8 Solar Energy Pros and Cons: Is Solar Right for You? (2024)

In this EcoWatch guide on solar energy pros and cons, you’ll learn:

- How you can reduce electric bills and carbon emissions

- How much you could save from solar

- What are the pros and cons of solar

EcoWatch has helped many homeowners learn about of solar energy and will help you decide whether going solar is the right choice for you.

Each product and or company featured here has been independently selected by the writer. You can learn more about our review methodology here. If you make a purchase using the links included, we may earn commission.

Pros and Cons of Solar Energy: What You Need to Know

By installing a home solar system, you can use solar panels to harness the sun’s rays, convert them into electrical energy and use that energy to power your home. This can offset or even completely replace the energy you’d typically get from your utility company.

While the advantages of solar energy are plenty, there are also some drawbacks. Here are the top solar energy pros and cons to consider when deciding if solar panels are worth it for your home.

| Pros of Solar Energy | Cons of Solar Energy |

| Solar energy is a renewable resource | Solar panel manufacturing has a carbon footprint |

| Provides long-term savings | Expensive upfront cost |

| Increase value of your home | Location-dependent |

| Enables energy independence | Solar panels require a lot of space |

SunPower

Nationwide Service

Average cost

Pros

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

Cons

- Expensive

- Customer service varies by local dealer

SunPower designs and installs industry-leading residential solar and storage solutions across all 50 states. With a storied history of innovation dating back to 1985, no other company on this list can match SunPower’s experience and expertise.

SunPower earns its position as the top national installer on our list for a handful of reasons: It installs the most efficient solar technology on the residential market, offers the most expansive service area and backs its installations with a warranty well above the industry standard. All the while, SunPower pioneers sustainability efforts within the industry.

If that weren’t enough, SunPower systems come packaged with products all manufactured in-house by its sister company, Maxeon. This means that your panels, solar cells, inverters, battery and EV chargers are designed to work together and are all covered under the same warranty.

SunPower’s biggest downside? Its high-efficiency panels are considerably more expensive than most of its competitors’ products. However, its powerful panels are workhorses that make up for the initial cost with more backend production (think about this like spending more money for a car that gets more miles per gallon).

Facts and Figures: SunPower

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 5 |

| A+ |

| 1985 |

| $$$$ |

| Solar Panels, Solar Batteries, EV Chargers, System Monitoring |

| SunPower Panels |

| 25-year all-inclusive warranty |

Blue Raven Solar

Regional Service

Average cost

Pros

- Industry-leading in-house financing

- Competitive pricing

- Excellent reputation

Cons

- Doesn't offer solar batteries (coming 2022)

We like Blue Raven Solar because it understands that, for most homeowners, the cost of solar presents the biggest barrier to entry.

For that reason, Blue Raven Solar developed an innovative solar financing plan that offers in-house, flexible, zero-money-down options. The results speak for themselves, as Blue Raven Solar is now one of the fastest-growing solar companies in the nation and was recently acquired by SunPower. Its BluePower Plus+ plan (exclusive to Blue Raven) mimics the flexible structure of a lease while still providing the greatest benefits of owning your system.

Eligible homeowners enjoy 18 months of solar power before having to pay their first bill. When coupled with the federal solar investment tax credit (ITC), the initial energy savings can offset more than a third of the overall cost of a system before requiring a dollar down.

In contrast, other installers can only offer similar financing through solar leases, PPAs or third-party providers (such as Mosaic or Sunlight). Third-party loan providers can complicate the process, while opting for a loan or PPA will disqualify you from some of solar’s biggest benefits (additional property value, federal solar tax credit and local solar incentives).

Facts and Figures: Blue Raven Solar

| EcoWatch Rating |

|---|

| Better Business Bureau (BBB) Rating |

| Year Founded |

| Average Cost ($-$$$$$) |

| Solar Services |

| Brands of Solar Equipment Offered |

| Warranty Coverage |

| 4.5 |

| A+ |

| 2014 |

| $$ |

| Solar Panels, System Monitoring |

| Trina Solar, Canadian Solar, SolarEdge, Silfab, SunPower |

| 25-year manufacturer warranty; 10-year workmanship warranty, 2-year production guarantee |

Benefits of Solar Energy

We’ll begin with a summary of the biggest advantages of solar energy.

1) Solar energy is a renewable source of power

Solar energy is a renewable source of energy, meaning it comes from natural sources and replenishes at a faster rate than it is consumed. Unlike non-renewable energy sources like coal and other fossil fuels, solar energy is harnessed without creating any emissions in the process.

This means that by using solar panels, you help to reduce greenhouse gas emissions, like carbon dioxide, therefore lessening your environmental impact and doing your part to mitigate the worsening of climate change.

Although solar panels aren’t perfect, they represent the most sustainable and cost-effective modern method to power a home in the U.S.

