail price of electricity), Maryland has an awesome net metering program that requires utility companies to reimburse customers dollar-for-dollar on the excess electricity they return. This is the best-case scenario for homeowners considering solar. Recently, the rules changed to let you continue to accrue credits or take a payout at the end of each year, which gives you more options to save based on your electricity consumption.

How to Enroll in Net Metering in Maryland

After you install solar panels, your utility company should come to your home to install a meter that keeps track of how much energy your panels produce and send to the grid, as well as how much energy you pull from the grid.

Your solar company should work with your utility to get the net metering process started, but we recommend that you take the following steps to ensure things go smoothly with your net energy metering connection.

- Step 1: Speak with your electricity provider to ensure you have the correct meter installed. If you don’t, request the installation (it should be free).

- Step 2: Proceed with installing your home solar energy equipment.

- Step 3: Once your system is commissioned, we recommend monitoring your energy bills for a month or two to ensure that the credits are appearing.

EcoWatch’s Opinion on Net Metering in Maryland

Maryland’s net metering compensation rate is one of the highest in the country. As many states begin to roll back their net metering rates, Maryland’s continues to go strong.

While it’s hard to calculate exactly how much NEM is likely to save you over your system’s lifespan, it can help push you toward eliminating your electric bills entirely.

We suggest Maryland homeowners install solar sooner rather than later to fully take advantage of this incentive before any potential changes take shape. The state is currently running a pilot program on its current form of net metering, so changes are due to take shape soon.

Local Solar Incentives in Maryland

Certain counties, municipalities and utilities may help you further lower the cost of going solar with individualized incentives.

Below are some of the ones we’ve found, but if you don’t see anything familiar to you on this list, we encourage you to ask your solar installer what might be available.

- Anne Arundel County Solar Tax Credits: One-time property tax credit of up to $2,500 for residential homes that use solar energy for heating and cooling, water heating, and electricity generation. Visit Anne Arundel County’s website for more information.

- Baltimore County Solar Tax Credits: Property Tax Credit up to $5,000 for property owners who use solar energy for heating and cooling, water heating and energy generation. The credit applies to single and multi-family dwellings. Go to Baltimore County Government’s website to learn more (Note: there is a waiting list for new applicants).

- Harford County Solar Tax Credits: Property tax credit of up to $2,500 for property owners who utilize solar energy for heating and cooling, water heating and energy generation. The credit applies to residential and non-residential buildings. Learn more at Harford County’s Property Tax Credits website.

- Prince George’s County Solar Tax Credits: Alternative Energy tax credit of up to $5,000 for installation or construction of solar energy devices in residential structures. Visit Prince George’s County web page for more information.

What Maryland Residents Need To Know About SRECs

In 2019, Maryland aggressively raised its Renewable Portfolio Standard (RPS) target from 25% to 50% by 2030. This means the state has a goal to generate 50% of its energy through renewables by 2030. Under the RPS standard, both Maryland’s government and its utility companies are being held to these goals.

As part of its plan to achieve this target, Maryland is rewarding property owners who contribute to the state’s RPS by installing solar. For each megawatt-hour (mWh) — or 1,000 kilowatt-hours — of clean energy generated by your home solar system, you can earn one solar renewable energy certificate (SREC).

SRECs are a complex yet effective solar incentive. Maryland residents can sell their certificates on the SREC market or sell them to power companies.10 The value of these certificates typically ranges from about $5 to $20 in Maryland, and many homeowners use the extra cash to help offset the cost of going solar. The average homeowner may earn about ten SRECs per year.

Are SRECs Taxable in Maryland?

Yes, SRECs are taxable for both your federal and state tax returns. You’ll typically report these sales on Form 1099-MISC, but again, we recommend working with a tax professional to make sure you file correctly.

Which Tax Incentives Are Best in Maryland?

At this point, we’ve covered all the incentives, but you may not be eligible or able to claim all of them. In our opinion, these are the Maryland solar incentives you should prioritize applying for or getting set up ASAP.

- Federal Solar Tax Credit: This is Maryland’s largest solar benefit, worth a whopping 30% of your total solar system price. Applying won’t take you too much time and it can shave thousands of dollars off of your solar investment.

