Our global economy is undergoing the “Great Transition” from an energy system based on fossil fuels to one based on clean, renewable energy sources and technologies. So as longtime advocates for a safe, just and sustainable future, we at As You Sow decided to partner with our friends at Corporate Knights and develop the Carbon Clean 200—to start a broad and dynamic conversation about how all investors can create a clean energy economy and how best to recognize companies that are already on this path.

Six years ago, students began to call on their university endowments to divest from fossil fuels, urging university leaders to stop profiting from companies that were destroying their future. Over time, many of those investments have increased risk in university endowment portfolios, and the trustees who listened to their students and aligned their institutions’ investing with the school’s mission ended up avoiding significant financial pain.

Since then, a great deal of effort has been devoted to identifying the fossil fuel companies that most threaten our fragile climate. These 200 companies were first identified by the Carbon Tracker Initiative in their seminal “Carbon Bubble” report. The Clean200 turns the Carbon Bubble inside out and asks which companies are currently profiting from participation in the clean transition and what is the best way to spot them?

How We Did It.

The Clean200 ranks the largest publicly listed companies worldwide by their total clean energy revenues as rated by Bloomberg New Energy Finance (BNEF). In order to be eligible, a company must have a market capitalization greater than $1 billion (end of Q2 2016) and earn more than 10 percent of total revenues from clean energy sources.

More than 70 of the companies on the list receive a majority of their revenue from clean energy. The list excludes all oil and gas companies and utilities that generate less than 50 percent of their power from renewable sources, as well as the top 100 coal companies measured by reserves.

The list also filters out companies profiting from weapons manufacturing, tropical deforestation, the use of child and/or forced labor, and companies that engage in negative climate lobbying. We then took the top 200 and ranked them by estimated clean revenue—the Clean200.

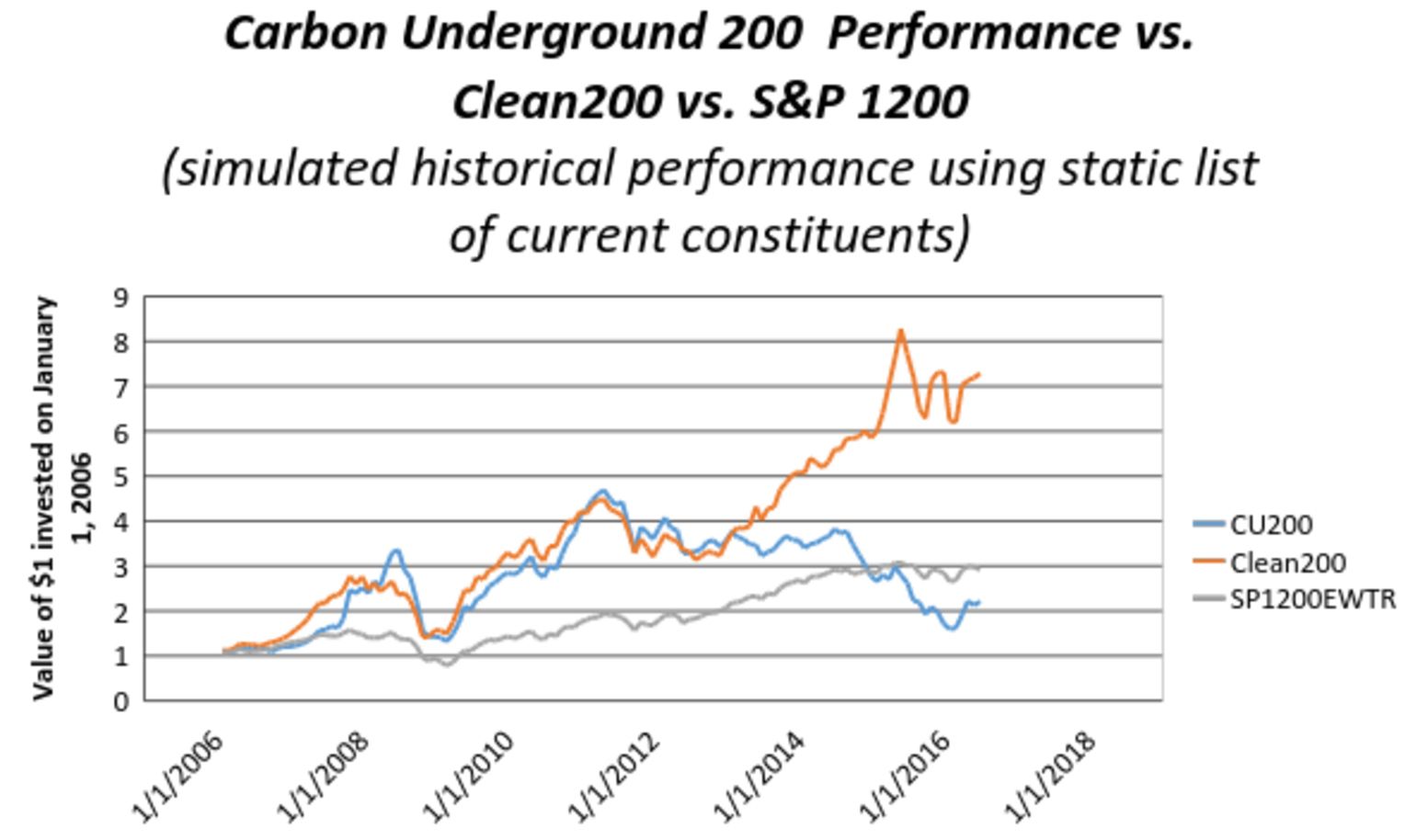

We compared the Clean200 to the Carbon Underground 200, the list of the largest fossil fuel companies that the Divest-Invest movement and many fossil free mutual funds use as a screen. We also compared the Clean200 to the S&P 1200 global benchmark. Our findings were telling, to say the least. First, more than one-third of the Clean200 companies are Chinese, which speaks to a quiet green energy revolution brewing in the world’s largest economy. Another interesting finding is that 26 countries are represented.

The performance analysis for each of the three lists is based on a “snapshot in time” analysis of current constituents as the BNEF clean energy revenue exposure database is new and does not go back in time. The analysis also introduces a survivorship bias that can be present when stocks which do not currently exist (because they have failed, for example) are excluded from the historical analysis. This bias can result in the overestimation of past returns.

The methodology and list used to develop the Clean200 are in the creative commons and can be downloaded at www.clean200.org.

We also noted that the top 10 Clean200 companies with a majority of their revenue from clean energy include Vestas (wind power), Philips Lighting (LED lighting), Xinjiang Gold-A (wind plants), Tesla Motors (electric vehicles), Gamesa (wind turbines), First Solar (solar modules), GCL-Poly Energy (solar grade polysilicon), China Longyuan-H (wind Farms), Kingspan Group (Insulation and building envelopes) and Acuity Brands (LED lights).

This inaugural version is just the beginning. We want to see how our Clean200 methodology may be improved over time, so we decided to make the data available to anyone and everyone on creative commons, and to update the list every quarter to track the changes and trends. With this list, we hope to open a broad and transparent global conversation. We hope that the best minds will find this thought exercise as exciting as we do and join us.

As You Sow and Corporate Knights are not investment advisors nor do we provide financial planning, legal or tax advice. Nothing in the Carbon Clean 200 Report shall constitute or be construed as an offering of financial instruments or as investment advice or investment recommendations.

233k

233k  41k

41k  Subscribe

Subscribe