2) Solar energy provides significant long-term savings

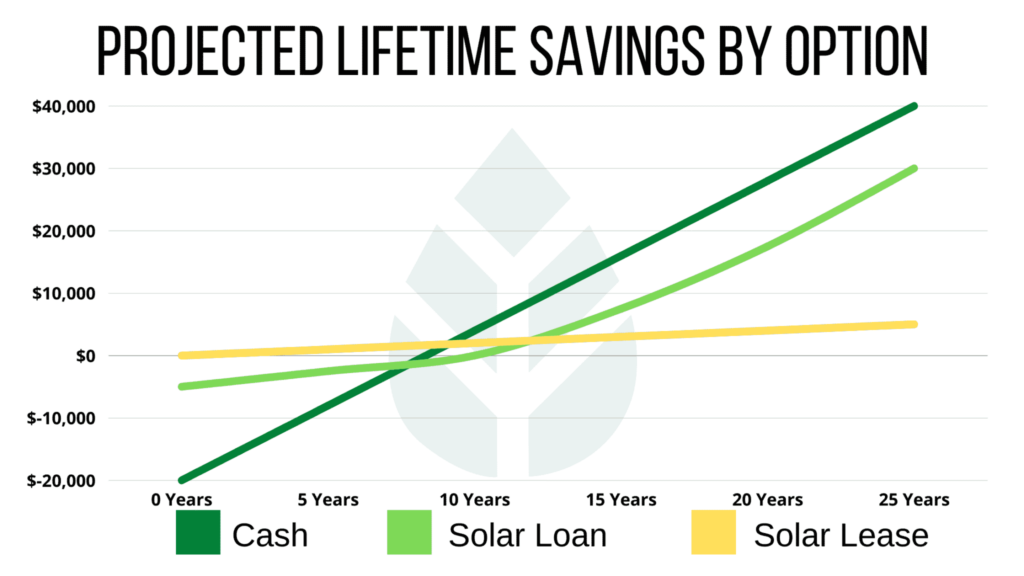

Apart from the obvious environmental benefits, one of the most significant perks of solar energy is economic: By using energy from the sun rather than electricity from your utility company, you can significantly reduce your household energy costs.

According to our estimates, the average household in the U.S. can generate an average of $31,513 in long-term savings by switching to solar panels. The average solar system lasts for two to three decades, which means that your energy savings will pay for the system itself over time.1

For example:

- Upfront cost of a solar panel system after incentives: $29,970

- Annal energy savings: $1,668

- Payback period on system: 11 years

- Total 25-year savings minus initial cost of system: $31,513

As you can see, installing solar panels is an investment that focuses on maximizing your long-term savings.

3) Investing in a solar power system can increase the value of your home

Several studies have shown that home buyers are willing to pay more for homes with solar panels. Note that this helps offset one of the primary cons of solar energy, which is the steep startup cost of solar panels — but more on that later.

Here’s a bonus as well — most states offer property tax exemptions on renewable energy systems like solar panels. This means that even though a solar array adds around $30,000 of value to your property, your taxes won’t increase accordingly.

4) Enables energy independence

Tired of unexpected spikes on your bills or inconsistent service from your utility provider? Installing solar panels is often the most practical way for you to increase your energy independence, meaning you’re less impacted by the shifting costs and performance of your public power provider.

Increasing your energy independence provides a handful of benefits, most notably including:

- Allowing predictable energy costs, making it easier to budget years into the future

- Increased safety, via the ability to store and use backup power in the event of a grid outage or extreme weather event (requires a solar battery)

In other words, if you can generate your own electricity, you don’t have to rely on your utility company for it — especially if you install a solar battery for excess energy storage. We should note that many local governments still require homeowners with solar systems to connect to the electrical grid, so solar users who live populated areas won’t be able to go fully off-grid, but they may be able to earn net metering credits through their utility company.

If you’d like to connect with a solar installer to see what financing options may be available, click one of the buttons below:

Disadvantages of Solar Energy

There are obviously some significant benefits of solar energy, but it’s only fair to outline the downsides, too. A few of the most notable disadvantages include:

1) Solar panel manufacturing has a carbon footprint

Although solar energy is an inexhaustible, renewable resource, the main tool that we use to harness that energy is not.

Solar panels are still an imperfect technology; the resources that it takes to produce them (such as aluminum, copper and silicon) are scarce and often hard to acquire. There is also a lot of concern about what to do with the end-of-life (EOL) product as well, especially older models that were not designed to be recycled.

2) The upfront cost of going solar can be quite expensive

According to some estimates, the average cost to invest in a solar system is around $29,970, and for some homeowners, may exceed $39,000. The specific number will vary according to the size of your home, your household energy needs and the type of solar panels you choose.