- Maryland Net Metering: We love that Maryland offers a generous net metering program that reimburses customers dollar-for-dollar on the excess electricity they return. Even better, you shouldn’t have to do much to have net metering set up!

- Maryland’s Clean Energy Rebate: Getting $1,000 in cash just for installing solar panels is a pretty sweet deal, but it does come with the high cost of having to pay for your entire system upfront.

- Local Tax Credits: If you live in one of the countries mentioned under the local incentive section, you could be eligible for $2,500 to $5,000 in tax credit deductions on top of the federal ITC.

- SRECs: SRECs are complicated, but are an extremely valuable incentive for Maryland’s homeowners. Given that the average homeowner can generate enough electricity to earn an SREC in about one month, that can earn a little over $100 per year given the current rate of SRECs.

What’s The Near Term Outlook For More Incentives In Maryland?

The Free State is at the forefront of the solar revolution, and it seems many of its incentives will stick around for 2024 — with one exception.

Funds for Maryland’s Energy Storage Income Tax Credit for solar batteries have run out as of September 2022 and at this time it doesn’t seem like it will be extended. However, the Biden Administration created a 30% federal tax credit for solar energy storage as part of the Inflation Reduction Act, so Maryland residents will still be able to claim these funds as tax credits.

All of the other solar incentives in Maryland should stick around throughout 2024. However, it’s worth noting that many states — including California — are beginning to roll back their net metering programs. We can’t help but anticipate that Maryland may do the same at some point, so we recommend installing solar panels in Maryland sooner rather than later to capitalize on these benefits.

The cost information presented in this article is derived from a comprehensive analysis, incorporating data from multiple industry sources. The average cost per watt per state was calculated based on figures from Consumer Affairs, Energy Sage, and Berkeley Lab’s Electricity Markets & Policy Department. Additionally, monthly energy consumption and the average monthly cost of electricity were sourced from the U.S. Energy Information Administration, ensuring a well-rounded and accurate representation of the information presented.

FAQ: Solar Incentives Maryland

At EcoWatch, we’re happy to get questions about the process and costs of getting rooftop solar from Maryland residents. Below are some of the questions we see most often, along with our responses. If you have specific questions that aren’t answered here, reach out to our team of solar experts at solar@ecowatch.com.

The only solar incentive that won’t be available in Maryland in 2023 is the state’s storage tax credit. However, it will be replaced by a federal tax credit for solar energy storage.

The following incentives will still be available for Maryland homeowners who install solar in 2024:

- The federal solar tax credit, worth 30% of your system

- Maryland’s net metering program, crediting you for the electricity your solar panels produce at the equivalent electricity rate.

- Maryland’s solar sales tax exemption

- Maryland’s solar property tax exemption

- The SREC market in Maryland

- Local tax incentives in select Maryland counties

Most homeowners find solar is well worth the investment in Maryland, especially because its solar-friendly policies and incentives significantly lower the cost of installing solar panels while helping you lower your utility bills.

No, Maryland has not announced any plans to reduce rooftop solar incentives in the next 24 months.

There is no Maryland solar tax credit for panel installations, but there is a tax credit available for installing a solar storage system such as a solar battery. Additionally, all U.S. homeowners are eligible to receive the federal solar tax credit, worth 30% of total installation costs.

Through market research and data from top solar companies, we found the average price of solar in Maryland to be $3.37 per watt. This means a 5 kW system would cost $16,850 ($11,795 after the 30% federal tax credit), and a 10 kW system would cost $33,700 ($23,590 after the tax credit).

These figures do not include the $1,000 residential clean energy rebate offered by the state of Maryland or any other solar incentives.

Keep in mind that these are averages, and you’ll need to connect with a solar installation company to get an accurate estimate of how much it would cost to put solar on your roof.

Related articles

Top Solar Installers in Maryland Cities

Comparing authorized solar partners

-

- Comprehensive service offerings

- Offers products from leading manufacturers

- NABCEP-certified technicians

- Relatively young company

- Slightly limited service area

A+Outstanding Regional Installer

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe