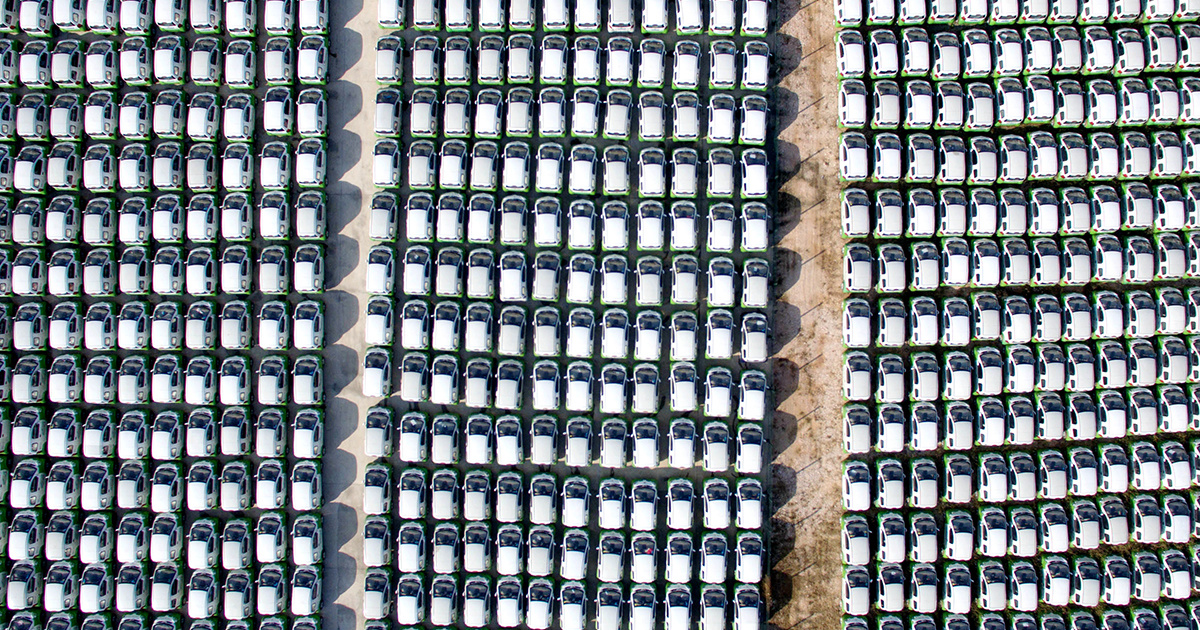

Aerial view of electric cars lining up at Kandi Electric Vehicles Group Co., Ltd in Changxing County on Oct. 24, 2017 in Huzhou, Zhejiang Province of China. Tan Yunfeng / VCG

By Jordan Davidson

Electric vehicles will be the stars of the show when the Auto Shanghai 2019 expo opens Tuesday. China wanted cleaner air, reduced dependence on foreign oil and to be a pacesetter in a growing high-tech industry. So, it invested more than $60 billion in electric vehicles over the last decade and plans to keep that investment going over the next decade, according to Quartz.

The downside is the $18 billion electric vehicle industry in China is set to crash.

In 2018, sales of electric cars there outpaced the rest of the world combined. Yet, with more than 486 homegrown electric vehicle manufacturers vying for market share and in-flux of foreign companies ready to grab customers, concern is rising that too many manufacturers are churning out cars for nonexistent demand, according to Bloomberg. When the bubble bursts, only a few companies will survive.

“We are going to see great waves sweeping away sand in the EV industry,” said Thomas Fang, a partner and strategy consultant at Roland Berger in Shanghai, as Bloomberg reported. “It is a critical moment that will decide life or death for EV startups.”

However, China’s goal of having annual sales of 7 million new-energy vehicles by 2025 would barely sustain a few companies, not the hundreds currently in the industry, according to Bloomberg.

The massive growth potential drew investors not only from traditional car markers, but also from companies not known for building cars, such as internet startups, electronics companies and real-estate developers. Two dozen of those companies will show off their vehicles at the Shanghai auto show alongside Renault, Audi, Buick, Volkswagen and several other companies trying to make headway in the Chinese market, according to the automotive journal Overdrive.

“Only companies that have solid technology reserves can stand out amid competition,'” said Wang Chuanfu, founder and chairman of BYD, as reported by Bloomberg. “By owning core technologies, we can see further and deeper.”

The ones facing the biggest risk are the upstarts still seeking their footing. Many are founded or funded by people with an internet or technology background, used to hefty cash-burn rates but still not necessarily fully aware of the massive investment needed for car manufacturing, Roland Berger’s Fang said, according to Bloomberg.

The dangers of creating oversupply were evident in March when an electric car “graveyard” was photographed on the outskirts of Hangzhou. Thousands of electric cars divided into three sections sit idle in the photographs. The cars belong to Microcity, a ride-sharing company. Yet ride-sharing companies, which have bought heavily into the electric vehicle market, have faced a tough road. Several folded in 2018 and the state media, CCTV, questioned not only the business model, but also whether the companies add to congestion by putting more cars on the road, according to Abacus News.

- Volkswagen Ups Its EV Production, Aims to Be Carbon Neutral by ...

- Tesla Unveils 2nd Mass-Market EV: The Model Y - EcoWatch

- Trump and Big Oil Want to Pull the Plug on the Electric Car Market ...

233k

233k  41k

41k  Subscribe

Subscribe