For example, if you make your own DIY solar panels, you’ll cut down on installation costs, or if you want to get the most efficient solar panels, they’ll cost significantly more.

There are plenty of ways to offset the cost, including tax incentives, earnings through net metering, increased home value and financing options. For most homeowners, the solar payback period is around 11 years, which is less than half of the 25-year lifespan of most systems.

Plus, solar panel systems are low maintenance once installed, so you won’t have to worry about upkeep costs. Still, there’s no getting around it: Making the switch to solar energy is a significant investment.

3) Solar energy can be very location-dependent

You may have a roof that’s ideal for a solar energy system and still not be a good candidate for solar energy. Why? Because to take full advantage of the benefits of solar panels, you need to have a roof or yard that gets consistent and direct daily sun exposure.

While photovoltaic (PV) solar panels still work on cloudy days, they’re most efficient when soaking up direct sunlight. So, if you live in a part of the country that tends to be pretty cloudy or grey, or if your roof is partly shielded by trees or by neighboring homes, you may not get the full benefits of solar to justify the cost of installation.

Additionally, the total savings that you can generate with solar depends on the existing cost of electricity in your area. If you live in an area with very affordable electricity, your utility bills are likely too low to justify the costs of solar. Solar performs best in areas where electricity is expensive, like California.

4) Solar panel arrays take up a lot of space

Solar panels are probably larger than you think, with most residential panels about 5 feet long and 3 feet wide individually. What most homeowners don’t consider when thinking about making the switch to solar is that not all roofs can fit an array large enough to justify the price of installation.

The average household needs about a 9 kilowatt (kW) solar panel system to meet its needs.2 A 9 kW solar array, complete with an inverter, requires about 25 solar panels and can take up nearly 530 square feet of space.

That doesn’t include the space taken up on your roof by obstructions like skylights, chimneys or satellite dishes. For safety reasons, most city zoning laws also require that installers leave at least a foot of space between the panels and the edge of your roof.

With all that in mind, can your roof fit 25 solar panels?

Even if homeowners have the space for solar, they may not invest because of their big and bulky nature. In a recent survey conducted by Ecowatch, 31% of homeowners said they wouldn’t install solar panels because they think they’re ugly. However, community solar does offer a viable alternative for friends or neighbors to share a solar array without having to install it on a roof. Think of it as a shared subscription plan to clean energy.

One last consideration — if you have an older home, especially one with slate or cedar tiles on the roof, then you may not even be able to install a rooftop solar system without first replacing your roof.

Check out this more detailed video discussing the truth about solar panels:

Weighing the Solar Energy Pros and Cons

So, do the advantages of solar energy outweigh the disadvantages? Unfortunately, there’s no easy answer here, as different homeowners may experience different levels of savings when they make the jump to solar.

Before investing in a system, make sure you do your due diligence. Research local sun exposure, tax incentives and your own household energy expenses. And, get quotes from a few solar providers that can give you more details about how much a new system will cost you. By weighing the pros and cons of solar energy, you can make the most advantageous decision for your household.

If you’d like to connect with a solar installer to see what financing options may be available, click one of the buttons below:

FAQ: Solar Energy Pros and Cons

We aren’t naive enough to claim that solar is always a good choice. For homeowners with low energy costs, shady roofs or insufficient space, the cost of solar can outweigh its benefits. Your location is important, too — not just in terms of sunshine, but also the financial incentives available to you. Check your local net metering policy and statewide and local incentives to see if you can save money on solar.

The three biggest disadvantages to solar energy include:

- The long-term nature of the investment: Life happens. Things change. Unfortunately, transferring solar loans or leases over to new homes or homeowners can be tricky. Some solar companies charge to have the panels relocated, and not all new homeowners will accept the solar lease or loan should you wish to transfer it.

- Not every roof can accommodate a solar system: Small roofs, roofs with obstructions or roofs made with alternative materials can have trouble accommodating solar panels.

- The cost of solar: Purchasing 25 years’ worth of electricity upfront can make a lot of customers uncomfortable — and we understand why! The upfront cost of solar won’t be feasible for all homeowners. Luckily, solar leases, flexible loan plans and incentives are making solar accessible to a wider range of home and business owners.

Solar panels provide a reliable, low-maintenance way to avoid the carbon dioxide emissions associated with conventional energy generation. In addition to the environmental benefits, solar typically provides a great deal of energy savings for customers weighed down by rising utility costs. When properly designed and installed, solar is one of the best and most sustainable investments you can make.

Comparing authorized solar partners

-

- Most efficient panels on the market

- National coverage

- Cradle to Cradle sustainability certification

- Great warranty coverage

- Expensive

- Customer service varies by local dealer

A+Best National Provider1985SunPower Panels25-year all-inclusive warranty

Having trouble deciding? Click below and use our process to receive multiple quotes instead:

233k

233k  41k

41k  Subscribe

Subscribe