Goldman Sachs Is First U.S. Big Bank to Divest From Arctic Oil and Gas

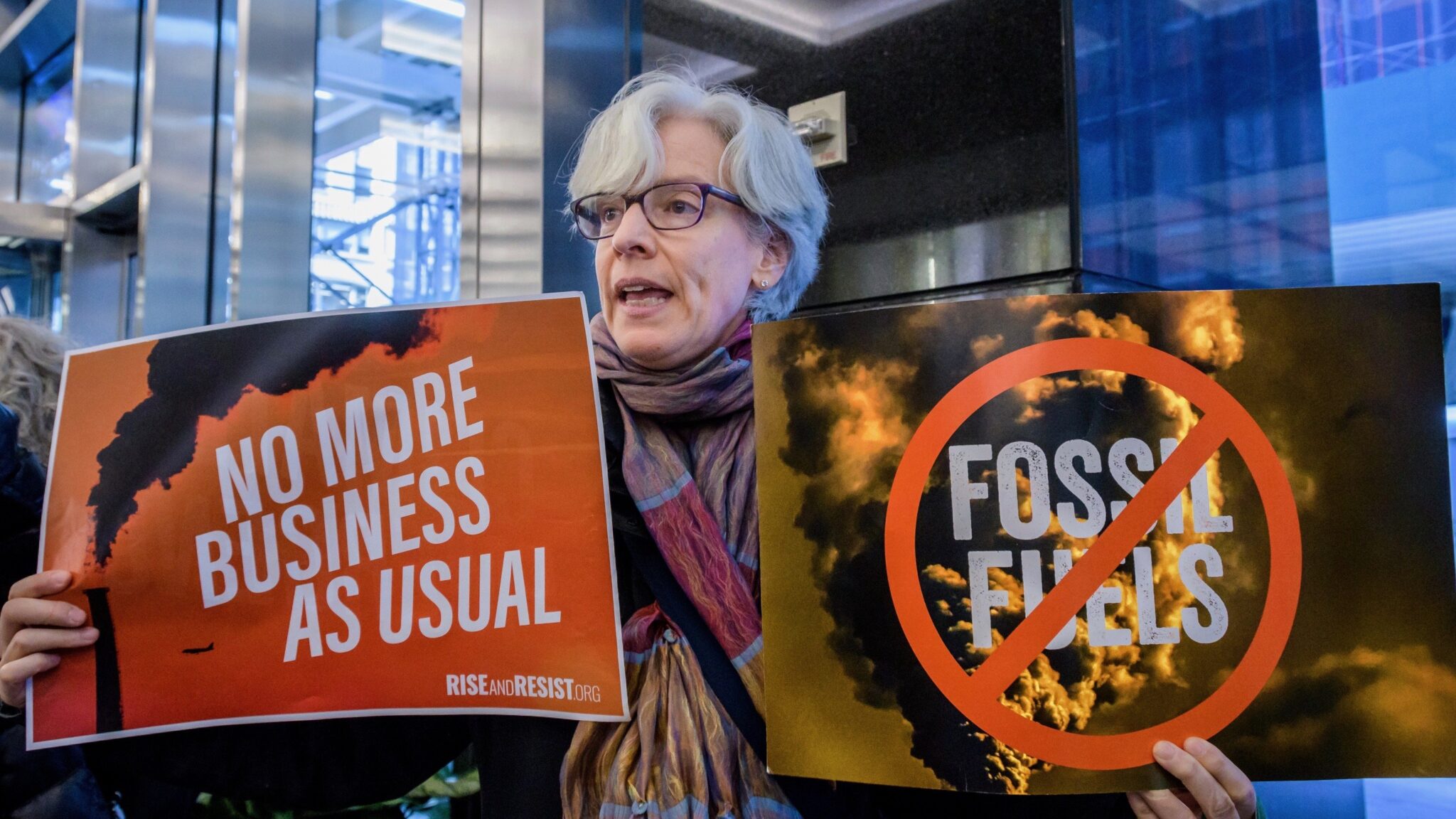

Protesters hold signs at a protest inside JP Morgan Chase headquarters in Manhattan on Nov. 20. As Goldman Sachs divests from Arctic Oil explorations, Rainforest Action Network says the move shows other Big Banks like JP Morgan Chase can too. Erik McGregor / LightRocket / Getty Images

Goldman Sachs, one of the world’s largest investment banks, gave a minor victory to the divestment movement by declaring that it will not fund an new arctic oil explorations, as CNN reported.

Citing the importance of the Arctic’s fragile ecosystem and its importance to indigenous populations, the investing giant said it will decline investing in any oil exploration in the Arctic, including the Arctic National Wildlife Refuge.

“Oil development in the Arctic Circle is prone to harsh operating conditions, sea ice, permafrost coverage, and potential impacts to critical natural habitats for endangered species,” Goldman Sachs said in its Environmental Policy Framework. “The unique and fragile ecosystems of the Arctic region also support the subsistence livelihoods of indigenous peoples groups that have populated certain areas in the region for centuries.”

Goldman Sachs also said in its policy framework that it would not finance any new thermal coal mines or any mountaintop removal projects. It added that where it has already invested, it would work with companies to diversify their strategies and reduce their carbon emissions.

“Companies’ diversification strategy and carbon emissions reduction initiatives will be a key consideration in our evaluation of future financings with the goal of helping their transition strategy,” the Environmental Policy Framework says. “We will phase out our financing of thermal coal mining companies that do not have a diversification strategy within a reasonable timeframe.”

Goldman Sachs follows a dozen global banks, based largely in Europe and Australia, that pledged not to finance Arctic oil and gas development in the arctic. Several of the policies mention Arctic National Wildlife Refuge specifically, as NPR reported. Goldman is the first U.S. headquartered bank to make the same promise, as CNN reported.

“Goldman Sachs’s updated policy shows that US banks can draw red lines on oil and gas, and now other major US banks, especially JPMorgan Chase – the world’s worst banker of fossil fuels by a wide margin – must improve on what Goldman has done,” said Jason Opeña Disterhoft, a climate and energy campaigner at Rainforest Action Network, which helped to lobby for the change, as The Guardian reported.

The move did win praise from environmental activists, including the Sierra Club, though it did not extend to fracking, which environmentalists had campaigned for. Nevertheless, the Sierra Club, which had lobbied Goldman Sachs to stop funding Arctic exploration, praised the bank’s pledge.

“The Trump administration may not care about ignoring the will of the American people or trampling Indigenous rights, but a growing number of major financial institutions are making it clear that they do,” said Ben Cushing, a Sierra Club campaign representative, as The Guardian reported. “We hope other American banks will follow their lead.”

233k

233k  41k

41k  Subscribe

Subscribe